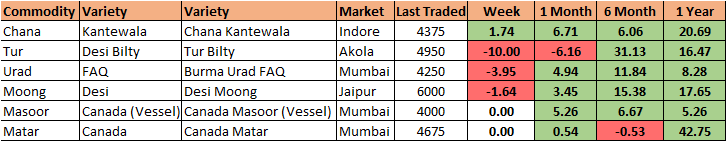

MUMBAI (Commoditiescontrol) – Major pulses such as Tur, Urad (Chennai), Moong, White Pea and Kabuli Chickpea moved higher during the week ended Saturday (April 8 - 12) on fresh buying support at lower rates.

While, Chana and Masoor ruled mixed amid thin trade activity. Green Pea prices remained more or less unchanged due to slack trade.

.png) Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin gained by Rs 50 to Rs 4,950/100Kg in Mumbai amid improved millers trade activity and less domestic arrivals as market was closed today due to ongoing Lok Sabha elections and also for festival. Demand and sale counter in processed Tur and forecast of weak monsoon had also supported prices.

As per market view, imports of Tur from overseas likely to delayed and shipments expected in July month due to ongoing elections in India and quota for millers may be released by government after election results.

Similarly, domestic tur in bilty trade at Akola also traded higher by Rs 75-100 at Rs 5,500-5,525/100Kg.

NAFED has successfully procured 244696.01 MT of Tur at Minimum Support Price of Rs 5,675/100kg as on April 11, 2019.Telangana:70300, Karnataka:110457.66, Gujarat:27386.85, Maharashtra:36196.84, Tamil Nadu:354.66.

Latur origin new Phatka variety gained by Rs 100 at Rs 7,700-7,800/100Kg for Mumbai delivery on good buying activity. Gujarat origin Wasat new phatka variety also moved higher at Rs 8,100-8,400/100Kg, Khamgaon origin new Phatka variety at Rs 7,600-7,800/100Kg (Mumbai Delivery), Jalna origin new phatka variety at Rs 8,000-8,200/100Kg (Mumbai Delivery) and Solapur origin new phatka variety at Rs 7,600-7,700/100Kg (Mumbai delivery).

Millers were not interested to liquidate their processed Tur at lower rates despite fall in raw Tur prices.

As per market talk, private traders were holding good stock in anticipation of rise in near future. Price of Tur were not sustained at higher rates despite less arrivals pressure as buying activity from retailers/wholesalers and sale counters were limited as per requirement and liquidity crunch. Sufficient stock of domestic tur is still lying with government and private traders to cater consumption demand ahead.Upcoming mango season and election period prices likely to witnessed range bound trend or may pressurise to some extent in May month.

.png) Burma Urad:

Burma Urad:

Burma Urad FAQ variety traded flat at Rs 4,350/100Kg at the Mumbai market amid limited millers demand and liquidity crunch despite less stock in Mumbai.

On other hand, In Chennai, Urad FAQ/SQ variety gained each by Rs 100-150 at Rs 4,350-4,375/100Kg and Rs 5,250-5,300 in ready delivery as per condition.

Similarly in forward business, Urad FAQ/SQ moved higher by Rs 100-150 at Rs 4,450/100Kg and Rs 5,400, respectively on buyers option delivery to take in April month.

As per Chennai trader, bulk buyers from local & Delhi were active in purchasing urad at lower rates after Madras high court dismissed all the writ petitions of importers against the DGFT and held that stand of the latter related to banning of import of pulses was correct. Importers liquidate their stock in panic after high court decision. Meanwhile, major pulses in container/vessel were cleared from customs and bonded warehouse.

Prices likely to rise around Rs 300-400/100Kg from existing prices on further millers buying support for crushing, negligible domestic arrivals, forecast of weak monsoon and also delayed in imports of Urad due to ongoing elections in India and quota for millers may be released by government after election results.

Demand and sale counters for processed urad from consumption centres were reported good at prevailing prices.

