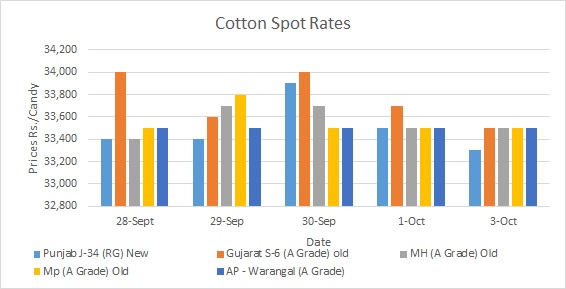

MUMBAI (Commoditiescontrol) - Cotton prices in commenced the week on a bullish tone in north India, but slipped later during the week ending 3rd October, 2015 on various negative fundamentals. As predicted in the last week’s report (26th September, 2015), prices ended the current week lower. While, prices continued to trade steady to easy in central and south India, mainly due to strong selling.

Prices in the domestic spot markets declined as much as Rs 2.000/bale in September. But, good demand was seen at the lower level by mills and exporters. Also, reports of an international merchant listing new crop at lower rates than the market expectations sent negative signals to market participants. Going with the market reports, cotton prices may correct further by Rs 1,000/bale in October.

FACTORS STRESSING DOMESTIC COTTON PRICES -

1. New Crop Supplies Remain Upbeat

New arrivals have capped upside in prices across all the major centres in the country. Supplies are rising with each day. Daily arrivals of new cotton reached 20,000 bales. Market participants are prepared for further correction in prices in days to come. The current smooth arrivals will ensure ample availability of the fibre in local markets in times to come. All India estimated arrivals as on 3rd October, 2015 is at around 11,000 bales. Market sources say that good quality cotton will start arriving in local markets by October-end.

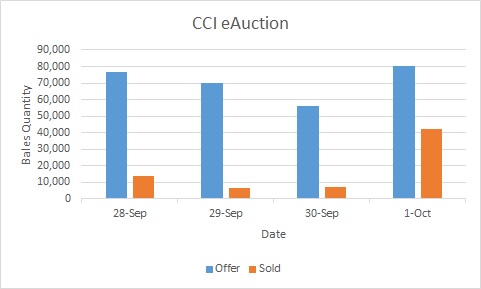

2. Sale Of Cotton By CCI

The government procurement agency, Cotton Corporation of India (CCI) auctioning process also lent to prevailing bearish factors to drag prices down in physical markets. Attempting to shift most of the cotton put up sale at its E-auctions, the agency had lowered its floor prices by upto Rs 300-400/candy throughout all the centres. But then, it received a mix bag of response for its cotton this week. It sold 69,300 bales out of 2,83,000 bales offered to sell during the week. However, the cotton quantity put up for sale by the agency is decreasing day by day. As on today, CCI has an unsold cotton stock of around 17 lakh bales.

3.Selling Pressure Still Looms Large

Active selling is another major factor suppressing cotton trade in the domestic markets. The soft commodity has been witnessing a lot of selling pressure from the last two weeks in the midst of rising apprehensions that the prices may correct further in sessions to come due to prevailing bearish trend in the commodity. A lot of stockists and private traders are actively liquidating their stocks at the current rates. Also, few of stockists are known to be reselling cotton purchased from CCI in local markets.

4. Extended Subdued Movement In Yarn Markets

Yarn prices traded more or less steady this week, with 30 single carded in Ichalkaranji quoted in the range of Rs 146-155/kg and 30 carded weft offered in the range of Rs 130-135/kg in Coimbatore, while 30 carded in Gujarat was offered in the range of Rs 160-165/kg. But decent offtake were recorded at the current lower rates. Unless demand at domestic and export front is improved, yarn prices cannot see any revival.

5. Dull Chinese Demand Prospect

China’s demand for imported cotton is forecast to remain weak in 2015/16 as well due to the country’s continuous attempt to encourage buying in domestic grown cotton. In 2014/15 season, demand from the world’s leading consumer slumped after Beijing issued limited import quotas for the country’s textile importers in an attempt to support its domestic cotton. China has a huge reserve stock of around 12 million tons, which it tried to reduce through reserve auctions in July. But the auctions could not help much as very little of the offered quantity was sold. Only 63,412 tons of cotton were liquidated, just 3.4 percent of the total offered.

