MUMBAI (Commoditiescontrol) – The global cotton markets were fraught with factors driving them bullish despite balanced demand-supply situation. Although availability estimated by experts is ample, Futures have been trending higher, also supported by weakening US$ of late.

On the international scene, Cotton Outlook’s latest estimates foresee a smaller 2016-17 global crop shortfall than USDA’s January forecasts. World 2016-17 cotton production is projected at 104.04 million bales (1 Bale = 480 lb) by Cotton Outlook and consumption at 109.74 million. The production shortfall would narrow to 5.7 million bales from 14.22 million last season. The USDA’s forecasts are at 105.34 million bales for production and 111.76 million bales for mill use, with the crop shortfall projected to narrow to 6.42 million bales from 14.79 million. ICAC has projected an 8 percent to 104.72 million bales in 2016-17.

With an exception to China, cotton production is projected to be higher in the top five producing countries. India's cotton production is forecast to increase 4 percent to 26.63 million bales, making it the world's largest producer. Production in US will rise 28 percent to 16.53 million bales, while production in Pakistan will recover 20 percent to 8.27 million bales. Despite declining by 4 percent to 21.12 million bales, China would still be the second largest producer in 2016-17. Production in Brazil, the world's fifth largest producer and largest in the southern hemisphere, is forecasted to increase by 10 percent to 6.43 million bales. Australia is expected produce 4.59 million bales up 64 percent due to expanded plantings as farmers were encouraged by high prices and better water availability.

On the demand side, Bangladesh will increase its imports by 1 percent to 6.43 million bales, making it the largest importer in 2016-17. Vietnam's imports are projected to rise 19 percent to just under 5.52 million bales. Consumption is forecast to grow 5 percent to 5.97 in Bangladesh and 13 percent to 5.05 million bales in Vietnam. Thus, total world consumption is likely to remain stable at 110.69 million bales. China's consumption is expected to remain stable at 33.98 million bales. However, mill use in India is projected to decline 1 percent to 23.88 million bales, while mill use in Pakistan is likely to remain stable at 10.56. World's ending stocks may fall 7 percent to 82.68 million bales in 2016-17, though stocks outside China are expected to grow 6 percent to 39.96 million bales.

The 2016-17 season started with a large shrinkage in stocks, particularly from countries in the southern hemisphere, which saw ending stocks in 2015-16 fall 21 percent to 7.34 million bales, the lowest since 2009-10. The shortage in supply carried through the first few months of the season, as the bulk of the crop was still being harvested, keeping prices firm.

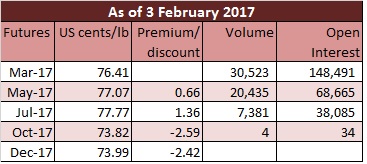

By early February, cotton futures neared their highest levels since 2014, even as the ICAC, forecast another drop in world inventories next season, despite a production rebound. Cotton futures for March touched US cents 77.35 a pound, the highest for a spot contract in nearly six months, and within 0.50 cents of hitting levels not seen since June 2014.

The gains extended a rally which has been attributed to factors including large number of outstanding fixations on physical cotton purchases which must be priced against the March contract before it expires. According to CFTC on-call report, showed that as of January 27, un-fixed on-call sales amounted to 11.96 million bales, which was 0.13 million bales more than a week earlier and just below the record of 12.12 million bales in early November 2010.

Unfixed on-call sales on March amounted to 3.24 million bales, just 0.31 million less than a week ago, implying that mills have their task to square off all these remaining fixations over the next 13 sessions until the First Notice Day of February 22. With another 3.10 million bales yet to be fixed on May and 3.12 million bales on July, total unfixed on-call sales in current crop remains high at 9.46 million bales.

Although export sales from US has been robust, it still has 7 million bales on offer. Total supply amounted to 20.8 million bales, including 3.8 million in opening stock, of which, 10.5 million are committed for exports and 3.3 million bales for mill-use. Of the remaining 7 million, about half will be reserved for supplies until the new crop arriving from August 2017.

Although export sales from US has been robust, it still has 7 million bales on offer. Total supply amounted to 20.8 million bales, including 3.8 million in opening stock, of which, 10.5 million are committed for exports and 3.3 million bales for mill-use. Of the remaining 7 million, about half will be reserved for supplies until the new crop arriving from August 2017.

This implies that US is not sold out yet and given the firmness in US Futures, some of the remaining cotton will find its way to the board. Certified stocks may be deterrent, it still does solve the trouble of many mills who still have to fix about 3 million bales in coming week.

Cotton prices worldwide may start falling from May and early June due to increased supply following higher production and remaining stocks from last year. The ICAC forecasts that cotton prices will range between US cents 66 - 83 cents per pound from the second half of the cotton season of 2016-17.

Additionally, cotton production in Brazil and Australia, is expected to put pressure on prices through the end of 2016-17 to the start of the next season as both countries are also large exporters.

In India, arrivals have started to rise but are still below the normal levels. And with only 40 per cent of the crop arriving until end-January, it is helping domestic prices to not only remain firm but rise on occasion of sluggish volumes. With cash crunch easing, farmers will start flooding the market with their produce, while exporters and mills will rush to secure their stock with intention of not facing the grim position as they were in the previous season.

However, in case the weakness in US$ is short-lived and the US$ index recover back to 104 and even hit 114, it will adversely impact international markets pushing cotton prices down.

(By Commoditiescontrol Bureau; +91-22-40015522)