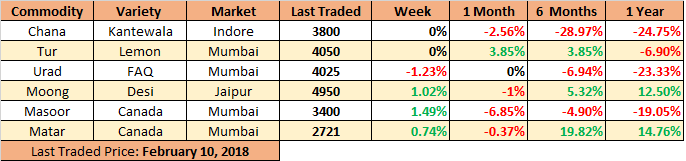

MUMBAI (Commoditiescontrol) - Moong, Masoor and Matar edged higher during the week ended Saturday (Feb 2-9) due to increased demand at the lower level amid restricted supply from overseas, while Urad fell 1.23% followed by steady tone witnessed in Chana and Tur.

Week Highlights

# India Pulses area as on February 7 increased by 5.29% at 169.10 lakh hectares versus 160.60 lakh hectares same period a year ago.

# Chana sowing reached at 107.63 lakh hectares compared with 99.53 lakh hectares last year. (Full Report)

# Masoor sowing in the country stood at 17.35 lakh hectares, up from 17.30 lakh hectares previous year. (Full Report)

# Matar has been sown in 11.92 lakh hectares, down from 11.97 lakh hectares in 2016-17. (Full Report)

# Urad acreage declined to 9.44 lakh hectares against 9.93 lakh hectares a year ago. (Full Report)

# Moong area was reported up at 8.31 lakh hectares from 7.34 lakh hectares previous year. (Full Report)

# India Apr-Nov Pulses import up 19.66% Y/Y at 47.45 lakh tonnes. (Full Report)

# Australia December Chana export declines on weak demand. (Full Report)

# India govt raises import duty on Chana. (Full Report)

# India's Apr-Dec pulses import at 50.8 lakh tonnes vs 66.08 lakh tonnes in FY17. (Full Report)

# Pulses imports decline by 66.06% (M/M) At Chennai Port. (Full Report)

# Centre approves West Bengal proposal for procurement of 10,000 mt Urad. (Full Report)

.png) Burma Lemon Tur:

Burma Lemon Tur:

Burma lemon tur at the benchmark Mumbai market closed mostly flat at Rs 4,050 amid limited inquiry from upcountry buyers. Buyers are hesitant to procure Tur in bulk quantity as supply of the commodity is expected to increase after procurement halts in Karnataka as target for the procurement achieved.

Farmers in the state are still holding a major share of crop and in case government didn’t extend it further farmers are likely to liquidate their stocks at below MSP.

Demand in Tur dal is not encouraging due to abundant availability of vegetables at the reasonable rates.

New tur of Uttar Pradesh origin remained weak for second straight day by Rs 50 at Rs 3,900/100Kg on sluggish trade for Kanpur delivery condition with 13% kachri quality, 11.5% moisture, 2.5% vatau and 1% bardana discount.

Madhya Pradesh origin new tur (Jabalpur, Damoh, Morena) eases at Rs 3,950/100Kg for Kanpur delivery condition with 13% kachri quality, 11.5% moisture, 2.5% vatau and 1% bardana discount.

In Kanpur, Maharashtra origin (Hinghanghat/Nagpur), tur dal new Phatka Sortex quality quoted lower by Rs 50 at Rs 6,000, new semi-Sortex at Rs 5,800, new regular variety at Rs 5,700 respectively. Trade activity were reported negligible from wholesalers/retailer’s counter and sellers were active in the market.

Gujarat origin Wasat Phatka variety new offered unchanged at Rs 6,500-6,700/100Kg and old at Rs 6,100-6,300.

Similarly, Latur origin new Phatka variety also ruled steady at Rs 6,400-6,500/100kg and old at Rs 6,200. Jalna origin new Phatka variety priced flat at Rs 6,400-6,600/100Kg.

According to market sources, prices of tur likely to trade sluggish in the near term due to lackluster inquiry in processed Tur from consumption centers. Further prices are also likely to weigh by expectations of increase in supply in markets after halt of Tur procurement in Karnataka. But downside is limited amid lower production estimate.

.png) Burma Urad:

Burma Urad:

In Mumbai, Burma urad moved down 1.23% at Rs 4,025/100Kg amid sluggish buying support from millers at lower rates despite of slow demand.

Moreover, demand for processed urad from consumption centers also reported good. Bikaner origin branded Urad dal price offered firm at Rs 5,000-5,200/100Kg. Tiranga brand of Mumbai at Rs 5,750/100Kg. Parivar brand of Jalgaon at Rs 5,400/100Kg.

Likewise, Urad FAQ and SQ varieties remained stable at Chennai, Tamil Nadu on Saturday but no deal finalised, and sellers remained active at the market place.

