MUMBAI (Commoditiescontrol) - Urad was the major gainer this week (Jul 30-Aug 4) followed by masoor, while chana edged down after strong rise in July with marginal losses witnessed in Tur as demand in tur dal faded at higher level.

Activity in the market was mostly dull as offtake in processed pulses was said to be sluggish at higher level from consumption centres.

Key Highlights

Higher Import Duty On 29 US Products, Including Pulses To Be Effective From Sept 18 (Full Report)

India's 2018-19 Kharif Sowing Reaches 854.56 Lakh Hectare, Down 1.83% (Full Report)

RBI Hikes Repo Rate (Full Report)

MP Govt Removes Mandi Tax On Pulses Purchased From Other States (Full Report)

Skymet Lowers Monsoon Forecast To 92% Of Normal (Full Report)

Matar Imports In July Month (Full Report)

Pulse Australia Sharply Cuts 2018-19 Chana Crop Estimate At 3 Lakh Tonnes (Full Report)

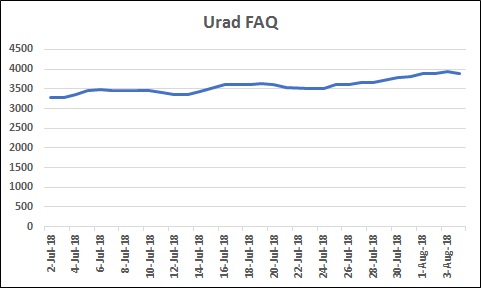

Burma Urad FAQ (MUMBAI) Burma Urad FAQ (MUMBAI)

Burma urad FAQ variety surged nearly 7% to trade at Rs 3,900/100kg during the week at the benchmark Mumbai market supported by strong buying from local and upcountry buyers amid good demand in processed urad from consumption centres.

Demand in processed Urad was reported strong as pipeline has turned mostly dry as loading and unloading of pulses almost stopped amid eight days of truckers' strike. Bikaner origin branded Urad dal at Mumbai market rose nearly 4%, or Rs 250 week-on-week at Rs 5,100-5,450/100Kg. Tiranga brand of Mumbai also surged by Rs 350 at Rs 5,750/100Kg. Parivar brand of Jalgaon moved up by Rs 100 at Rs 5,300/100Kg.

At Chennai, Urad SQ gained by Rs 350 at Rs 4,950/100Kg in ready delivery as per condition amid good millers' buying. While, FAQ variety rose by Rs 325 at Rs 3,925.

Burma urad SQ variety escalated by Rs 100 to Rs 5,250/100kg, while surged by Rs 350 to Rs 3,950 at Kolkata market.

.png) Urad sowing in the country as on August 1 stood down 11.28% to 32.51 lakh hectares versus 36.65 lakh hectares during the same period a year ago. Urad acreage this kharif season is expected to decline as farmers are focusing on other remunerative crops like cotton, jowar, bajra, moong and paddy due to sharp hike in MSP. Urad sowing in the country as on August 1 stood down 11.28% to 32.51 lakh hectares versus 36.65 lakh hectares during the same period a year ago. Urad acreage this kharif season is expected to decline as farmers are focusing on other remunerative crops like cotton, jowar, bajra, moong and paddy due to sharp hike in MSP.

Nafed didn't auctioned urad this week, which was also supposed to be a supportive factor.

According to Burma based-sources, India is likely to import good quantity of urad in the month of August as importers who have received licenses have almost utilised their quota allotted by the government. Indian government has restricted urad annual import at 1.5 lakh tonnes and has asked millers to import the same by August 31.

Urad price in the coming days is expected to trade steady to firm due to good buying from local and upcountry buyers, thin supply and slow kharif sowing progress.

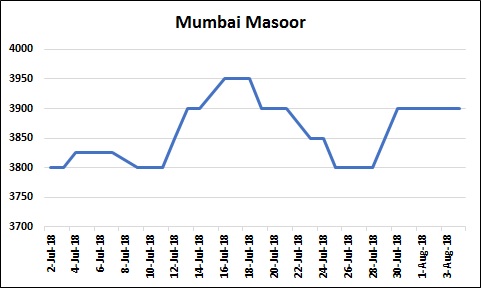

Canada Masoor (MUMBAI) Canada Masoor (MUMBAI)

Canada crimson masoor (vessel) gained 2.63% to Rs 3,900/100kg at the key Mumbai market as supply from overseas remained negligible followed by better domestic demand. Masoor stock is depleting at faster pace as supply was restricted due to higher import duty.

