MUMBAI(Commoditiescontrol): Indian cotton arrivals pace remains close to 7 year average levels despite daily arrivals averaging below normal levels.

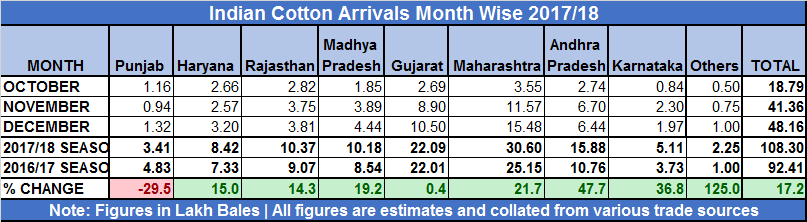

The Indian cotton arrivals for the first three months of 2017/18 season remained normal higher 17%, year on year. According to data maintained by CC team, the total arrivals as of Dec 31 was recorded at 108.30 lakh bales(170kg each), up 17.2%, compared to same period in 2016/17 season at 92.41 lakh bales.

As of date, arrivals have reached 122 lakh bales while as per CCI, arrivals as of Dec 27 was recorded at 106.22 lakh bales.

In 2016/17 season, arrivals slowed after demonetization hit the Indian economy on midnight of November 8, hence arrivals were higher in comparison.

The cotton planted area for 2017/18 season reached a 3 year high at 122.35 lakh ha and initial estimates of cotton production was ranging between 375-400 lakh bales however post the pink boll worm attack, on Maharashtra, Telangana and some regions of south region, Indian cotton production was trimmed to 350 lakh bales from prior estimates of 370 lakh bales. (Full Report)

Due to the trimmed Indian cotton production and quality issues, many buyers diverted to source cotton from US which brought an upsurge in the US market during December. Rise in exports prospects and trade shorts attributed to large mill on-call sales fixation boosted speculators to bid long position in US the market. The benchmark ICE March hit a new contract high at 79.7 cents/lb on Wednesday.

The above factor and prospects of shortage in premium variety cotton(30mm+) across Maharashtra and Telangana raised hopes of farmers to receive better rates for their produce and hence they resorted to tight selling.

Due to which, daily arrivals pace failed to clock normal levels of 1.9-2.2 lakh bales and 1.8 lakh bales was the highest level of daily arrivals recorded during November of the 2017/18 season while the average level clocked at 1.6 lakh bales

The prevailing raw cotton(kapas) rates received by farmers across India ranged between Rs 4,400-5,500/quintal and most farmers offloaded their produce between these rates according to the quality parameters. Some farmers were expecting rates upwards of Rs 5,500/quintal, mainly evident in Telangana and other south Indian cotton markets.

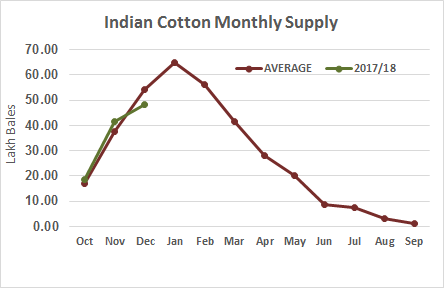

One would argue that the daily cotton arrivals continued to lag behind the normal levels 1.9-2.25 lakh bales however if we look at the historical average whereby around 30% of the total crop should arrive by December, we are in a very much comfortable position from supply perspective.

One would argue that the daily cotton arrivals continued to lag behind the normal levels 1.9-2.25 lakh bales however if we look at the historical average whereby around 30% of the total crop should arrive by December, we are in a very much comfortable position from supply perspective.

Total arrivals were at an estimated volume of 108.3 lakh bales which is 31% of the total estimated cotton production at 350 lakh bales. Hence, if arrivals clock the normal levels of 1.9-2.2 lakh bales on a daily basis in the later season, then it would act as an hindrance over the current bull run.

During the month of December, spot price rose nearly 9-11% tracing bullish global market sentiment. Taking the Gujarat Shankar 6(30mm) as the benchmark, prices crossed Rs 41,000/candy during December and is at Rs 41,400/candy as of January 11.

The Indian cotton market will continue to trend in the price range of Rs 39,000-43,000/candy, tilting slightly to a firm side tracing the uptrend on the ICE US futures.

(By Commoditiescontrol Bureau; +91-22-40015534)