Also, much to market disappointment, China has kept low-tariff import quota for cotton in 2016 unchanged at 894,000 tons. The import quota of 894,000 tons is as per the World Trade Organization (WTO) rule, but markets had expected some hike in the country’s import quota for the new season.

WEEKLY WEATHER UPDATE:

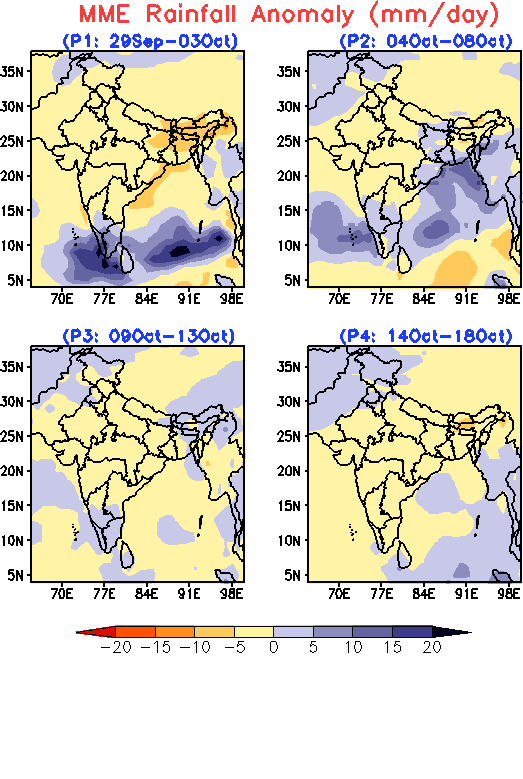

Rainfall Seen 62% Below Normal This Week

The country as a whole received below normal rainfall of 62 percent during 24-30 September, 2015, as per the Indian Meteorological Department (IMD).

During the week, central India received least rainfall of 0.9mm against normal rainfall of 30mm, showing a deficiency of 97 percent. The northwest part of India received 2.8mm rainfall against 17.5mm of normal rainfall, a 84 percent deficient.

South Peninsula recorded 14 percent rainfall deficit by receiving 36mm rainfall against 42mm of normal rainfall.

For the country as a whole, cumulative rainfall during monsoon season has so far upto 30 September been 14 percent below LPA. Rainfall activity was less than normal in all the four broad homogeneous regions.

Long Range Forecast For Coming Weeks:

Normal to above normal rainfall is likely over south Peninsular India till 13th October, 2015. A western disturbance may cause nearly normal rainfall over western Himalayan region during the period 13-18 October.

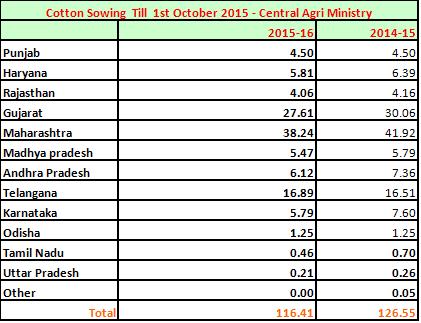

However, Cotton Sowing Area Fall 8% As On 30th Sept

Sowing area under cotton crop as on 30th September, 2015 narrowed down 8 percent percent to 116.41 lakh hectares compared to 126.55 lakh hectares in the corresponding period last year, as per the Central government data.

Weekly Technical Update

MCX Cotton Bales Weekly: Expect Lower Range To Be Tested

Exit long and sell on rise from 15680 to 16090 with a stop loss of 16270. Expect lower range of 15450-14810 to be tested.

Click Here

NCDEX Kapas April’16 Weekly: Cover Short Position

Cover short position at 841 or below as the opportunity arises. Traders still short need to maintain the stop loss at 855 with the objective to cover short position at 841 or below. Weakness will continue below 822. A rise and close above 855 can trigger a pullback towards DRV-876.

Click Here

NCDEX CoC Weekly September: Expect Higher Range To Be Tested

Traders long can keep the stop loss at 1530. Expect higher range of 1616-1679 to be tested. The peak is at 1611. Further rally can continue on breakout and close above 1611.