Traders, stockists and importers having masoor are selling gradually as they expect good rise ahead.

Australia nugget masoor was Rs 100 higher at Rs 4,000-4,100/100kg.

On the other hand, masoor of Uttar Pradesh and Madhya Pradesh was almost flat at Rs 4,025/100kg and Rs 4,125, respectively at the Kanpur market.

India has imported just 6,727 metric tonne of masoor during April-May 2018, sharply down 96.82% from 2.11 lakh tonnes during the same period a year ago. The Centre has slapped 30% import duty on masoor in a bid to protect farmers from distress sell.

The country has imported around 7.97 lakh tonnes of masoor during FY 2017-18.

Masoor price in short term may trade range-bound in short term, but long-term outlook is bullish as demand is mostly dependent on local production, which is insufficient to cater demand.

.jpg) Chana Kantewala (INDORE) Chana Kantewala (INDORE)

Chana prices corrected most in pulses complex this week weighed by slow demand from millers amid poor enquiries in chana dal from consumption centres. Buyers are hesitant to make bulk deals at higher level as prices at Indore market during July month soared by over 18%.

Chana Kantewala this week slipped by 4.65% to close at Rs 4,100/100kg at the main Indore market as offtake in chana dal was subdued during the week, which has prompted millers to wait and watch. Huge stock of 28 lakh tonnes of chana lying with Nafed followed by uncertainty about liquidity policy has also kept market sentiments nervous.

Australia chana at Mumbai and Mundra ports (MMTC) was however managed to trade mostly flat at Rs 4,200/100kg and Rs 4,275/100kg, respectively. At Delhi, chana of Rajasthan and Madhya Pradesh ruled steady at Rs 4,450-4,475/100kg and Rs 4,375-4,400, respectively.

However, trade sources believe that Nafed is expected to sell chana stock at MSP. In case Nafed offloads it at MSP then it will provide good support to domestic chana trade, as selling at market price will create panic as we have seen in tur, urad and moong earlier.

Chana is now mostly in strong hands of stockists and Nafed. Stockists are not in a panic as they are eying bigger target amid negligible imports followed by festive season ahead.

The key factor that will support is import curb on matar, which had significantly weighed on chana prices in recent years as large domestic consumption shifted to cheaper matar, but demand is likely to move back to chana again.

India imported around 9.81 lakh tonnes of chana and 28.77 lakh tonnes of matar from various destinations in FY 2017-18.

On futures, the most-active chana August contract dropped 1.82% to Rs 4,240/100kg on the National Commodity & Derivatives Exchange Ltd (NCDX). The contract during the week hovered between Rs 4,156 to Rs 4,280.

Chana prices may trade steady to weak in the near term, but long-term outlook is strong due to negligible imports, thin supply and festive season demand ahead.

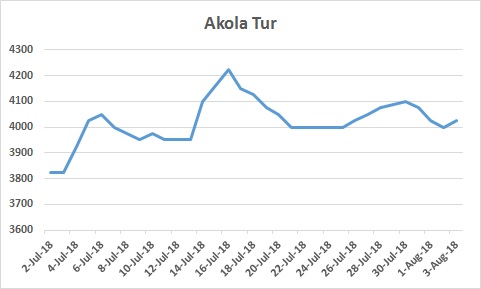

Desi Tur (AKOLA)

Desi tur price bilty fell nearly 2% to 4,000/100kg at the Akola market of Maharashtra mainly due to slow enquiries in processed tur. Demand in tur and tur dal was mostly sluggish throughout the week. Desi Tur (AKOLA)

Desi tur price bilty fell nearly 2% to 4,000/100kg at the Akola market of Maharashtra mainly due to slow enquiries in processed tur. Demand in tur and tur dal was mostly sluggish throughout the week.

At Mumbai, Burma lemon tur traded steady this week at Rs 3,551/100kg, while Mozambique origin red and white tur quoted at Rs 3,100/100Kg and Rs 3,375, respectively. On the other hand, lemon tur dropped by Rs 50 to Rs 3,800 at the Delhi market on lacklustre demand.

