MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Masoor, Chana and White Pea remained lower last week ended on Saturday (June 19-June 24) on negligible trade activity ahead of GST, regular supply from overseas and domestic arrivals. Millers with inventory of branded dals wanted to liquidate their stock. While, moong prices remained flat amid slow demand.

Dal mills have raised worries over the five per cent tax on registered branded packaged pulses.Under the Goods and Services tax (GST), five per cent tax will be charged on packaged branded pulses.

There was no tax on branded packaged pulses but now the government has levied 5 per cent. This will adversely affect the industry.Industry participants said the tax rate will kill margins of dal mills, hitting their business and also curtailing benefits to farmers.

It is mostly small scale dal mills that are engaged in the business of dal processing. Millers sell pulses as small registered brands into the regional markets.

Dal mills purchase raw pulses from the market and then process it into dal of various grades. Sixty per cent comes out as dal while 25 per cent goes as cattle feed and the rest is waste.

Maintaining the quality of dal is an expensive affair as Millers have to update to modern technology. Levying tax on packaged pulses will kill the business.

Sentiments in pulses remained weak due GST implementation & its impact, negligible demand in processed pulses, higher pulses production, timely/normal monsoon and financial problem.

Week Highlights

# Delhi Government Notifies To Lift Stock Limit From State With Immediate Effect (June 23).

# India Kharif Pulses Sowing Down 33.74 % As On June 21 At 5.97 Lakh Ha Vs 9.01 Last Year. Tur : 1.25 Vs 4.21, Urad : 1.15 Vs 1.08, Moong : 1.89 Vs 2.51, Other Pulses: 1.66 Vs 1.19.

# Statewise Kharif Tur Sowing Vs Last Yr (MT). Maharashtra:11200 Vs 11400, Karnataka:61000 Vs 318000, Uttar Pradesh:29000 Vs 30000, Andhra Pradesh:3200 Vs 26000, Tamil Nadu:1200 Vs 3800, Madhya Pradesh:3000 Vs 6000, Others:16800 Vs 311900, Total:125400 Vs 420900.

# Statewise Kharif Urad Sowing Vs Last Yr (MT), Karnataka:39000 Vs 43000, Andhra Pradesh:7900 Vs 9000, Maharashtra:5300 Vs 1000, Uttar Pradesh:7000 Vs 5000, Uttrakhand:19000 Vs 18000, Madhya Pradesh: 14000 Vs Nil, Gujarat: 2000 Vs Nil.

# Statewise Kharif Moong Sowing Vs Last Yr (MT), Karnataka:96000 Vs 205000, Maharashtra:5500 Vs 3000, Tamil Nadu:10200 Vs 7400, Andhra Pradesh:2500 Vs 10000, Madhya Pradesh:3000 Vs NIL, Odisha:1100 Vs 200, Uttar Pradesh:1000 Vs 4000.

# Pulses Import-Nhava Sheva Port-May 17 Vs May 16(MT). Matar:235500 Vs 7368, Chana:18384 Vs 3504, Moong:4440 Vs 27984, Masoor:17424 Vs 1128, Tur:15312 Vs 27144, Urad:5760 Vs 9000.

# The Karnataka government on Wednesday announced to waive farm loans worth Rs 8,167 crore to benefit over 22 lakh farmers who availed up to loans of Rs 50,000.

Burma Lemon Tur:

Burma Tur lemon variety traded lower last week by Rs 200 to Rs 3,400/100Kgs due to dull millers and traders buying support. Demand in processed tur was reported slack from retailers and wholesalers counters. Fresh supply around 453 containers of imported tur and 39 containers of Tur Dal arrived at Mumbai. (1 container = 24 MT).

In Burma, buyers from India, Singapore and Local purchaser were active in purchasing tur at lower rates. Around 200 containers of Tur trade was reported.

According to market talk, new crop of Arusha tur was priced at $480 per tonne on CNF basis for August-September shipment, Matwara at $460-$470, Malawi at $410-$420. Sudan tur was offered at $550 per tonne on CNF basis for July-August shipment.

Prices of processed Tur quoted lower between Rs 50-100/100Kg on sluggish trade activity from consumer centre’s at existing rates. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,400/100 Kg, semi-Sortex at Rs 5,250 and regular at Rs 5,100.

Tur sowing area down 70.30 Per Cent, prices may find support after GST. Tur prices declined sharply in recent week compare to processed tur on panic selling ahead of GST as purchaser who purchased in cash transaction and also millers having branded pulses inventory were active in destocking their stock. Actual trade volume in market were reported negligible ahead of GST.

Actual buyers and millers would grab the opportunity to purchase at lower rates as risk level is very low at current level and lower level may attract buyer.

Pipeline is empty with millers, retailers and wholesalers country. Demand is likely to gather the space after GST clearance due to higher vegetable prices in coming days, followed by end of mango season from June and still six month (December) is left in arrivals of new crop of tur.

.bmp)

Burma Urad:

In Mumbai, Burma origin FAQ variety Urad was priced lower 250 to Rs 4,550 amid subdued buying from millers and traders at higher rates, weak cues from Burma coupled with fresh supply around 219 containers at Mumbai port these week. Similarly, SQ variety also remained weak at Rs 5,550/100Kg, down Rs 250.

Sufficient availability of crop in domestic market, fresh arrivals of summer crop urad and supply from Burma will pressurized the prices.

Branded Urad dal of Bikaner origin was also traded weak at Rs 6,200-6,300/100Kg and Tiranga branded Urad dal of Mumbai was priced at Rs 6,600/100Kg.

The total supply of Urad in Burma during the current season 2016-17 (Dec-Nov) was estimated at 5-5.5 lakh tonnes, including 0.50 to 1 lakh tonnes of opening stocks and rest 4.5 lakh tonnes as production. Urad unsold stock was expected at 4 lakh tonnes.

