MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Masoor (new) and White Pea remained weak during the week ended Saturday ( December 10- 15) due to dull buying support from mills. While, Moong prices ruled firm on millers demand at lower rates. On the other hand, Chana and Green Pea traded flat on thin trade activity.

Supply from overseas, ongoing kharif crop arrivals, weak sale counters in processed pulses and also liquidity crunch have been pressurising the sentiments over the last couple of weeks.

Week Highlights

# India Rabi Pulse Sowing down by 9.32 % as on December 14 to 125.40 lakh Ha vs 138.29 last year at the same period.

# Tur Crop In Yavatmal Destroyed By Fungus. Average 1.5 Lakh Ha Tur Sown In District.

# Unseasonal rains in Gulbarga along with Hyderabad-Karnataka districts has hit the Tur standing crop, inflicting losses to growers, who were already reeling under the impact of a weak monsoon.The heavy rains have spoilt the harvest and also the standing crop.

# NAFED has successfully procured 179.70 MT of Tur at Minimum Support Price of Rs 5,675 as on Dec 13, 2018.

# NAFED has successfully procured 166250.11 MT of Moong at Minimum Support Price of Rs 6,975 as on Dec 13, 2018.

# NAFED has successfully procured 109656.54 MT of Urad at Minimum Support Price of Rs 5,600 as on Dec 13, 2018.

.png)

.png) Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin fell for second straight week by Rs 100 to Rs 4,300/100Kg in Mumbai due to slow enquiries from mills amid dull sale counters in processed tur, supply from overseas at Mumbai/Chennai and ongoing domestic arrivals.

Similarly, In Mumbai, Mozambique Tur both red/white also quoted lower by Rs 100-150 at Rs 4,100-4,350/100Kg on thin buying activity and average quality.

Good availibility of fresh vegetables at cheaper prices also restricted demand for processed pulses.

Domestic tur in bilty trade at Akola also eased by Rs 25 at Rs 4,650-4,675/100Kg following weak trend in imported Tur and slackened buying support from mills.

However, arrivals of new tur were reported below expectation at many markets of Maharashtra, Karnataka, Andhra Pradesh and Telangana as against in the same period last year.

Latur origin Phatka variety priced lower by Rs 150-200 at Rs 6,500-6,600/100Kg for Mumbai delivery in low trade volume, Gujarat origin Wasat phatka variety also offered lower at Rs 6,500-6,800/100Kg. While, Khamgaon origin Phatka variety quoted steady at Rs 6,450-6,650/100Kg (Mumbai Delivery) and Jalna origin phatka variety at Rs 6,550-6,950/100Kg (Mumbai Delivery).

On the other hand, Jalna origin new Phatka variety spot quoted at Rs 7,200/Kg, Latur origin new Phatka variety spot at Rs 7,000/100Kg and Solapur origin new Phatka variety spot at Rs 6,800/100Kg.

As per market talk, arrival of new Tur is unlikely to be strong in local market in December-January due to lower crop outlook and also as farmers will not be interested to liquidate their produce at lower market prices and prefer either to sale to government agencis at higher MSP of Rs 5,675/100Kg or hold back, expecting market prices to move ahead of MSP in the days to come.

Limited holding of old stock by Nafed may also support prices at lower rates in the long-term. Furthermore, Tur prices will depend on government procurement which has already begunin Telangana. The procurement is likely to gather pace once tur arrivals pick up.

.png) Burma Urad:

Burma Urad:

Burma urad FAQ variety also widened losses by Rs 150 to Rs 4,450/100Kg at the Mumbai market amid lacklustre buying by mills, ongoing domestic arrivals and also on regular cheaper import in Chennai/Kolkata.

Similarly, Urad FAQ/SQ new also fell by Rs 50-100 at Rs 4,250/100Kg and Rs 5,200, respectively in ready delivery as per condition due to sellers were active to liquidate their imported stock at prevailing rates in the market.

Buyers have opted to remain sideline ahead of likely judgment on December 17, 2018 by Madras High Court about pulses import restrictions.

