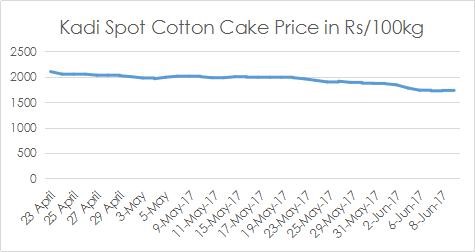

MUMBAI (Commoditiescontrol) – Cotton oil cake in the Spot market exhibited a bearish tone in the week ended June 10, amid sales of old stock by the stockiest which they were holding since March 2016 in their inventory. Prices declined by Rs 100 at Rs 1740/100kg in Kadi market of Gujarat.

Early during the week, prices dropped due to stockiest selling and absence of demand from feed manufactures, however end of the week support came from the cattle feed buyers lifting the prices by Rs 30 to trade at Rs 1710/100kgs.

Cotton oil cake price in spot markets have declined by nearly 26.70 percent in last four months which could attract some buyers at the current prices.

Stockiest are still holding huge quantity of stock and it is likely they will liquidate the stock in coming days.

Cotton oil cake futures followed the trend of physical market. Cottonseed oil cake July futures prices during the week on NCDEX has declined by 3.5 percent to close at Rs 1,705/100kg and however contract made a fresh four-month low of Rs 1,652/100kg on June 7.

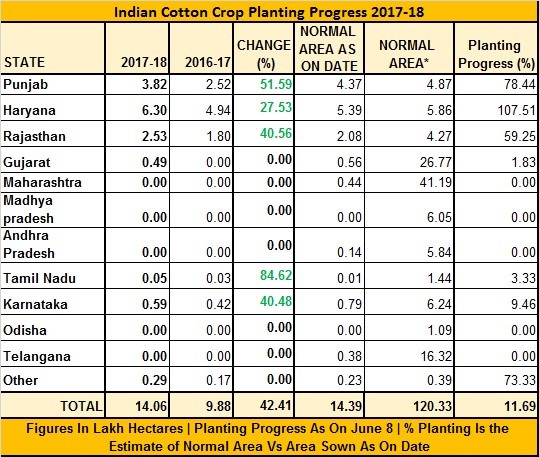

Meanwhile, the major factor which is weighing on the market sentiment is the on-going sowing progress of Cotton which has increased by 27.53% over last year in Haryana, 51.59% in Punjab and 40.56% in Rajasthan.

Expectation of higher production amid rise in sowing acreage in 2017-18 has limited any gains in cotton oil cake price in past few sessions. If cotton production increases then the availability of raw material i.e. cotton seed is likely to increase which will weigh on cotton oil cake prices.

The other factor which the stockiest and traders are closely watching is the progress of monsoon. If the monsoon progresses as expected then it will increase the availability of green grass during rainy season which will further reduce the demand of cotton oil cake from cattle feed manufacturer due to which cotton oil cake prices will remain under pressure.

There has been a drop in the consumption pattern for cotton oil cake by 30% since October 2016 as consumers shifted to other substitutes such as Tur churi, Bajara churi, Guar churi and Chana churi which were priced way lower in the range of Rs 1200 -Rs 1500 / 100Kgs and are still available at the same price.

For the coming week, Cotton oil cake will trade with a bearish bias amid good new crop cotton sowing, ample inventory with the stockiest and lower demand from the cattle feed industry.

(By Commodities control Bureau; +91-22- 40015516)