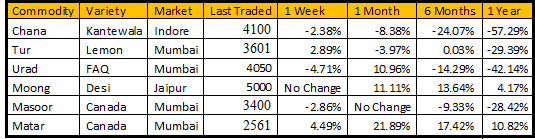

MUMBAI (Commoditiescontrol) – Tur and White Pea gained on fresh buying support from millers/Stockiest during the week ending on Saturday (Dec 4 - 9). While, Urad, Masoor and Chana declined due to absence of millers buying support, sluggish demand in processed pulses. On other hand, moong prices remained flat amid slow trade activity.

Week Highlights

# India's Rabi pulses sowing is up by 6.59 % as on December 6 to 127.62 lakh Ha vs 119.73 last year at the same period. Chana : 89.58 vs 81.25, Masoor : 14.84 vs 13.98, Field Pea : 7.90 vs 8.36, Urad: 3.62 vs 4.12, Moong : 1.24 vs 1.64,Other Pulses: 3.64 vs 3.97.

# SEBI Proposes To Allow Mutual Funds, Portfolio Manager In Commodity Market In A Bid To Increase Institutional Participation.

# Stat Canada Production Estimates 2017 Vs 2016 (LT). Matar: 41.12 Vs 48.36, Masur: 25.58 Vs 32.48, Chana: 0.86 Vs 0.75.

# Australia Agri Dept Forecast 2017-18 Chana Crop At 12.65LT Vs 20.04 Last Yr. In Sept It Estimate 2017-18 Chana Crop At 11.88LT.

# Australia Agri Dept Forecast 2017-18 Masur Crop At 4.79LT Vs 8.30 Last Yr. In Sept It Estimate 2017-18 Masur Crop At 4.19LT.

.png) Burma Lemon Tur:

Burma Lemon Tur:

Burma origin Tur Lemon variety gained by Rs.100 at Rs.3,600/100Kgs at Mumbai amid millers buying as some fresh enquiry in processed tur was reported at lower rates from retailers/ wholesalers counters. Pipeline is empty as they were purchasing as per immediate requirement. Monthly demand is expected in Tur dal in coming days.

Rally of new domestic tur arrivals appears unlikely in the coming days on weather concerns and affect the quality/yield loss in Maharashtra and Karnataka.

Tur prices is much depending on the arrivals pressure and quality of new crop, how much quantity government will purchase these year to support farmers.

Farmers were also not interested to sell their new Tur at lower market prices and were waiting for government to start procurement at MSP price.

Government is actively liquidating its old stock to avail storage spaces for procuring fresh new tur crop. Stock of old tur stock is depleting which procured by government. Limited stock positions of domestic tur is left with private traders/millers.

Prices of tur likely to get some support at lower level for short term period as prices of tur were traded much lower than MSP prices and government will start procuring new tur at MSP prices of Rs 5,450/100Kg.

Prices of processed Tur was traded firm on fresh buying activity. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,550/100 Kg, semi-Sortex at Rs 5,350 and regular at Rs 5,150.

Gujarat origin Wasat Phatka variety ruled flat at Rs 5,900-6,000/100Kg, Latur origin at Rs 5,600-5,700 and Jalna origin at Rs 5,800-6,000/100Kg.

.png) Burma Urad:

Burma Urad:

In Mumbai, Burma origin urad FAQ variety declined by Rs 200 at Rs 4,000/100Kg due to subdued buying support from millers, adequate stock and also regular arrivals of domestic Urad in major market.

Moreover, supply of domestic crop across the Madhya Pradesh state had improved in last couple of days as farmers were active in liquidating their stocks even at lower rates as Bhavantar Yojna is valid up to 15 December 2017.

Demand in processed urad also reported slack from consumption centers at prevailing rates.

Bikaner origin branded Urad dal price offered weak Rs 5,200-5,300/100Kg. Tiranga brand of Mumbai at Rs 5,600/100Kg. Parivar brand of Jalgaon at Rs 5,500/100Kg.

At Chennai, Urad FAQ fell by Rs 150 to Rs 4,350/100Kg amid subdued buying support from millers. However, Urad SQ variety also drifted down by Rs 350 to Rs 5,350.

Statewise Rabi Urad Sowing Down 12.14 % As On Dec 6 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:1.34 Vs 1.33, Tamil Nadu:1.56 Vs 1.72, Odisha:0.55 Vs 0.83. Total:3.62 Vs 4.12.

According to market talk, stockiest and millers were active purchasing domestic urad at lower rates as prices have fallen way below the minimum support price of Rs.5,400/100Kgs in domestic market. Prices are likely to get support as demand may continued from North India due to winter season.

.png) Chana Kantewala (Indore):

Chana Kantewala (Indore):

In Indore market, Chana prices shrugged off by Rs 50 to Rs 4,100-4,150/100Kg amid sluggish millers buying support due to lackluster sales counter in processed Chana. As per the latest data compiled by Ministry of Agriculture, the total acreage of chana increased by almost 10.25 percent from last year in the same period.

