MUMBAI (Commodities Control)

SOYBEAN

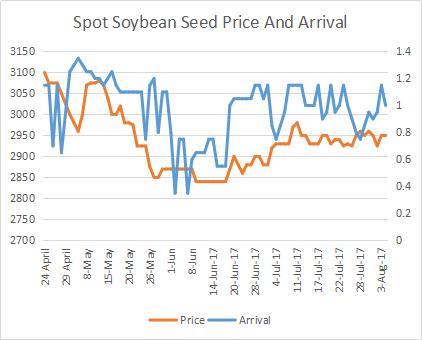

Soybean prices in the spot markets during the week ending 5th August traded steady and closed flat at Rs 2,950/100kg compared to week ago.

With the start of the week soybean prices slowly started moving up on buying interest by crushers, however Tuesday's selloff on CBOT in soybean futures closing down by nearly 3.40 percent changed the Indian market sentiment.

Soybean buying in the Indian markets have been slow, due to the lower offtake of Meal in the domestic & International markets, keeping crushers on the sidelines from big purchases. Total arrivals during the week, were reported at 0.95 to 1.15 lakh bags against 0.75 to 1.15 a week ago.

Soybean crop has entered the flowering stage in the key soybean growing areas of Madhya Pradesh and Maharashtra. Reports from the fields suggest that soybean crop condition in Madhya Pradesh is average and soil moisture is also good.

However, in Maharashtra in Parbhani, Akola, and Amravati districts the rainfall from June to till date is deficit by around 20% - 31% leading to less moisture in the soil. Rains are needed in 2-3 days for proper growth of the soybean crop and weather forecasts suggest no substantial rain in these areas in next week which may increase the stress.

Farmers forsee that if rains do not occur in next 2-3 days then around 25% of the crop will damage, mainly in late sown soybean crop as they are very weak. Also, soy bean crop acreage in 2017-18 has declined compared to 2016-17 season due to shift in farmer’s interest amid sharp slump in prices. The drop in acreage was sharp in Madhya Pradesh, Rajasthan, Maharashtra and Telengana as poor realization prompted farmers to shift to other better alternative.

Soybean planting reached 98.967 lakh ha as of August 3 compared to same period last year at 110.446 lakh ha according to Ministry of Agriculture. Soybean planting has declined by 10.39 percent over last year.

In futures market, Soybean most active August contract during the week was up by 4.52 percent at Rs 2,946/100kg on the National Commodity & Derivatives Exchange Ltd (NCDEX).

CBOT Soybean Futures

Chicago soybean futures inched lower on Friday with the market poised for its biggest weekly fall in a year, weighed down by crop-friendly weather across key U.S. producing states. The Chicago Board of Trade most-active soybean November contract has dropped 5.2 percent so far this week, the largest decline since July 2016. On 3rd August, it hit the lowest since June 30 at $9.55-1/2 a bushel.

Soybean prices have been pressured by forecasts of showers in Iowa and Minnesota, the No.2 and No.3 soy-producing states in the United States. Soybeans this month are setting pods, the key stage for determining yields.

The full impact of a hot and dry summer in the U.S. Midwest is unlikely to show up in the government's next estimate of the U.S. corn crop as it typically makes just small adjustments to its harvest outlook during August.

The USDA will update its yield projection in its monthly supply and demand report on Aug. 10. The forecast will be closely watched as it will be the first harvest outlook for the 2017/18 marketing year that includes data from field surveys.

SOYMEAL

Soymeal at the benchmark Indore markets declined by Rs 500 to trade at Rs 24,600 per tonne during the week tracking sharp fall in CBOT soymeal futures during the week.

Demand for soy meal from poultry farmers is gradually increasing as they have increased the placement of chicks but the international demand for Indian soymeal is weak which is weighing on soymeal prices.

Most active CBOT soymeal December futures have declined by 3.84 percent to trade at $309.60.

Indian Soymeal is priced at $412 per tonne FAS Kandla Vs $353 Argentina CIF Rotterdam (August) as of August 5, 2017. The difference between the two origin is $59 per tonne increased by $18 compared to a week ago.

Indian soymeal is trading at a premium of $59 compared to Argentine soymeal keeping the buyers on the sideline. Indian soymeal premium has also increased due to appreciation of rupee by 0.70 percent to close at 63.66 during the week which makes the commodity expensive for overseas buyer.

SOYOIL

A bearish trend followed in refined soy oil too, in benchmark Indore market of Madhya Pradesh on account of poor demand coupled with weak cues of CBOT soy oil futures and declined by Rs 10 to trade at Rs 634/10kg during the week. CBOT Soyoil December futures declined by 3.66 percent to trade at 33.99 cents per pound during the week.

The weakness in CBOT soyoil futures and Palm oil markets drove the bearish trend in the Indian markets, keeping the buyers away from any bulk trades.

Further, the appreciation of rupee will also impact the prices of imported soyoil in the near term. Soy oil prices were lower by USD 10 to trade at 804 per tonne in dollar terms (CNF) at Kandla port and gained by Rs 7 to trade at Rs 583/10kg due to rupee impact.

In futures market, soy oil most active August contract on the National Commodity & Derivatives Exchange Ltd (NCDEX) ends down by 2.14 percent at Rs 638.40/10kg.

NEXT WEEK:

Soybean is likely to trade range bound next week amid limited demand from crushers, however restricted farmer selling and deteriorating crop prospects will support to prices at lower level.

(By Commoditiescontrol Bureau; +91-22-40015516)