Click Here

SPECIAL COVERAGE THROUGH THE WEEK

CCI Likely To Procure 30-40 Lakh Bales In 2015/16 Season

Cotton Corporation of India (CCI) may procure only 30-40 lakh bales of cotton from farmers in the 2015/16 season compared to 87 lakh bales purchased in 2014/15. CCI feel that market intervention by it may not be required to a great extent in the new season as market prices may not fall beyond the minimum support price (MSP). Cotton prices are currently in the region of Rs 32,000 to Rs 34,000 per candy (Click Here For Full Report).

CAI Forecasts Record Cotton Closing Stock During 2014-15

The Mumbai based industry body - the Cotton Association of India (CAI) has forecast record closing stock of cotton during the season 2014-15. Further, CAI has lowered its estimate for the cotton season 2015-16 at 377.00 lakh bales of 170 kgs each. It has released second estimate for the cotton season 2015-16 beginning at 1st October 2015 (Click Here For Full Report)

India’s Cotton Exports May Grow 34% In 2015/16, Says ICAC

After falling as much as 48 percent in 2014/15, India’s cotton exports are projected to recover 34 percent to 1.2 million tons in 2015/16, as per International Cotton Advisory Committee (ICAC). The U.S. is likely to lead in export volume, although its exports are projected down 9 percent to 2.2 million tons due to a smaller volume of production in 2015/16. Exports in the next three largest exporting countries are likely to decrease due to reductions in their exportable surplus. Brazil’s exports are forecast down 10 percent to 766,000 tons, Uzbekistan’s down 5 percent to 565,000 tons and Australia’s down 10 percent to 467,000 tons, as per ICAC. (Click Here For Full Report)

Nearly 69% Of U.S. Cotton Crop Reach Bolls Opening Stage - USDA

The U.S. Department of Agriculture (USDA) in its weekly crop progress report for the week ended 27th September, 2015, stated that nearly 69 percent of U.S cotton crop reached bolls opening stage, higher than 63 percent in the last year same time, but below five year average of 70 percent. The report showed that 13 percent of the crop is very poor/poor compared to 12 percent a week ago. About 50 percent of the crop is rated good/excellent, below 52 percent a week ago period, the report showed (Click For Full Report)

Demand In Brazilian Cotton Seen Declining Amid Easy Availability

Demand for cotton in Brazilian markets seen declining as with harvesting almost finished and advancing grinning, processors are getting required quantity of the commodity in market. Wholesale agents, however, are more active, buying cotton to accomplish contracts. Good part of negotiations in the spot market involves small batches with various types. Sellers are also focused on accomplishing contracts and, thus, it is normal to ask higher prices in the spot trades. In general, some batches have quality problems (Click Here For Full Report).

TOP STORIES THROUGH THE WEEK

Cotton Production May Fall 10-15 Lakh Bales Than Estimate In 2015/16 - CDRA

Cotton production might be lower by 10-15 lakh bales than the anticipated level of 390 lakh bales during 2015-16, an industry body said on Sunday. SIMA Cotton Research and Development Association (CDRA) has attributed the decline to white fly attack in Punjab, Haryana, Rajasthan and inadequate rains in Gujarat, Maharashtra and Karnataka.

FMC Merges With SEBI; Option Trading On The Anvil

The much talked about merger of the Forward Markets Commission (FMC) and Securities and Exchange Board Of India (SEBI) is set to take place today, 28th September, 2015. But as per reports, SEBI will create a unified regulatory body.

In the wake of several fraudulent activities in commodities market, apart from the National Spot Exchange Ltd (NSEL) scam in the recent past has forced the government to announce FMC’s merger with SEBI.

The merger would be consummated today at a function attended by Finance Minister Arun Jaitley along with SEBI Chairman U.K. Sinha and other top officials from the government and the regulatory bodies.

While addressing the event, SEBI Chairman U.K. Sinha informed soon green signal will be given to option trading on commodity exchanges in the country. Besides, foreign investors, institutional investors and banks will also be allowed to participate in commodity trading very soon, Sinha informed.

SIMA Wants Textile Policy To Access Global Markets

Southern India Mills' Association (SIMA) sought urgent policy for textile industry to ensure access to global markets. For ninth straight month, India’s textile exports fell 20.66 percent in August. SIMA said abnormal duties imposed on Indian textiles are severely affecting Indian exports. SIMA Chairman M Senthil Kumar urged government to extend 3 percent incentive for yarn, 5 percent for fabrics and 7 percent for garments and made-ups till FTAs were signed.

