MUMBAI (Commoditiescontrol) – Imported White Pea gained for the second straight week (November 13 – November 18) amid better buying support. White Pea is a cheaper alternative of superior grade pulses like Chana, Tur, Moong, or Urad and largely consumed in the rural areas.

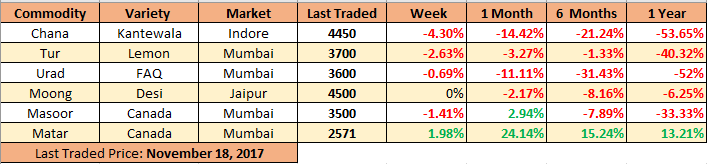

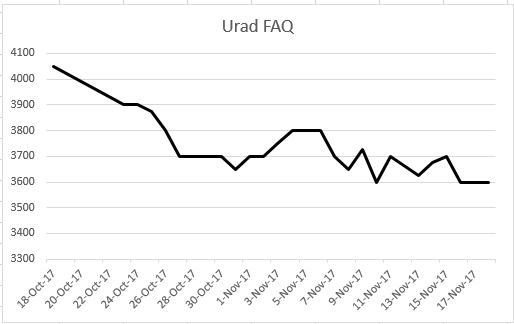

While, other pulses, such as Tur, Urad, Chana, Masoor remained weak even though government removed export curbs on all varieties of pulses owing to absence of millers trade due to sluggish demand in processed pulses. Moong remained flat on thin buying support and regular arrivals.

Week Highlights

# India Rabi pulses sowing is up by 34.37 % as on November 15 on 81.24 lakh ha vs 60.46 last year at the same period. Chana : 60.69 vs 43.91, Masoor : 7.96 vs 5.03, Field Pea : 4.38 vs 3.70, Urad: 1.59 vs 1.51, Moong : 0.39 vs 0.44,Other Pulses: 1.76 vs 1.54.

# Director General of Foreign Trade (DGFT) allows an import of Tur under Memorandum of Understanding (MoU) from Mozambique. Total import target of 1.25Lac MT Tur. 40000 MT Tur has already been imported while the arrival 85000 MT is pending.

# India Chana imports from Russia slips. The share of India, dropped down to 4% against last season’s 16%. Russia supplied 2.31 lakh MT of Chana to foreign markets in the 2016/17 season, or 7.5% more than in the previous marketing year (2.15 lakh MT was in MY 2015/16).

# Cabinet allows export of all pulses to ensure farmers get remunerative price for their produce.

# Prices of Yellow Pea declines in Canada as Indian Government imposed 50% import duty on White/Yellow Pea.

Burma Lemon Tur:

Tur Lemon variety of Burma origin declined by Rs 100 at Rs 3,625-3,650/100Kg in Mumbai amid fresh supply around 1141 containers (1 container =24 MT) from overseas at lower cost and more supply is likely to come around 85,000 tonnes from Mozambique at cheaper cost. Absence of millers buying support as sale counters in processed Tur was sluggish as millers were active in selling their dal stock ahead of new Tur crop harvest in December. Market were also depressed due to announcement of Maharashtra state government to sell Tur dal at Rs 55 per kg through PDS.

However, ban on export of Tur dal was already lifted on September 15. Tur Dal is less competitive for exports. Dal from African countries and Myanmar is available cheaper in the international market. Export market is relatively very small compare to India’s domestic crop size. It hardly makes any impact on prices of pulses, but improves sentiments. India is out of export market from past 10 years and it has lost the market against county like Burma, Africa, Dubai and it will be very difficult to revive export from India in near future. Exports may improve and likely to be established in about six months as Indian pulses command a premium owing to its quality.

.png)

On other hand, prices of processed Tur remained unchanged on subdued buying and sellers were active in the market. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,700-5,750/100 Kg, semi-Sortex at Rs 5,550-5,600 and regular at Rs 5,350.

Gujarat origin Wasat Phatka variety quoted flat at Rs 5,900-6,000/100Kg, Latur origin at Rs 5,600-5,700 and Jalna origin at Rs 5,800-6,000/100Kg.

Arrivals of new Tur started at Tauru market of Haryana. New Tur traded in the range of Rs 2,700-3,000/100Kg. Arrivals of new Tur may begin in upcoming days at Bulandshahr, Hatras, Aligarh, Khurja and Kher market of Uttar Pradesh.

Burma Urad:

In Mumbai, Burma origin Urad FAQ variety weakened by Rs 25 to Rs 3,600/100Kg following sluggish millers buying, regular domestic arrivals and adequate stocks position.

Millers were crushing new domestic Urad as they were getting superior and dry quality at cheaper rates.

However, demand in processed Urad remained subdued at existing rates. But expected in near future from North due to upcoming winter season.

Bikaner origin branded Urad dal price offered at Rs 4,800-5,000/100Kg. Tiranga brand of Mumbai at Rs 5,550/100Kg. Parivar brand of Jalgaon at Rs 5,400/100Kg.

Procurement of new Urad by government has gathered pace, at Minimum Support Price (MSP) (Rs 5400) in Rajasthan, Karnataka, Maharashtra, Gujarat and Telangana.

At Chennai, Urad FAQ fell by Rs 50 to Rs 3,900/100Kg as sellers were active in the market despite stock of imported Urad is depleting. On other hand, Urad SQ variety traded firm by Rs 50 at Rs 5,450 on millers buying for crushing superior quality.

