MUMBAI (Commoditiescontrol) - Cotton prices in India remained largely down in the week ending 20th June, 2015, owing to the prolonged bearish cues which halted any significant movement in the domestic markets.

In fact, domestic markets commenced the week on a sluggish note in the backdrop of last week’s sluggish closing. On Saturday last week, A-Grade S6 cotton in Gujarat and J34 cotton in Punjab lost around Rs 300-400/candy and closed at Rs 35,000-35,500/candy (356kg each) and Rs 3,820-3,860/maund (37.3kg each) respectively.

.png)

Progress of sowing throughout the country is more than expected by market participants, according to market sources. Advancing monsoon across the major cotton belts is helping sowing progress in a faster manner. Cotton sowing throughout India as on 19th June, 2015 is estimated at 19.66 lakh hectares compared to 20 lakh bales in the corresponding period last year.

Market sources say that the manner sowing is progressing, is ensuring timely arrival of next crop in markets yards. Also, with estimated carry-forward stock of around 70-80 lakh bales for 2015-16, availability of cotton will be ample, they added.

China’s announcement of releasing its reserve cotton has created a havoc in domestic as well as international markets. Tracking the negative signals from the announcement, domestic textile mills have become cautious for the time being.

Sluggish movement in yarn is also playing its role in pressurising cotton prices. Prices of 30 to 60 count Hosiery carded yarn have eased Rs 10-12/kg in the last one month. The current situation is that yarn is being sold at much discounted rates in the midst of thin selling inquiries. Market sources say that prices may drop further in the near future. Yarn mills have an inventory of around 1 month and with negligible inquiries from overseas, fresh buying from mills is unlikely to pick-up. Low demand and piling inventory have threatened the very existence of small mills, which are forced to closed down their spindle lines. Big players sitting on previously earned profits and have adequate marketing set up, are continuing with their operations, hoping on better prospects in the future.

Furthermore, tracking the overall bearish cues, which is most likely to continue in the long-term, country’s private traders/stockists have become active in liquidating their stocks at the current rates before the prices start falling further, according to an Ahmedabad-based trader. Private traders and stockists have an unsold stock of around 18-20 lakh bales, while CCI is sitting with an unsold stock of around 69 lakh bales, according to market sources. Total estimated cotton arrivals as on 20th June is at around 355.3 lakh bales compared to around 378 lakh bales in the corresponding period last year.

Though the Union Cabinet on Wednesday raised minimum support price (MSP) for cotton by Rs 50 for 2015-16 year, to be effective from 1st October, 2015, it could not bring any cheer among the country’s farm leaders who called the hike too little. They suffered heavy losses in the last kharif as well as rabi seasons in the aftermath of a weak monsoon followed by unseasonal rains and hailstorm. Many of the market people expected a hike of least by Rs 500. Accordingly, MSP for medium staple cotton has been raised to Rs 3,800/100kg from Rs 3,750/100kg and that of long staple cotton has been raised to Rs 4,100/100kg from 4,050/100kg

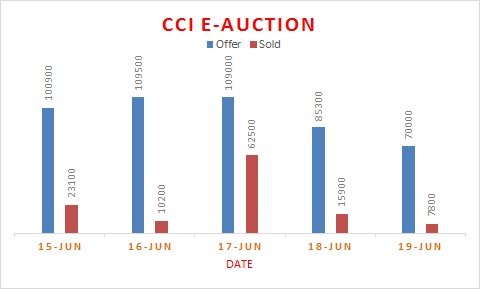

The Cotton Corporation of India (CCI) has been receiving a mixed response at its E-auction held during the week. On Wednesday, the government agency sold 62,500 bales from 109,000 bales put up for sale earlier in the day amid strong demand. Though, the response received in the remaining sessions was not so encouraging.

