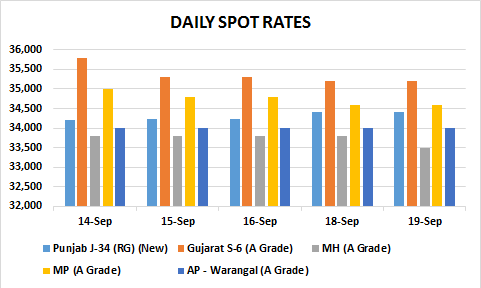

MUMBAI (Commoditiescontrol) - As predicted in the last week’s report, 12th September, 2015, cotton prices traded more or less steady in domestic markets during the week ending 19th September, 2015. Until a week ago, cotton prices were continuously gaining due to increased buying interest by domestic mills at the back of bullish reports on next crop.

Major Factors Halting Upside Momentum -

1. Active Selling Against Slow Demand

Domestic demand in the fibre was seen subdued throughout the week amid gradual rise in new crop arrivals. Stockists chose to stay active in liquidating their stocks at the current rates, tracking bearishness in markets and fearing prices may fall further. Also, traders are liquidating cotton purchase from Cotton Corporation of India (CCI).

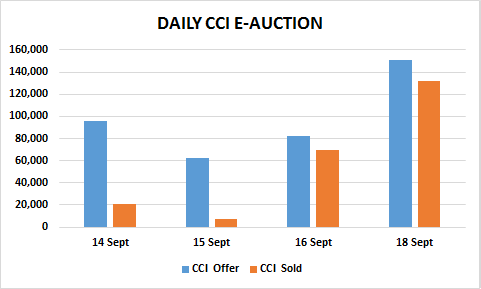

At the same time, CCI is liquidating its cotton stockpile regularly for domestic mills and spinners, which is also suppressing cotton prices on spot markets. The government agency has sold 2,29,075 bales out of 3,91,750 bales (excluding 17th September due to festive Holiday) this week. Currently, it has around 21.5 lakh bales of unsold cotton stock with it. Chairman B.K. Mishra had earlier said that the agency intends to reduce its inventory to 5 lakh bales by the end of the current season.

2.Dull Movement In Yarn Market

Yarn prices traded more or less steady this week, with 30 single carded in Ichalkaranji quoted in the range of Rs 146-152/kg and 30 carded weft offered in the range of Rs 130-135/kg in Coimbatore. At exports front, there is no demand for normal yarn from Bangladesh, while demand for special yarns like BCI cotton yarn and organic cotton yarn is encouraging. Yarn market will see any improvement only when the huge inventory with mills is reduced.

3.Grim Prospect Of Chinese Demand In Near-Term

Demand in Indian cotton from the world’s leading consumer, China, has remained weak this year after Beijing issued limited import quotas for the country’s textile importers in an attempt to support its domestic cotton. China has a huge reserve stock of around 12 million tons, which it tried to reduce through reserve auctions in July. But the auctions could not help much as very little of the offered quantity was sold. Only 63,412 tons of cotton were liquidated, just 3.4 percent of the total offered.

That apart, the weekly export sales report for U.S cotton released by the U.S. Department of Agriculture (USDA) showed that China remained absent from the list of buyers this week again, for the second straight week. This has solidified concerns about weak import demand from the world's leading consumer.

4. Good/Heavy Rain Over Cotton Belts

Portions of Gujarat, Marathwada and Madhya Pradesh continued to receive revived monsoon showers this week. The revival in rainfall is considered to be beneficial for cotton crop in these major cotton growing areas. The fresh spell of monsoon showers is expect to boost yield by around 7-10 percent per hectare, according to traders. The Indian Meteorological Department (IMD) has predicted the revival of rains will continue till the first week of October.

Reports Likely To Renew Buying Sentiment

Over 10% Fall In Sowing Area

But sowing area under cotton across the country depicts a different story all together. As on 18th September, 2015, all India cotton sowing area reduced to 115.2 lakh hectares compared to 125.75 lakh bales, a slump of 10.55 lakh bales, as per Central government data.

