MUMBAI (Commoditiescontrol) – Major pulses such as, Tur, Urad, Chana, Moong, Masoor and White Pea remained weak ending on Saturday (October 3 - 7) amid sluggish trade activity from millers and traders as demand in processed pulses still remained sluggish from wholesale/retail counters despite upcoming festive period. Sentiment were pressurized due to liquidity crunch, absence of bulk buyers, stockiest.

.bmp)

Week Highlights

# Maharashtra Government Given Permission For Purchase Of 1 LT Of Soybean, 0.37LT Urad And 0.35LT Moong At MSP.

# Rabi 2017-18 Chana Production Target Vs 2016-17 Final Estimates (MT).Maharashtra:1908000 (1987000), Rajasthan:1425000 (1391000), Karnataka:655000 (578000), Chhattisgarh:438860 (412910), Andhra Pradesh:652000 (418000).

# India April-July Pulses Import 2017/2016 (MT).Tur:150670/206155, Matar:766828/1033204, Chana:32258/243708, Masoor:43519/428152, Moong/Urad:318349/210887.

# Pulses import at Tuticorin Port August Vs July (MT). Matar:5743 Vs 21631, Chana:3772 Vs 3662,Moong:1790 Vs 5972, Masur:4517 Vs 9782, Tur: Nil Vs 72, Urad:264 Vs 433, Other:4238 Vs 8139.

Burma Lemon Tur:

Tur lemon variety of Burma origin offered weak at Rs 3,550/100Kgs, down Rs 250 in Mumbai on lackluster buying and Government liquidating Tur stock below MSP in Maharashtra, Karnataka and Gujarat is pressurizing the sentiments.

Similarly, Processed Tur also priced weak by Rs 300/100Kg. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,500-5,550/100 Kg, semi-Sortex at Rs 5,350-5,375 and regular at Rs 5,200-5,250.

Millers were sellers for their processed pulses in the market despite facing losses, but demand and trading activity in processed pulses is negligible from wholesale/retail counters despite monthly and less period left for upcoming festive period.

.bmp)

Prices of Tur/Tur dal is unlikely to sustain as sellers were active to liquidate their stock in fear of upcoming new crop within 2 month. Government started liquidating its stocks at market price i.e. below MSP and now they have to gear up to procure entire next kharif crop as prices will be below MSP. Prices may be more under pressure once the arrivals of new Tur began in Karnataka and Andhra Pradesh from mid of November.

Millers and traders in future have to shift from imported Tur to domestic Tur as stock is declining day by day due to cheaper prices and also government imposed restriction on the imports of Tur.

Due to the rainfall in the past two days, Tur standing crop which had sown earlier has been affected in Karnataka and Andhra Pradesh.

Burma Urad:

In Mumbai, Burma origin FAQ variety Urad traded weak by Rs 200 to Rs 4,100/100Kg on dull millers buying coupled with improved arrivals of new domestic urad in major markets at cheaper rates. However, demand in processed Urad remained subdued at existing rates.

Nafed started procuring new Urad at MSP prices (Rs 5400) in Rajasthan and Telangana.

At Chennai, Urad FAQ and SQ variety fell this week by Rs 50-150 to Rs 4,350/100Kg and Rs 5,600 respectively in ready business as sellers were active in the market..bmp)

Similarly, Bikaner origin branded Urad dal price offered weak at Rs 5,500-5,600/100Kg. Tiranga brand of Mumbai at Rs 6,000/100Kg. Parivar brand of Jalgaon also declined at Rs 5,800/100Kg.

However, trading activity were reported dull as buyers were cautious due to higher acreage, expectation of higher arrivals of dry quality new Urad in major states amid clear weather and availability of sufficient stocks.

Chana Kantewala (Indore):

In Indore market, Chana priced lower by Rs 250-300 to Rs 5,300/100Kg on weak cues from futures, dull physical buying from millers as demand in processed Chana was sluggish, fresh supply around 726 containers from overseas and also upcoming supply in break bulk vessel from October end.

Similarly,Australia origin Chana in ready business at Mumbai and Mundra port remained weak by Rs 350 to Rs 5,150/100Kg and Rs 5,200 respectively.

New crop Australia chana (2017) also offered lower by Rs 250 to Rs.5,050/100Kgs for October-November shipment and Rs.5,000/100Kgs for November-December shipment on negligible trade despite lower forecast in Australia.

