MUMBAI (Commoditiescontrol) - Trend in cotton prices was mostly steady-to-easy during the week ending April 18, 2015 on couple of factors, though tone can be called weak to some extent. In north India, the fibre maintained downward movement throughout the week due to subdued demand from mills and spinners despite slow arrivals.

On the other hand, price trend was mixed in other major markets across the country. In few central Indian regions, cotton initially moved steady to weak, while recording losses in few other markets. Price of S6 A-grade cotton in Gujarat was quoted at Rs. 34,000/candy (356kg each) during today’s session.

The prime reason for the prices to come under stress is the Cotton Corporation of India’s (CCI) lowering of its floor prices. On Wednesday, the agency had lowered its floor prices by Rs. 300-400/candy in various centres across India, which it repeated the next day too by reducing Rs. 400/candy again.

.bmp)

Note: Price In Rs/Candy

The state-owned agency had sold around 18,500 cotton bales (170kg each) in various centres on Thursday out of 50,900 cotton bales earlier offered in the day in various centres. CCI received lukewarm response at its auction a day before by selling only 1,200 bales, when it reduced its floor prices by Rs. 400/candy. Market players fear of downtrend in the commodity over the next coming sessions.

.bmp)

Adding to the downtrend, the USDA released its weekly export sales report that showed a net cancellation in new sales. Exports of upland cotton fell 54 per cent from a market-year high the previous week to 201,500 bales. The disappointing export sales data indicates of piling up of stock, which would limit demand and import demand too may get affected.

Total arrivals this week is estimated at about 2.5 lakh bales compared to 3.25 lakh bales during the last week. India cotton arrivals reached around 319 lakh bales as on April 18 in the current season that started Oct 2014 compared to nearly 334 lakh bales last year same time.

At the start of the current cotton season, farmers brought in their produce to markets very aggressively due to falling prices all over. But now they are not willing to sell at the current prevailing rates and bringing cotton in a slow manner in markets. They are learnt to hold their stock to get higher returns on prospect of further rise in prices. In a way, farmers are taking benefits from the current bullish situation in markets when there is limited availability of cotton, especially that of fine quality.

Yarn prices in the week rose Rs. 1-2 per kilogram (kg) due to good demand from gray market. Demand in cotton yarn has shown good improvement in the recent months thanks to stable prices, good overseas demand and recovery in crude oil.

Further, prices of cotton complex, including cotton seed and kapas were traded lower throughout the week due to disparity of crushing as perceived by mills and consumers’ subdued demand. On Friday, movement in market improved slightly on account of technical buying on futures markets. On Friday, CoC prices hit upper circuit of 4 per cent, but but open interest reduced 10,550 lots, while trade volume increased around 50 per cent against a day earlier.

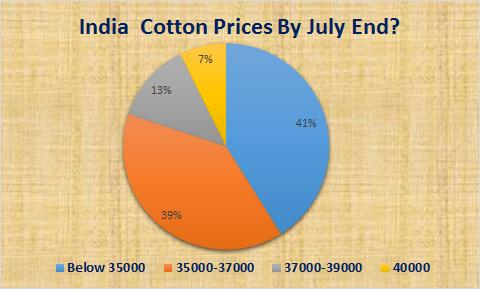

Cotton Prices Unlikely To Cross Rs. 35,000/Candy Till July End - CC Survey

As per a survey conducted by commoditiescontrol.com on 11-12 April (with inputs from 382 traders, analysts, ginners, brokers, spinners and mills), cotton prices are expected to trade below Rs. 3,5000/candy (356kg each) till end of July 2015. While a minority of respondents expect prices to cross Rs. 40,000 level.

Of the total sample size, around 41per cent of respondent representing the industry, opined that cotton will trade below Rs 35,000/candy by July-end. Meanwhile, 39 per cent of people believe cotton to trade in the range of Rs 35,000-37,000/candy. The least participants i.e. 7 per cent said that cotton prices will rule above Rs 40,000/candy by the end of July.

Of the total sample size, around 41per cent of respondent representing the industry, opined that cotton will trade below Rs 35,000/candy by July-end. Meanwhile, 39 per cent of people believe cotton to trade in the range of Rs 35,000-37,000/candy. The least participants i.e. 7 per cent said that cotton prices will rule above Rs 40,000/candy by the end of July.

A leading mill owner requesting anonymity shared his view on the market. He said that cotton prices will trade between Rs 35,000-37,000/candy as higher prices will dent demand from spinners. Domestic spinners will find it difficult to survive in case prices cross Rs 37,000/candy, he added. He said “domestic demand in garments is unlikely to improve in the near-term due to absence of festive season.