| State |

Normal |

Current |

Previous |

Change % |

| Andhra Pradesh |

5.21 |

5.75 |

7.31 |

10.36 |

| Telangana |

15.16 |

16.73 |

16.35 |

10.36 |

| Gujarat |

27.25 |

27.61 |

30.06 |

1.32 |

| Haryana |

5.69 |

5.81 |

6.39 |

2.11 |

| Karnataka |

5.15 |

5.39 |

7.6 |

4.66 |

| Madhya Pradesh |

6.3 |

5.47 |

5.78 |

-13.17 |

| Maharashtra |

40.55 |

38.23 |

41.95 |

-5.72 |

| Odisha |

1.08 |

1.25 |

1.25 |

15.74 |

| Punjab |

5.12 |

4.5 |

4.5 |

-12.11 |

| Rajasthan |

3.9 |

4.06 |

4.16 |

4.10 |

| Tamil Nadu |

0.22 |

0.17 |

0.07 |

-22.73 |

| Uttar Pradesh |

0.26 |

0.21 |

0.26 |

-19.23 |

| All India |

116.01 |

115.2 |

125.75 |

-0.70 |

Govt’s First Advance Estimate For 2015-16 Cotton Output

All India cotton production in 2015-16 is seen at 335 lakh bales (170kgs each), as per central government’s first advance estimate. Cotton output was seen at 355 lakh bales in 2014-15, as per fourth and final estimate of the government for 2014-15.

The cumulative rainfall during the current monsoon season has been deficient by 16 percent, higher than rainfall deficit of 12 percent in 2014-15. The cumulative rainfall during the current monsoon season has been deficient by 16 percent, higher than rainfall deficit of 12 percent in 2014-15.

This year’s monsoon was extremely weak over Gujarat, Madhya Maharashtra, Marathwada, north interior Karnataka, Telangana, east Uttar Pradesh, Punjab and Delhi. Elsewhere, monsoon rains were seen normal on the whole.

Less than normal rainfall in major agriculture belts in the country is likely to impact yield and may affect kharif production numbers.

That apart, whitefly attack menace on cotton crop in northern India posed a serious threat to cotton growers this year, damaging their crop to the extent it became unmanageable to control. As per a latest field survey conducted by Revenue Department in collaboration with the Agriculture Department, at least 1.30 lakh hectares of the 4.50 lakh hectares cotton crop in Punjab have been attacked so far this year.

Monsoon Makes Its Gradual Exit

Southwest monsoon rainfall is gradually making its exit from the northern parts of the country. The withdrawal line of southwest monsoon continues to pass through Amritsar, Hissar, Ajmer and Barmer.

Weekly Technical Update

MCX Cotton Bales Weekly: Expect Lower Range To Be Tested

Exit long and sell on rise from 15920 to 16147 with a stop loss of 16250. Expect lower range of 15797-15447 to be tested. Overall movement may remain between 15450 and 16610 with a momentary bias to test the lower range. Click Here

NCDEX Kapas April’16 Weekly: Expect Lower Range To Be Tested

Exit long and sell on rise from 828-845 with a stop loss of 855. Expect lower range of 819-791 to be tested. Lower range can attract support therefore cover short position at 819 or below as the opportunity arises. Click Here

NCDEX CoC Weekly September: Minor Correction To Sideways Movement Likely

Exit long on rise from 1562 to 1584 as the opportunity arises. Expect lower range of 1545-1506 to be tested.

Swing top appears to be in place. Click Here

U.S. MARKET THROUGH THE WEEK

U.S cotton lost more than 4 percent this week, closing the week on 7-1/2 month low at the back of several negative cues resulting in strong selling. However, most of the losses were registered on Friday, when prices went down by 3 percent after the U.S. central bank's decision to hold interest rates near zero stoked concern about economic growth in the world's leading cotton-consuming countries.

The December contract finished the week down 4 percent, and settled Friday just slightly above the March contract, after trading at a premium to it for nearly six weeks.

The December frequently traded at a discount to March during the session, threatening the end of a market condition known as backwardation, in which nearby contracts trade higher than forward prices, which is seen as a sign of tight supplies.

With top-exporter United States experiencing good weather ahead of the harvest, and demand weak in emerging market economies, traders say that is no longer the case.

The U.S. Federal Reserve on Thursday cited weak economic activity in outside economies as a reason behind its decision not to raise rates, solidifying demand concerns as export sales and shipments of cotton have been low so far in the 2015/16 season, which began in August.

U.S. export sales reached 96,600 bales last week, up 16 percent from the prior week and up 46 percent from the prior four-week average, the U.S. Department of Agriculture said in its weekly report. Nonetheless, China was absent from the list of buyers for the second straight.

.png)

SPECIAL COVERAGE THROUGH THE WEEK

All India Rainfall Deficit Turns 16%

Southwest monsoon across the country turned 16 percent deficient as on since 1st June to 13th September. The country as a whole received actual rainfall of 673.5mm against normal rainfall of 802mm, as per Indian Meteorological Department (IMD). This year’s monsoon was extremely weak over Gujarat, Madhya Maharashtra, Marathwada, north interior Karnataka, Telangana, east Uttar Pradesh, Punjab and Delhi. Elsewhere, monsoon rains were seen normal on the whole (Click Here For Full Report).

