MUMBAI (Commoditiescontrol) – Major pulses such as, Tur, Urad, Chana and White Pea remained weak ending on Saturday (October 9 - 14) amid slack trade activity from millers and traders as demand in processed pulses still remained dull from wholesale/retail counters. Millers and stockiest holding stock were interested to liquidate their stock despite facing losses. Sentiment were pressurized due to liquidity crunch, absence of buyers, stockiest. On other hand, Masoor, Kabuli Chickpea and Moong prices ruled firm amid some lower level buying support.

.bmp)

Week Highlights

# Agri Minister Radha Mohan Singh On Tweeter Handle Said Government Approves Gujarat Government Proposal Of Procurement Of 16000MT Moong, 20750MT Urad For Kharif 2017.

# Madhya Pradesh: CM Declares 13 Districts As Drought-Hit. Sidhi, Vidisha, Indore, Panna, Sagar, Satna, Shivpuri, Tikamgarh, Bhind, Ashoknagar, Damoh, Chhatarpur & Gwalior.

# A Source Close To The Development Said CACP Recommends Chana MSP Hike By 375/100kg. Chana MSP For 2016-17 Was 3800 (+200 Bonus).

# Pulses Import Nhava Sheva Port Sept 2017 Vs Sept 2016 (MT) Tur:16488/37608, Chana:79667/20832, Urad:14784/1872, Moong:4224/2832, Masoor:1488/3192, Matar:1608/45864, Total:125603/118176.

Burma Lemon Tur:

Tur lemon variety of Burma origin offered weak at Rs 3,600/100Kgs, down Rs 25 in Mumbai on amid slow trade activity as millers were interested to liquidate its processed stock at any rise in prices as they had crushed Tur of higher prices.

On other hand, Processed Tur priced flat on thin demand from Wholesalers/retailers counters. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,650-5,700/100 Kg, semi-Sortex at Rs 5,500 and regular at Rs 5,350.

.bmp)

But, prices of raw Tur may gain due to lower rates and also domestic market will be remained closed for festive. The latest rain spell is unusual and is hurting the early sown standing crops of Tur in parts of Telangana, Andhra Pradesh, Karnataka, Maharashtra (Marathwada). While, in Vidarbha region of Maharashtra, Tur is still in flowering stage and rain is beneficial for crop.

According to market talk, prices of Tur/Tur dal is expected to rise for short term period due to lower rates and also some demand in dal may gets support from consumption centers. Buying strength is still thin as they purchase as per immediate requirement as government liquidating its stock at lower rates and also upcoming new crop starts from November month end-December. Market will also remain closed next week for Diwali festive. Due to recent rain prices of vegetable may be higher compare to dall prices. Millers were also interested to crush domestic Tur due to good quality at cheaper prices. At current stage, weather will play vital role for Tur prices.

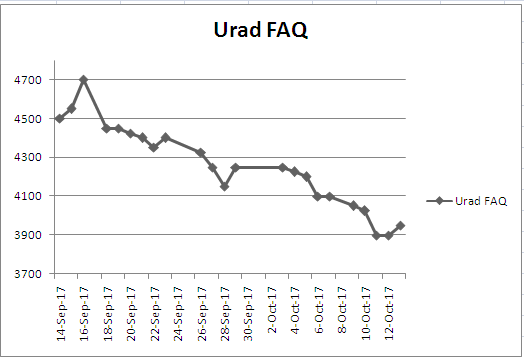

Burma Urad:

In Mumbai, Burma origin FAQ variety Urad traded weak by Rs 150 to Rs 3,950/100Kg on dull millers buying and arrivals of new Urad in major states. Millers were interested to purchase new domestic Urad as they were getting superior and dry quality at cheaper rates.

Nafed were procuring new Urad at MSP prices (Rs 5400) in Rajasthan, Karnataka and Telangana.

At Chennai, Urad FAQ and SQ variety moved up by Rs 50-100 to Rs 4,400/100Kg and Rs 5,600 respectively in ready business amid fresh mills buying support at lower rates and slow arrivals of new domestic Urad, also market will be remained closed from next week and most millers are going to stop crushing on account of Diwali and maintenance.

Bikaner origin branded Urad dal price offered at Rs 5,250-5,300/100Kg. Tiranga brand of Mumbai at Rs 5,850/100Kg. Parivar brand of Jalgaon at Rs 5,650/100Kg.

However, buyers were still cautious and are purchasing as per their immediate requirement because they are aware of increase in supply of new crop coupled with availability of sufficient stock of domestic Urad.

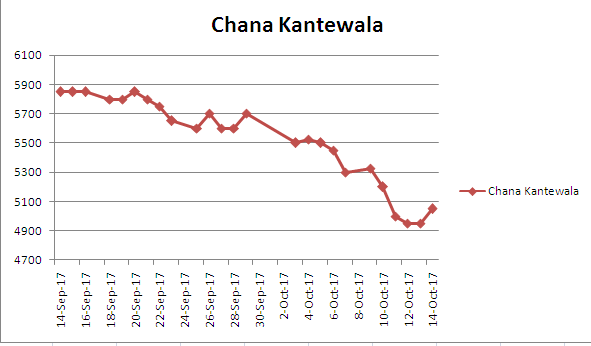

Chana Kantewala (Indore):

In Indore market, Chana priced lower by Rs 250-300 to Rs 5,000-5,050/100Kg on weak cues from futures, slack physical buying support from millers and traders, dull demand in processed chana despite festive period, regular supply in containers from overseas and also upcoming supply in break bulk vessel from October end.