CCI’s E-Auction Through The Week

Commoditiescontrol Special Coverage During The Week

Cotton Yarn Industry Reels Under Pressure From Weak Demand

Domestic cotton yarn industry continues to reel under pressure from weak demand in the local markets besides subdued queries from overseas/export market. Low demand and piling inventory have threatened the very existence of small mills, which are forced to closed down their spindle lines. Big players sitting on previously earned profits and have adequate marketing set up, are continuing with their operations, hoping on better prospects in the future. Prices of 30 to 60 count corded yarn have eased Rs 10-12/kg in last one month. There should not be any surprises if prices drop further in the near future. Industry bigwigs have echoed their concerns about the prevailing market conditions and worried about its future course of action.

(Click Here To Read The Full Story).

China To Release Reserve Cotton At Discounted Rates - Market Talks

After the world’s top cotton consumer, China announced that it would soon start releasing cotton from its massive state stockpile at discounted rates, domestic and overseas markets have been feeling the pressure. Various talks have cropped up with regards to what consequences will this move by the largest consumer would bring in the markets. China is holding around 10 million metric tons (MT) of cotton at its state reserves, more than 40 percent of world stock. To start with, the country is likely to offer up to 1 MMT from reserve cotton, including 400,000 MTs from 2011 crop, 300,000 MTs from 2012 crop and 300,000 MTs from 2012 crop which was imported from U.S at discounted rates. However, there is still no official announcement about the reserve selling details. (Click Here To Read The Full Story)

China Cotton Imports In May Fall 14.8% On Year

China, the world’s leading cotton consumer, had imported around 163,100 tons of cotton in May, down 14.8 percent compared to the corresponding period last year, according to the country’s customs authority.

China’s cotton imports this year have fallen after the country announced that it would restrict low-tariff quotas to 8,94,000 tonnes, the amount agreed with the World Trade Organisation, with the country trying to encourage the use of domestic produce. The country had cut its import quota to help its domestic cotton farmers and reduce its reserves.

Cotton Sowing In Gujarat This Year May Fall 15 Percent

Cotton sowing in Gujarat may fall nearly 15 percent this year. Farmers in the state are likely to shift to groundnut, sesame and pulses as they are not getting expected return from cotton. Cotton was sown in around 1,51,400 hectare (ha) till 15th June, 2015 in the state compared to around 2,56,800 ha in the corresponding period last year. While, total cotton acreage was at around 30.06 lakh ha in the state in 2014-15. Production was at 125 lakh bales (170kg each). In 2013-14, around 124 lakh bales were produced from 26.91 lakh ha. (Click Here To Read The Full Report).

India’s Textile Exports In May Rise Marginally In Rupee Terms

India’s exports of cotton yarn and related products recorded a marginal growth of 0.78 percent, worth Rs 5,278.3 crores in May, 2015 compared to Rs 5,237.5 crores same month last year in rupee terms, according to a Commerce Ministry data.

However, in dollar terms, textile exports weakened in the month by 6.3 percent to $827.3 compared to $883.1 last year same period. Deprecating Indian currency by around 8 percent since May 2014 against the U.S. Dollar helped exports revenue rise. (Click Here To Read The Full Story).

Cotton Price Settlement On NCDEX As On 19th June, 2015

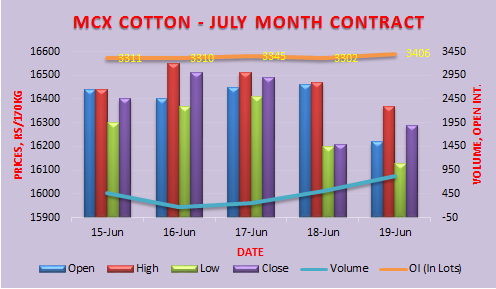

Cotton final settlement prices of National Commodity and Derivatives Exchange (NCDEX) contracts which expired on 19th June, 2015 stood at Rs 16,517.15/bales for 29MM cotton. Meanwhile, prices of kapas khali (CoC) settled at Rs 1,813.19/100kg.

Stock Position At Exchange Warehouses

Cotton stocks at National Commodity and Derivatives Exchange (NCDEX) accredited warehouses remained unchanged at 300 bales as on 19th June, 2015. Cotton stocks at Multi Commodity Exchange (MCX) accredited warehouses reduced 9,400 bales to 83,600 bales as on 17th June, 2015 compared to 93,000 on 11th June, 2015.

