Mumbai (Commoditiescontrol): China Cotton Auction: Quality of Cotton Offered Improving

The quality of cotton on offer has been seen to be improving as the auction enters the ninth day today.

Auction Quantity

Auction commenced on 3rd May. Cotton being auctioned is that of the year 2012-13.

.png)

Quantity in Metric Tons

.png)

|

Total Offer Quantity

|

Total Offer Sold

|

Domestic Cotton Sold

|

Imported Cotton Sold

|

|

242209.4

|

240266.4

|

72671.22

|

167595.2

|

240266.40 tons of cotton or 99.20 percent of total quantity offered was sold in the auction. Of which Domestic cotton accounted for 72671.22 tons or 30 percent of total quantity offered. The remaining 70 percent or 167595.20 tons comprised of imported cotton. Quantity of domestic cotton offered decreased on 11th and 12th May while that of imported cotton increased. Total quantity of imported cotton sold continued to outnumber that of domestic cotton.

Average quantity being offered on a daily basis has been slowly increasing from 30015 tonnes seen till 10th May to 30276.17 tons till 12th May. This increase can mainly be attributed to increase in offer on 12th May.

Auction Turnover And Staple Length

.png)

Total turnover was above 99 percent on the first three days of the auction and then on 11th May. The remaining days has seen turnover remain below 99 percent. Turnover in imported cotton has been reported to be 100 percent while that in domestic cotton is reported to be at 97.39 percent.

.png)

Average staple length has generally been dropping with the exception on 11th May which saw the staple length range between 29.4 and 28.86 mm.

Auction Price

Prices this time are more competitive.

.png)

Auction prices fell from 3rd to 10th May after which they have been seen increasing as better quality of cotton was being offered.

.png)

.png)

Premium and discount from the floor price on 5th, 11th and 12th May suggesting variance in the quality of cotton being offered.

Exchange Prices With Volumes

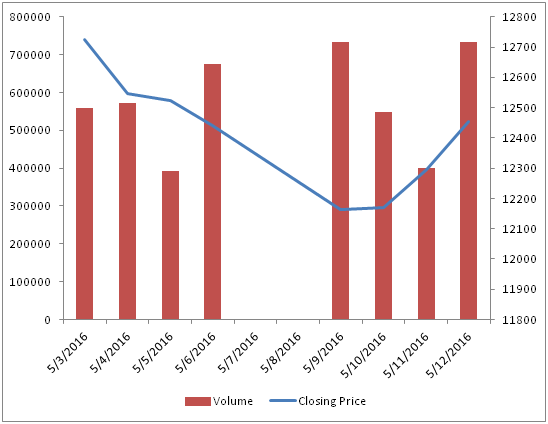

ZCE Cotton 3rd Month (September)

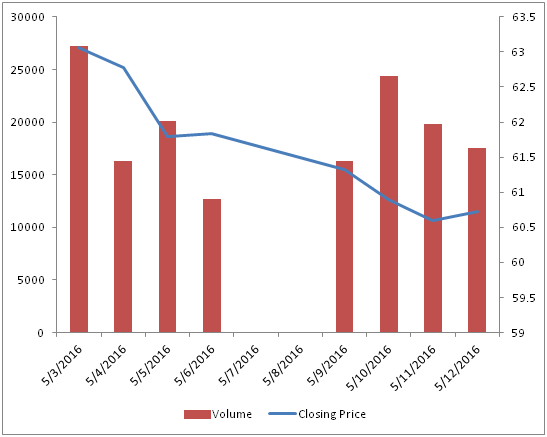

ICE Cotton July

ZCE is more accurate in reflecting the price impact of the auction. As auction prices have risen in the past two trading days, so to has prices on ZCE.

Increase on ICE futures is noted on 12th May, however, intensity of increase is lower.

Today’s (13th May) Auction Offer

China State Reserves has offered 30027.2957 tons for sale today.

First Session will comprise of 15026.6261 tons of which 5939.017 tons will be domestic cotton and 9087.6091 tons will be imported cotton.

Second session will comprise of 15000.6696 tons of which 3648.169 tons will be domestic cotton and 11352.5006 tons will be imported cotton.

Floor price set for today’s auction is even lower than that of 10th May at 11,931 yuan per ton or $0.89 per pound.

Impact

Higher quality of staple offered is causing prices to be supported which can be seen in price action over the past two trading days. Impact on domestic market is direct as stocks are being drawdown prices are picking up. Impact on the international markets is still to be seen on a full fledged basis as price increase yesterday was minimal.

(By Commoditiescontrol Bureau; +91-22-40015522)