MUMBAI(Commoditiescontrol)- US cotton on ICE futures breaches 70 cents/lb level while the Indian market trades range bound for the week ended August 4.

US MARKET:

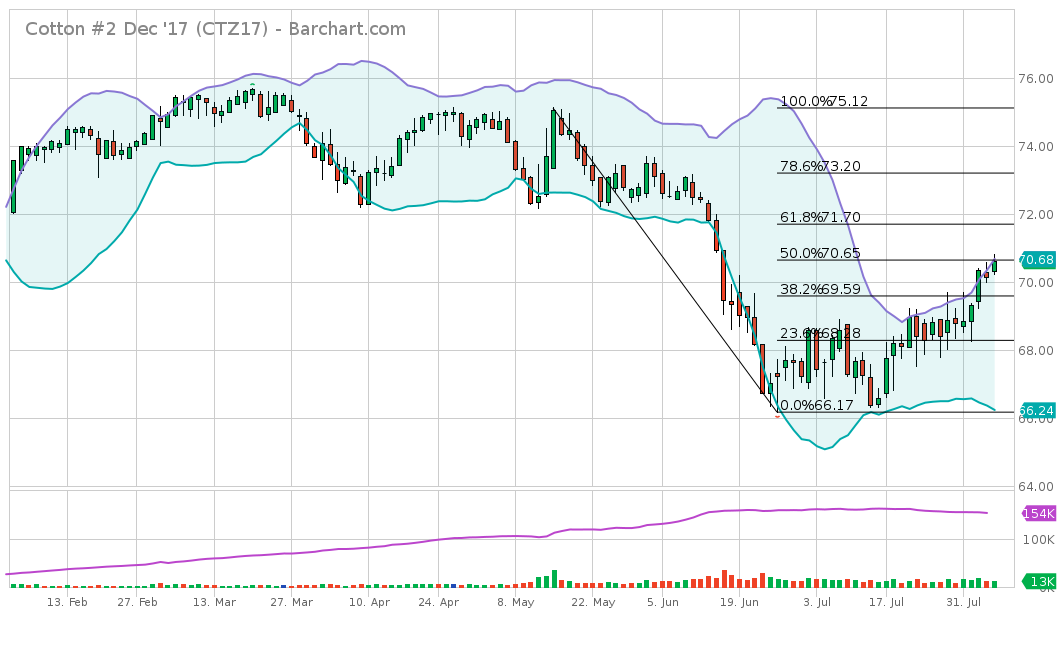

The US cotton futures rallied with the benchmark December contract increasing 1.82 cents to settle higher at 70.62 cents/lb over the week.

The December contract breached the 70 cents level for the first time since July 14 on heels of major short covering attributing rally in prices during this week as open interest dropped 2,905 lots to 154,251 lots as of August 3.

The highlight of the week was the major cancellation observed in the weekly exports sales report at a whopping 91,800 Running Bales(RB) for both marketing year. (Full Report)

Total commitments for the 2016/17-season, with 4 days of data still missing, were at 15.62 million statistical bales, of which 14.7 million bales have been shipped which was higher than USDA’s export forecast at 14.5 million bales and a revision could likely be expected in USDA August balance sheet estimates bringing the ending stock to 3 million bales or less.

Export commitments for the 2017/18 season, which began on Tuesday, are already at 6.33 million statistical bales, including a carryover of 0.9 million bales from 2016/17. With ending stock expected to be below 3 million bales, a tight supply scenario could likely occur which will make it difficult for the merchants to meet large mill commitments for the fourth quarter of 2017. According to experts, 1990/91 season had the lowest carryover in recent history with just 2.34 million bales.

The first phase of difficulties could likely explain the large sum of cancellations in weekly export sale when prices were trading below 70 cents/lb.

The USDA WASDE report is due in the next week which will confirm the scenario of new crop in the first U.S. 2017/18 crop report of State-by-State estimates. The December cotton prices has potential to trace the 61.8 percent retracement level at 71.72 cents/lb or could go even higher next week with trade range between 71-73 cents/lb.

Recent USDA crop ratings consider the crop 56% good to excellent and 30% fair and we would expect further improvement to these figures in light of the recent favorable growing conditions across the vast majority of the Cotton Belt.

CHINA MARKET:

The ZCE cotton futures exhibited an uptrend as the January 2018 contract settled 1.5 percent higher on major roll over for the week ended August 4.

.jpg) The benchmark January contract settled at 15,075 yuan/tonne on Friday, surging 215 yuan/tonne over the week. Open Interest rose 30 percent to 151,874 lots implying major long addition amid roll over from September to January.

The benchmark January contract settled at 15,075 yuan/tonne on Friday, surging 215 yuan/tonne over the week. Open Interest rose 30 percent to 151,874 lots implying major long addition amid roll over from September to January.

The September contract settled at 15,055 yuan/tonne while open interest dropped 40 percent to 83,778 lots.

Meanwhile, the state reserve auctioned a total of 148,908 tonnes from which it sold a total of 65,801 tonnes for the week ended August 4, recording the season’s lowest weekly turnover at 44 percent.

Since the commencement of auction, around 2,146,351 tonnes (12.63 million 170kg bales) were sold from the total offered quantity of 3,214,546 tonnes (18.91 million 170kg bales). (Full Report)

INDIAN MARKET:

The Indian cotton futures traded sideways with the October futures ending the week marginally higher Rs 130/bale in speculative trade.