India Textile Exports In August Fall 6% In U.S Dollar Terms

India’s exports of cotton yarn and related products fell 6 percent in U.S. dollar terms to $863.18 million in August compared to $932.02 million same month last year, according to a Commerce Ministry data. In Rupee terms also, textile exports declined marginally 1.03 percent in the month to Rs 5616.91 crores compared to Rs 5675.54 crores last year (Click Here For Full Report)

U.S. Cotton Crop Seen 13% Poor/Very Poor - USDA

The U.S. Department of Agriculture (USDA) in its weekly crop progress report for the week ended 13th September, 2015 rated U.S cotton crop 13 percent poor/very poor, slightly higher than last week’s 12 percent. About 52 percent of the crop is rated good/excellent, below 53 percent a week ago period, the report showed. According to the report, 4 percent crop reached harvesting stage, which is below last year’s level of 6 percent and five year average of 7 percent (Click Here For Full Report)

China’s August Cotton Imports Down Over 65%; Lowest Since 2005

Cotton imports by China in August stood at 70,000 tons, down 65.8 percent from the same month a year ago, according to customs data. As per the data, this is the lowest monthly level in atleast 9 years, since 2005. The government has issued fewer import quotas to the country’s importers in its effort to boost demand for the domestic crop (Click Here For Full Report)

Cotton Prices In Brazil Stay Firm; Harvest Soon To End

Cotton prices in Brazil continued to stay firm even as buying cools off. Traders and speculators are betting on stable prices or even decreases in the upcoming weeks tracking soon to end harvesting and with advances in cotton processing (Click Here For Full Report)

TOP STORIES THROUGH THE WEEK

PAU Blames Farmers For Whitefly Attack On Cotton

Punjab Agricultural University (PAU) blamed cotton farmers for whitefly attack on cotton in Malwa district of the state. The University expressed helplessness in providing any urgent help. It said sowing of unrecommended cotton varieties and sowing cotton before time led to this distress.

Punjab Announces Rs 10 Cr Compensation For Cotton Farmers

Punjab Chief Minister Parkash Singh Badal today announced Rs 10 crore compensation for cotton growers affected by whitefly attack. Compensation was announced for farmers who have uprooted their crop. Interacting with the members of the delegation, the Chief Minister Parkash Singh Badal assured cotton growers that they would be duly compensated for the substantial loss incurred by them due to whitefly attack.

Revived Rains In Central Zone Raise Cotton Output Estimate

Revived rains in Marathwada and Vidarbha raised cotton crop estimates. Industry experts now pegged output at 400 lakh bales from area of 120 lakh hectares. Vidarbha may produce around 37-38 lakh bales cotton compared to normal output of 30-32 lakh bales.

Cotton Prices May Remain Low In New Season - Reports

Cotton prices in Punjab and Haryana may remain low in the new season, according to traders. Prices may remain stressed due to good crop yield and lower yarn prices. Raw cotton prices may also remain poor due to bad shape of country’s textile sector.

Textile Sector Seeks Relief From Cheap Chinese Dumping

Indian textile sector is seeking protection against cheap Chinese dumping. About 60 percent of dumping in India is claimed to be done from China. Industry players want government to regulate inspection of country of origin of goods coming to India.

SIMA,TN Govt Join Hands To Set Up Textile Parks

Southern India Mills Association (SIMA) signed an MOU with Tamil Nadu government to set up two textile processing parks worth Rs 500 crore. The projects are likely to generate employment to around 10,000 people directly and 25,000 indirectly.

CCI To Begin Cotton Purchase From 10th Oct In Telangana

Cotton Corporation of India (CCI) to start purchasing cotton from farmers from 10th October in Telangana, Marketing minister T. Harish Rao informed media. He further said that government is likely working towards ending middlemen in selling cotton in the state.

TEA Seeks Urgent Govt Intervention To Check Falling Exports

Tirupur Exporters Association (TEA) Want Govt To Implement 3% Interest Subvention On Packing Credit, Reduction Of Bank Interest Rates, Refund Of Duty Drawback Rate. All India Readymade Garment Exports, Including Tirupur Knitwear Exports Fell 7.3% In August.

OUTLOOK FOR NEXT WEEK

Commoditiescontrol assume cotton prices to maintain steady trend during the course of the next week tracking insignificant movement in markets due to limited domestic demand. Downside seems unlikely as tight balance sheet and tight supply outlook will keep buyers attach to the market. Also, the CCI has sold most of its stock and left with small quantity of around 21.5 lakh bales.

(By Commoditiescontrol Bureau; +91-22-40015532)