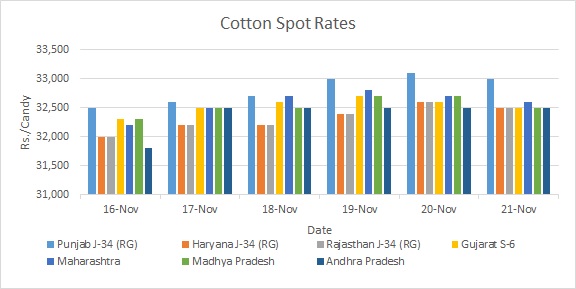

MUMBAI (Commoditiescontrol) - Cotton prices in domestic markets ended the week ending 21 November, 2015 on a lower note, after recording gains for most of the sessions in the week.

Prices in north India declined Rs 20-30/maund (37.3kgs each) over the last two sessions as binola and cake prices in Punjab have become 4 percent cheaper after Punjab government slashed value-added tax (VAT) on binola and khal to 2 percent from 5.5 percent on Friday. local buyers who were buying the cotton complex from other states would now purchase them from Punjab itself. In the backdrop of this, sellers have indulged in panic selling lowering their quotes to liquidate their stocks as much as possible.

Similarly, prices in Gujarat slipped Rs 200/candy (356kgs each), Rs 200/candy in Maharashtra and Madhya Pradesh over the last two days.

Earlier in the week, the commodity registered gains of up to Rs 500/candy in Maharashtra and Madhya Pradesh, and Rs 400/candy in Gujarat. In Andhra Pradesh too, prices had moved up Rs 400/candy during the week and remained stable so far.

One of the major reasons for the upsurge the prices during most of the week is several statements by and discussions by central and state governments making headlines with regards to providing perks and soaps to the textile industry as a whole. The statements by officials wooed farmers and stockists and they turned reluctant in offloading their stocks in markets at price level then.

Besides, limited arrivals of new crop in domestic markets contributed to the rise in cotton prices. This season, the pace of arrivals has been comparatively slower than previous years. Till 19th November, all India arrivals as per Cotton Corporation of India (CCI) is at around 33.14 lakh bales.

Cotton seed prices saw sharp volatility during the week, as they gained Rs 100-120/100kg but then slipped Rs 100/100kg also in a single trading session.

Surge In Exports Demand:

Overseas markets like Pakistan, Bangladesh and Vietnam are facing limited arrivals in local markets. Restricted arrivals are forcing these nations to enquire for Indian cotton in order to save themselves from shortfall of the fibre in future. These neighboring countries have emerged as the major potential buyers of Indian cotton in the current season as domestic production in these Asian countries is estimated to be lower.

2015/16 cotton crop in Pakistan is pegged between 11.5-12 million bales of cotton (155kgs each). Domestic mills consumption is being quoted to range between 14-14.5 million bales. Imports of cotton may range from two to 2.5 million bales. As production is forecast lower, cotton prices in Pakistan cotton markets are also constantly trading firm from the last few sessions.

CCI MARKET OPERATIONS

MSP Operations: The Cotton Corporation of India (CCI) started its minimum support price (MSP) operations across Andhra Pradesh, Telangana, Maharashtra and few centres in Madhya Pradesh. Till 18th November, 2015, it has procured around 94,885 bales through 92 centres in various states, according to its website. Earlier this month, CCI Chairman B.K. Mishra announced that the agency may restrict its MSP operations to only 20-25 lakh bales in 2015/16 season.

E-Auctions: At its e-auction this week, CCI has sold 1,20,700 bales of cotton from 3,95,400 bales put up for sale, 30.5 percent of the total offer. There are quality issues with unsold cotton left with it, prompting buyers to meet their needs from physical markets.

.jpg)

FACTORS TO IMPACT PRICES IN THE LONG-RUN:

For Price Rise -

1. Lower Domestic & Global Crop Estimates In 2015-16

2. Slight Improvement In Yarn Prices

3. Hand To Mouth Cotton Stock Position With Domestic Mills

4. Slow Domestic Cotton Supply, Particularly In North India

5. Exports Demand May Rise From Pakistan, Vietnam & Bangladesh

6. Indian Prices Cheaper In International Markets

7. Government Policy (Duty Drawback, Interest Subvention, Lifting Of Ban On Rajasthan Dying Units)

Against Price Rise -

1. High Unsold Stock With CCI As Well As Big Merchants (Unsold Stock With CCI From 2014-15 Crop As On Nov 19 Is 5.69 Lakh Bales)

2. Reduced Chinese Demand

3. Slow Consumption In Near-Term

4. Liquidity Pressure In Cotton Industry

5. Lower Crude Oil Prices (Competitive In PTA/Silk Yarn Market)

6. Vietnam Trans-Pacific Partnership (TPP) Policy

7. Depreciation In Currency Of Major Exporting Nations

U.S. MARKET THROUGH THE WEEK:

On Intercontinental Exchange (ICE), March cotton contract closed the week at 63.12 cents/lb, gaining 96 cents. Cotton futures on the exchange traded on the positive territory for most of the sessions this week as speculators increased their positions in March contract from December contract. Traders who are long in December contract have turned aggressive in moving out of the contract rather than short-term.