India To Import Pakistan Origin Cotton

India To Import Pakistan Origin Cotton Of 1505 SL 1/3/32 Variety With Moisture Content Of 5 Percent At 0.59 Cents Per Pound. 1505 SL 1/16 Variety With 5 Percent Moisture At 0.59 Cents Per Pound. 1503 SL 1/3/32 With 6 Percent Moisture Content At 0.59 Cents Per Pound. 1503 SL 1/1/16 With 6 Percent Moisture At 0.58 Cents Per Pound. 1467 SL 1/3/32 With 7.5% At 0.57 Cents Per Pound. 1467 SL 1/1/16 With 7.50% At 0.57 Cents Per Pound.

Punjab Govt Announces Rs 600 Cr Aid For Affected Cotton Growers

Punjab Chief Minister Parkash Singh Badal on 28th September announced to disburse Rs 600 crore of compensation to farmers whose crops were damaged by whitefly attack in the state. Badal said that he was well aware about the agony faced by the farming community due to whopping loss suffered by them on account of pest attack for which he had asked the officers yesterday to disburse Rs 600 crore so that farmers could be bailed out during this hour of crisis.

Haryana Govt Cuts Market Fee On Kapas

The Haryana government has slashed market fee on seed cotton (kapas) from Rs 2.80 to Rs 1.60, providing relief to cotton ginners. Cotton ginners in the state earlier expressed fear that state cotton growers will prefer selling their crop in neighbouring states of Punjab and Rajasthan because of "higher" levies on fiber in the state.

Karnataka Estimates 50% Fall In Cotton Production In 2016

Cotton production in Karnataka in 2015/16 season is likely to fall 50 percent to 10.99 lakh bales (170kgs each) compared to 21.58 lakh bales in 2014/15, as per state agriculture department. As per the first advance estimates released by state agriculture department, kharif crop production is set to drop significantly in the state due to poor rainfall, 20 percent less than normal.

Sangrur Gets Rs 13.68 Crore For Whitefly-Hit Cotton Growers

The district administration has received a sum of Rs 13.68 crore to be distributed among the farmers who have lost their cotton crop in the whitefly attack. Unlike in Bathinda district, where cheques were given to the land owners instead of cultivators, the administration here is giving cheques to the persons who took land on lease or rent for cultivation, said sources.

RBI Cuts Repo Rate By 50 BPs To 6.75%

Reserve Bank of India on Tuesday cut its key interest rate by 50 basis points to 6.75 per cent, lowest since May 2011 and the repo rate by 50 basis points to 6.75 per cent. In the fourth bi-monthly Monetary Policy Statement for 2015-16, Governor Raghuram Rajan also announced a downward revision, the second this year, in the Reserve Bank’s growth projection for the year—to 7.4 per cent from the earlier 7.6 per cent.

Textile Industry Welcomes RBI Repo Rate Cut

The Indian textile industry has welcomed the move of the Reserve Bank of India (RBI) to reduce the repo rate, the rate at which the central bank of a country lends money to commercial banks during shortage of funds, as it will stimulate the much needed investment in the textile industry and help in growth. RBI governor Raghuram Rajan announced a repo rate cut of 50 basis points, making it stand at 6.75 per cent from 7.25 per cent, with immediate effect in its monetary policy on September 29, 2015. This is RBI’s fourth repo rate cut in the year 2015.

The repo rate cut indicates that there is a sense of urgency to push the economic growth rate, which is welcome, Siddhartha Rajagopal, executive director of The Cotton Textiles Export Promotion Council of India (TEXPROCIL) told Fibre2Fashion.com. It also suggests that RBI does not view inflation as a key risk currently which is a relief to all. The repo rate cut of 50 basis points will stimulate the much needed investment in the textile sector as the cost of funds are expected to come down. It will also give a sense of feel good to all at a time when the overall global outlook is still in the recovery mode, he stated.

OUTLOOK FOR NEXT WEEK:

Cotton prices may continue to trade easy during the course of next week due to gradual rise in new crop supplies. Despite decent lifting of yarn at the current rates, yarn prices are comparatively negative, which would continue to add pressure on overall cotton business. Also, CCI E-auction process is remains to be seen if the agency continue to reduce its floor prices.

(By Commoditiescontrol Bureau; +91-22-40015532)