NCDEX, MCX Weekly Update

MCX Bales Weekly Technical Update. Click Here

NCDEX Kapas Weekly Technical Update. Click Here

.jpg)

NCDEX CoC Weekly Technical Update. Click Here

.jpg)

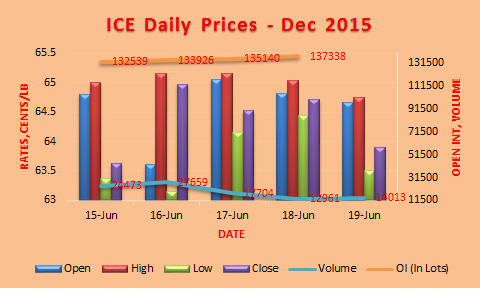

U.S. Market Through The Week

Cotton futures on the Intercontinental Exchange (ICE) traded steady for most of the current week, touching a high of 65.16 cents per pound and low of 63.16 cents per pound. The weekly export data of U.S. cotton released by the USDA showed net sales of 52,600 bales last week for the 2014-15 crop, up 21 percent from the prior week. Open interest in the December month increased continuously, gaining 4,700 contracts due to fresh buying by speculators.

ICE cotton on-call purchases in the most-active December contract rose 2,410 contracts to 14,521 contracts. While, on-call sales increased 1,539 contracts to 22,458 contracts as of 12th June, 2015.

ICE cotton on-call sales in July contract fell 3,712 contracts to 7,745 contracts. On-call purchases decreased 1,187 contracts to 3,533 contracts. As far as trend in prices this week is concerned, prices maintained sideways movement. Both, on-call purchases and sales in the December month contract rose. Speculators have raised their positions in the contract. Open interest in the contract also seen higher. (Click Here To Read The Full Story).

Meanwhile, U.S. cotton exports in March 2015 were seen at 3,47,571 RB bales (480 lb) compared to 3,11,311 RB bales in February 2015, according to the USDA.

TOP STORIES THROUGH THE WEEK

Texas Likely To Hit By Rains Yet Again

After suffering from heavy rains in May, Texas is set to face the same trouble yet again, with tropical storm ‘Bill’ formed in the northwest gulf of Mexico on Monday night. Poised to come ashore Tuesday morning, the system is expected to dump 4 to 8 inches in eastern Texas and Oklahoma. Western Louisiana and Arkansas are expected to see up to 4 inches of rain.

Burkina Faso’s Aim To Achieve Record Crop In 2015-16 Possible

Ecobank in a research note said that Burkina Faso’s target of a record 8 lakh tons cotton crop in 2015-16 is achievable. The country can achieve its targeted cotton crop despite low world prices and threat of an El Nino weather system. The note said that the country can attain a 13 percent growth in cotton production from last year given government’s efforts to support. Despite a 20 percent drop in world cotton prices over the past year, the AICB has raised the farmer price from 225 CFA Francs ($0.3850) per kg last season to 235 CFA Francs/kg for 2015-16. AICB is also cutting price of fertilisers to help boost yields.

SIMA Urges Govt For Comprehensive Textile Policy

Southern India Mills Association (SIMA) urged Tamil Nadu Chief Minister J Jayalalitha to announce a comprehensive textile policy. With that, financial viability can be ensured, according to SIMA. It is also required to attract investments for modernisation and value addition to make Tamil Nadu a global hub for textile manufacturing.

Australia Cuts Cotton Crop Forecast By 7 Percent For 2015-16

Citing a possible El Nino weather phenomenon, australia has cut its forecast on cotton crop by 7 percent for 2015-16. In the year ending 1st July, 2016, cotton production is forecast to reach 520,000 tonnes versus a march forecast of 559,500 tons, according to the latest quarterly update from the Australian Bureau Of Agricultural And Resource Economics and Sciences (ABARES). an El Nino brings less rain over the country's east, where most of the cotton is grown.

Maharashtra Releases Guidelines For Major Kharif Crops

The Maharashtra government released guidelines for major kharif crops including cotton considering a drought like situation. The state agri department also has a contingency plan in place in case of failure of monsoon or extended dry spells. This year the department has set specific targets for the krishi sevaks to cover a minimum 100 ha area and reach the guidelines and contingency plan to farmers. Total expected area under cotton in Nagpur division is at around 6-8.10 lakh ha.

