MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Chana, Masoor and Kabuli Chickpea remained weak during the week ended Saturday ( December 01- 08) due to dull buying support from mills. While, Moong, Green and White Pea traded flat on thin trade activity.

In addition, the business activity in the market remained also thin due to liquidity crunch. The circulation of payment is now very slow between buyers and sellers.

Meanwhile, appreciation in rupee from 74.27 to 70.80 against USD may benefit pulses importers.

Week Highlights

# India Rabi Pulse Sowing down by 10.32 % as on December 7 to 113.69 lakh Ha vs 126.78 last year at the same period. Chana: 77.27 Vs 88.94, Masoor: 13.95 Vs 14.77, Matar: 7.48 Vs 7.82, Urad: 2.98 Vs 3.61, Moong: 1.14 Vs 1.22, Other Pulses:3.71 Vs 3.54.

# Canada Export 26 Nov-2 Dec Vs Last Wk (MT). Matar: 49700 Vs 22900, Masoor: 24500 Vs 1400, Export (1 Aug To Dec 2) Vs Last Yr (LT). Matar: 7.43 Vs 8.89, Masoor: 1.67 Vs 1.12.

# Fitch Ratings Cuts India Growth Forecast To 7.2% From 7.8% Earlier In Sept On Higher Financing Costs.

# Australia Agri Department Forecast 2018-19 Chana Production At 3.30 LT Vs 11.48 LT Last Year. Masoor Production At 3.43LT Vs 4.85 LT Last Year. Matar Crop At 1.94 Vs 2.89 LT.

# IMD: India Likely To Experience Warmer Winter This Season Due To El Nino.

.jpg)

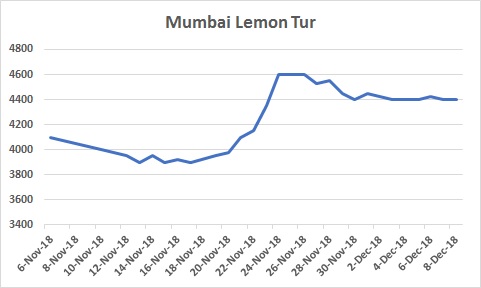

Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin fell by Rs 50-100 to Rs 4,400/100Kg in Mumbai due to dull buying support from mills amid limited sale counters in processed tur and supply from overseas at Mumbai/Chennai.

Good availibility of fresh vegetables at cheaper prices also restricted demand for processed pulses.

Similarly, domestic tur in bilty trade at Akola also declined by Rs 75 at Rs 4,775-4,800/100Kg following weak trend in imported Tur and slackened buying support from mills.

On the other hand, Mozambique origin red and white new tur ruled flat at Rs 4,200/100Kg and Rs 4,500, respectively in the absence of trade activity.

However, arrivals of new tur were reported below expectation at many markets of Maharashtra and Karnataka as against in the same period last year.

Latur origin Phatka variety priced lower by Rs 100 at Rs 6,600-6,800/100Kg for Mumbai delivery on slow trade volume. Gujarat origin Wasat phatka variety also offered weak by Rs 100 at Rs 6,800-7,200/100Kg, Khamgaon origin Phatka variety at Rs 6,500-6,700/100Kg (Mumbai Delivery), Jalna origin phatka variety at Rs 6,700-7,100/100Kg (Mumbai Delivery).

As per market talk, arrival of new Tur is unlikely to be strong in local market in December-January due to lower crop outlook and also as farmers will not be interested to liquidate their produce at lower market prices and prefer either to sale to government agencis at higher MSP of Rs 5,675/100Kg or hold back, expecting market prices to move ahead of MSP in the days to come. Consistent decline in stock left with Nafed may also support prices at lower rates in the long-term. Movement in Tur prices will also depend on government procurement.

.jpg) Burma Urad:

Burma Urad:

Burma urad FAQ variety remained weak by Rs 25-50 to Rs 4,525/100Kg at the Mumbai market amid dull buying by mills, ongoing domestic arrivals at major markets and also on regular cheaper import in Chennai/Kolkata due to recent appreciation in rupee.

On the other hand, in Chennai, Urad SQ new moved up by Rs 50 at Rs 5,350 in ready delivery as per condition amid fresh buying by mills at lower rates despite regular supply from overseas. Urad FAQ variety also gained by Rs 150 to Rs 4,350/100Kg.

