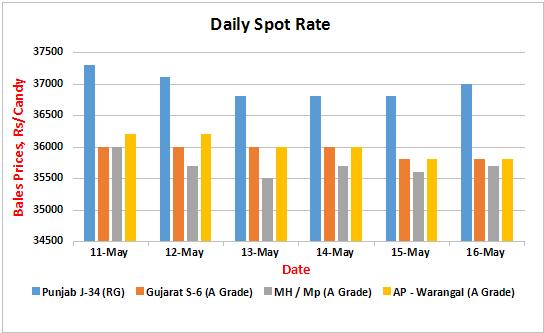

MUMBAI (Commoditiescontrol) - As predicted last week (9th May 2015), cotton prices moved sideways for most of the sessions in the week ending 16th May 2015. Sustained demand from local mills helped prices stay at firmer side. Regular arrivals across the country have dwindled, with major markets receiving upcountry demand. All India cotton arrivals as on May 12 is estimated at 345.42 lakh bales compared to 359.16 lakh bales last year, according to traders. North India is receiving the lowest supplies, with total estimated arrival as on May 12 was at around 47.41 lakh bales compared to around 59.13 lakh bales during the last year same time.

Given the rising temperature over most of the country, moisture content in cotton bales left with ginners and stockists reduced to around 2-3 percent, resulting in weight loss of the bales, market sources said. Therefore, ginners may hold back their stocks for now and start selling sometime in June or July, when monsoon arrives. Cotton bales could regain weight with rains. As per traders, unsold stocks with private traders and stockists in Maharashtra are at around 4-4.50 lakh bales. Unsold stock of around 9-10 lakh bales of cotton in Gujarat, about 1.5 lakh bales in Madhya Pradesh and nearly 3.25 lakh bales in north India.

Another reason for the markets to stay largely sideways is that most of the market players were keenly following Prime Minister Mr. Narendra Modi’s three day China visit and were looking forward to some new deals between the two countries, especially with regards to the textile sector. Mr. Modi did signed as much as 24 agreements worth over $10 billion, but not related to cotton and textile industry. Resultantly, yarn prices softhened by Rs. 1-3/kg this week compared to last week.

However, the fibre moved downward then onwards and recorded slight losses over the last two days of around Rs. 100-300/candy. The major factor that had put pressure on prices is Indian Meteorological Department’s (IMD) report on Thursday that stated that monsoon will arrive ahead of schedule this year, hitting Kerala coast on 30th June (with an error window of 4 days). The report could encourage country’s cotton growers to sow the agri commodity much on time, indicating that the prices may come down in the short-term.

There are reports that an international trader has placed quotes for 2015-16 for S-6 cotton at around Rs. 36,500/candy for June Delivery and Rs. 36,900/candy for September delivery. In north India, the trader quotes 2015-16 cotton in the range of Rs. 3,855-3,965. These set quotes suggest that much movement would not be seen in the markets in the sessions to come.

The Cotton Corporation of India (CCI) has been regularly releasing cotton in good quantity. On Friday, the agency sold 14,800 out of 40,000 bales offered earlier in the day. Throughout the week, the government agency has sold around 53,000 bales of cotton. It has been receiving lukewarm response at its auction as market players are expecting the agency to lower its prices. Additionally, many private traders are active at the current levels.

.jpg)

North India Achieve Over 25 Percent Cotton Sowing - Special Coverage

We at commoditiescontrol.com, interviewed few of the market people to get an update on sowing progress in the country. Around 25-40 percent cotton sowing has been completed till now in Haryana, Punjab and Upper Rajasthan. According to market estimate, cotton sowing acreage is likely to be 10 percent higher this year over previous years.

According to Mr. Jagdeep Brar, Joint Director of State Agriculture Department of Haryana, “Cotton is sown in 2-2.5 lakh hectares (ha) till now, which is around 40 percent of 6.5 lakh ha target area. Last year, cotton was sown in 6.39 lakh ha in the state.” He added that cotton sowing has been delayed by 10-15 days so, the activity is expected to continue till May end. Normally, cotton sowing begins in third week of April, but it started in May first week due to delayed harvesting of wheat crop. Untimely rains in March and April have delayed wheat harvesting. He is optimistic of achieving cotton acreage target this year. However, he is yet to see comparative increase in acreage till now.

Similarly, cotton sowing is in full swing at Punjab. Here, sowing acreage reached 1.58 lakh ha so far. Mr Gurdial Singh, Joint Director of State Agriculture Department of Punjab, said that, “The delay in sowing was very little and sowing progress is satisfactory.” The department has set a target of 5.25 lakh ha this year. Cotton was sown in 4.5 lakh ha last year.

