MUMBAI (Commoditiescontrol) – Major pulses such as Tur, Urad, Masoor, Moong and Green Pea remained weak during the week ended Saturday (April 01-05) on slack buying support at higher rates as demand and sale counters in processed pulses were slow.

While, Chana and Kabuli Chana ruled mixed amid thin trade activity. On the other hand, White Pea prices remained more or less unchanged due to slack trade and overseas supply.

Week Highlights

# Skymet Says Monsoon Likely To Be Below Normal In India This Year.

# Government Extends Restrictions On Import Of Pulses For FY 2019-20. Tur - 2 lakh tonne, Urad- 1.5 lakh tonne , Moong - 1.5 lakh tonne. This restriction will not be applicable on any government’s bilateral agreements / MOU / Trade agreements. Further Peas/Matar quota is restricted to 1.5 lakh tonne.Earlier it was 1 lakh tonne/quarterly.

# The RBI lowered the benchmark interest rate by 0.25 percent, the second cut in a row, to the lowest level in one year on softening inflation.

# Madras High Court Dismisses Importers Petitions, Upholds DGFT Order To Ban Pulses Import.

# Kolkata High Court Permits Pulses Cargo Clearance Against 5% Bank Guarantee.

.png)

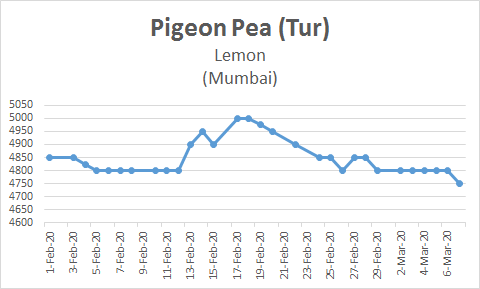

Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin slipped by Rs 200 to Rs 4,950/100Kg in Mumbai as resellers were active at higher rates in the market who had purchased the tur stock earlier, weak cues from domestic markets and dull millers buying as demand and sale counter in Tur Dal reported slack amid liquidity crunch.

Buyers were cautious due to upcoming election and also sufficient stock of domestic tur is still lying with government and private traders to cater consumption demand ahead.

In Mumbai, Mozambique Tur Zebra variety quoted weak at Rs 4,100/100Kg, Gajri white variety at Rs 4,575-4,600 and red lakhota variety at Rs 4,500.

Tanzania origin Arusha Tur priced lower at Rs 4,600/100Kg.

Domestic tur in bilty trade at Akola also traded weak by Rs 100 at Rs 5,450-5,500/100Kg.

NAFED has successfully procured 233441.72 MT of Tur at Minimum Support Price of Rs 5,675/100kg as on April 4, 2019.Telangana:70300, Karnataka:110019.34, Gujarat:20579.65, Maharashtra:32210.77, Tamil Nadu:331.96.

Latur origin new Phatka variety priced lower by Rs 100 at Rs 7,600-7,700/100Kg for Mumbai delivery on thin trade activity. Gujarat origin Wasat new phatka variety priced weak at Rs 8,000-8,300/100Kg, Khamgaon origin new Phatka variety at Rs 7,500-7,700/100Kg (Mumbai Delivery), Jalna origin new phatka variety at Rs 7,900-8,100/100Kg (Mumbai Delivery) and Solapur origin new phatka variety at Rs 7,500-7,600/100Kg (Mumbai delivery).

In forward trade, Tur Phatka variety of Latur ( Pistol/Popat/Dollar) were priced at Rs 8,700/100Kg for Diwali.

As per market talk, prices likely to get support as sellers will refrained to sell stock at lower rates, decreasing domestic arrivals due to lower output and also weak monsoon forecast. Demand in Tur dal is expected at lower rates as retailers/wholesalers pipeline are empty.

.png) Burma Urad:

Burma Urad:

Burma Urad FAQ variety traded weak by Rs 75 at Rs 4,425/100Kg at the Mumbai market amid dull trade activity as sellers were active on every rise in prices, liquidity crunch and following weak cues from Chennai.

Moreover, demand in processed urad also reported weak from consumption centers.

Similarly, In Chennai, Urad FAQ/SQ variety declined by Rs 200 at Rs 4,250/100Kg and Rs 5,150-5,175, respectively in ready delivery as per condition.

On other hand in forward business, Urad FAQ/SQ priced at Rs 4,400-4,425/100Kg and Rs 5,350, respectively on buyers option delivery to take in April month.

Bikaner origin branded Urad dal priced lower by Rs 100 at Rs 5,900-6,100/100Kg for Mumbai delivery. Tiranga brand of Mumbai also quoted down at Rs 6,350/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 6,100/100Kg for Mumbai delivery.

NAFED has successfully procured 3419.67 MT of Urad 1n Rabi-2019 Season at Minimum Support Price of Rs 5,600 as on April 4, 2019. Tamil Nadu:3419.67.