Bikaner origin branded Urad dal priced higher by Rs 100 at Rs 6,000-6,200/100Kg for Mumbai delivery. Tiranga brand of Mumbai also quoted higher at Rs 6,450/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 6,200/100Kg for Mumbai delivery.

NAFED has successfully procured 3436.08 MT of Urad 1n Rabi-2019 Season at Minimum Support Price of Rs 5,600 as on April 11, 2019. Tamil Nadu:3436.08.

.png) Chana Kantewala (Indore):

Chana Kantewala (Indore):

New Chana prices traded weak by Rs 50 at Rs 4,350/100Kg in Indore on slow millers buying support at higher rates, ongoing domestic arrivals.

On the other hand, Burma origin chana at Mumbai priced higher by Rs 25 at Rs 4,225/100Kg on miller buying support due to cheaper prices compared to domestic chana.

While, Australia origin Chana in ready business at Mumbai and Mundra port remained unchanged each at Rs 4,300/100kg, respectively due to average quality and old crop.

NAFED Procured 40949.45 MT Chana In Rabi-2019 Season as on April 11,2019.Telangana:34500, Rajasthan:4758.06, Maharashtra:980.51, Madhya Pradesh:710.88.

Balance Stock of procured Chana during Rabi-18 season with Nafed is 1643710.43 MT as on 11 April, 2019.

Chana for May delivery on National Commodity and Derivatives Exchange (NCDEX), settled higher by 1.3 per cent or Rs 57 at Rs 4,522/100kg. Earlier, in the day, the contract hovered in the range of 4,465 and 4,549 on Friday.

Chana stocks at NCDEX accredited warehouses stood at 27,727 metric tonnes (Indore: 91, Bikaner 26,122, Jaipur 1514) as on 11th April, up 26,739 metric tonnes from the previous session, the exchange data showed.

Australian chana dal moved higher by Rs 50 at Rs 5,350/100 Kg for Mumbai delivery on fresh trade activity. Domestic chana dal of Pistol brand also gained by Rs 100 at Rs 5,550 for Mumbai delivery, Angel brand at Rs 5,750 for Mumbai delivery, Samrat brand at Rs 5,900 for Mumbai delivery. While, Chana besan priced steady at Rs 3,100/50Kg, Vatana besan at Rs 2,900/50 Kg and Vatana dal at Rs 5,200.

In Mumbai, Sudan/Russia and Ethiopia origin kabuli chana gained each by Rs 25-50 at Rs 4,250-4,300/100Kg, Rs 4,150-4,200 and Rs 4,225, respectively.

While, Burma origin Kabuli Chana remained unchanged at Rs 4,500/100Kg.

Flour millers were also active in purchasing chana due to cheaper prices and easy availability compared to White Pea.

Kabuli chana of 40-42, 42-44 and 44-46 counts traded flat at Rs 6,600/100Kg, Rs 6,400 and Rs 6,200, respectively at Indore market amid limited buying and ongoing arrivals.

As per market sources, the government had decided to procure 25 % of pulses out of total production. However,in Madhya Pradesh procurement target for chana and masoor has been fixed at 22% and 15%. At this fixed target Madhya Pradesh Government would procure 1,10,600 MT masoor and 11,48750 MT chana. Total procurement target for chana has been fixed at 22,24,823 MT against 2724051.17 lakh MT last year. Government would procure total 2,81,166 MT masoor this year In Madhya Pradesh and Uttar Pradesh.

As per market talk, prices of chana were traded much below MSP. Farmers are in worry as government procurement is still slow in selected states and also yet not began procurement in other major states. Prices of Chana likely to get support if government started purchasing aggressively. Moreover, output of chana is lower by about 10-15 per cent this season in the country, according to trade estimates. Import restriction on peas extended for another one year and Matar quota restricted to 1.5 lakh tonne/annually, earlier it was 1 lakh tonne/quarterly will also support chana prices.

.png) Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Australia Masoor new gained by Rs 50 at Rs 4,150-4,200/100Kg at Mumbai due to fresh millers buying support, also sellers remained reluctant to liquidate imported Masoor at lower rates and also below expectation arrivals of domestic Masoor.