USDA 2015-16 Attache Cotton Supply-Demand Estimate

Australia

- Production at 2.2 million bales (227kg each) compared to 2.1 million bales in 2014-15

- Area at 2.10 million hectares, unchanged from the revised 2014-15 official estimate

- Yields estimated at 2.2 tonnes or 10 bales per hectare for irrigated regions and 3-4 bales per hectare for dryland cotton production

- Exports at 2.1 million bales, down one third from 3.4 million bales in 2014-15

- Total supply at 2.4 million bales compared to 3.9 million bales in 2014-15

- Ending stock at 0.68 million bales against 0.5 million bales

Mexico

- Production at 1.02 million bales (220kg each) compared to 1.26 million bales in 2014-15

- Consumption at 1.97 million bales compared to 1.95 million bales

- Imports at 1 million bales, unchanged from 2014-15

- Export at 0.15 million bales compared to 0.17 million bales in 2014-15

- Total supply at 2.75 million bales compared to 2.85 million bales in 2014-15

- Ending stock at 0.63 million bales against 0.72 million bales in 2014-15

Stock Position At Exchange Warehouses

Cotton stocks at National Commodity and Derivative Exchange (NCDEX) accredited warehouses as on April 16 stood at 2,200 bales, while cotton oil cake (CoC) was at 38,705. At Multi Commodity Exchange (MCX) accredited warehouses, cotton stock increased to 1,17,700 as on April 9.

NCDEX, MCX Weekly Update

|

MCX COTTON UPDATES

|

|

Date

|

Expiry Month

|

Open(Rs)

|

High(Rs)

|

Low(Rs)

|

Close(Rs)

|

PCP(Rs)

|

Volume(Bales)

|

OI(In Lots)

|

|

13-Apr-15

|

29-May-15

|

16080

|

16190

|

15950

|

16040

|

16130

|

35155

|

4871

|

|

14-Apr-15

|

29-May-15

|

16060

|

16090

|

15970

|

16020

|

16040

|

3125

|

4918

|

|

15-Apr-15

|

29-May-15

|

16020

|

16100

|

15860

|

15960

|

16020

|

28500

|

5019

|

|

16-Apr-15

|

29-May-15

|

16000

|

16000

|

15520

|

15610

|

15960

|

60275

|

5017

|

|

NCDEX KAPAS UPDATES (Expiry Month: APRIL 2015)

|

|

Date

|

Prev Close Price

|

Open Price

|

High Price

|

Low Price

|

Close Price

|

Volume

|

Open Intrest

|

Trade Value

|

|

13-Apr-15

|

825

|

822

|

823.5

|

810

|

818

|

2752

|

3448

|

4492.42

|

|

14-Apr-15

|

818

|

816

|

818.5

|

814

|

815.5

|

430

|

3482

|

701.49

|

|

15-Apr-15

|

815.5

|

815

|

825

|

813

|

817

|

2122

|

3254

|

3472.38

|

|

16-Apr-15

|

817

|

817.5

|

821

|

805.5

|

806.5

|

2204

|

3141

|

3576.96

|

|

17-Apr-15

|

806.5

|

807

|

812

|

801.5

|

809

|

1851

|

2966

|

2989.31

|

|

NCDEX COTTON OIL CAKE UPDATES (Expiry Month: APRIL 2015)

|

|

Date

|

Prev Close Price

|

Open Price

|

High Price

|

Low Price

|

Close Price

|

Volume

|

Open Intrest

|

Trade Value

|

|

13-Apr-15

|

1766

|

1768

|

1768

|

1730

|

1740

|

51900

|

100930

|

9052.68

|

|

14-Apr-15

|

1740

|

1738

|

1746

|

1732

|

1743

|

6500

|

101480

|

1131.34

|

|

15-Apr-15

|

1743

|

1741

|

1758

|

1741

|

1746

|

28820

|

98870

|

5040.97

|

|

16-Apr-15

|

1746

|

1748

|

1749

|

1707

|

1712

|

63900

|

102080

|

11019.28

|

|

17-Apr-15

|

1712

|

1716

|

1780

|

1699

|

1776

|

94900

|

91530

|

16554.33

|

MCX Bales Weekly Technical Update. Click Here

NCDEX Kapas Weekly Technical Update. Click Here

NCDEX CoC Weekly Technical Update. Click Here

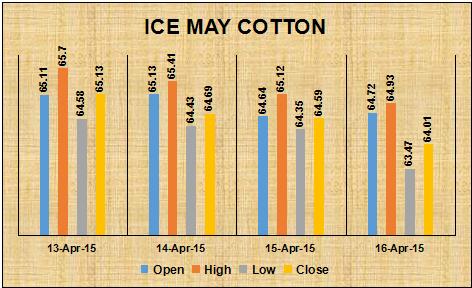

U.S. Market Through The Week

Cotton futures trade on Intercontinental Exchange (ICE) traded mostly sluggish during the week amid profit booking after the recent surge in prices. Also buyers are reluctant to take positions at the higher level resulted bearish trend on futures. ICE May cotton touched weekly low of 63.47 cents on Friday after USDA’s bearish export sales report. Open interest has declined constantly during the week with 42,134 and reduced as low as 12,061 on Thursday. This suggests that investors are shifting from the May contract to July contract.