Meanwhile, millers are preferring to crush imported urad as they are facing difficulty in getting good quality of domestic urad stock amid lower output of domestic crop as compared to last year.

The Madras High Court has further extended the date of hearing till December 17, 2018 on a plea challenging the DGFT notification to restrict Urad imports. Against that backdrop, importers continue imports of Urad till the next date of hearing resulting in more pressure on supply side.

Buyers have also turned cautious amid reports that Indian government is likely to take steps to implement import restrictions completely and effectively.

However, demand for processed urad from consumption centres remained weak at prevailing prices.

Bikaner origin branded Urad dal priced lower by Rs 100 at Rs 6,200-6,500/100Kg for Mumbai delivery, Tiranga brand of Mumbai at Rs 6,551/100Kg for Mumbai delivery and Parivar brand of Jalgaon at Rs 6,400/100Kg for Mumbai delivery.

Overall Rabi Urad Sowing Down 17.45 % As On Dec 5 Vs Same Period Last Yr (LAKH HA).

State-Wise Breakup: Andhra Pradesh:1.07 Vs 1.34, Tamil Nadu:1.29 Vs 1.55, Odisha:0.48 Vs 0.55. Total:2.98 Vs 3.61.

Chana Kantewala (Indore):

Chana prices ruled weak by Rs 150-200 at Rs 4,400-4,450/100Kg in Indore in limited trade due to election this week in Madhya Pradesh.

Australia origin Chana in ready business at Mumbai and Mundra ports also moved lower by Rs 150-200 at Rs 4,500-4,525/100kg and Rs 4,575-4,600, respectively amid dull millers trade due to limited demand and sale counters in Chana dal and besan.

However, Nafed activeness in liquidating procured stock at existing prices also pressurised sentiments.

Burma origin chana also fell by Rs 125 at Rs 4,575/100Kg on slack trade despite shortage of ready stock.

At National Commodity and Derivatives Exchange (NCDEX), Chana benchmark December contract settled down at 0.4 per cent or Rs 19 at Rs.4,549/100Kgs.

Chana stocks at NCDEX accredited warehouses stood at 10,245 metric tonnes (Akola: 6,701, Bikaner 3544) as on 7th December, up from 9,560 metric tonnes in the previous session, the exchange data showed.

Australian chana dal priced lower by Rs 50 at Rs 5,800/100 Kg for Mumbai delivery on dull trade activity. Domestic chana dal of Pistol brand offered lower by Rs 50 at Rs 5,950 for Mumbai delivery, Angel brand at Rs 6,350 for Mumbai delivery, Samrat brand at Rs 6,400 for Mumbai delivery. On other hand, Chana besan traded steady at Rs 3,300/50Kg, Vatana besan at Rs 3,000/50 Kg and Vatana dal at Rs 5,500.

In Mumbai, Sudan and Burma origin kabuli declined by Rs 125-150 each at Rs 4,375/100Kg and Rs 4,700, respectively amid dull buying support from traders and besan flour millers, following slow trend in Chana.

Kabuli Chana dollar variety at Indore priced flat at Rs.5,000-5,500/100Kgs as per quality at Indore.

Kabuli chana of 42-44 and 44-46 counts quoted at Rs 6,000/100Kg and Rs 5,800, respectively at Indore market.

The long term outlook of chana will very much depend on progress of rabi crop sowing, which has already begun but is lagging behind as compared to last year.

Prices may get further support due to tightening supply of imported chana amid higher duties and quantitative restrictions, and on expectations that the government may extend curbs on import of yellow peas till March 2019.

Sowing Update (Rabi Season 2018-19)

Overall Rabi Chana Sowing Down 13.12 % As On Dec 5 Vs Same Period Last Yr (LAKH HA) In The Same Period Last Year.

State-Wise Breakup

Maharashtra:8.93 Vs 14.23, Rajasthan:12.96 Vs 13.96, Karnataka:11.01 Vs 12.91, Madhya Pradesh:30.78 Vs 31.24,Uttar Pradesh:5.03 Vs 5.20, Andhra Pradesh:3.15 Vs 4.31, Telangana:0.96 Vs 0.77, Total:77.27 Vs 88.94.

