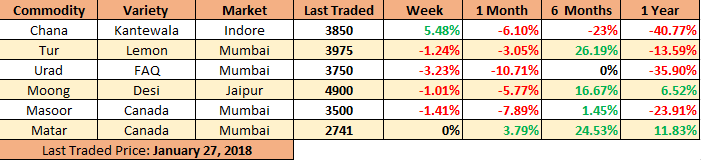

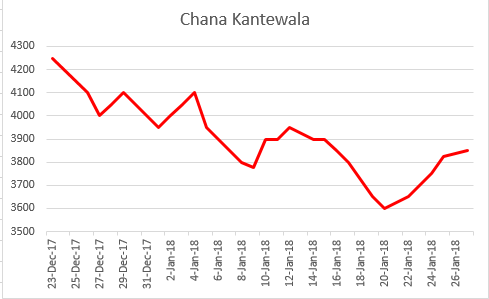

MUMBAI (Commoditiescontrol) – Tur, Urad, Masoor and Moong remained lower for week ending on Saturday (January 22-27) amid dull millers trade as demand in processed pulses was sluggish due to shifting of consumption demand in vegetables during winter season. On other hand, chana prices traded firm on lower level buying support. While, White pea and Kabuli chickpea remained flat.

India's Rabi pulses sowing for these week is not available as yesterday was holiday on occasion of “Indian Republic day”.

Week Highlights

# As per CGC: Export of Matar from Canada at 65,200 MT in December Compared to 36,800 MT in November. Total Export stood at 952,800 MT against 2.02 Million MT Last Year.

# Centre Approves Tur Procurement Of 446,800 MT In Maharashtra In 90 Days. It Will Start Once Agreement With Procurement Agencies Completed. Last Yearr Maharashtra Government Procured 5.75LT.

# India Government Agreed To Provide Prior Notice To Australia About Future Increase In Import Tariffs On Pulses (If Any) To Improve Reliability Of Trade.

Burma Lemon Tur:

Tur Lemon variety of Burma origin declined by Rs 25 at Rs 3,975/100Kg at Mumbai amid slow trade activity by millers/traders, regular domestic arrivals and fresh supply around 253 containers from overseas. (1container = 24 MT).

NAFED Procures (Kharif 2017-18) 84194.161 MT Tur As On 25 January At MSP Prices Of Rs 5450.Karnataka:50689.789, Telangana:33504.37. Note: Procurement target is completed in Telangana on 18 January 18.

MMTC E-Tender for Sale At CWC Vashi, Mumbai: All In (MT) (+/- 5%) (2016). Africa Tur Whole: 5000. Tender Open/Close on 29 January.

MMTC Ltd Invites Bids for Sale at CWC Mundra (In MT). Africa Tur FAQ: 5385.80 (2016-17). Tender Open/Close 29 January.

In Kanpur, Maharashtra origin (Hinghanghat/Nagpur), tur dal old and new Phatka Sortex quality eased at Rs 5,850-5,900/100 Kg and Rs 6,050-6,100, old and new semi-Sortex at Rs 5,750-5,800 and Rs 5,950, old and new regular variety at Rs 5,600 and 5,750 respectively. Trade activity were reported negligible from wholesalers/retailers counter and sellers were active in the market.

Gujarat origin Wasat Phatka variety new traded flat at Rs 6,400-6,600/100Kg and old at Rs 6,000-6,200.

Similarly, Latur origin new Phatka variety also ruled steady at Rs 6,300-6,400/100kg and old at Rs 6,100. Jalna origin new phatka variety priced steady at Rs 6,300-6,500/100Kg.

According to market sources, prices of raw tur is not sustaining at higher rates as sales counter in processed tur is thin as vegetable prices have declined during winter season, regular new domestic arrivals. The government was already sitting on huge stocks of tur procured at MSP last year. That will have to be offloaded to clear space for the fresh purchases. If government does that, it would bring down the rates for short term period. But, prices likely to get support at lower rates due to lower yield, empty pipeline with private traders/millers and also arrivals had not increased as per expectations.

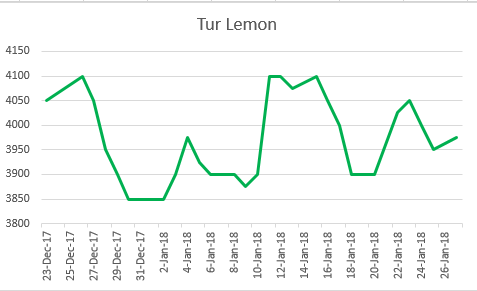

Burma Urad:

In Mumbai, Old and new crop of Burma Urad FAQ variety extended losses by Rs 50 at Rs.3,750 and Rs.3,850 per quintal respectively due to absence of millers buying activity. Moreover, poor demand for Urad dal from consumption centers and adequate stock positions of domestic crop restricted upside in commodity.

Bikaner origin branded Urad dal price offered Rs 4,800-5,000/100Kg. Tiranga brand of Mumbai at Rs 5,500/100Kg. Parivar brand of Jalgaon at Rs 5,200/100Kg.

At Chennai, Urad FAQ moved up by Rs 50 to Rs 4,100/100Kg on lower level buying support from millers. On other hand, Urad SQ variety quoted lower by Rs 100 at Rs 4,850 as sellers were active in the market.

NAFED Issued Tender To Sale 15530.49 Mts Urad-PSS (Rabi 2017) lying in State of Madhya Pradesh on 25.01.2018 through nafed.agribazaar.com.

