MUMBAI (Commoditiescontrol) - As predicted in the last week’s report (18th July, 2015), primary tone in Indian cotton prices was bearish throughout the week ending 25th July, 2015. Domestic cotton prices came under pressure due to various discouraging local and global fundamentals.

Key Factors Pushing Prices Down:

Favorable Weather Dampens Sentiment

Weather conditions have turned favorable during the entire week, with monsoon rains covering most of the cotton growing areas in the country. This is after various weather forecasters estimating that rains would cover all the areas by the end of this week. This has raised likeliness of better crop next year despite reduced acreage in few portions, putting cotton prices under stress. But then, there are reports of whitefly attacks on crop in Sirsa of Haryana, which according to local farmers is too early. Sirsa contributes more than one third to the total production of cotton in Haryana. In the backdrop of this, the Central Institute of Cotton Research (CICR) has advised farmers to take required steps to ensure minimal loss to the crop.

Surplus Indian Cotton Stockpiles

Going by the various talks in markets about next year’s ending stocks in India, the country is likely to going to witness a record Inventories will surge 25 percent to 7.39 million bales (170kg each) by October from 5.89 million a year earlier, the Cotton Association of India (CAI) estimates. China has restricted its cotton buying this year as it intends to bring down its mounting state reserve stock. Beijing is aiming to sell as much as 1 million tons of fibre from state stocks by the end of August as part of a plan to gradually reduce its bulging reserves. Further, U.S. is expected to witness much better crop in next year. cotton stockpiles in the next year as China limited its buying of cotton and expected much better crop in the U.S. Therefore, significant growth in cotton exports seems uncertain.

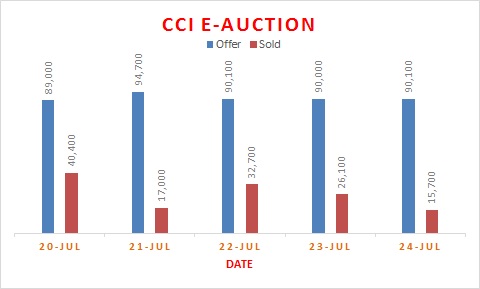

CCI E-Auction Limits Buying

Continued release of cotton by the Cotton Corporation of India (CCI) put a break in millers’ buying. Buyers indulged in hand-to-mouth purchasing of the fibre to fulfill their immediate requirements. Most of the buyers are not in hurry to source cotton in larger volume for inventory purpose as they can depend on cotton released by CCI. The agency’s release of cotton will very comfortably cater to mills’ near-term needs as it is offloading its cotton on a regular basis. It has sold around 1,31,900 bales of cotton this week out of 4,53,900 bales offered.

So far, CCI has sold around 37 lakh bales from its stock, leaving about 50 lakh bales in stock, BK Mishra, CMD, CCI said. The agency is likely to carry forward around 10-20 lakh bales of cotton in next season, said Mishra. After selling to Bangladesh, CCI is set to export cotton to Thailand. A leading mills in Thailand has shown interest in purchasing cotton from India. Samples from India have been approved and CCI has now set into motion a process to get buyers from Thailand registered on its website for daily e-auction, CCI informed. Thailand consumes 5-6 lakh bales of cotton.

Increased Sowing Across The Country

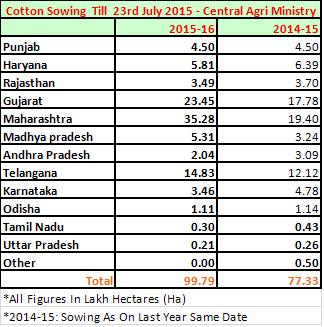

Sowing of cotton is gaining momentum across the country helping by good round of monsoon rains over the last few days. Sowing has completed in the northern cotton belts, while it is progressing well in the central and southern portions. As per the central government of India, total sowing area throughout the country as on 23rd July, 2015 is at around 77.33 lakh hectares.

Below is the state-wise cotton sowing data as on 23rd July, 2015:

Bearishness In Cotton Yarn Persists

Constant bearish trend in cotton yarn has continued to add pressure on cotton prices. Mills are sitting with large inventory of yarn and demand in grey market is gloom at the moment. Domestic as well as export demand is yarn is depressing. In June, China’s textile and apparel exports fell 8.79 percent to $233.92 billion in June, 2015, according to China customs data. While, exports of textile yarn, fabrics and related products saw an increase of 2.25 percent to $94.68 billion. Yarn prices in domestic markets witnessed a correction of 2-3/kg during this week. However, the Indian Rupee is now trading at Rs 64 against a dollar, indicating a possible positive tone in yarn markets in the sessions to come.