Brazil’s Cotton Harvesting Delay Limits Supply And Prices Remain High

Cotton prices in Brazil are on a rising spree in the midst of delayed harvesting due to rains in the Cerrado region which is causing supply crunch in the domestic markets. Purchasers with needs for prompt delivery, such as processors in the northeastern and southern regions, are accepting whatever asking rates quoted by sellers. However, as prices are increasing, few processors are using their own stocks, while others are reducing activities due to weak sales and low perspective for recovery in the second semester this year. Despite low quality of most cotton available - end of the 2013-14 season - agents reported trades involving cotton type 41-4 and above in Mato Grosso and Bahia States. Some sellers, in turn, are retracted. (Read The Full Story Here).

Texprocil Urges Govt To Include Cotton Textiles In New FTP 2015-20

The Cotton Textiles Export Promotion Council (Texprocil) urged the government to include cotton textiles in the New Foreign Trade Policy (FTP) 2015-20. The council expressed its fears regarding serious impact on exports of value-added products due to removal of benefits. Though the newly introduced Merchandise Exports from India Scheme (MEIS) allowed a duty credit scrip of 2 percent, 3 percent and 5 percent to export of notified products to certain specified countries. But, The scheme does not include exports of value added and labour intensive products like cotton dyed and printed fabrics and made-ups to different african countries like Mauritania, Mali, Dar Es Salaam, Burkina Faso, Angola, Senegal, Ghana, Kenya and Tanzania which is a major blow to the exporters.

China’s Cotton Output Estimated At Around 5.50-5.70 Mln Tons - Report

China’s cotton output in 2015-16 is seen at 5.50-5.70 million tons, according to CCFGroup. Output in inland areas may decrease by nearly 40 percent and in Xinjiang output may drop by 10 percent. The country may import 1.00-1.30 million tons of cotton, while consumption is likely to touch 7.50-7.80 million tons due to recovery of economy and narrower price gap between Chinese and foreign cotton.

50 Percent Subsidy On Pesticides To Cotton Growers

Punjab government along with central government is set to provide 50 percent subsidy on pesticides to cotton growers for 15,000 ha area in Muktsar district of the state. The government has launched this scheme in the entire cotton belt of Malwa region, but the area sanctioned for the distribution of subsidised pesticides is different in all districts. Muktsar district is the worst affected by waterlogging, thus sucking pests breed faster here.

Indian Govt Likely To Extend Interest Subsidy On Exports

The Indian government is expected to extend the interest subsidy scheme for exporters by the end of this month, with a view to revive exports. Commerce Secretary Rajeev Kher said that in the budget there is an arrangement for interest subvention scheme, under which exporters get loans at affordable rates. He said the ministry has completed the process and soon, under an institutional mechanism of the department of revenue, they will take the decision on the issue. Loans at subsidised rates would help exporters to boost shipments as the country's exports were in the negative zone during the last six months.

Bill To Amend U.S. Cotton Futures Act Approved

The House Agriculture Committee approved a bill that amends the U.S. cotton futures act to allow for the development of certain new cotton futures contracts. Current law requires that 100 percent of the cotton tendered under a U.S. listed cotton futures contract be sampled and graded (classed) by the USDA. This restriction has hampered development of new cotton futures contracts designed to hedge against market risks for foreign-grown cotton or U.S. cotton merchandised abroad. The Bill - H.R. 2620, would amend the law to allow U.S.-based futures exchanges flexibility in handling foreign-grown cotton and foreign delivery points.

OUTLOOK FOR NEXT WEEK

Cotton prices may most probably continue to trade steady in the coming week, with no significant movement expected in markets. The selling policy of CCI may be a major determinant of any major movement in prices. Also, China is expected to roll out a detailed plan about release of its state stockpile anytime next week. Therefore, most of the leading market players may prefer to stay from entering into new deals.

Click Here To Read Our Last Weeks's Cotton Report.

(By Commoditiescontrol Bureau; +91-22-40015522)