Similarly, Australia origin Chana at Mumbai and Mundra port drifted down by Rs 125 to Rs 4,425/100Kg and Rs 4,475 respectively following selling pressures on futures, fresh supply around 271 containers from overseas this week at Mumbai port. (1 container = 24 MT).

At National Commodity and Derivatives Exchange (NCDEX), chana for December delivery was settled lower by 3.96% or Rs 173 down to Rs 4,201/100kg. The contract had slide to Rs 4,200 and touched the high of Rs 4,380.

Analysts said the trend is down in Chana futures for Januaray contract. Crucial Support Breaks, Further Fall Likely. Keep a stop loss of 4490 for any short positions. Expect lower levels of 4340 – 4170 to be tested in coming sessions.

Statewise Rabi Chana Sowing Up 10.25 % As On Dec 6 Vs Same Period Last Yr (LAKH HA). Maharashtra:14.23 Vs 14.96, Rajasthan:13.96 Vs 15.80, Karnataka:13.25 Vs 9.59, Madhya Pradesh:31.24 Vs 26.67, Uttar Pradesh:5.20 Vs 5.89, Telangana:0.77 Vs 0.98, Andhra Pradesh:4.31 Vs 2.42, Haryana:0.49 Vs 0.57. Total:89.58 Vs 81.25.

Australian chana dal offered lower by Rs 50-100 to Rs 5,650/100 Kg due to lackluster trade from wholesalers/retailers counters since alternate option of cheapest dal such as Matar dal is available.

Domestic chana dal of Maharashtra also ruled weak by Rs 100 at Rs 5,750 and regular chana dal at Rs 5,650/100Kg. Chana besan was offered weak by Rs 250 at Rs 3,350/50Kg. On other hand, vatana besan gained by Rs 75 at Rs 1,750/50 Kg and vatana dal at Rs 2,950, up Rs 25.

Kabuli Chana prices of all counts declined by Rs 100/100Kg in Indore market as sellers were active in the market.

Supply of new crop of kabuli chana is likely to begin in mid-January from Maharashtra and Andhra Pradesh. Hence, sellers remained active to liquidate their old stock, while buyers were cautious and anticipate prices of commodity to further decline.

.png) Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada Crimson and Australia Nugget variety fell by Rs 100 to Rs 3,300-3,400/100Kg and Rs 3,500-3,600 respectively in Mumbai due to subdued millers buying coupled with sufficient stock and supply from overseas. Demand in processed Masoor was reported slack at higher rates from consumption centers.

Rates of Canada Masoor dal of Bhiwandi mills were traded flat at Rs 4,400/100Kgs, for APMC Vashi market delivery on thin trade activity.

State-wise Rabi Masoor Sowing Up 6.15 % As On Dec 6 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:5.68 Vs 5.17, Uttar Pradesh:5.66 Vs 5.58, Bihar:1.91 Vs 1.78, Uttrakhand:0.15 Vs 0.15, West Bengal:0.77 Vs 0.75. Total:14.84 Vs 13.98.

Prices of Masoor likely to get support at lower rates as no supply pressure from overseas and also selective number of importers and participants hold imported Masoor of good quality, which made them reluctant to sell inventories of Masoor at lower rates.

.png) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada and Russia origin White Pea at Mumbai were gained by Rs 75-100 to Rs 2,531-2,571/100Kgs and Rs 2,501 on lower level millers trade and also no fresh supply from overseas in break bulk vessel at Mumbai port after 50% duty imposed. Canada White Pea of godown delivery was traded at Rs 2,531/100kg and superior quality at Rs 2,571.

However, demand for processed Matar from consumption centers was reported as per requirement due to cheaper prices compare to processed chana.

State-wise Field Pea Sowing Down 5.50 % As On Dec 6 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:2.71 Vs 2.80, Uttar Pradesh:3.88 Vs 4.37, Jharkhand:0.29 Vs 0.25, Assam:0.27 Vs 0.18, Chhattisharh:0.23 Vs 0.23. Total:7.90 Vs 8.36.

Prices of White Pea may get support at lower rates as consumption likely to improved due to cheaper pulses.

.png) Moong (Jaipur):

Moong (Jaipur):

Moong remained unchanged in Jaipur market as per quality at Rs 5,000-5,100/100Kg during the last week on limited buying support despite slow arrivals in major states. Millers were interested to purchase superior quality moong.

Similarly, Moong dal prices traded flat at Rs 6,000-6,200/100Kg.

State-wise Rabi Moong Sowing Down 24.39 % As On Dec 6 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:0.32 Vs 0.26, Tamil Nadu:0.41 Vs 0.53, Odisha:0.43 Vs 0.67, Total:1.24 Vs 1.64.

Prices may rise by Rs 200-300/100Kg on millers buying as per sales in Moong Mogar and also commodity trading below MSP but will not sustain due to sufficient availability of stock.

(By Commoditiescontrol Bureau; +91-22-40015513)