In Rajasthan, cotton sowing is progressing steadily. According to Mr L N Berwa, Chief Statistical Officer of State Agriculture Department of Rajasthan, sowing activities are going on. The department will compile and release sowing report very soon. He said cotton sowing is very limited. Normally, the department gathers report from various areas by 15 May every year.

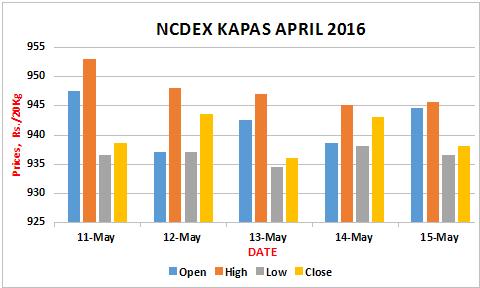

NCDEX, MCX Weekly Update :

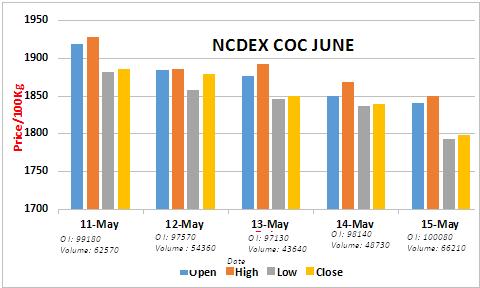

Cotton Seed Oil Cake June Contract Dips 6 Percent

Cotton seed oil cake for June contract dropped around 6 percent on National Commodity & Derivatives Exchange Ltd (NCDEX) this week amid profit booking followed by fresh selling which was observed by analyzing volume and open interest.

CoC surged around 10 percent since April 1 to May 11 which has resulted buyers to lock profit. Also India weather office projected that southwest monsoon likely to hit Kerala a couple of days earlier than usual, led to fresh selling by market participants.

Volume and open interest (OI) had fallen during the first three trading session indicating profit booking at higher level followed by increased in OI and volume, which suggest fresh selling positions has been created in the contract.

NCDEX CoC Weekly Technical Update. : Click Here

MCX Bales Weekly Technical Update. Click Here

NCDEX Kapas Weekly Technical Update. Click Here

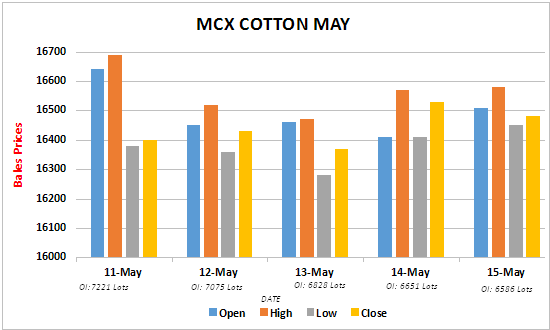

Stock Position At Exchange Warehouses

Cotton stocks at National Commodity and Derivatives Exchange (NCDEX) accredited warehouses remained unchanged at 400 bales as on 14 May. Cotton stocks at Multi Commodity Exchanges (MCX) accredited warehouses decreased to 1,15,200 bales as on 14 May.

U.S. Market Through The Week

ICE cotton posted 1 percent gain this week as buying interest continued from market participants amid weaker dollar followed by strong export sales report. The dollar moved to its lowest since January against basket of six major currencies. It fell 1.75 percent this week. Strong weekly export sales report also spurred buying interest. Exports rose to 48,800 bales from 19,800 the prior week, according to data released on Thursday.

.jpg)

TOP STORIES THROUGH THE WEEK

China Plans To Sell Reserve Cotton - Market Sources

As per fresh rumors in the markets, Chinese government has plans to auction around 1 million MTs reserve cotton during June, July and August this year. It plans to sell 300,000 MTs of 2011 crop domestic cotton at 13,200/Mt. 400,000 Mts of 2012 crop domestic cotton at 14,200/Mt. 300,000 Mts of old crop import cotton at 15,000/Mt. These prices are based on standard 328 quality, price of each lot will depend on premium/discount based on the re-classing result.

India Cotton Yarn Output Rises Over 3 Percent Till March

India cotton yarn production during April 2014-March 2015 posted a growth of around 3.26 percent at 4056.60 million kg compared to 3928.27 million kg in April 2013-March 2014, as per a provisional data provided by the Textile Commissioner’s office. Cotton yarn production increased by 5 percent in March 2015 to 351.57 million kg from 334.73 million kg in February 2015. The government data further said that cotton consumption during October 2014-March 2015 rose by 4.5 percent to 152.21 lakh bales compared to 145.63 during October 2013-March 2014. In March 2015, India’s cotton yarn stock reduced by 2.8 percent to 148.59 million kg from 152.89 million kg a month ago. Last year, same month, stocks were at 133.80 million kg, the data further stated.