.jpg) Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin masoor in container/vessel both old/new and MMTC old procured masoor along with Australia origin masoor declined by Rs 100/100Kg in Mumbai amid dull buying support from mills.

Canada crimson variety masoor in vessel old/new (Sea Breeze) fell by Rs 100 at Rs 3,700-3,800/100Kg and Rs 4,100, respectively. Similarly, Canada crimson variety masoor in Container old/new ruled weak at Rs 3,900-4,000/100Kg and Rs 4,200, respectively.

MMTC was active in selling old masoor stock, procured earlier at Rs 3,600/100Kg, down Rs 50.

Similarly, Australia masoor nugget variety both old/new quoted lower at Rs 4,000-4,100/100Kg and Rs 4,300, respectively as per quality amid limited stock availability.

However, demand and sale counters in masoor dal remained limited. Canada Masoor Khopoli spot traded at Rs 5,000/100Kg.

Selling of procured Masoor by Nafed in Madhya Pradesh/Uttar Pradesh and overseas supply from Canada are likely to limit the gains for short term. However, slow pace of sowing as farmers are focusing on sowing chana and White Pea and avoiding masoor in Uttar Pradesh because of poor returns for the crop and amid further rise in Tur price may support masoor prices.

Overall Rabi Masoor Sowing Down 5.55 % As On Dec 5 Vs Same Period Last Yr (LAKH HA).

State-Wise Breakup: Madhya Pradesh:5.14 Vs 5.68, Uttar Pradesh:5.34 Vs 5.66, Bihar:1.52 Vs 1.91, West Bengal:1.21 Vs 0.77, Uttrakhand:0.15 Vs 0.15, Jharkhand:0.18 Vs 0.17, Total::13.95 Vs 14.77.

.jpg) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada origin white pea at Mumbai, Hajira and Mundra ports, Lithunia White Pea at Mundra port along with Ukraine White Pea at Mundra/Hajira ports almost traded flat as per quality due to limited trade, regular supply at Chennai/Kolkata port.

Canada White Pea traded at Rs 4,650/100Kg at Mumbai and Rs 4,500-4,600 at Mundra port. Lithunia origin quoted at Rs 4,460 in Mundra. Ukraine White Pea ruled at Rs 4,600 at Mumbai and at Rs 4,550 at Mundra and Hajira.

Demand in matar dal/besan remained limited at prevailing rates.

In India, government had earlier extended curbs on matar import till December end and likely to extend further til March 31.

White Pea prices remained firm in the international market due to good export demand for shipment during the first quarter of 2019. Market tone has also been helped by the reduction in surplus stocks because of shipments to China's livestock feed industry.

Overall Rabi Field Pea Sowing Down 4.35 % As On Dec 5 Vs Same Period Last Yr (LAKH HA).

State-Wise Breakup: Madhya Pradesh:2.27 Vs 2.71, Uttar Pradesh:4.04 Vs 3.88, Assam:0.27 Vs 0.27, Bihar:0.21 Vs 0.26, Chattisgarh:0.21 Vs 0.23, Total:7.48 Vs 7.82.

.jpg) Moong (Jaipur): Moong traded unchanged at Rs 5,400-5,550/100Kg as per quality at Jaipur market amid limited buying by the mills despite slow arrivals in Rajasthan. No parity was reported in purchasing good quality as demand in dal were thin.

Moong (Jaipur): Moong traded unchanged at Rs 5,400-5,550/100Kg as per quality at Jaipur market amid limited buying by the mills despite slow arrivals in Rajasthan. No parity was reported in purchasing good quality as demand in dal were thin.

Demand and sale counters in processed moong remained slow at existing rates. Moong dal prices remained flat at Rs 6,900-7,000/100Kg, depending on the variety.

Overall Rabi Moong Sowing Down 6.56 % As On Dec 5 Vs Same Period Last Yr (LAKH HA).

State-Wise Breakup: Andhra Pradesh:0.36 Vs 0.32, Tamil Nadu:0.25 Vs 0.38, Odisha:0.39 Vs 0.43, Total:1.14 Vs 1.22.

Canada Green Pea (Mumbai):

Canada origin green pea at Mumbai quoted flat at Rs 6,500/100Kg as per quality due to limited trade activity and supply from overseas at Mumbai (JNPT) and Chennai port.

(By Commoditiescontrol Bureau; +91-22-40015513)