Jaipur (Commoditiescontrol) - Indian commodity markets have experienced choppy in recent past, particularly after the news of economic slowdown in China. Domestic markets are fearing adverse impact on the exports of cotton, guar gum, red chilli, cumin seed and oil cakes. Castor seed was unaffected by this onslaught. Industry experts associated with oil industry anticipate little impact of slump in China to have over castor market. Most of the exporters of castor DOC and oil say, “We export castor oil in very small quantity to China and manufactures produce special oil and sell in the International market. China is not a major consumer.”

As per the Solvent Extractors Association of India (SEA), exports of castor seed during January to June 2015 was 2.69 lakh tonnes as compared to the corresponding period a year ago level of 2.35 lakh tonnes. Exports of castor seed in the last calendar year were 4.30 lakh tonnes. However, sources in custom department say, castor oil exports in early six months of this year were 2.97 lakh tonnes against 2.44 lakh tonnes year ago and total overseas sale in the last calendar year was 4.70 lakh tonnes. Directorate General of Foreign Trade (DGFT) a body under the department of Foreign Trade’s data show 505,738 tonnes of castor oil during the financial year of 2015 (April 2014-March2015), as against 504,765 tonnes during the financial year-2013-14 and 527,050 tonnes in 2012-13 and 452,460 tonnes in the accounting year-2011-12. The data suggests of constant rise in castor oil exports. The data from different sources are varying.

Dr B V Mehta, Executive Director, SEA clarifies that the association collects data from the surveyors and this is why figures vary. “ We want to make the data available for our members at the earliest while government agencies take three months to release the current situation of imports and exports,” said Mehta. Several times the data include other derivatives besides, castor which make differences, he added. According to Dr Mehta, “ China buys castor oil in large volume form India and sell its products in the global market, obviously, economic slowdown will bring some effects over our trade.”

Castor seed stocks in the NCDEX warehouses were 3,96,425 tonnes on May 1, 2015 which reduced to 1,14,192 tonnes on July 9, 2015. In fact, a major company of Madhya Pradesh which piled up castor seed in the NCDEX warehouses is getting the rid off it by selling at loss. This company is expected to cost Rs 5,000 for a quintal of castor seed inclusive of all expenditure like buying prices, interest and other expenditures while currently, castor seed trades at Rs 3,000-4,000.

“Castor seed sowing is continuing and data of sowing appear not much from Banaskantha, Sabarkantha, Mehsana, Patan, Kutch and Surendranagar of Gujarat and Sirohi, Jalore, Jodhpur and Barmer of Rajasthan where 90 per cent of the crop is produced,” said Manoj Agarwal, a trader from Palanpur, Gujarat. However, the data shows a significant rise in acreage of all crops including castor seed, groundnuts, cotton as most parts of the country receive rainfall in June usually it has been in practice ahead of July 5. But situation of rain seems distressful now. Castor seed already sown in non-irrigated areas of Telangana and Andhra Pradesh will be a complete waste if these areas do not receive rain within the next five to seven days. Rainfall during the month of August has a great importance for castor seed crop as its sowing gathers momentum in Gujarat and Rajasthan. Castor seed acreage in both states has not covered even 10,000 hectares as of now but it will sharply go up if rain is received in August and the following month which will be proved as boon for the crop. Hence, everything depends on rain shower.

Manoj expects prices of castor seed to be in range bound till August 15 as till then monsoon will be cleared. “Afterwards, price-trend will be decided on the rainfall received and the data of the acreage as well,” he added. “I don’t understand slump in China will impact castor oil exports significantly,” said Bharat Patel, Proprietor, Kissan Agro Products, Palanpur. He doesn’t expect much rise in castor seed acreage this year. He explained, “Castor seed growers didn’t get good return last year which discourage them from castor seed farming, however, acreage may increase in Gujarat if the month of August this year witness rain. But sowing in other states mainly goes on till July 30 and no encouraging news regarding castor seed sowing is received.” As far as the availability of castor seed and its products after converting them are concerned, he said, “Presently it will be around 9-10 lakh tonnes and expected to remain nearly 3-4 lakh tonnes as carryover stocks after new crop of the next season appears.” Patel doesn’t expect much fluctuation in prices. He said, “castor seed prices didn’t fall below Rs 4,000 per quintal last year and it appears to remain in range bound this year. However, further movement in prices will depend on rainfall next month and figures of sowing area.

“We export very low quantity of castor seed products, hence, there will not be any adverse effect of slowdown in China over domestic castor derivatives industry,” said B V Babaldas Patel, Chief, Patel and Company. Monthly sale of castor oil in overseas market is around 40,000-50,000 tonnes and there will be hardly any effect if it reduces to 35,000 tonnes, he added. Shoppers don’t have any stocks of castor seed while farmers are still reluctant to sell the stocks they hold at Rs 3,500 per quintal, he further added. Hence, there is no slacking in castor fundamentally. However, it will be something else if prices slack technically at the commodity exchange NCDEX. According to Patel, “Present stocks of castor seed which are around 10 lakh tonnes will fall to 2.5-3 lakh tonnes till the new crops appears.” He also expect rise in sowing of groundnuts, guar and millet (Bajra) in Gujarat. Cotton acreage will remain as usual and there appears less possibility of rise in castor seed acreage, Patel added. He suggests not to rely on the exports figures of the custom department and the association doesn’t have labs everywhere, that is the reason it doesn’t get information regarding exports from other route.

Ashok Singhvi from Kandla Agro Chemicals Private Ltd said, “There Has been a weak demand in castor products for last one year and there is hardly any problem in its supply or availability but buyers are diminishing.” He doesn’t find any clear signal for the futures of castor seed and its products but expects prices to be range bound in days to come.

