MUMBAI (Commoditiescontrol) - Raw sugar futures hit new five and half month high on Intercontinental Exchange (ICE) on Friday, while raw sugar has also closed the week with 2.7% hike.

On Friday, March raw sugar ended up 0.11 cents, or 0.72% at 15.37 cents per pound on ICE US Exchange, after hitting 15.46 cents high since May 30.

Raw sugar futures continued its rally since last week, except a marginal fall during a week on Tuesday and Wednesday. However, it rose at 5-1/2 in previous session followed by front contract encounterd with a key resistance of 15.20 cents on Thursday.

Trader’s short-covering has also fueled the hike in raw sugar futures in previous session.

Raw sugar futures have extended its rally despite the reports of surplus sugar output for current sugar season. According to International Sugar Organization (ISO), global sugar market will have 44 lakh tonnes of surplus sugar production in 2017-18 (October-September).

Sugar futures is getting support from higher ethanol production in Brazil. Consequent by higher ethanol demand and consumption of biofuel in Brazil.

Further, recent rally in international oil prices have also improved the ethanol demand. So due to better returns against sugar, Brazilian sugar mills are crushing higher amount of sugarcane for ethanol production instead of sugar.

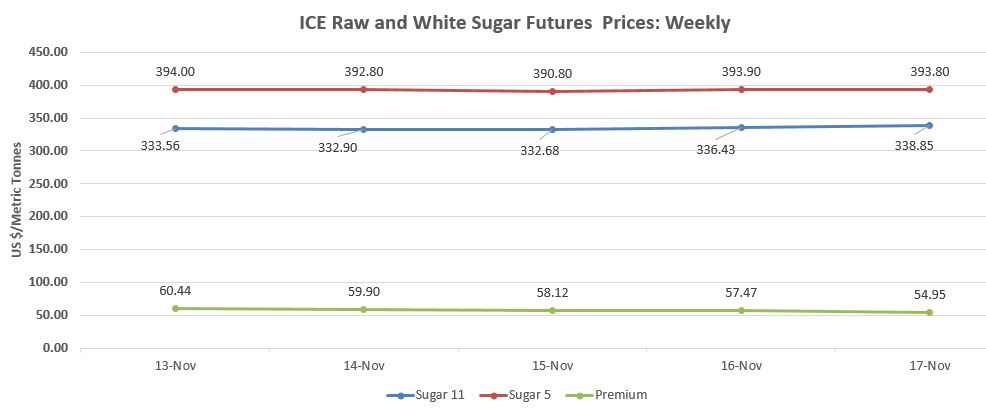

On other hand, March white sugar closed with a slight fall of 10 cents, or 0.03%, at $393.80 per tonne on ICE Europe Exchange. However, it has closed with 1.16% high in current week.

This reduction in White Sugar Futures is primarily due to hedging by the European Union sugar producers, against the recent rise in white sugar futures March contract. As per the initial forecast, the EU is estimated to produce about 200 lakh tonne of white sugar after removal of quota regime.

Notably, there will be excess sugar supplies in next year. According to reports, major sugar producing countries like India, Thailand, Pakistan, Russia is expecting a higher sugar output.

On other hand, the white premium or the price difference between the white and raw sugar remained lower, below the $60 per tonne.

With lesser white premium, sugar refineries are unable to match the cost of refining and processing, so due to lesser returns refineries will not purchase more raw sugar.

(By Commoditiescontrol Bureau: +91-22-40015532)