Statewise rabi Urad sowing is up 5.30 % as on November 15 vs the same period during last year (Lakh Ha). Andhra Pradesh:0.29 vs 0.49, Tamil Nadu: 0.94 vs 0.53, Odisha: 0.31 vs 0.36. Total:1.59 vs 1.51.

Chana Kantewala (Indore):

In Indore market, Chana priced slipped by Rs 200 at Rs 4,400-4,450/100Kg amid selling pressure on futures, higher progressive, dull millers buying support as sluggish sales counter in processed chana due to alternate available option of cheapest dal—such as Matar dal.

Similarly, Australia origin Chana at Mumbai and Mundra port lowered by Rs 150 to Rs 4,800/100Kg and Rs 4,850/100Kg respectively on regular supply from overseas in container/break bulk vessel.

In forward business, new crop of Australia Chana priced at $745 per ton for November-December shipment. But no trade was reported.

.png)

Chana for December delivery on National Commodity and Derivatives Exchange (NCDEX) settled lower by 2% or Rs 103 down at Rs 4,726/100kg. The contract had slide to Rs 4,690 and touched a high of Rs 4,802.

State-wise Rabi Chana sowing is up by 38.21 % as on November 15 vs the same period during last year (Lakh Ha). Maharashtra: 7.60 vs 5.23, Rajasthan: 9.66 vs 10.16, Karnataka: 11.56 vs 8.37, Madhya Pradesh: 23.63 vs 14.43, Uttar Pradesh: 3.11 vs 2.37, Telangana: 0.49 vs 0.58, Andhra Pradesh: 2.76 vs 1.57, Haryana: 0.35 vs 0.23. Total:60.69 vs 43.91.

Australian Chana dal was priced lower by Rs 150 at Rs 6,050/100 Kg due to negligible trade from wholesalers/retailers counters. Domestic Chana dal of Maharashtra also ruled weak at Rs 6,150 and regular Chana dal at Rs 6,050/100Kg. Chana besan variety eased at Rs 3,700/50. Vatana besan traded flat at Rs 1,720/50 Kg. On other hand, Vatana dal at Rs 3,000, up Rs 150 following uptrend on raw Matar.

Kabuli Chana prices of all counts fell by Rs 200/100Kg in Indore market amid absence of trade activity from exporters and traders.

Imported Masoor (Mumbai):

Canada origin Crimson variety and Australia origin Nugget variety masoor eased by Rs 50 at Rs 3,300-3,500/100Kg and Rs 3,600-3,700 respectively on subdued millers buying support, higher progressive sowing and regular supply from overseas.

Market players were hoping that Government might ban or impose duty on Masoor imports. But, Government allowed export of all pulses after 10 years. It is not easy to regain in international market for the commodity.

.png)

Decreasing import of Masoor from Canada and depleting domestic stock is likely to support domestic Masoor prices for the short term. Masoor prices were trading below MSP in domestic market. The support is likely to sustain till the arrivals of new domestic Masoor crop--which will begin in February 2018.

Rates of Canada Masoor dal of Bhiwandi mills were traded higher by Rs 100 to 4,450/100Kgs, for APMC Vashi market delivery on lower level buying activity.

State-wise Rabi Masoor sowing is up 58.25 % as on November 15 vs same period last year (Lakh Ha). Madhya Pradesh: 4.46 vs 2.99, Uttar Pradesh: 2.68 vs 1.33, Bihar: 0.51 vs 0.44. Total:7.96 vs 5.03.

Imported White Pea (Mumbai):

Canada and Russia origin White Pea at Mumbai were traded higher for the second straight week by Rs 50-75 to Rs 2,571/100Kgs and Rs 2,501 on improved millers trade due to cheaper pulses despite regular supply from overseas.

Moreover, business activity in Matar dal and besan was also good from consumption centres due to cheaper prices.

State-wise Rabi field Pea sowing is up 18.38 % as on November 15 vs same period during last year (Lakh Ha). Madhya Pradesh: 2.38 vs 1.37, Uttar Pradesh: 1.69 vs 2.02. Total:4.38 vs 3.70.

.png)

Moong (Jaipur):

Moong priced steady in Jaipur market as per quality at Rs 4,400-4,500/100Kg during the last week on regular arrivals of new kharif Moong in major states and sufficient availability of stock.

Millers were interested to purchase superior and dry quality crop of Moong. Stockiest are sidelined as produce, which arrived in the market, were not possible to stock due to inferior quality.

Similarly, Moong dal prices traded flat at Rs 5,600-5,700/100Kg.

Procurement of new Moong by government is increased at MSP prices (Rs 5575) in Rajasthan, Karnataka, Maharashtra and Telangana.

.png)

On other hand, Consumer affairs ministry has asked government's trading company MMTC to explore the possibility of exporting Moong dal to foreign countries. Government agencies have stock of more than 1.5 lakh tonnes of Moong and it needs to be sold off quickly since the shelf life of Moong less compare to other pulses. The agency will assess if moong can be exported to countries, which have more NRIs. Because people from any other origin hardly consume moong dal.

State-wise Rabi Moong sowing is down 11.36 % as on November 15 vs same period during last year (Lakh Ha). Andhra Pradesh: 0.06 vs 0.05, Tamil Nadu: 0.20 vs 0.19, Total:0.39 vs 0.44.