Markets Eye China Reserve Cotton Sale

Markets all over the world are keenly monitoring cotton sales by China. Though, it has sold 6.7 percent of the cotton on offer from its state reserves after two weeks of sales as demand stays weak for expensive state cotton, as per media reports. Beijing is aiming to sell as much as 1 million tons of fibre from state stocks by the end of August as part of a plan to gradually reduce its bulging reserves. But with plenty of commercial inventory still available in the market, and the state auction prices relatively high, mills have held back from bidding. Mills were mainly interested in the cheapest crop, the 2011 domestic cotton. None of the 2012 domestic cotton has been sold, and only 5,226 tonnes of imported fibre found buyers.

Weekly Weather Roundup - IMD

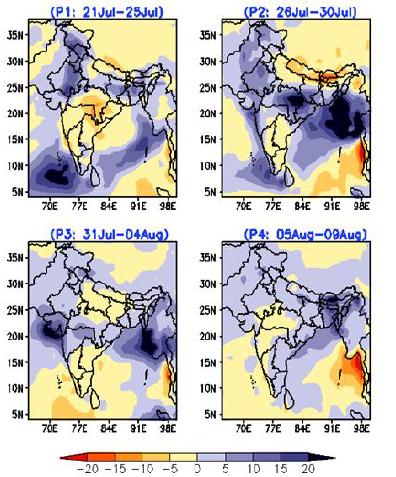

Major portions of India witnessed a deficient rainfall during the week i.e. from 16- 22 July, 2015, according to Indian Meteorological Department (IMD).

.jpg)

During the period, the country as a whole recorded 12 percent lower rainfall than normal limit, which is a cause of concern as Kharif crop needs rain desperately for growth. Seasonal (June 1 to July 24) rainfall pegged down 6 percent to 261.8mm against normal limit of 386.10mm.

Marathwada, north Interior Karnataka and Saurashtra are the worst hit areas and lie under scantly rainfall zone, while east Rajasthan, Punjab and Himachal Pradesh recorded normal rainfall.

Extended Range Forecast Till 9 August, 2015

Northwest and central parts of the country are likely to receive normal rainfall on most of the days. Similarly, eastern and northeastern parts of the country may receive near normal rainfall activity. However, monsoon rains are likely to be below normal over interior peninsula till 4th August, 2015.

SPECIAL COVERAGE THROUGH THE WEEK

Cotton Acreage Shrinks In Major North Indian Belts

Commoditiescontrol team recently traveled to cotton producing regions in Punjab, Haryana and Rajasthan, and covered district wise reports on sowing of cotton, crop condition, production, prices and worries of cotton growers in the area. The reports drew staggering facts, showing a considerable fall in cotton acreage in the ongoing kharif season in all of the three states as compared to the previous year. However, sowing figures of government show a marginal decline in acreage. While acreage under cotton fell significantly according to farmers and traders.

(Click Here To Read Full Story).

Cotton Cake Prices May Gain On Sinking Inventories

Cotton seed cake prices are expected to add Rs 100-150/100kg in near terms due to the shortage of the commodity. The warehouse inventory levels have sink sharply lower. Further, the expectations of late new crop arrival due to delayed rainfall in major cotton producing states is further adding pressure. Cotton cake prices are likely to find support from low availability of cotton seed amid fresh demand being generated from August. However, sharp rise in prices is unlikely given the fact that cotton seed cake are already ruling firm.

(Click Here To Read The Full Story).

India Fixes 2015-16 Textile Export Target Up 14%

India’s textiles export target for 2015-16 has been fixed at $47.5 billion, up 14 percent from $41.6 Billion in 2014-15, Textiles Minister Santosh Kumar Gangwar announced. He said the government is encouraging exports through Merchandise Exports from India Scheme (MEIS), which has recently been modified to include the markets of Bangladesh and Sri Lanka. (Click Here To Read The Full Story).