NAFED Procures 5705.15 MT Urad In Madhya Pradesh Under PSS On 23 June.

Similarly, at Chennai, Urad FAQ variety traded lower this week by Rs 300 to Rs Rs 4,400 in ready business. SQ variety also declined by Rs 350 to Rs 5,350/100Kg as sellers were active in the market at higher rates.

.bmp)

Chana Kantewala (Indore):

In Indore market, Chana priced lower for second straight week at Rs 5,100-5,150/100Kg, down Rs 100 during the last week amid dull buying from millers. Demand in processed chana was sluggish from consumption centers.

On other hand, Australia origin Chana in ready business at Mundra and Mumbai port remained flat at Rs 5,350/100Kg and Rs 5,300 despite fresh supply around 391 containers from overseas at Mumbai port.

While, new Chana crop of Australian origin (2017) offered firm by Rs 50 to Rs 5,050/100Kgs for October-November shipment and Rs 4,950 for November-December shipment.

In forward business, Australian Chana offered at $810 for July-August Shipment.

Australian Chana dal traded weak at Rs 6,300/100 Kg, down Rs 200. Domestic Chana dal of Latur origin was priced lower by Rs 150 to Rs 6,450. Chana besan variety at Rs 3,840/50 Kg and Vatana besan at Rs 1,575/50 Kg. Vatana dal was remained steady at Rs 2,700.

NAFED procures 49631.43 MT of Chana As On June 22. Rajasthan: 39,733.39 MT, Madhya Pradesh: 8,822.74 MT, Uttar Pradesh: 910.80 MT and Haryana:164.50 MT.

Kabuli Chana in ready business at Indore market declined for second straight week by Rs 200/100Kg to Rs 11600-11700 for 42-44 count and Rs 11400-11500 for 44-46 count amid due to dull buying support from exporters and stockiest at existing level and regular arrival.

Chana prices had been slowed down in recent weeks along with previous month despite lower output compare to government estimates due to weakness in other pulses and also destocking by stockiest who had purchased in cash transaction before GST implement.

According to market sources, demand in near future will gradually gather pace after GST clearance and support prices due to upcoming festive period and eight months for arrivals of new crop.

.bmp)

Masoor (Mumbai):

Canada origin crimson variety Masoor remained lower for second straight week by Rs 50-100 to Rs 3,350-3,650/100Kgs amid sluggish buying support, fresh supply around 180 containers from overseas, regular arrivals of new crop from producing belts and carry over stock of domestic/imported masoor of higher cost.

As per Canadian Grain Commission weekly report, Masoor export from Canada was down at 5,800 tonnes during the week ended June 11 (June 4-11) from 21,700 tonnes a week ago. Lentil export during the season so far exceed at 7.99 lakh tonnes compared with 6.15 lakh tonnes same period last year.

Importers were bearing huge losses in Masoor and White Pea due to difference in purchase cost against current market prices and were avoiding to release their cargo and suffering heavy damrage/Detention charges.

In order the support the falling prices NAFED has procured 16788.48 Metric Tonnes (MT) of Masoor as on June 22, 2017 from major states. Madhya Pradesh: 10,005.38 and Uttar Pradesh: 6,783.10.

.bmp)

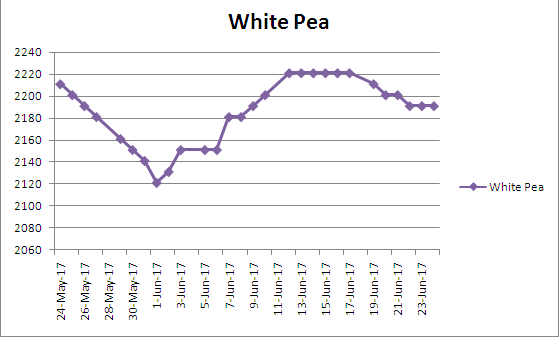

Canada White Pea (Mumbai):

Canada origin white pea at Mumbai traded weak at Rs 2,221/100Kgs, down Rs 30 on dull trade activity and regular supply in breakbulk vessel from vessel Qing Yun Shan from Canada. Farmers hesitated to liquidate their stock in the market due to low prices. Business activity in matar dal and besan was slow from consumption centers.

Canada Matar (Dry Pea) exports during week ended June 11 (June 4-11) dropped to only 600 tonnes against 32,900 tonnes a week ago, according to the latest Canadian Grain Commission weekly report. However, total exports-to-date (August 1, 2016 to June 11, 2017) are still about a million tonnes ahead of the year-ago pace, with 32.35 lakh tonnes.

Total Canadian matar exports for 2016-17 are now forecast to hit 38 lakh tonnes, according to last June supply-demand estimates from Agriculture and Agri-Food Canada (AAFC).

While, new crop Canada white pea (2017) offered unchanged at Rs 2,175/100Kgs on negligible trade activity for September-October shipment.

Moong (Jaipur):

Moong priced ruled unchanged at Rs 4,500-4,600/100Kg during the last week on limited miller buying support and fresh arrivals of summer crop moong in Madhya Pradesh, Gujarat and Uttar Pradesh. Similarly, moong dal prices also remained steady at Rs 5,500-5,600/100Kg.

Prices of moong are unlikely to sustain due sufficient kharif crop in Rajasthan and Bihar. Moreover, moong crop in the country is cultivated throughout the year and thus crop is mostly available abundantly for domestic consumption.

NAFED Procures 30234.40 MT Moong In Madhya Pradesh and 960.34 MT Moong In Odisha Under PSS On 23 June at MSP prices of Rs 5225 (Rs 4800+425 bonus).

.bmp)

(By Commoditiescontrol Bureau +91-22-40015513)