Chana Kantewala (Indore):

Chana Kantewala (Indore):

New Chana prices slipped by Rs 50 at Rs 4,300/100Kg in Indore dull millers buying support, increased domestic arrivals and slack demand and sale counters in processed chana/besan.

On the other hand, Australia origin Chana in ready business at Mumbai and Mundra port moved higher by Rs 25 each at Rs 4,325/100kg, respectively millers buying support due to cheaper prices compared to domestic chana despite average quality and old crop.

While, Burma origin chana priced flat at Rs 4,250/100Kg on limited buying by mills.

NAFED Procured 37020.16 MT Chana In Rabi-2019 Season as on April 4,2019.Telangana:34500, Rajasthan:2170.55, Maharashtra:349.61.

Balance Stock of procured Chana during Rabi-18 season with Nafed is 1645010.43 MT as on 2 April, 2019.

Chana for May delivery on National Commodity and Derivatives Exchange (NCDEX), settled higher by 0.7 per cent or Rs 32 at Rs 4,529/100kg. Earlier, in the day, the contract hovered in the range of 4,495 and 4,554 on Friday.

Australian chana dal ruled weak for Rs 100 at Rs 5,300/100 Kg for Mumbai delivery on slack trade activity. Domestic chana dal of Pistol brand also offered lower at Rs 5,500 for Mumbai delivery, Angel brand at Rs 5,700 for Mumbai delivery, Samrat brand at Rs 5,850 for Mumbai delivery. While, Chana besan priced steady at Rs 3,100/50Kg, Vatana besan at Rs 2,900/50 Kg and Vatana dal at Rs 5,200.

In Mumbai, Sudan/Russia and Ethiopia origin kabuli chana gained each by Rs 25-50 at Rs 4,275/100Kg, Rs 4,175 and Rs 4,225, respectively.

While, Burma origin Kabuli Chana remained unchanged at Rs 4,500/100Kg.

Kabuli chana of 40-42, 42-44 and 44-46 counts traded lower by Rs 150 at Rs 6,650/100Kg, Rs 6,450 and Rs 6,250, respectively at Indore market on increased arrivals.

As per market sources, prices of Chana are likely to get some support for the short term if government begins procurement at MSP of 4,620/100Kg and may stop sale of last year procured chana. New arrivals will also be slow as farmers will not be interested to sell chana at lower current rates in open market while preferring to sell to government at MSP.

.png) Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin Masoor in vessel declined by Rs 50/100Kg at Mumbai pulses market due to overseas supply at Mundra/Kolkata port, ongoing domestic arrivals and slack buying support from millers.

Canada crimson variety masoor in vessel new fell by Rs 50 to Rs 4,000/100Kg. While, Canada crimson variety masoor in container new priced unchanged at Rs 4,150.

Australia masoor nugget variety new also remained steady at Rs 4,250/100Kg as per quality amid limited stock availability.

However, demand in processed masoor from consumption centres was reported slack. Canada Masoor Khopoli spot traded weak by Rs 50 at Rs 4,850/100Kg.

As per market sources, prices of Masoor likely to get support on long term basis as domestic arrivals were below expectation, stockiest were active at existing prices in domestic markets and also further rise in Tur price may support masoor prices due to substitute and also cheaper prices.

.png) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada/Ukraine origin White Pea new priced more or less flat in Mumbai due to ongoing domestic arrivals, overseas supply at Chennai/Kolkata/Mundra port and also due to shifting of demand from traders, millers and flour millers to chana/Kabuli chana due to cheaper prices as compared to white pea.

However, demand in matar dal/besan remained slow at prevailing rates.

Canada White Pea old/new traded unchanged at Rs 4,650-4,675/100Kg. While Ukraine White Pea new ruled steady at Rs 4,550-4,575/100Kg.

.png) Moong (Jaipur):

Moong (Jaipur):

Moong prices traded weak by Rs 100 at Rs 5,700-6,100/100Kg as per quality at Jaipur market amid slack millers buying support at higher rates and also Nafed were active in selling old procured balance stock of Kharif 2017 in Rajasthan and also stock of Kharif 2018 in Maharashtra, Telangana and Karnataka.

Moong dal prices also fell by Rs 200 at Rs 6,800-7,000/100Kg, depending on the variety.

NAFED has successfully procured 918.88 MT of Moong in Rabi 2019 season at Minimum Support Price of Rs 6,975 as on April 4, 2019.Tamil Nadu: 918.88.

Canada Green Pea (Mumbai):

Canada origin Green pea slipped by Rs 100 to Rs 7,000-7,100/100Kg at Mumbai amid dull buying support at higher rates and availability of sufficient stock at Mumbai/Chennai cold storage and godowns.

(By Commoditiescontrol Bureau; +91-22-40015513)