Similarly,Australia origin Chana in ready business at Mumbai and Mundra port remained weak by Rs 100 to Rs 5,200/100Kg and Rs 5,250 respectively.

New crop Australia chana (2017) also offered lower by Rs 50 to Rs.5,050/100Kgs for October-November shipment and Rs.5,000/100Kgs for November-December shipment on negligible trade despite lower forecast in Australia.

Chana for November delivery on National Commodity and Derivatives Exchange (NCDEX) was settled higher at 1 percent or Rs 53 up at Rs 5,225/100kg. Earlier in the day, the contract had slide to Rs 5,124 and touched a high of Rs 5,235. Chana for October delivery jumped up by Rs.70 or 1.34 Per Cent at Rs.5,290/100Kgs; further the contract will be settled today on the exchange.

In forward business, new crop of Australia Chana priced flat at $750 per ton for October-November shipment, $740 for November-December and $730 for December-January. But, no trade was reported.

Australian Chana dal priced lower by Rs 100 at Rs 6,500/100 Kg due to dull trading activity from Wholesalers/Retailers counters. Domestic Chana dal of Maharashtra at Rs 6,600. Regular chana dal at Rs 6,500/100Kg. Chana besan variety also eased at Rs 4,000/50. Vatana besan at Rs 1,450/50 Kg. Vatana dal quoted lower at Rs 2,525.

Kabuli Chana in ready business at Indore market traded firm by Rs 100 to Rs 13100 for 42-44 count and Rs 12900 for 44-46 count on some lower level buying from exporters and traders.

As per market talks, Chana prices had declined around 1200/100Kg from higher prices on selling pressure as stockiest liquidating their stock due to regular and upcoming supply from Australia, favorable weather for Chana sowing and demand in processed Chana is still reported dull from wholesale/retail counters. Stockiest holding Chana is now getting inferior (Danki) and were sold at lower prices. Traders expect higher sowing of Chana in these rabi season due to good rainfall and better prices, which could boost supplies next year and weigh on prices. But, domestic chana crop will start from January end and still 4 month is left.

Prices of chana is temporary bounce back for short term period due to sharp fall. But, Traders holding stock in anticipation of chana prices to gain at time of festive period were now exit their position on every rise in the prices due to supply pressure in coming days. Millers were interested to liquidate its processed chana bearing losses at any rise in prices as they had crushed Chana of higher prices.

Imported Masoor (Mumbai):

Canada origin crimson variety and Australia origin nugget variety masoor remained firm by Rs 100-200 to Rs 3,200/100Kg and Rs 3,450 respectively on some lower level buying support despite upcoming fresh supply in break bulk vessel from Canada, sufficient stock of imported/domestic Masoor, weak trend in Tur prices. Sellers in domestic markets were active in clearing their inventories of Masoor even at lower rates and bearing losses.

.bmp)

According to market sources, area of masoor likely to decline these year and may shift to Chana in Uttar Pradesh, Madhya Pradesh and Bihar due to lower rates.

Rates of Canada Masoor dal of Bhiwandi mills were traded flat to 4,200/100Kgs, for APMC Vashi market delivery on sluggish buying activity.

In forward business, Australia origin Nugget variety masoor was priced at $505 per ton in container on CNF basis Nhava- Sheva for November-December shipment. Canada crimson variety masoor offered at $510 per ton in container and $500 in vessel on CNF basis For October-November shipment.

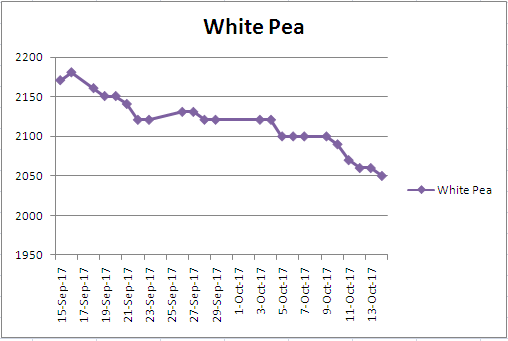

Imported White Pea (Mumbai):

Canadian origin white pea at Mumbai was offered down by Rs.50 to Rs 2,050/100Kgs on dull trade activity at existing rates coupled with regular supply from overseas and also upcoming higher supply in break bulk vessel. Russia White Pea also eased by Rs 10 to Rs 2,000/100Kg. Fall in Chana prices will also drag prices of White Pea more in coming days.

Moreover, business activity in matar dal and besan was slack from consumption centers despite cheaper pulses.

In forward business, Canada White Pea in bulk was priced at $310 per ton on CNF basis Nhava- Sheva for October-November shipment. Russia White Pea Baltik variety was priced at $283 per ton on CNF basis Nhava- Sheva for November-December shipment.

Moong (Jaipur):

Moong priced steady to firm in Jaipur market as per quality at Rs 4,600/100Kg during the last week despite improved arrivals of new kharif Moong in major states and major arrivals quantity contains moisture, dagi and discolour variety due to recent rains.

Millers were interested to purchase superior and dry quality crop of Moong. Stockiest are sidelined as produce, which arrived in the market, were not possible to maintain stock due to inferior quality.

On other hand, Moong dal prices traded flat at Rs 5,700-5,800/100Kg.

NAFED were Procuring Moong (Kharif 2017) In Telangana, Rajasthan and Karnataka Under PSS At MSP Price Of Rs 5575 (Rs 5375+200 Bonus).

.bmp)

(By Commoditiescontrol Bureau +91-22-40015513)