MUMBAI (Commoditiescontrol) - Raw and white sugar futures ended lower on Intercontinental Exchange on Friday, while sweetener futures also settled the week down 2% and 0.5% respectively.

On Friday ICE March raw sugar ended down 0.24 cents, or 1.76%, at 13.38 cents per pound, while most active May raw sugar contract also settled down 0.23 cents, or 1.70%, at 13.28 cents per lb.

ICE raw sugar futures were traded down in last session, amid a rolling-forward of positions by funds from the front month contract to a further-out month. Which put downward pressure on sugar futures prices.

The premium of March contract over May rose upto 0.15 cents in last session.

On other hand, during current week raw sugar futures also seen a hike on Monday and Thursday, on expected immediate tight supplies. Despite the surplus sugar production for current season. But the excess sugar supplies is estimated to be in white form, while raw sugar supplies will lower against it. As the world's biggest raw sugar producer, Brazil is expected to have lower sugar output in upcoming season 2018-10 (April to March).

According to Biosev SA, Sao Paulo-based the world's second-largest sugar producer (owned by the Louis Dreyfus Commodities Group), sugar output in the country is forecasted to drop in upcoming season which starting from April 2018 and run until March 2019.

During 2018-19, Centre-South sugar mills are expected produce 35-36 million tonnes of sugar, down 4-5 million tonnes against current season. C-S mills have so far produced 35.831 million tonnes of sugar since April 2018 upto January 2018 in current season 2017-18.

C-S region contributes 90% sugar production in Brazil.

Sugar production in Brazil is estimated drop as Brazilian sugar mills and refineries have moved toward ethanol production due to better returns and higher demand. However, mills will divert more amount of sugarcane for alcohol production instead of sweetener in next season 2018-18, which may support sugar futures in current season.

According to UNICA, the Brazilian Sugarcane Industry Association, in upcoming sugar season about 41.7%of sugarcane will be used to produce sugar in Brazil, while reaming 58.3% raw material will get crushed for ethanol production.

On other hand, white sugar futures also finished weak on Friday, also closed the week down 0.5% on concerns over a global surplus estimates.

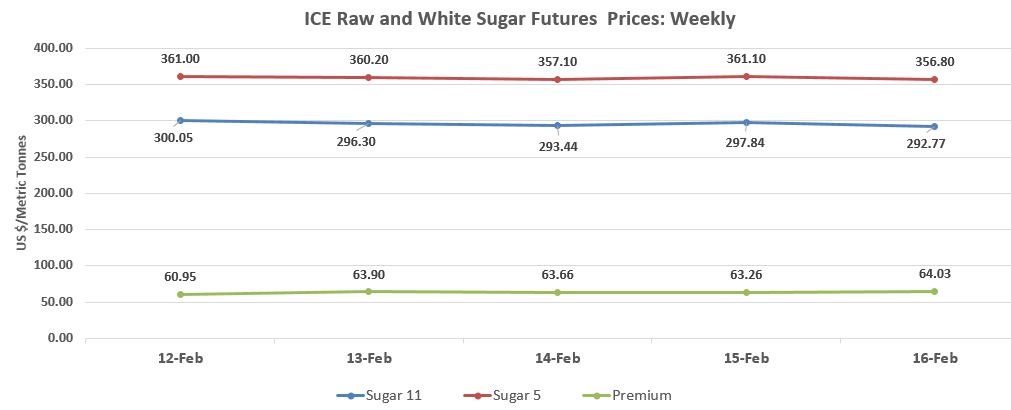

London May white sugar closed off $4.30, or 1.19%, at $356.80 per tonne on ICE Europe Exchange.

The global sugar industry is expected to have surplus sugar production of 115 lakh tonnes in current sugar season 2017-18 (October-September),according to Green Pool, an Australian commodity specialist.

While firm also forecasts the excess production in next season 2018-18 to 55 lakh tonnes.

However, white sugar futures remained under pressure over expected oversupply in current season during October 2017 to September 2018.

World sugar output has boosted by an increase in production in the European Union, India, Pakistan, Mexico, Thailand etc.

As per the European Commission, the European Union is expected to produce 201 lakh tonnes of sugar in 2017-18 (Oct-Sept), against sugar production of 176.24 lakh tonnes during last season.

India, a biggest sugar consumer estimated to produce 263 lakh tonnes of sugar in ongoing season, Green Pool.

Additionally, Pakistan sugar production is expected to hit 80 lakh tonnes in 2017-18, as per Pakistan Sugar Mills Association (PSMA).

Mexico projected to have 60.54 lakh tonnes sugar output in current season, as per the National Sugar Council (CONADESUCA).

While sugar production of Thailand is forecasted to be 110 to 120 lakh tonnes, Cane and Sugar Board Thailand.

Meanwhile, there will be ample white sugar supplies in the world market, over raw sugar. Although the white premium is also expected to remain lower in 2017-18, due to higher availability of exportable white sugar in global market.

The white premium is the difference between refined and raw sugar futures.

The spot white premium traded at the average rate of $63 per tonne during the week, while earlier on Monday it hit the weakest level since September 2017.

Moreover, with lesser white premium, sugar refineries can not match the cost of refining and processing costs.

(By Commoditiescontrol Bureau: +91-22-40015532)