MUMBAI (Commoditiescontrol) – Crude oil prices rose on 10 February reports showed that OPEC members delivered more than 90 percent of the output cuts they had pledged in a landmark deal that came into effect in January. The 11 members of OPEC’s production targets under the deal fell to 29.92 million barrels per day, according to the average assessments of the six secondary sources OPEC uses to monitor output, or 92 percent compliance. European Brent crude settled at US$56.70 a barrel up 1.9 percent on weekend but down 0.2 on the week. U.S. West Texas Intermediate crude futures settled 1.6 percent up on weekend at US$53.86 a barrel, also up 0.6 on the week.

Polyester Intermediates

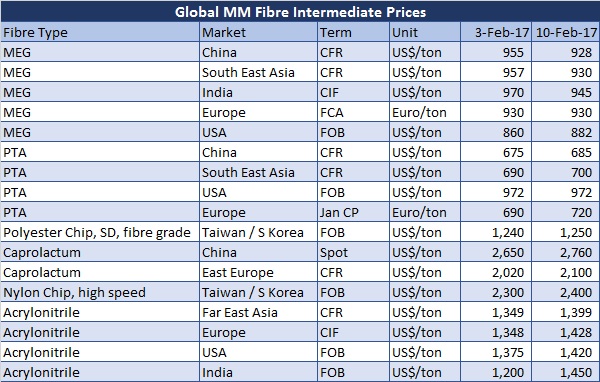

MEG Price Down In India

Mono ethylene glycol prices fell in Asian markets sending cues to other regions. However, it saw support from tight avails on turnaround as margin sank ending two weeks of steady gains by falling sharply to the lowest level since 21 December 2016. In China, MEG markets were under fluctuation. Prices in India were also down tracking Asian trends. Asian marker, CFR South East Asia was at US$930-932 a ton, down US$27 on the week while CIF India values fell US$25 to US$945 a ton.

In Europe, MEG prices were flat at Euro930 a ton FCA NWE for the second consecutive week, as plant turnarounds approached. In US, MEG prices slipped off the 19-month high despite supply described as tight. However, it followed dip in Asia market with limited export availability. In US, spot MEG dipped off a 19-month high at US cents 40-42 per pound FOB USG, down US cent 1 from last week, following dip in Asia market with limited export availability.

PTA firms up in India and South Korea

Purified terephthalic acid markets in Asia were mainly in upward correction as paraxylene prices moved up quickly with two units in Japan and South Korea shutting down before holiday due to some reasons. On cost support and tight supply, spot prices inched as quite a few plants were shut in Asia. India's Reliance Inds shut its 750,000 ton a year Hazira PTA line due to unexpected technical fault. In India, CIF values gained US$20 to US$715 a ton. Asian prices inched up US$10 week on week with CFR China at US$685-687 a ton while CFR Southeast Asia marker was assessed at US$700-702 a ton.

In US, February PTA remained unsettled after January rise. In US, PTA for January was at US cents 44.10 per pound (US$972 a ton) FOB USG. In Europe, PTA February contract price firmed up, reflecting a higher initial settlement in feedstock paraxylene contract price for February February contract price firmed Euro30 to Euro720 a ton.

POLY CHIPS

Polyester chip prices were range bound at high price levels this week. Semi dull chip offers were raised on higher cost after the holiday despite limited enquiries. Asian marker for semi-dull continuous spinning fibre grade chip gained US$10 on the week at US$1,250-1,300 a ton FOB Taiwan/Korea. In China, offers were up US$20 at US$1,155-1,160 a ton while super bright chip offers jumped US$40 to US$1,150-1,155 a ton.

Nylon Intermediates

Caprolactum jumps in Asia

Feedstock benzene prices declined sharply midweek but partially regained weekend on firmer discussions. Asian marker, the FOB Korea gained US$10 on weekend but sobered US$5 on the week to US$1,035.50-1,036.50 a ton while CFR China jumped US$32.50 on the week to US$1,050-1,051 a ton.

Caprolactum prices were lifted citing tight supply and on the back of strong benzene. In China, offers for liquid and solid goods edged up on cost support. Sinopec raised its February contract nomination for liquid, AA grade, goods while Fibrant released its nomination for Feb matching Sinopec’s numbers. High‐end contract price for February was offered higher. Spot prices were up US$80 at the lower end on the week with SE and FE markers at US$2,100-2,180 a ton while East European goods were also up at US$2,100-2,180 a ton. In China, liquid caprolactum offers in spot market moved up to US$2,760-2,800 a ton.

Nylon chip prices were hiked in view of higher caprolactum while transaction volume also increases. Recovering benzene prices and tight supply saw caprolactum prices gain further. Taiwan‐origin high-speed chip from majors were offered US$100 up on the week at US$2,400-2,450 a ton. In China, semi-dull high-speed spinning chip offers were raised to US$2,935-3,010 a ton, up US$102 on the week.

Acrylic Fibre Intermediates

Acrylonitrile import price up in India

Acrylonitrile prices surged 3-5% on the week in Asian markets ahead of turnaround season in the second quarter and looming maintenance limited supply. Feedstock propylene cost also rose supporting downstream derivatives. The CFR Far East Asia was at US$1,399-1,501 a ton while Southeast Asia at US$1,369-1,371 a ton. In China, offers for offshore cargoes were at US$1,450-1,480 a ton. In India, domestic prices gained Rs1,000 a ton at Rs.130,000 a ton while CFR India values surged US$250 on the week to US$1,450-1,500 a ton.

In US, ACN export assessment jumped US$45 week on week to US$1,420-1,430 a ton FOB USG tracking feedstock as ammonia contract settled up on the month. European ACN prices were up as imports were scarce amid firm global price. Sellers were keen to hold material for sale expecting higher prices in coming weeks. Spot prices were assessed at US$1,428-1,432 a ton CIF ARA, increasing US$80 on the week. February contract settled at an increase of Euro 75 a ton.

(By Commoditiescontrol Bureau; +91-22-40015522)