MUMBAI(Commoditiescontrol) - Arrivals of cotton in India have widened the suspense looming over the production estimates which were already revised downwards post pink boll worm attack. There is a huge confusion over the final estimate - what could be the possible production figure this season?

There is a large discrepancy between various agencies, including the government estimates for the season. Some still were estimating production in the range of 360-380 lakh bales but seems next to impossible judging by the gradually declining arrival pace.

Arrivals Slowing Down:

Average daily arrivals this season has failed to cross 1.8 lakh bales till date and the current arrival pace has fallen to 1 lakh bales on average recorded in the past 15 days of February. Various ginners have cut down their three-shift workforce to one or either two shift workforce and this is a clear indication of sluggishness in arrivals since past one month.

The Indian cotton arrival pace lagged as of end of January and data collated during the first week of February has shown no major improvement. This has raised doubts, whether India cotton production could really touch 350 lakh bales in the current season and a downward revision is due? (Full Report)

.png)

As per the balance sheet drawn on January 31, The unsold stock scenario showed a comfortable position with domestic spinning mills having an average of 50 lakh bales as of January 31, enough to satisfy the consumption requirement for the next two months. While, the remaining bales were with ginners and MNCs.

Sluggish arrivals raised concerns of production potential failing to cross 350 lakh bales, and further created confusion that despite sluggish arrivals and lower production prospects, why is the spot price falling. Further, due to various traders find it hard to believe production prospects between 360-380 lakh bales.

One of the reason behind declining spot prices could be due to lackluster demand from spinning mills as farmers were offloading more of inferior quality cotton and restricted offloading premium variety cotton in order to achieve higher price. The prevalent raw cotton rates ranged between Rs 4,300-5,200/quintal.

Many experts believe that soon the inferior variety cotton would deplete tentatively by mid-February, and the remaining stock of premium variety cotton would majorly arrive in the market going forward. Further, arrivals can average at 1 lakh bales on daily basis between Feb-April.

What could be the production potential this season?

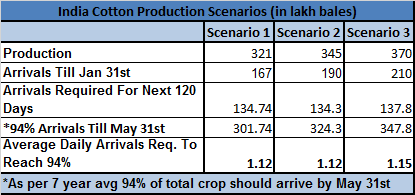

We drew out three scenarios and based our analysis that around 94% of the total crop should arrive by May 31st. So, based on various production estimates, which scenario seems more credible and has higher possibility of success.

Coming back to the arrival progress, as per 7 year average, 94% of the total crop should arrive by May 31st. Hence, scenario 1 & 2 seems more credible judging by the current arrival pace where daily average arrivals clocks at an average of 1.1 lakh bales, recorded in the past 15 days.

Note: All information contained in this report should be treated as estimates and has been obtained in good faith from sources deemed to be reliable in commodities control LLP’s discretion but does not warrant or represent the accuracy and accepts no liability whatsoever for any reliance on or commercial decisions taken on use of this report by the client company or any third party. There could a variation of 5% from the above mentioned figures.

(By Commoditiescontrol Bureau; +91-22-40015534)