MUMBAI (commodities control) - Domestic RBD Palmolein was mostly steady to up during the week ended Saturday 17th June, largely tracking positive Malaysian Palm Oil futures.

Malaysian palm oil futures closed up 0.89 percent this week at MYR 2,482/tonne on account of depreciating of ringgit.

Southern Peninsular Palm Oil Millers Association (SPPOMA) reported significant rise in production for June 1-15 with a rise of 12.53% versus same time last month. Improvement in the latest SPPOMA data should give a lift to peninsular Malaysia production.

Estimates released Wednesday by cargo surveyors Intertek Agri Services and SGS (Malaysia) for the month of June 1-15 showed palm oil exports dropped more than 17% that pampered the market sentiment.

On domestic front their is sufficient stock with the traders to meet the near term demand, moreover they have been on the sidelines from making any bulk purchases as GST will be rolled out in July and they don’t want to carry heavy stocks ahead of it.

RBD Palmolein prices at Kandla port gained by Rs 5 to trade at Rs 545/10kg during the week, and also prices have risen by USD 2 to trade at USD 707 per tonne.

The Port stock of RBD Palmolein+CPO has increased to 2,37,909 as of 12 June vs 2,06,633 as of 6 June.

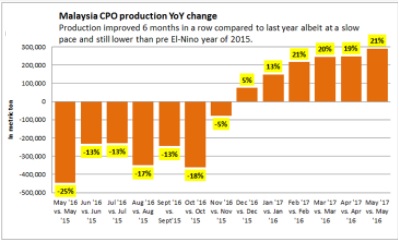

Malaysian CPO production rose 6.88% to 1.65 million tons in May from previous month and 21% above same time last year– MPOB May data showed. Improvement in yield helped production recover this year rising at a steady pace of 20-21% for the last four months. Meanwhile monthly exports jumped 17.33% to 1.51 million tons and 2.50% above market estimate, adding 17.43% more to same time last year.

On the local bourses, the most-active June RBD Palmolein contract declined 0.74 percent to close at Rs 533.90/10kg on the National Commodity & Derivatives Exchange Ltd. The contract during the week traded in the range of 533.20-536.20

NEXT WEEK: RBD Palmolein prices trade in a bear trend on account of improving production in Malaysia and Indonesia.

(By Commodities control Bureau; +91-22-40015516)