India’s Cotton Exports To China Fall 56.7% To 26 Lakh Bales In 2014/15

India’s cotton exports to China in 2014-15 dropped 56.7 percent to 26 lakh bales compared to 61 lakh bales in 2013-14, Commerce and Industry Minister Nirmala Sitharaman said in a written reply to Rajya Sabha. Since, the exports to the top consuming nation in the world remained tepid, cotton prices had been moving sluggish in domestic markets unlike last year, she said. The minister attributed the cotton policy adopted by China as the major reason for the reduced imports of Indian cotton by the country. (Click Here To Read The Full Story).

Cabinet Extends 3% Interest Subvention For Crop Loans

In a bid to further strengthen the farmers and energies the sagging agriculture economy, the central cabinet ministry has approved further extension of 3 per cent interest subvention benefit for crop loans. The benefits is made allowed to those farmers who have paid their previous loan on time. According to the media reports, the Cabinet on Tuesday approved the scheme to ensure farmers get crop loans up to Rs 3 lakh at seven per cent a year interest. An additional subvention of three per cent would be given to those who pay loans on time. (Click Here To Read The Full Story).

North India 2015-16 Cotton Production Seen Higher - Private Agency

Despite lower acreage of cotton recorded as of now, the fibre production is expected to rise this year due to better yield and good monsoon, as per the Bathinda based private agency prediction. The agency tracks sowing, output and market trend in cotton. As per the agency’s report, cotton sowing has covered 4.32 lakh hectares as of now while last year’s figure was 4.53 lakh hectares. However, output may increase with the expectations of better yield as monsoon appears favourable for the crop. If weather condition remains favorable, cotton production in Punjab will be 15 lakh bales (170kg each) in the ongoing crop season against 12 lakh bales a year ago, the agency suggested. (Click Here To Read The Full Story).

Global Cotton Output In 2015-16 To Be Down 6% - USDA

The U.S. Department of Agriculture (USDA) in its July estimate projected 2015-16 global cotton output down 6 percent at 111.5 million bales, or 7.5 million bales lower than 2014-15. Next year’s global cotton crop could be the smallest since 2009-10. Declines in production the world over are attributed to the relative cotton prices, which forced a large chunk of growers to look at other alternatives, as per the USDA.

(Click Here To Read The Full Story).

USDA Firm On 57% Good/Excellent Condition Of U.S. Cotton Crop

The U.S. Department of Agriculture (USDA) in its weekly crop progress report for the week ending 19 July, 2015, maintained the U.S. cotton crop condition at 57 percent good/excellent, same as the last week. According to the USDA report, 76 percent of U.S. cotton crop reached squaring stage in all the 15 major cotton growing states during the week, below five year average of 81 percent. Cotton setting bolls totaled 33 percent, slightly behind the five year average of 36 percent.

(Click Here To Read The Full Story).

China Reserve Cotton Sales Fail To Ignite Good Buying; Authorities May Cut Prices

In its effort to reduce its record accumulated cotton stockpiles, China started auctioning the soft commodity at discounted rates from 10th July, 2015. However, it witnessed not so good response at the first few sessions, selling nominal volume of cotton from the reserve stockpiles. In the week ended 17 July, the auctions continued to see poor outcome. (Click Here To Read The Full Story).

Brazilian Cotton Prices Remain High In July – CEPEA

In the just gone by fortnight ended July 15, besides weakened pace of trades in early July, cotton prices remained high in the Brazilian market. “Low cotton supply for prompt delivery and purchasers’ need to trade pushed quotes up in the first fortnight of July,” a CEPEA report revealed. “In the upcoming weeks, advance of harvesting should make cotton farmers turn their attention to accomplish delivery cotton from contracts,” it said.

(Click Here To Read The Full Story).

Liquidity Increases In Brazilian Markets; But Cotton Prices Fail To Sustain

Liquidity in Brazilian cotton markets was higher last week due to purchasers’ interest. Prices also increased early last week as sellers were firm, especially for high quality batches. In the last few days, however, prices decreased because of higher supply of low quality cotton in the market. According to agents surveyed by CEPEA, growers are cautious regarding production, output and quality for the 2014-15 season due to rains and low temperatures in the main producing regions.

(Click Here To Read The Full Story).

WEEKLY TECHNICAL UPDATE

MCX Cotton Bales Weekly: Exit Long On The Rise (Price are in INR (Rs)/Bales)

Support will be at 15450-15430-15280. Expect lower support cluster to be tested.

