MUMBAI(Commoditiescontrol): The US cotton futures snapped from three consecutive weeks of winning streak and witnessed correction on major spec long liquidation.

The benchmark May contract settled at 82.85 cents/lb, falling to a 10 session low on Friday and plunging more than 2% over the week. Open interest, as of March 15, showed 126,255 lots outstanding, dropping 2.7% from prior week at 129,782 lots.

However, Total open interest for all contract rose 1.3% over the week to 272,833 lots. Traders seem to betting on the bulls for July and next season crop December. The open interest in July rose 2%, over the week, to 59,047 lots and December rose 7% to 70,156 lots. Open interest for both contracts rose amid fall in price indicating short build up.

This maybe likely attributed to the rise in on-call sale position, where mills purchase bales on-call but do not fix prices and in turn sellers/merchants, hedge themselves creating a short position on the futures market.

.png)

The on-call sales position, as of March 8, reached 15.63 million bales(480lb), up 4.4% from prior week at 14.98 million bales and close to the record high at 15.8 million bales witnessed on January 19.

The old crop May contract saw mills fixing their outstanding position as on-call sales dropped 3.1% to 3.1 million bales(480 lb), while July increased 6% to 4.7 million bales.

The new crop December on-call sales continued to show growth as it rose 2.4% to 3.3 million bales. This compared tocorresponding period last year where new crop December 2017 position stood at 1.99 million bales. There is a lot of mills purchases being made in the new crop December and there were lot of bets being made as open interest stood at 70,156 lots while prices closed at 78.28 cent/lb, trading near contract highs.

This would attract more speculators building a long position eventually as the new season 2018/19 begins and we could see prices crossing 80 cents mark just before 2018 ends. One of the reason could be expectation of large land abandonment in Texas where drought conditions were observed during the recent weeks and ahead in the coming weeks too.

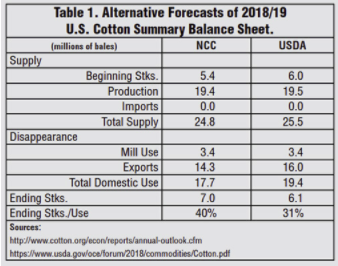

Early forecasts by USDA and NCC showed poor yields next season despite large planting intentions. NCC forecasts area to increase 3.7% to 13.1 million acres but production to decline 8% to 19.4 million bales(480lb) while Outlook forum forecast on similar lines at 13.5 million acres and production at 19.5 million bales(480lb).

Hence, prices of December will likely trade strong unless a big bearish factor brings in the much-needed liquidation to fall below 70 cents/lb. There were good rain predictions in Texas during the month of May. Hence, lets take this as a speculation and as the season progresses keep a close eye on the developments.

The CFTC report, dated March 13, showed Money managed players increasing their position by 3.3%, over the week, to 85,046 lots and 28.5% from previous lows at 66,146 lots. On the other hand, the trade shorts rose 3% to 177,780 lots.

The market has fallen into the curse of lacking sell liquidity and the trade shorts are in trouble as there is a lot of bullish factors feeding on the bulls. Spec longs still have room to add in more net long position hence the probability of prices crossing 90 cents/lb is high at present.

However, the threat of an escalating trade war has cast a shadow over commodity markets this week, which might affect the behavior of spec longs going forward. Markets don’t like uncertainty and at the moment we have plenty of it, by not knowing whether the Trump administration is just bluffing or whether they will actually follow through on their tough stance on trade.

Peter Egli, Cotton Expert from UK based Plexus Cotton, said in a report, “So far only tariffs on steel and aluminum have been imposed, which are relatively insignificant in a global context. But now the US seems to be targeting China directly, with potential tariffs on a wide array of Chinese imports, including apparel.

The Trump administration may feel that it operates from a position of strength, because North America as a whole (US and Canada) has become self-sufficient in food and energy, and also has the ability to manufacture more or less everything its citizenry needs, albeit at a much higher cost. Europe and Asia on the other hand still have to import a large percentage of their food and/or energy needs, and a much larger percentage of their GDP depends on exports.”

.jpg)

Technical Ideas(May): Last week, Cotton No2 May 2018 formed an In Bar on weekly chart along with the Harami candle which suggest that near term pause to the rise could be seen.

Resistance will be at 83.31-84.57- 87.56. The peak registered 2 week back was 86.60.

Support will be at 81.58-81.71. Correction and swing top will be confirmed on fall and close below 81.70. A lower high and lower low with bearish candle will confirm the swing top. Expect resistance and profit booking on long position to be undertaken at 83.31-84.57- 87.56.

Traders can maintain the stop loss at 81.71 and look for rise to take profits until 86.6 level is not breached.

(By Commoditiescontrol Bureau; +91-22-40015534)