Urad prices are already in floor now but weak trend in other pulses and new arrivals of other domestic pulses dampened the sentiment. But prices are likely to get support at lower rates as demand may appear due to winter season.

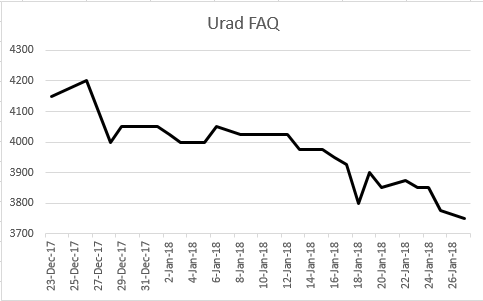

Chana Kantewala (Indore):

In Indore market, Chana prices moved up by Rs 200 at Rs 3,600/100Kg due to fresh physical trade from millers and traders at lower rates, following firm cues from futures.

Similarly, Australia origin Chana at Mumbai and Mundra port also ruled firm by Rs 50 to Rs 3,700/100Kg respectively on millers trade despite fresh supply of 44 containers of chana / 6 containers chana dal from overseas at Mumbai port. (1 container = 24 MT).

Around 134018.558 tonnes stock of Australia chana were reported at Mundra port as on January 20.

At National Commodity and Derivatives Exchange (NCDEX) chana for March contract settled firmed by 0.4 per cent or Rs. 14 up at Rs.3,721/100Kgs. Earlier in the day, the contract had slid to Rs.3,691 and touched a high of Rs.3,744 per quintal respectively.

Australia origin chana in forward business was priced around $630 per ton on CNF basis for March shipment.

Analysts said the trend is down. Expect further decline towards 3680 – 3650 levels or below in coming sessions. Keep a stop loss at 3810 for holding any short positions.

Australian chana dal priced firm by Rs 100 at Rs 4,600/100 Kg on negligible trade activity. Domestic chana dal of Maharashtra also remained firm at Rs 4,800 and regular chana dal at Rs 4,600/100Kg. While, Chana besan offered steady at Rs 3,000/50Kg. Vatana besan also quoted stable at Rs 1,790/50 Kg. Vatana dal also trades steady at Rs 3,150.

New Kabuli Chana traded flat at Indore due to limited demand from stockiest and exporters despite better inflow. Supply will increase further in coming days which may add pressure on prices of the commodity.

Recent rain spell across north India led to drop in temperatures and cold weather conditions, which is likely to benefit standing rabi crop especially chana. Due to high acreage and favorable weather so far, record chana crop this year in India. The best to begin with is price support and procurement operations. Chana, being the single pulse in the group on exchange platform. Both farmers and traders are wary of government procurement. Rates of pulses across the board are ruling below MSP. Chana is worse as it is large size crop and is harvested in mid-March. Rates are ruling below MSP and there was no mechanism in place for government procurement.

Imported Masoor (Mumbai):

Canada Crimson masoor remained weak by Rs 50 at Rs 3,450-3,500/100Kg in Mumbai due to dull millers buying coupled with sufficient stock of domestic and imported masoor. Demand in processed Masoor was reported slack from consumption centers. While, Australia masoor remained unchanged at Rs 3,600-3,700/100Kg.

Canada Masoor dal of Bhiwandi mills were offered lower at Rs 4,350/100Kgs, for APMC Vashi market delivery on dull trade activity.

Around 100040.235 tonnes stock of imported Masoor reported at Mundra/Hazira port as on January 20.

Arrivals of new domestic masoor expected to begin from mid February in Madhya Pradesh. But, farmers will liquidate their stock in bhavantar bhugtan yojna from March 01, 2018.

.png)

Imported White Pea (Mumbai):

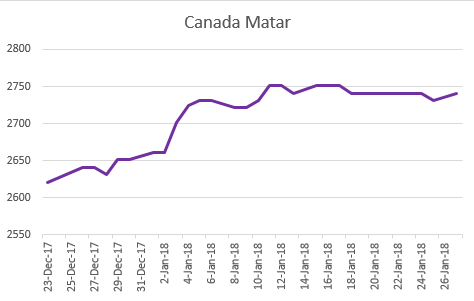

Canada, Ukraine and Russia origin White Pea at Mumbai were flat at Rs 2,731-2,741/100Kgs, 2,671 and Rs 2,621 respectively amid limited millers buying despite no supply pressure from overseas.

However, demand for processed Matar from consumption centers was reported thin despite cheaper prices compare to processed chana.

Around 318168.324 tonnes stock of Canada white pea reported at Mundra and Hazira port as on January 20.

Moong (Jaipur):

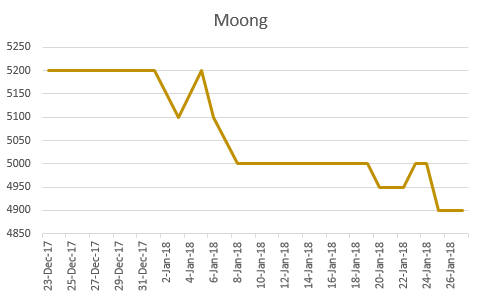

Moong priced lower for second straight week in Jaipur market by Rs 50 at Rs 4,900/100Kg during the last week on dull millers trade and sufficient availability of stock. Stockiest were also active to liquidate their old stock of moong to make room to purchase new tur/chana.

Similarly, Moong dal prices priced weak by Rs 100 at Rs 5,900-6,000/100Kg.

New moong of Ganjam and Puri district of Odisha likely to began after Holi festive.

(By Commoditiescontrol Bureau; +91-22-40015513)