Last week was a bearish candle with closing below the DRV. Correction can end if rise and close above 15990 is to be witnessed. Exit long and sell on rise to 15693-15817 with a stop loss of 15990. Expect lower range of 15477-15137 to be tested.

CLICK HERE FOR MORE DETAILS

NCDEX Kapas April’16 Weekly: Expect Lower Range To Be Tested

(Price are in INR (Rs)/20 Kg)

Exit long and sell rise to 894-900-909 with a stop loss of 927. Expect lower range of 886-861 to be tested. Addition of short position was seen with the fall and negative candle along with the rise in open interest. Indicators have fallen which suggest lower range to be tested with volatility. Correction to 875-854 range can be seen before making attempts to move higher. The 61.8% retracement of the rise from 801 to 967 is placed at 863.50. The 61.8% and range of 875-854 can attract support.

CLICK HERE FOR MORE DETAILS

NCDEX CoC Weekly July: Expect Higher Range To Be Tested

(Price in Rs/Quintal)

Traders long can keep the stop loss at 1882. Addition of long position has been witnessed as open interest increased with the rise and positive candle. Weaker opening and correction to 1938-1908 can be used for buying with a stop loss of 1882. Expect higher range of 1998-2088 to be tested.

CLICK HERE FOR MORE DETAILS

U.S. Market Through The Week:

Benchmark cotton futures on Intercontinental Exchange (ICE) dropped 0.88 percent this week amid stronger demand and concern over demand. The counter witnessed four straight weekly loss on Friday, the longest such streak for the second-month contract in nearly one year.

The market received a slight boost on Thursday after the U.S. government export sales report, which showed that the U.S. sold a higher-than-expected 91,500 bales of cotton from the 2014-15 crop in the past week, up 79 percent from the prior week and up 64 percent from the prior four-week average.

Meanwhile, the latest data released by U.S. Commodity Futures Trading Commission suggests cotton speculators cut net long position by 3,106 contracts to 43,004 in week to July 21.

On the other hand, the USDA in its U.S crop progress report said 57 percent of cotton condition is good to excellent, more or less similar to last year, while up from 52 percent from 5 year average.

.jpg)

TOP STORIES THROUGH THE WEEK

Nearly 100 Textile Mills In TN Closed In First Weekend Shut Down

Around 100 textile mills in Tamil Nadu, producing blended yarn including polyester cotton, closed down operations on Saturday in the first weekend shutdown. The stoppage of production during the weekends would result in a 25-30 percent reduction in output, which mills hope would be able to reverse the continuing fall in prices. The 100-odd mills have a total installed capacity of nearly 19 lakh spindles and produce about 5.5 lakh kgs of yarn per day.

Govt To Release Rs 400 Cr Crop Insurance For Gujarat Farmers

The central government will release crop insurance worth Rs 400 crore for Gujarat farmers this week, as per a state minister. The crop insurance will benefit around 2.5 lakh farmers of the state. All the farmers who have paid crop insurance premium, will get the insurance amount. The crop insurance is for the year 2014, the minister said.

Govt Extends Duty Benefits To More Handicraft Items

The Commerce Ministry has increased duty benefits on several handicraft items to boost exports. Besides, there are several other products whose duty benefits have been increased. Handicrafts products which have been benefited include candles, hand bags/shopping bags of cotton, wooden frames for paintings photographs mirrors or similar objects, handmade paper and shawl, scarves and muffler of man-made fibres. The rates of the 63 lines (of handicraft sector) are amended under the Merchandise Exports From India Scheme (MEIS), said the Director General of Foreign Trade has said.

Texprocil Lauds Sops To Boost Cotton Fabrics Export

TEXPROCIL welcomed the inclusion of exports of cotton fabrics - both woven and knitted - to Bangladesh and Sri Lanka under the MEIS. The Director General of Foreign trade announced a new list of textile items eligible for export sops, last week. However, knitted fabrics with H S (Harmonised System) Code 6006, which covers most of the knitted fabrics, including those with lycra, were left out in the list of items covered for export benefit. TEXPROCIL demanded that the entire range of fabrics should be covered under the benefit to avoid unintended exclusions. Also, industry leaders said that excluding knitted fabric from the list will have adverse impact on the country’s exports.