Burma origin Urad FAQ and SQ varieties offered flat at Rs.4,400/100Kgs and Rs.4,900/100Kgs.

Buyers were hesitant to source the commodity as they are aware of sufficient supply of Urad from producing belts and slackened demand from retailers and wholesalers for Urad dal.

.png) Chana Kantewala (Indore):

Chana Kantewala (Indore):

Chana prices ruled steady at Rs 3,800/100kg this week at the key Indore market due to restricted buying from millers.

Millers have opted to procure the commodity only as per immediate requirement due to expectations of some correction in prices ahead of new crop supply. New rabi crop supply arrivals have made their way in many markets of Maharashtra and Madhya Pradesh and likely to start in full swing by March.

Australia origin Chana at both Mumbai and Mundra ports both weakened by Rs.25 each to Rs.3,875/100Kgs and Rs.3,850/100Kgs, respectively due to slow buying from millers as sales counter in chana dal reported at lower rates from wholesalers/retailers counters.

At National Commodity and Derivatives Exchange (NCDEX), chana for March contract settled this week tad up by 0.4 per cent at Rs.3,857/100Kgs.

Australia origin chana in forward business was priced around $650 per ton on CNF basis for March shipment.

Australian chana dal priced unchanged at Rs 4,800/100 Kg on negligible trade from wholesalers/retailer’s counter. Domestic chana dal of Maharashtra also remained flat at Rs 4,900 and regular chana dal at Rs 4,800/100Kg. Chana besan also offered steady at Rs 2,890/50Kg. Vatana besan quoted stable at Rs 1,790/50 Kg. Vatana dal also trades steady at Rs 3,150.

New kabuli chana 85-90 count of Rayalseema in Andhra Pradesh traded unchanged at Rs 5,100 in loose and Rs 5,200/100kg spot loading on slow local buying. Commodity offered at Rs 5,800/100kg for Delhi. But, no trade reported due to disparity. Local buyers were purchasing and storing commodity in cold storages. New Coc-2 variety kabuli traded flat at Rs 5,300/100Kg with arrivals of 25 bags.

Kabuli Chana new of selected counts, such as 58-60 60-62 62-64 64-66 and 66-68 remained weak amid dull demand from purchasers despite lower supply of the commodity. While, 42-44 and 44-46 counts ruled flat. Supply totaled at 18,000 bags (1Bag=100Kgs) today at Madhya Pradesh out of which 6,000 bags arrived at Indore spot market compared to 7,000 bags in the previous trade session.

At Indore market, Kabuli Chana Dollar variety traded unchanged in the range of Rs. 6,500-7,500/100Kgs despite higher supply of 9,000 bags (1bag=100Kgs) compared to 7,500 bags yesterday.

.png) Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada crimson variety edged higher by 1.49% at Rs 3,400/100kg during the week at the Mumbai market supported by good buying from upcountry buyers due to negligible supply from overseas after hike in import duty.

Canada Masoor dal of Bhiwandi mills were offered lower at Rs 4,300/100Kgs, for APMC Vashi market delivery on dull trade activity.

Arrivals of new domestic masoor expected to begin from mid February in Madhya Pradesh. But, farmers will liquidate their stock in ‘Bhavantar Bhugtan Yojana’ from March 01, 2018.

Masoor prices is expected to trade steady with negative bias in the near term as new crop is expected to increase, but sharp downfall in prices will be capped due to negligible supply from major producing countries.

.png) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Matar imported from Canada rose by 0.74% at Rs 2,721/100kg at the benchmark Mumbai market due to good domestic demand helped by negligible arrivals of shipment from Canada and other major producing countries.

India consumption is majorly depends on imports, but it has come to standstill after India government slapped 50% import duty in a bid to support falling prices in the domestic market.

Matar consumption this year is expected to drop due to shift in demand to Chana, which is available at attractive rates.

Matar outlook in the near term is slightly range-bound, but long term prospects is good due to lack of overseas supply.

.png) Moong (Jaipur):

Moong (Jaipur):

Moong priced 1.02% higher in Jaipur market at Rs 4,950/100Kg during the this week on fresh millers inquiry despite sufficient availability of stock. Meanwhile stockiests are active to liquidate their old stock of moong to make room to purchase new tur/chana.

Other hand, Moong dal was priced unchanged at Rs 6,000/100Kg.

New moong of Ganjam and Puri district of Odisha likely to began after Holi festive.

(By Commoditiescontrol Bureau; +91-22-40015533)