Tur price is expected to get good support as prices of vegetables have turned costlier due to truckers' strike, which may lead to higher consumption of tur dal as it is available at affordable rates. However constant selling of tur by Nafed at lower rates will keep upside limited.

.png)

At Mumbai market, Tur dal Phatka of Gujarat and Jalna dropped by Rs 50 Rs 6,050-6,350/100kg and Rs 5,950-6,000. Likewise, Tur dal Phatka of Latur and Khamgaon origin dropped by Rs 100-150 to Rs 5,700/100kg and Rs 5,750, respectively.

Demand in tur dal from consumption centres has slowed down during the last few days and thus millers are hesitating to make any major buying. The current higher prices are unattractive and thus buyers are waiting for some correction, said traders.

Government is still holding decent quantity of tur and selling it below the MSP, making sufficient supply available for millers.

However, market players are eying on weather in tur growing regions as there are concern about crop at many places in Marathwada and Karnataka.

Tur acreage in the country as on August 1 rose a tad at 39.89 lakh hectares as against 39.38 lakh hectares a year ago, according to agri ministry.

Tur price is expected to trade sluggish next week, and it will be difficult to predict long term outlook as new crop sowing is still in progress.

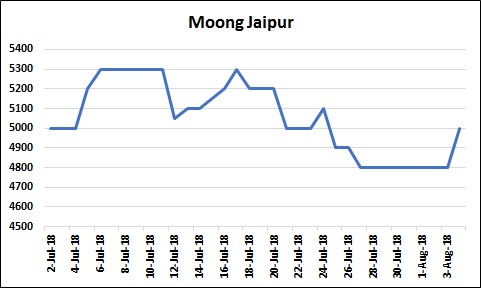

Desi Moong (JAIPUR)

Desi moong remained more or less steady at Rs 5,000/100kg at the benchmark Jaipur market of Rajasthan this week with limited demand, while moong dal also remained unchanged at Rs 6,300-6,400. Desi Moong (JAIPUR)

Desi moong remained more or less steady at Rs 5,000/100kg at the benchmark Jaipur market of Rajasthan this week with limited demand, while moong dal also remained unchanged at Rs 6,300-6,400.

Nafed is continuously selling moong lying at various godowns, procured during Kharif 2017. It has still balance stock of 2.15 lakh tonnes in Telangana, Andhra Pradesh, Maharashtra, Karnataka and Rajasthan.

Moong sowing is making good progress and it has reached at 29.78 lakh hectares as on August 1 versus 29.05 lakh hectares last year.

Moong price is expected to trade stready to firm as import has been resctricted, while domestic demand is entirely dependent on local crop.

.png)

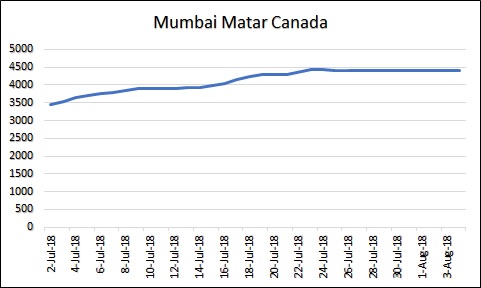

Canada Matar (MUMBA)

Canada white peas (matar) closed this week on steady note at Rs 4,400/100kg at the Mumbai pulses market on limited demand at higher level and weak cues from Chana.

However tight supply amid negligible imports and slow selling by stockists is likely to keep prices firm in future.

Canada White Pea priced quoted firm at Mundra and Hajira ports at Rs 4,251/100kg and Rs 4,351, respectively. Russia origin Baltic variety gained at Rs 4,221 in Mundra. Ukraine White Pea was at Rs 4,251 at Mundra.

Sellers are not interested to liquidate the good quality pulse amid depleting stock of imported white pea, increase in consumption as compared to chana and slow supply pressure from overseas.

Meanwhile, demand in Matar dal/besan remained limited this week, but overall outlook is positive as import is negligible and current stock/supply position is insufficient to meet domestic consumption.

India domestic matar consumption is estimated over 35 lakh tonnes which is mostly met through imports, while supply has been restricted due to higher import duty followed by quantitative restrictions put by the government.

India's matar consumption is huge against present supply and thus prices are expected to remain strong ahead.

(By Commoditiescontrol Bureau; +91-22-40015533)

|