While, Canada origin Masoor in both container/vessel new priced unchanged at Rs 3,950/100Kg and Rs 4,050, respectively.

However, demand in processed masoor from consumption centres was reported slow. Canada Masoor Khopoli spot traded unchanged at Rs 4,850/100Kg.

Vessel MV Great Link carrying Masoor from Canada arrived at Vizag on 9th April will discharge Masoor from today onwards at Vishakhapatnam port.

In forward business, Canada crimson variety masoor new offered at $425 per ton in container on CNF basis Nhava- Sheva for May-June shipment.

As per market sources, prices of Masoor likely to get further support on long term basis as domestic arrivals were below expectation, stockiest were active at existing prices in domestic markets and also further rise in Tur price may support masoor prices due to substitute and also cheaper prices.

Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada and Ukraine origin White Pea new moved higher by Rs 100-125/100Kg in Mumbai amid fresh buying support, limited imported stock in Mumbai and also less domestic arrivals as farmers not interested to liquidate at lower rates.

Canada White Pea new traded higher by Rs 100 at Rs 4,750/100Kg. Ukraine White Pea new also gained by Rs 125 at Rs 4,650/100Kg.

In Kolkata, cargo of White pea in container were cleared from custom against 10% Bank guarantee and 5% penalty. On other hand, old cargo in vessel were also cleared from custom against 10% Bank guarantee.

Vessel MV Great Link carrying Masoor and White Pea from Canada arrived at Vizag on 9th April will discharge Masoor from today onwards at Vishakhapatnam port and then will discharge White Pea at Kolkata port.

As per local trader, stock of Canada White Pea in Kolkata were low and buyers were active Canada White Pea from Chennai.

Demand in matar dal/besan remained thin at prevailing rates due to shifting of demand from traders, millers and flour millers to chana/Kabuli chana due to cheaper prices as compared to white pea.

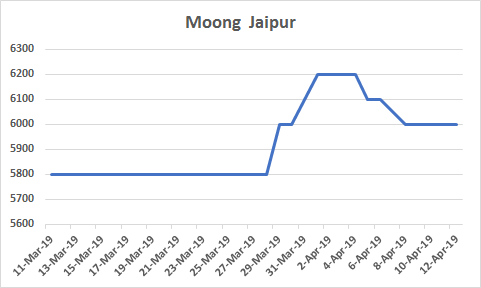

Moong (Jaipur):

Moong (Jaipur):

Moong prices traded higher by Rs 200 at Rs 5,800-6,000/100Kg as per quality at Jaipur market amid fresh millers buying support and weak monsoon forecast.

Similarly, Moong dal prices also gained by Rs 200 at Rs 7,000-7,200/100Kg, depending on the variety.

However, Nafed were active in selling old procured balance stock of Kharif 2017 in Rajasthan and also stock of Kharif 2018 in Maharashtra, Telangana and Karnataka may limit the gains.

NAFED has successfully procured 1207.93 MT of Moong in Rabi 2019 season at Minimum Support Price of Rs 6,975 as on April 11, 2019.Tamil Nadu: 1207.93.

In forward business, Tanzania Moong traded in the range of $670-$710 per ton in container on CNF basis Nhava- Sheva for June shipment.

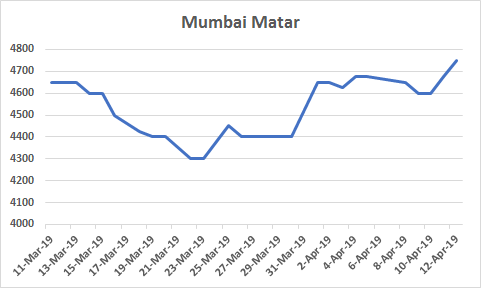

Canada Green Pea (Mumbai):

Canada origin Green pea priced flat at Rs 7,000-7,100/100Kg at Mumbai amid limited buying support and availability of sufficient stock at Mumbai/Chennai cold storage and godowns.

(By Commoditiescontrol Bureau; +91-22-40015513)