Speculators raised their net long position in March by 1,633 contracts to 28,884 in week to 17th November, 2015, showed U.S. Commodity Futures Trading Commission data.

Besides, a U.S.Department of Agriculture (USDA) report released Friday showed a drop in in the percentage of exchange-grade cotton, stoking supply concerns. The report indicates that there may be fewer tenderable grades this year.

USDA’s weekly export sales were up 52 percent at 194,400 RB for 2015-16, with Turkey, Thailand and Vietnam buying most of the U.S. cotton.

TOP STORIES THROUGH THE WEEK

MP Govt Releases Over Rs 1,000 Cr For Farmers’ Relief

As a Diwali gift to drought-hit farmers in Madhya Pradesh, state govt released Rs 1,049.24 crore. Amount would be distributed among farmers who suffered crop losses this year in 22 districts, as per an order issued by Commissioner Relief Department. Compensation of Rs 135 crore sanctioned for Vidisha district, while the lowest amount of Rs 42 lakh sanctioned for Ratlam district.

Andhra Govt To Declare MSP For Cotton After Research

Union Agriculture Ministry will declare MSP for cotton after thorough research and study by commission for agricultural costs and prices, said Union Minister of state for Labour and Employment Bandaru Dattatreya. Commission considers cost of production as one of the important factors in determining MSP of mandated crops, he said. Other important market related factors such as demand-supply balance, inter-crop price parity and market price trends. Demand factor is also important in pricing. He said prices fell below MSP due to weak demand of cotton seed and cotton bale market.

Hosiery Manufacturers Want Limit On Cotton Exports

Hosiery manufacturers in Tirupur sought restrictions on cotton exports. They attributed unrestricted export of cotton without meeting the domestic consumption needs and hoarding to fluctuation in cotton and yarn prices. South India Hosiery Manufacturers’ Association feel that cotton produced should be ginned and sold directly to CCI at government fixed rate. It also suggested that export of cotton should be allowed only at the rate of 5 lakh bales (175 kgs each) at the maximum a month.

India, Bangladesh Sign SOP To Operationlise Coastal Shipping Deal

India and Bangladesh signed a Standard Operating Procedure (SOP) on 15th November to operationalise coastal shipping agreement. The two countries entered into the agreement in last June. The deal is likely to increase bilateral trade, including textile and apparel trade. Nitin Gadkari, Shipping, Road Transport and Highways Minister said the SOP will promote coastal shipping between India and Bangladesh. As per the agreement, two nations shall render same treatment to other country's vessels as it would have done to its national vessels used in international sea transportation. They have also agreed to use vessels of river sea vessel category for Indo-Bangladesh coastal shipping.

Centre, CCI Blamed For Poor Cotton MSP

Telangana Minister For Marketing and Irrigation T. Harish Rao Blamed Centre and CCI for poor MSP to cotton and slow purchase from farmers. CCI purchased only 1.44 quintals cotton in the state till 12th November against 6.56 lakh quintals same time last year, Rao said. He said CCI failed to make necessary arrangements to purchase cotton despite knowing the production was estimated to be 284 lakh quintals this year.

AP To Waive Loans Of Rs 110 Cr To Waivers

Andhra Pradesh government will waive loans worth Rs 110 crore taken by over 25,000 weavers. Loan waiver cheques would be handed over to the beneficiaries in January next year. Government is also planning to provide interest-free loans to weavers to promote traditional handloom sector in the state.

India Exports Remained In Negative Territory For 11th Month

India's exports remained in the negative territory for the 11th month in a row by registering a dip of 17.53 percent in October to $21.35 billion due to a demand slowdown, while trade deficit showed an improvement. The imports too shrank an annual 21.15 percent to $31.12 billion in October, narrowing the trade gap to $9.76 billion, lowest figure since February. The trade gap was $6.85 billion in February. The cumulative exports during April-October this fiscal came down by 17.62 percent to $154.29 billion as against $187.2 billion in the same period last year, according to data released by the Commerce Ministry. The trade deficit during the first seven months of the current fiscal has shrunk to $77.76 billion as against $86.26 billion last fiscal.

Textile Industry Hails Revision In Export Duty Drawback Rates

Textile industry applauded revision of duty drawback rates of exports on Monday by finance ministry. Rates enhanced on value-added products like yarn counts in 100s and above, fabrics with less than 200 grams per square metre, knitted and woven garments. Industry believe revised rates would encourage the textile industry to give more focus for value addition which would generate more foreign exchange.

Re-Opening Of Rajasthan Textile Units Bring Good Days For Malegaon

Textile units in Malegaon will see good days ahead after 9 month recession after National Green Tribunal (NGT) lifted ban on dyeing units in Rajasthan. Malegaon textile clusters were already facing recession due to market slowdown. Closure of Rajasthan units made the situation worst.

