MUMBAI(Commoditiescontrol): Demonetisation and GST scarred the textile industry as domestic cotton consumption fell to 5-year low however industrial players bet on the 2017/18 season as a year to make a comeback.

Cotton consumption fell to 5-year low in the 2016/17 season as Demonetisation and GST, two biggest economic reforms, thrashed the operation of the textile industry.

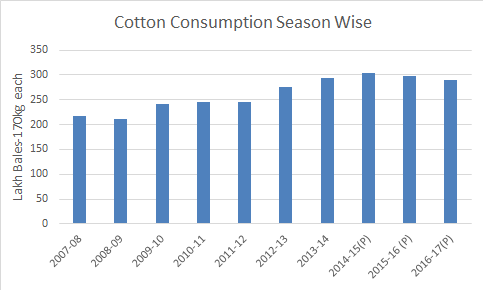

As per the latest data collated from the Ministry of Textile, the cotton consumption for the 2016/17 season is projected at 289 lakh bales(170kg), recording a 4-year low.

The cotton and textiles industry were severely hit with two major economic reforms, first the demonetization implemented on November 9, 2016 and second the Goods & Services Tax(GST) implemented on July 1, 2017. During these two major economic reforms, the industry faced liquidity issues which slowed down sales of textile industry considerably.

.png)

First, the industry was reeling under the problems of demonetisation and during the November-January period, cotton consumed by the spinners fell to a 4-year low at 72.67 lakh bales and cotton stock dropped to 5-year low to 101.82 lakh bales. Similarly, the cotton yarn production tumbled to 1013.25 million kg, a 3-year low and stock of cotton yarn declined to 479.76 million kg, a 3-year low.

Due to liquidity crunch, many spinners were quoting tentative cotton yarn rates and most buyers were off trading ring, hence no major sales were reported during the November-January period.

It had been a little more than five weeks into demonetisation and respite not on the horizon, textile makers in major hubs of Ludhiana and Coimbatore lost interest of doing business during 2016/17. (Full Report)

Fast Forward to April, as the industry was gradually standing back on its feet post Demonetisation, the next phase of economic reform known as Goods and Services Tax(GST) implemented in July, brought fresh round of concerns in the textile industry. After GST was rolled out, the market expected recovery however the reality brought major disappointments in the form of slow sales in the third quarter of 2017.

The industry faced major liquidity crisis and concerns on high GST on certain sections of the value chain, slowing not just the yarn sales but also garment sales during the third quarter of 2017.

.png)

Looking at the numbers during the July-Sept period, the stock of cotton yarn reached historical high of 564 million kg while the stock of cotton bales reached 7-year high at 111 lakh bales. This implied that the spinners were banking on all issues to be resolved during this period, hence they stocked up both cotton bales and stocked yarn in large scale.

However, the reality was that yarn sales were worst during this period and witnessing no major improvement, many spinners cut down their production inorder to curb excess loss. During this period, cotton yarn production fell to 4-year low at 997 million kg while cotton consumption dropped to 5-year low at 70 lakh bales.

Taking the 60s carded weft yarn from Tirpur as the benchmark of our analysis, prices as on July 3, 2017 was quoted at an average price of Rs 237/kg after which it dropped sharply 11% to Rs 209/kg as on September 28.

The industry was gradually getting back up with major industrial players resorting to hand to mouth basis and prices have sharply risen since September 28. The benchmark 60s carded weft was last quoted at an average price of Rs 251/kg, up 20% since September 28.

"The most affected player of Demonetisation & GST were the stockists who cannot purchase in bulk to replenish their inventories as the millers have to make their payments under GST norms, clearly stating all the particulars in the invoice note. Industrial players were facing difficulties at the beginning but now not anymore and tentatively by March, most of the liquidity issues should be resolved", said Ghanshyam Gupta, a Delhi based yarn trader.

Prashant Mohota, Managing Director, Gimatex, briefly explained that, “the demonetisation and GST were structural economic changes which impacted the textile industry heavily. Demonetisation affected the industry by creating liquidity crunch while GST affected the taxation system of textile industry as it was out of the tax net, both excise as well as state VAT. Due to which the industry faced tremendous issues during 2016/17.

However, most of the issues have been resolved and textile sector is in a position to make a comeback during the 2018 season. We have been seen good demand in both exports and domestic front in both the powerloom and garment sector, Mr Mohota added.

2016/17 season was the worst year for the spinning and textile industry as most of them dealt with major losses and were hoping that the 2017/18 season could act as a ray of hope in revival of the textile industry as it stands back on its feet.

The industry still faces liquidity issues to an extend on the aftermath of GST however such issues are gradually being resolved.

(By Commoditiescontrol Bureau; +91-22-40015534)

|