India’s Cotton Fabric Exports May Rise With Inclusion Of MEIS

Texprocil Chairman R.K. Dalmia told a news agency that India’s exports of cotton fabric may rise 10 percent this year with the inclusion of fabric in the MEIS. Inclusion of cotton fabric into MEIS would increase India’s competitiveness in Bangladesh and Sri Lanka with respect to other countries, including China, said Dalmia. Bangladesh and Sri Lanka form 28 percent of India’s cotton fabric shipments. Secretary-General of the Confederation of Indian Textile Industry, D.K.Nair also said that inclusion of cotton fabrics under MEIS to Bangladesh and Sri Lanka will certainly help India’s exports.

Tamil Nadu To Unveil New Textile Policy Soon

Government of Tamil Nadu will unveil a new textile policy in the next few days to attract investment ahead of global investors meet. For this, the handlooms and textiles department is studying the textile policies of states like Maharashtra, Gujarat and Madhya Pradesh and evaluating the financial and legal aspects. Global investors meet is scheduled for 9-10 September, 2015.

Textile Units In Sindh On The Verge Of Closing On Water Shortage

Federation of Pakistan Chambers of Commerce and Industry's (FPCCI) said that persisting water shortage in all industrial zones of Sindh will lead to closure of many textile processing units. The country will suffer badly in case exports orders were either cancelled or delayed. Gulzar Firoz, Former Vice President of FPCCI suggested government to set up Reverse Osmosis (RO) plants on war-footing basis in all industrial areas of the metropolis.

Indian Cotton Stocks May Jump To Record High

Cotton stockpiles in India are poised to jump to a record high as exports plunge and a revival in monsoon rains boost crop prospects. Inventories will surge 25 percent to 7.39 million bales by October from 5.89 million a year earlier, the Cotton Association of India (CAI) estimates. China is importing less cotton, used to make everything from jeans to tee shirts, after inventories in the world’s largest user swelled.

Mali Completes 97 Percent Of Cotton Planting

Mali completed cotton planting In 97 percent of allocated farmland this week, said the state-owned CMDT cotton company. With this, the country seems to be very much on track to meet a 2015-2016 production target of 650,000 tons, it said. If it meets its target, it would be Mali’s largest crop ever. It produced around 550,000 tons of raw cotton fibre in the 2014-2015 season.

Weavers Become Strict To Curb Payment Defaults

Nearly 2,000 powerloom weavers in Surat have unanimously decided not to enter into any business deal with merchants who do not provide valid references of traders from respective markets in the city. Accordingly, fabric merchants and traders will have to furnish valid references of prominent traders from the market to purchase unfinished fabrics from the weavers. The Sachin weavers have adopted strict business practices after over 136 weavers from Sachin GIDC and Hojiwala estate were cheated by a gang of fly-by-night operators in the textile markets for over rs 4.5 crore last week.

Pakistan Eyes Raising Textile Exports To $26 Billion

Pakistan government has prepared a plan to increase textile exports from existing $13 billion to $26 billion in the next five years. Under the plan, special incentives would be given to small and medium enterprises.

Indian Finance Ministry For The Benefit Of Local Manufacturers

Finance Ministry issued notifications with regards to restricting low duty benefits to domestic manufacturers. The three new notifications by the Central Board Of Excise And Custom (CBEC), dated July 17, aim to strengthen the differential duty regime. This will protect domestic manufacturing, as imported items will attract 12.5 percent duty, while domestic manufacturers will be required to pay 2 percent duty if they do not avail CENVAT (Central Value Added Tax) credit on taxes paid on inputs.

Govt Extends Duty Benefits To More Handicraft Items

The Commerce Ministry has increased duty benefits on several handicraft items to boost exports. Besides, there are several other products whose duty benefits have been increased. Handicrafts products which have been benefited include candles, hand bags/shopping bags of cotton, wooden frames for paintings photographs mirrors or similar objects, handmade paper and shawl, scarves and muffler of man-made fibres. The rates of the 63 lines (of handicraft sector) are amended under the MEIS, Said The Director General Of Foreign Trade has said.

OUTLOOK FOR NEXT WEEK

We see cotton maintaining their sideways tone in the next week, with prices likely to stay stressed. Weather conditions would continue to add pressure, with forecasts of good rains in many areas. However, much correction in prices is unlikely as slow demand from textile mills is expected.

(By Commoditiescontrol Bureau; +91-22-40015534)