Pakistan Apparel Forum Criticises Govt For Unhealthy Sales Tax On Exports

Pakistan apparel forum criticised unhealthy sales tax Of 2 percent exports imposed by PPP government. Forum expressed concerns that the PML-N government is continuing the policy. Exporters said that sales tax regime harmed Pakistan’s overall exports dragging them down 13.42 during July-October 2015/16.

Pakistan Ginners Receive Over 8 Million Bales Cotton

According to a fortnightly report of Pakistan Cotton Ginners Association (PCGA) showed that Seed cotton (Phutti) equivalent to 8.019 million (8,019,613) bales have reached ginneries across the country till November 15, registering a shortfall of 23.17 percent compared to corresponding period of last year. Out of total arrivals, Phutti equivalent to 6,924,395 bales has undergone the ginning process.

Govt Approves 3% Interest Subsidy To Boost Exports

Cabinet Committee on Economic Affairs (CCEA) has approved 3 percent Interest Equalisation Scheme on Pre and Post Shipment Rupee Export Credit with effect from 1st April, 2015. The scheme will be in effect for a period of five years, stated an official release. The interest subsidy scheme will have a financial implication of about Rs 2,700 crores. The decision to help boost overseas shipments was taken at a meeting of CCEA headed by Prime Minister Narendra Modi.

The scheme would be available to all exports of Micro, Small and Medium Enterprises (MSME) and 416 tariff lines. But it would not be available to merchant exporters. Power Minister Piyush Goyal said that the scheme would help country’s exports to achieve a level playing field and boost MSME sector, handicraft, agri-products and food processing.

SIMA Happy With Interest Equalization Scheme

Southern India Mills' Association (SIMA) hailed centre’s approval for 3 percent interest equalization scheme for all fabrics and made-ups. SIMA said all the latest implementations would prove very beneficial for india’s textile sector and clothing industry.

Punjab Cabinet Slashes VAT On Khal, Binola

Punjab Cabinet slashed value-added tax (VAT) on khal & binola to 2 percent from 5.5 percent, reports The Outlook. State government provided health insurance over of Rs 50,000 to farmers who bring their produce to purchase centres set up by Punjab Mandi Board.

Brazil’s 2015/16 Cotton Output Seen At 6.4 Mln Bales

U.S Department of Agriculture (USDA) attache report showed that Brazil’s 2015/16 cotton production is likely at around 6.4 million bales compared to last year from an area of 900,000 hectares (ha). The reduction is a result of the higher costs of production and the high cost to borrow money. Yields are forecast to be at 1.54 metric tons (MT) per ha, similar to last year’s yields. Brazil is likely to export nearly 4 million bales due to relative weaker domestic currency, which is making Brazilian cotton more competitive. Post forecasts imports for MY 2015/16 to drop to 20,000 bales, a drop of 2 percent compared to the last MY. Post forecasts consumption for 2015/16 to 3.3 million bales (725,000 MT). The economics in Brazil, especially the higher inflation affecting consumers and the increase in energy prices are truly affecting domestic demand.

SPECIAL REPORTS THROUGH THE WEEK

USDA Attache Report: India 2015/16 Cotton Exports Seen Up At 4.7 Mln Bales

Cotton exports by India in the season 2015/16 are forecast higher at 4.7 million bales (480 lb each), as per USDA’s FAS Mumbai. The body expects export demand of more than 80 percent from Bangladesh, China and Pakistan during the season. Vietnam and Indonesia are likely to contribute to nearly 9 percent and 3 percent of export orders (Click Here For Full Report)

India Textile Exports Up 1.88% In October In Rupee Terms; Imports Rise Too

India’s exports of cotton yarn and related products rose 1.88 percent in Indian Rupee terms to Rs 5588.58 in October compared to Rs 5485.35 same month last year, according to a Commerce Ministry data. Currently, Indian cotton is cheaper in overseas markets compared to their domestic prices, which is driving export orders. So much so that exporters are buying nearly 60 percent of total cotton being sold in domestic markets (Click Here For Full Report)

Finance Ministry Revises Duty Drawback Rates For Merchandise Exports

In a bid to provide some relief to the country’s ailing exporters, the Indian Finance Ministry has revised duty drawback rates for merchandise exports. The revised rates will come into effect from 23rd November, as per a government notification released on Monday. “These revised rates are based on average incidence of customs and central excise duties and service tax related with the manufacture of export goods and involve substantial total drawback for exporters,” stated the release (Click Here For Full Report)

Increased Selling Drags Cotton Prices Down In Brazil

Cotton prices declined in Brazil during the first week of November owing to increased willingness in selling. Aggressive selling limited buying activity, which further pressured the prices. Growers and traders who are in need to make cash, offer batches especially to domestic purchasers. This position is also linked to decrease in export parity in the first fortnight of November (Click Here For Report).

OUTLOOK FOR NEXT WEEK:

Cotton prices are likely to stay steady in the coming week, with further correction mostly unlikely decent demand would offset selling pressure. We at commoditiescontrol.com foresee business to take place in the range of Rs 32,00-32,800/candy in domestic markets.

(By Commoditiescontrol Bureau; +91-22-40015532)