India Cotton Consumption In March 2015

India's cotton consumption increased in March 2015, according to a provisional data provided by Textile Commissioner's Office. Country's cotton consumption rose by 3.7 percent to 25.95 lakh bales (170kg) in March 2015 from 25.00 lakh bales in February 2015 and 25.07 lakh bales in March 2014. Consumption during October 2014-March 2015 rose by 4.5 percent at 152.21 lakh bales compared to 145.63 during October 2013-March 2014.

India Cotton Exports Reach 3.6 Mln Bales By April End - USDA

The U.S. Department of Agriculture’s (USDA) has earlier estimated India’s cotton exports in 2014-15 at 4.2 million bales (480lb each), from which around 3.6 million bales has been exported during August 2014-April 2015 in the current season. As per the USDA, India’s cotton exports would be moving on a sluggish note during rest of the season, considering the pace of exports and a probable rise in release of auction volume by the CCI. The average export shipments are likely to hover near 200,000 bales per month through July.

India's Cotton Yarn Stock In March 2015

India's cotton yarn stock reduced by 2.8 percent in March 2015 at 148.59 million kg from 152.89 million kg in February 2015, according to a provisional data provided by Textile Commissioner's Office. India's cotton yarn stock increased by 11 percent in March 2015 to 133.80 million kg.

India’s 2014-15 Imports Estimate - USDA

The FAS Mumbai 2014-15 import estimate remains unchanged. Demand for imported cotton has picked up as indian arrivals have slowed down. Imports of higher quality upland and ELS from the U.S remain dominant (30 percent of total shipments received in April). Competitively priced new crop cotton from West Africa (Mali, Cote d Ivoire, and Burkina Faso) is being imported to cover mill demand, as well Indian Ex-Gin prices have firmed up and are on par with Cotlook Index. Consequently domestic buying from mills has been limited in the last month as international cotton provides a cheaper option.

El Nino Emerges, Likely To Continue Into Autumn

The Japan Meteorological Agency (JMA) on Tuesday said that El Nino weather pattern emerged in spring and is likely to continue into autumn. El Nino can trigger droughts in Southeast Asia and Australia, and floods in South America, which has hit production of key foods such as rice, wheat and sugar. The Australian Bureau of Meteorology (BOM) also said that an El Nino has formed and models indicate a substantial weather event. It said that current El Nino event is likely to see a sustained increase in intensity, peaking around spring or early summer

India’s Textile, Garment Exports

India’s textile and garment exports may not achieve initial growth target of 10 percent for 2015-16, according to Northern India Textile Mills’ Association (NITMA). Besides, the expected expansion rate of 5 percent is also likely to face a miss. Sharad Jaipuria, NITMA Chairman said that the industry needs basic raw material cotton at competitive prices to export value added products. Cotton is not available at competitive prices, despite record production in cotton. He adds that the CCI also wants to sell its stocks in phases during the remaining five months of the season. Textile segment rose just 2.4 percent from April 2014-Feb 2015 compared to a year ago.

USDA Cotton Monthly Supply - Demand Report

For 2015-16

--World cotton stocks are expected to decrease for the first time in five years due to growing consumption outside of China, a reduction in China’s stocks, and lower global production

--Continued lower prices are expected to weigh on global production

--Trade is down, largely due to continued decline in Chinese imports

--The U.S. season average farm price is projected at 60 cents/pound, with the mid-point unchanged from the current season estimate

For 2014-15

--World Production Is Relatively Unchanged

--World Trade, Use And Stocks Are Raised

--Forecasts For The U.S. For 2014-15 Are Unchanged

--Forecast For The U.S. Season Average Farm Price Is Maintained At 60 Cents/Pound

Govt Releases 2014-15 3rd Advance Estimate For Cotton

The government of India has released its 3rd advance estimate for 2014-15 cotton at 35.32 million bales. The estimate is slightly higher than its 2nd advance estimate, but lower than 2013-14 final estimates and higher by 2.85 million bales than the average production of last 5 years. Government’s 2nd advance estimate for 2014-15 was at 35.15 million bales and 2013-14 final final advance estimate was 35.9 million bales.

90 Percent Chance Of El Nino This Summer

The Climate Prediction Centre (CPC) in its monthly report stated that there is 90 percent chance of El Nino conditions developing during Northern Hemisphere Summer this year. Last month the weather forecaster estimated 70 percent chance of El Nino.

OUTLOOK FOR NEXT WEEK

Cotton prices may trade sideways to negative during most of the next week due to thin buying position coupled with slow demand in yarn. The timely arrival of monsoon prediction by the IMD may have a lasting impact in market and buyers’ psyche. Prices of cotton seed oil cake (CoC) may also trade on the negative zone due to the above factors.

(By Commoditiescontrol Bureau; +91-22-61391533).