Demand and sale counters in processed urad remained slack.

Bikaner origin branded Urad dal priced lower at Rs 6,150-6,450/100Kg for Mumbai delivery, Tiranga brand of Mumbai at Rs 6,500/100Kg for Mumbai delivery and Parivar brand of Jalgaon at Rs 6,250/100Kg for Mumbai delivery.

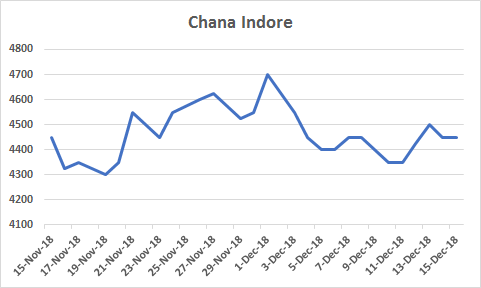

Chana Kantewala (Indore):

Chana Kantewala (Indore):

Chana prices traded flat at Rs 4,450/100Kg in Indore in limited trade amid selective millers trade activity as demand and sale counters in Chana dal and besan remained slackened.

Similarly, Australia origin Chana in ready business at Mumbai and Mundra ports also priced more or less unchanged at Rs 4,550-4,600/100kg and Rs 4,600, respectively on slack physical activity and overseas supply from various origin.

However, Nafed activeness in liquidating procured stock at existing prices also pressurised sentiments.

On the other hand, Burma origin chana eased by Rs 25 at Rs 4,550/100Kg on slack trade despite shortage of ready stock.

Chana for January delivery on National Commodity and Derivatives Exchange (NCDEX), was settled tad weak or Rs 1 at Rs 4,592/100kg. Earlier, in the day, the contract hovered in the range of 4,572 and 4,633 on Friday.

Chana stocks at NCDEX accredited warehouses stood at 13,180 metric tonnes (Akola: 6,701, Bikaner 6,428 and Jaipur 51) as on 13th December, unchanged from the previous session, the exchange data showed.

Australian chana dal quoted lower by Rs 100 at Rs 5,600/100 Kg for Mumbai delivery on dull trade activity. Domestic chana dal of Pistol brand also offered weak by Rs 150 at Rs 5,850 for Mumbai delivery, Angel brand at Rs 6,200 for Mumbai delivery, Samrat brand at Rs 6,200 for Mumbai delivery. Chana besan also traded lower by Rs 50 at Rs 3,250/50Kg. While, Vatana besan remained steady at Rs 3,100/50 Kg and Vatana dal at Rs 5,450.

In Mumbai, Sudan and Burma origin kabuli ruled steady each at Rs 4,350/100Kg and Rs 4,700, respectively amid thin buying support from traders and besan flour millers, following slow trend in Chana.

Kabuli Chana dollar variety at Indore priced at Rs.4,500-5,600/100Kgs as per quality at Indore.

Kabuli chana of 42-44 and 44-46 counts quoted at Rs 6,000/100Kg and Rs 5,800, respectively at Indore market.

The long term outlook of chana will very much depend on progress of rabi crop sowing, which has already begun but is lagging behind as compared to last year.

Prices may get further support on expectations that the government may extend curbs on import of yellow peas till March 2019.

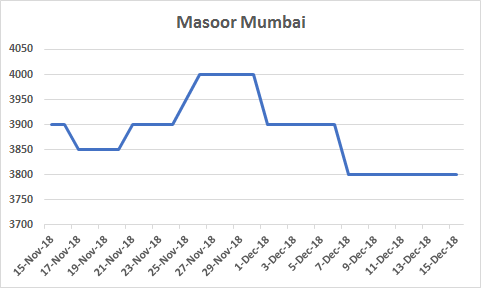

Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin masoor in container/vessel new and Australia origin masoor new declined in Mumbai by Rs 100/100Kg amid dull buying support from mills.