However, Manoj Agarwal has other opinion as he says demand for castor products by and large remains every month. In fact, exports fluctuate as volume of exports is big in one month and small in the other. However, the total exports remain around 4.50 lakh tonnes annually. Castor DOC is said to be at $110 a tonne at Kandla port and castor oil at $1,235 a tonne. Manoj Agarwal categorically refuted any impact of Chinese slowdown over the exports of castor products.

It should be noted that the Solvent Extractors Association of India (SEA) had projected the acreage of castor seed was 10.27 lakh hectares 2014-15 while the government data showed 10.99 lakh hectares. The SEA had estimated 12.76 lakh tonnes of castor seed production while government’s estimate was 13.68 lakh tonnes.

TECHNICAL OUTLOOK

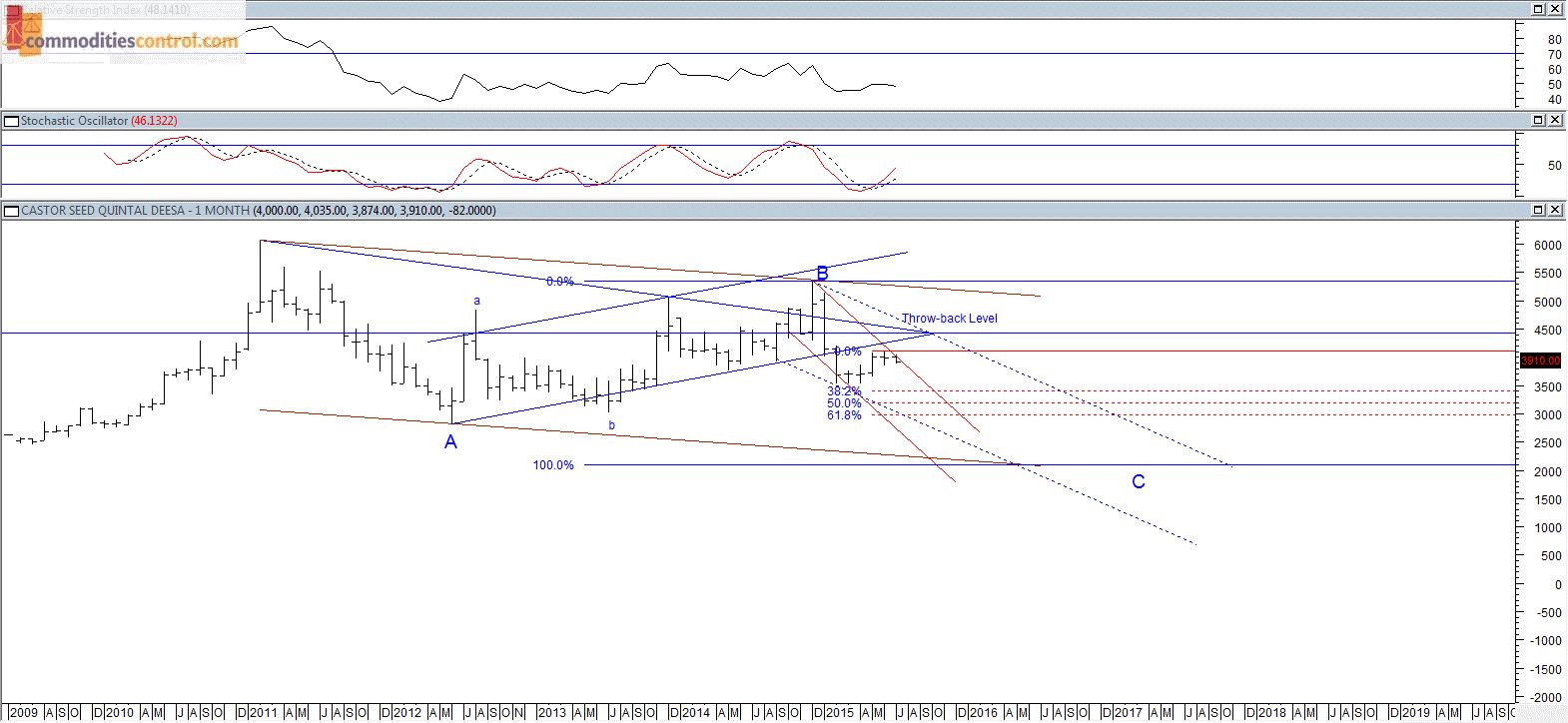

Castor seed Deesa NCDEX 1st Month Continuous Monthly chart View

Last close 3910 Per Quintal

while analyzing the monthly chart of castor seed futures traded on National Commodity and Derivatives Exchange (NCDEX), it is observed that the prices are in wave C of A-B-C corrective pattern. The slide in price has begun after scaling a top of 6,058.

The A and B Legs are mostly completed and the third wave – the C is currently in progress.

The correction can go to 61.8% to 100% projection which is a price fall to Rs 2,980 – 2,100 levels as shown in the chart with red dotted lines.

However, the momentum indicators such as Relative Strength Index (RSI), and Stochastic are pointing towards some upside before the commencement of decline.

The possible sideways to upside movement is on breakout and close above Rs 4,100 and if the level is sustained then one can expect the rise towards the “Throw-back” point of earlier breakdown which is marked with a triangular Blue lines in the attached chart. The Levels would be Rs 4,330-4,420.

In case the prices fail to break the resistance of Rs 4,100, then the prices may retrace towards the projected levels.

Conclusion: Castor seed prices are likely to fall to Rs 2,980-2,100 levels in a longer term perspective though a near-term positive momentum towards Rs 4,330-4,400 cannot be ruled out if a breakout and close above Rs. 4,100 happens.

(By Commoditiescontrol Bureau; +91-22-40015533)