Top Stories Of The Week

China Cotton Imports May Rise

Cotton imports by china may rise as the major producing region - Xinjiang - is set to reduce its production in 2015 by around 10 percent. The govt of the region is trying to encourage farmers to switch to more beneficial crops such as fruits. Govt Is concerned because of difference in soil quality in the east, south and north of Xinjiang. Soil in south region is more suited for food crops and cotton has been depleting groundwater. therefore, government is forced to abandon cotton. In another news from China, cotton acreage in the country may be reduced by 11.2 per cent this year compared to last year, according to the National Bureau of Statistics. Farmers may grow 1.9 per cent more corn instead of cotton. NBS said that farmers in the country intend to grow 1.2 per cent more rice and 0.7 per cent more wheat this year compared to last year.

China March Textile & Garment Exports

China’s March textile and garment export totaled $12.564 billion, down 42.03 percent from previous month and down 32.59 per cent from a year ago, as per China Customs. Similarly, textile exports totaled $5.875 billion. The Customs data showed that the country’s cotton yarn imports in February totaled 124,100 tonnes, 43.02 per cent down from a month earlier and down 19.05 per cent from a year ago period. China exported 22,500 tonnes of cotton yarn in the month, which is down 35.34 per cent a month earlier. The country’s March cotton imports stood at 127,900 tonnes, down 42.4 per cent on year and down 19.6 per cent on month.

U.S. 2015 Cotton Crop Loan Rate

The USDA has kept 2015 U.S. cotton crop loan rate differentials for upland and extra-long staple cotton unchanged from 2014. 2015 crop differential schedules are applied to 2015 crop loan rates of 52.00 cents/pound for base grade of upland cotton and 79.77 cents/pound for extra-long staple cotton. The differentials are based on market valuations of various cotton quality factors for the prior three years.

A USDA report suggested that yarn spinning is rapidly gaining in south and southeast Asia. The trend would continue to grow in the near future. Yarn spinning in south and southeast Asia surpassed that of Chinese in 2011-12 and is on the rise then on due to growth in India, Indonesia, Bangladesh and Vietnam.

Texprocil Urges CCI To Release Cotton Stocks

Mr. R.K. Dalmia, Chairman of Texprocil earlier in the week said the CCI’s policy of holding up huge stocks, which is creating shortage of cotton, may derail government’s make in India campaign. The campaign cannot be a success if the prices of raw materials in local markets continue to be higher than international prices. Mr. Dalmia earlier urged government to ask CCI to release atleast 50,000 bales each day through E-auction.

CCI’s cotton procurement from farmers this season, starting October 1, 2014 to April 11, 2015 is estimated at 86.90 lakh bales, trading sources said. In north India, the agency procured nearly 2.93 lakh bales, in Gujarat around 6.66 lakh bales, in Maharashtra about 17.63 lakh bales, Madhya Pradesh nearly 2.81 lakh bales, around 54.42 lakh bales in Andhra Pradesh and Telangana, in Karnataka about 1.39 lakh bales and around 1.02 lakh bales.

SIMA Plans Warehousing Facility At Mangalore Port

The Southern India Mills’ Association (SIMA) has plans to use warehousing facilities at Mangalore Port to store cotton imported from West Africa. T.Rajkumar, Chairman, SIMA, said that congestion at ports in the south region has forced the association to look out for other options. SIMA has urged the Port Trust Chairman to extend customs-free bonded warehouse for cotton without attracting any tax/levies as in Malaysian port so that traders can store imported cotton and supply to small and medium spinning units when they the requirement emerges.

India Monsoon Likely Normal - SKYMET

Private weather forecaster Skymet in its latest report predicted early onset of monsoon this year by around 27 May. The report has dampened price prospects for the commodity. IMD will release its official forecast for southwest monsoon sometime in the next week. Skymet earlier in its report discounted any fear of dreaded El Nino and said it will not have any adverse impact on southwest monsoon. According to Skymet, monsoon this year is expected into be strong across the country and the current phase of unseasonal rain will continue well into May.

India Pressed 31 Million Bales Cotton - ICF

The Indian Cotton Federation (ICF), in its latest report said that India has pressed around 31 million bales cotton till date during 2014-15 season. The report stated that cotton prices are gradually rising, although mill demand is still moderate. Unseasonal rains may not effect cotton in north India much as the season is coming to a close and kapas arrivals have dropped drastically, the report informs. Kapas arrivals are quite good in cotton markets of Gujarat, it added.

OUTLOOK FOR NEXT WEEK

Trend in cotton prices during the course of next week may remain steady to easy. However, traders are not expecting much downfall in prices as supply is decreasing constantly. According to market sources, nearly 80 per cent of the total production has already arrived in markets so far. The selling pattern of cotton by CCI has to be followed very closely as it may be a major determinant of any significant movement in markets.

(By Commoditiescontrol Bureau; +91-22-61391533)