Canada crimson variety masoor in vessel new (Sea Breeze) fell by Rs 100 at Rs 4,000/100Kg. Similarly, Canada crimson variety masoor in Container new ruled weak by Rs 100 at Rs 4,100.

Australia masoor nugget variety new also quoted lower at Rs 4,200 as per quality.

On the other hand, Canada crimson variety masoor in vessel old ruled unchanged at Rs 3,700-3,800/100Kg. Similarly, Canada crimson variety masoor in Container old remained flat at Rs 3,900-4,000.

Australia masoor nugget variety old offered steady at Rs 4,000-4,100, respectively as per quality against limited ready stock.

MMTC was active in selling old masoor stock, procured earlier remained stable at Rs 3,600/100Kg.

However, demand and sale counters in masoor dal remained thin. Canada Masoor Khopoli spot traded at Rs 4,950/100Kg.

Selling of procured Masoor by Nafed in Madhya Pradesh and overseas supply from Canada may further pressurise sentiments for the short term. However, lower sowing as farmers are focusing on sowing chana and White Pea and avoiding masoor because of poor returns for the crop and amid, further rise in Tur price may support masoor prices.

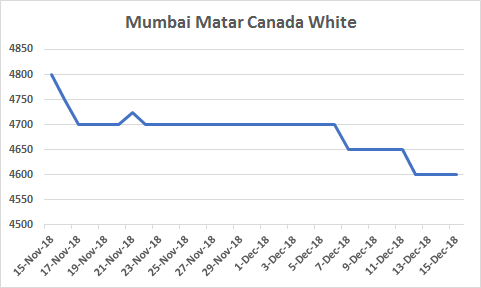

Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada and Ukraine white pea at Mumbai along with Canada White Pea both old/new at Mundra port remained weak with a fall of Rs 50-75/100kg as per quality due to slackened trade activity and regular supply at Chennai/Kolkata/Mumbai port.

On the other hand, Lithunia origin white pea at Mundra port and Ukraine White Pea at Mundra and Hajira ports ruled unchanged.

Canada White Pea old traded at Rs 4,600/100Kg at Mumbai and Rs 4,371-4,450 at Mundra port. Canada White pea new priced at Rs 4,550/100Kg at Mundra port. Lithunia origin quoted at Rs 4,460 in Mundra. Ukraine White Pea ruled at Rs 4,525 at Mumbai and at Rs 4,550 at Mundra and Hajira.

Demand in matar dal/besan remained limited at prevailing rates.

In India, government had earlier extended curbs on matar import till December end and likely to extend further til March 31.

White Pea prices remained firm in the international market due to good export demand for shipment during the first quarter of 2019. Market tone has also been helped by the reduction in surplus stocks because of shipments to China's livestock feed industry.

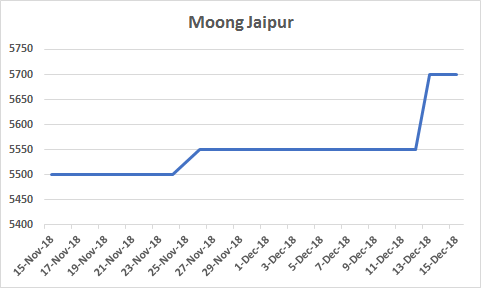

Moong (Jaipur):

Moong (Jaipur):

Moong traded firm by Rs 150 to Rs 5,500-5,700/100Kg as per quality at Jaipur market amid millers buying support and slow arrivals in Rajasthan.

However, overseas supply from various origin at Chennai/Mumbai port and dull demand and sale counters in processed moong had weighed sentiments. Moong dal prices offered at Rs 6,600-6,800/100Kg, depending on the variety. Still no parity was reported in purchasing good quality as demand in dal were thin.

The government is procuring pulses in very small quantities, and it is not enough to push prices up.

Canada Green Pea (Mumbai):

Canada origin green pea at Mumbai quoted flat at Rs 6,500/100Kg as per quality due to limited trade activity and supply from overseas at Mumbai (JNPT) and Chennai port.

(By Commoditiescontrol Bureau; +91-22-40015513)