The benchmark October contract on MCX futures settled higher 0.7 percent (130 points), over the week, to Rs 18,570/bale. However, if we look at the trade activity throughout the week, open interest persistently rose 6 percent to 2,241 lots (0.56 lakh 170kg bales) however trade volume was dull throughout the week dropping 40 percent to 0.87 lakh bales from prior week’s 1.46 lakh bales.

Summarizing the entire trade, speculators were majorly active as most market participants adopted a sideways stance awaiting fresh cues.

Prices was majorly influenced by the market trend of US cotton on ICE futures while strengthening Rupee against US Dollar, which hit a two year high on August 2 closing at 63.63, provided additional support.

.jpg)

Technical chart showed that price is striving to breakout the symmetrical triangle pattern and another sustained rise/close above Rs 18,640 with bullish candle at the end of the week would likely confirm the trend line breakout however if prices fall/close below Rs 18,300 with bearish candle, then a false breakout situation could be created.

Inter-week resistance is placed at Rs 18,690-18,980 and support is placed at Rs 18,400-18,110. (Technical Report)

DOMESTIC SPOT MARKET:

Weekly spot benchmark prices rose Rs 400-600/candy, with the lowest level of Rs 42,400/candy recorded in Rajasthan while the highest level of Rs 44,250/candy recorded in Andhra Pradesh/Telangana.

.jpg) The bull trend which began two weeks ago followed through in the first half of the current week (July 31-Aug 4) with prices rallying in North India, Gujarat and Madhya Pradesh. Some small lot deals were reported from local mills, procuring to meet their near-term requirements.

The bull trend which began two weeks ago followed through in the first half of the current week (July 31-Aug 4) with prices rallying in North India, Gujarat and Madhya Pradesh. Some small lot deals were reported from local mills, procuring to meet their near-term requirements.

Spot prices rallied for four consecutive days until August 3 at North India which surged the weekly average higher Rs 50-65/maund to Rs 4,440-4,470/maund(Rs 42,400-42,700/candy). The Madhya Pradesh spot price rallied three out of the five trading days which increased weekly average by Rs 200/candy to Rs 43,000/candy. Gujarat witnessed a single day rally on Monday after which it extended a flat trend to end with a higher weekly average of Rs 43,200/candy.

Prices quoted in Central India were tentative offers with no major trade observed in all three markets(Guj, Mah, MP). Spinners continued to adopt a wait and watch approach amid standstill situation in the yarn market. Ample quantity of stock, obtaining GST numbers by textile traders, etc were the major factors causing a subdued trade activity in the yarn market. Tentative yarn rates extended steady trend in most markets while hosiery yarn rates declined Rs 10/per kg in Tamil Nadu.

On the crop scene, official assessment of Gujarat crop in the major flood hit districts was underway with trade sources estimating major cotton crop damage in Banaskantha and Patan district, which covers merely 4 percent of the total planted area at 26.36 lakh ha as of July 31. Meanwhile, estimates of 20 percent damage is speculated in Saurashtra which covers 70 percent at 18.74 lakh ha.

However, there was a split vote on the magnitude of damage in Saurashtra with 50 percent traders believing the 20 percent damage speculation while the other 50 percent believing less than 15 percent crop has been affected with possible re-sowing in some regions. Assuming 20 percent crop loss then the total planted area could likely touch 22-24 lakh ha which could take total state production at 75-80 as per our calculations.

Total cotton planting reached 114.34 lakh ha as of August 3 compared to same period last year at 96.48 lakh ha covering more than 93 percent of the total normal area at 122.46 lakh ha and remained significantly ahead 7 percent from the normal area as on date at 106.75 lakh. (Full Report)

North and South India received normal rains at regular intervals however Maharashtra observed hot and humid climatic conditions since past two weeks with cotton crops in Vidarbha, Marathwada, Nagpur and Yavatmal in need of heavy rains during next week in order to avoid another phase of crop concerns in the market.

Gujarat transportation service is gradually returning to normalcy as old crop supply rose, during this week (July 31-Aug 4) to 24,750 bales of 170kg from 16,400 bales in the prior week (July 24-28).

.jpg) Conclusion:

Conclusion:

The Indian market witnessed a flat trend with spot prices witnessing marginal changes and futures market trading range bound. The market is lacking direction and until the fog created by the uncertainty of crop loss in Gujarat clears, prices will likely trade range bound.

Two factor could bring in the bulls back in the game, namely, the final report on the crop damage in Gujarat and expectation of revival in yarn market which could increase procurement of cotton bales by spinners, creating a bull rally for short term, with the latter factor expected to come into play after August 15. Taking the Gujarat S6 30mm, as the basis of our analysis, spot prices is nearing the first resistance level at Rs 44,000/candy however remained miles behind the strong resistance at Rs 45,000/candy.

However, we believe, the bears, attributed to large next season crop production, large ending stock for 2016/17 at 3.8 million 170kg bales, uncompetitive export basis, will likely topple over the bulls.

Forward contracts were agreed in the price range of Rs 37,500-39,000/candy(75.18-78.17 cents/lb, calculated as per today’s USD/INR exchange rate at 63.63). With major factors favoring the bears, Indian cotton prices could begin the 2017/18 season at an average price ranging between Rs 37,000-38,000/candy with possibilities upside risk limited.

The Gujarat S6(30mm) traded at Rs 43,150/candy(84.92 cents/lb) as of August 4.

(By Commoditiescontrol Bureau; +91-22-40015534)