MUMBAI (Commoditiescontrol) - ICE sugar futures ended down at multi month low on Friday, over expected higher supplies.

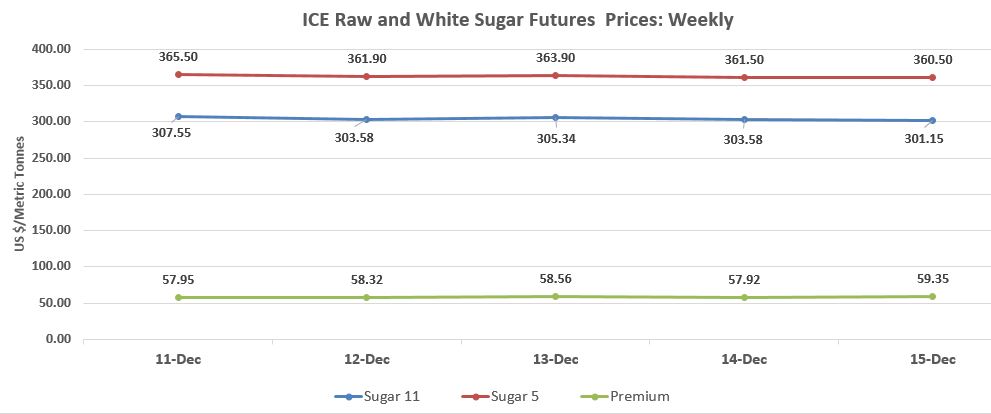

Raw and white sugar futures also closed the week down 2.78% and 1.72%, respectively.

On Friday, ICE March raw sugar finished lower 0.11 cents, or 0.80%, at 13.66 cents per pound, a lowest level since September 30. While March white sugar also closed down $1, or 0.28%, at $360.50 per tonne, a 2-1/2 month low, since September 29.

On other hand, the white sugar premium, or difference between the white and raw sugar price, also remained lower and traded below $60 per tonnes level since last two months. Moreover, current white premium can not match the cost of refining and processing costs of sugar refineries. Although, refineries will also not hold more raw sugar, because of lesser premium.

ICE raw sugar futures ended lower for the third consecutive session, amid concern of surplus sugar production in current season and also due to weak technical. While weak Brazilian real also led the fall in raw sugar futures prices during a trading week.

On Thursday, the US dollar hit the seven month low against the Brazilian currency due to delay in pension reform in federal nation. The greenback advanced 0.62% up to BRL 3.3365 on Thursday, the highest level since June 23. The US dollar increased 0.4%, week-on-week, while it also rose 2.34% since last three weeks.

The sharp fall of Brazilian currency against the greenback, encourage local millers to ship more amount of sugar to overseas instead of selling in domestic market, to get better returns in local currency terms.

On other hand, London white sugar prices also closed lower on ICE Europe Exchange, due to estimated excess supplies from the European Union and Thailand.

The European Union is expected to produce more than 200 lakh tonnes of sugar in ongoing sugar season 2017-18 (October to September), up 30 lakh tonnes from 2016-17.

While Thailand sugar mills are estimated to produce 120 lakh tonnes of sugar in current season, about 18% higher from last season.

Thai sugar mills have produced 96 thousand tonnes of sugar as of December 14 in current sugar season 2017-18 (November-October), in last season for same period mills had produced just 6 thousand tonnes of sugar.

Meanwhile, there will be surplus sugar output is estimated in current as well as upcoming sugar season. According to FO Licht, global sugar production in 2017-18 (Oct-Sept) is expected to be 1920 lakh tonnes.

The Australian Bureau of Agril. & Resource Economics and Sciences (ABARES) also forecasted the world sugar production at 1915.7 lakh tonnes for the season, while projected surplus of 5.96 lakh tonnes in 2017-18.

However, surplus sugar production estimates kept sweetener futures prices under pressure.

World Sugar Balance (October-September)

| |

|

Fig. are in million tonnes |

| Particulars |

2015–16 |

2016–17* |

2017–18# |

Change (%) |

| Production |

174.20 |

178.31 |

191.57 |

6.56 |

| Consumption |

179.90 |

181.49 |

185.61 |

2.04 |

| Surplus/Deficit |

-5.70 |

-3.18 |

5.96 |

- |

| Exports |

58.50 |

68.80 |

71.02 |

2.94 |

| Closing stocks |

74.80 |

71.24 |

75.73 |

6.70 |

| Stocks-to-use ratio (%) |

41.58 |

39.25 |

40.80 |

- |

| Price (USc/lb) |

16.65 |

17.31 |

14.00 |

-23.53 |

#ABARES forecast *ABARES estimate

Sources: ABARES; Australian Bureau of Statistics; F.O. Licht, International Sugar and Sweetener Report, US Department of Agriculture

(By Commoditiescontrol Bureau: +91-22-40015532)