MUMBAI (Commoditiescontrol) – Although the latest USDA report on global supply and demand for 2016-17 season has lifted cotton output and closing stock and pegged consumption almost at the same levels of previous season, international prices are unlikely to fall in coming months. There is an initial reaction to these numbers, with prices moderating a bit, but going ahead they may recover the losses as supply will remain sluggish, particularly from the largest producer and exporter of cotton, India.

Cotton crop arrivals continued to remain low, due to cash crunch, at around 1.50 lakh bales compared to a daily average of 2.00-2.25 lakh bales at this point of time in the season. Almost 2/3rd of the crop is yet to arrive in the markets. For consumers, mills are covered for the next two months and may not hurry to buy the white fibre as of now. However, export demand and prolonged arrivals will continue to pressure prices in India. Cash crunch easing is still far away and hence farmer do not see any incentive in sell but remain on wait and watch mode.

Technical: Cotton Bales Rajkot- Pullback Up Trend Is Likely (Full Report)

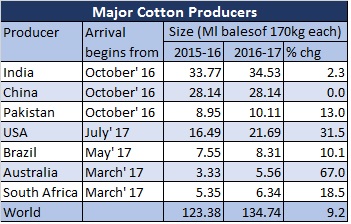

International prices will remain strong until the new crop enter the market beginning March 2017 from Australia and South Africa, followed by Brazil in May and USA in July. In the interim, major cotton consuming nationals like Bangladesh and Pakistan will remain active in the market. Pakistan, short of domestic crop will seek cotton either from India or other origin including USA. China will continue to import until end March when stocks from State Reserves will be offloaded.

In India, cotton prices will remain strong until arrivals is back to normal probably after mid-February in case crunch eases. Currently at Rs42,000 per bale, speculators believe it to rise to Rs44,000 a bale in February while bear traders peg them to Rs38,000 per bale once daily arrivals touch 2.50 lakh bales. The current Cotlook A index averaging US cents 82/lb as against US cents 78/lb spot price of India. Prices in India will continue to hover at high levels while cotton hungry nations support global prices by demanding cotton in global market until arrivals in India are back to normal and fresh crops from Australia and South Africa enter the market in March 2017.

.jpg)

(By Commoditiescontrol Bureau; +91-22-40015522)