.bmp)

Chana for October delivery on National Commodity and Derivatives Exchange (NCDEX) was settled at 4 percent lower circuit or Rs 219 down at Rs 5,262/100kg. Earlier in the day, the contract had slide to Rs 5,262 and touched a high of Rs 5,476.

In forward business, new crop of Australia Chana priced at $800 per ton for October-November shipment.

Australian Chana dal priced lower by Rs 200 at Rs 6,700/100 Kg due to sluggish trading activity from Wholesalers/Retailers counters. Domestic Chana dal of Maharashtra at Rs 6,800. Regular chana dal at Rs 6,700/100Kg. Chana besan variety also eased at Rs 4,061/50. Vatana besan at Rs 1,460/50 Kg. Vatana dal quoted lower at Rs 2,575.

Kabuli Chana in ready business at Indore market traded lower by Rs 100 to Rs 136 for 42-44 count and Rs 13400 for 44-46 count amid slack demand from exporters and traders.

As per market talks, Chana prices had declined continuously from last one week on selling pressure as stockiest liquidating their stock due to regular and upcoming supply from Australia, favorable weather for Chana sowing and demand in processed Chana is still reported dull from wholesale/retail counters and time period is less for upcoming festivals. Stockiest holding Chana is now getting inferior (Danki) and were sold at lower prices. Traders were also active to liquidate their stocks on upcoming supply from overseas. Traders expect higher sowing of Chana in these rabi season due to good rainfall and better prices, which could boost supplies next year and weigh on prices. But, domestic chana crop will start from January month and still 3 month is left. still more correction is expected due to weak technical chart.

Imported Masoor (Mumbai):

Canada origin crimson variety and Australia origin nugget variety masoor declined by Rs 50-100 to Rs 3,100/100Kg and Rs 3,400 respectively negligible buying even at low rates, upcoming fresh supply in break bulk vessel from Canada, sufficient stock of imported/domestic Masoor, weak trend in Tur prices. Sellers were active in clearing their inventories of Masoor even at lower rates and bearing losses.

.bmp)

Similarly, rates of Canada Masoor dal of Bhiwandi mills were traded lower to 4,300/100Kgs, for APMC Vashi market delivery on sluggish buying activity.

In forward business, Australia origin Nugget variety masoor was priced at $510 per ton in container on CNF basis Nhava- Sheva for October-November shipment. Canada crimson variety masoor offered at $510 per ton in container and $500 in vessel on CNF basis For October-November shipment.

Imported White Pea (Mumbai):

Canadian origin white pea at Mumbai was offered down by Rs.20 to Rs 2,100/100Kgs on dull trade activity at existing rates coupled with regular supply from overseas and also upcoming higher supply in break bulk vessel around 215700 MT at Kolkata, 118400 MT at West Coast and also at Mumbai port.

.bmp)

Moreover, business activity in matar dal and besan was slack from consumption centers despite cheaper pulses. Russia origin White Pea also priced lower by Rs 10 to Rs 2,011.

In forward business, Canada White Pea in bulk was priced at $312 per ton on CNF basis Nhava- Sheva for October-November shipment. Russia White Pea Baltik variety was priced at $287 per ton on CNF basis Nhava- Sheva for October-November shipment.

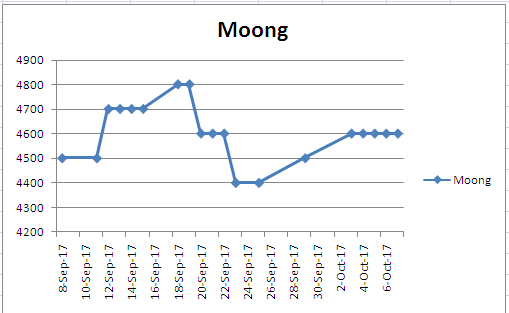

Moong (Jaipur):

Moong priced flat in Jaipur market as per quality at Rs 4,500-4,600/100Kg during the last week despite improved arrivals of new kharif Moong in major states and major arrivals quantity contains moisture, dagi and discolour variety due to recent rains. Millers were interested to purchase superior and dry quality crop of Moong. Moreover, millers and traders were cautious and not interested to source Moong with high content of moisture, dagi and discolour variety.

On other hand, Moong dal prices traded weak by Rs 100-200 to Rs 5,700-5,800/100Kg.

NAFED wre Procuring Moong (Kharif 2017) In Telangana and Karnataka Under PSS At MSP Price Of Rs 5575 (Rs 5375+200 Bonus).

(By Commoditiescontrol Bureau +91-22-40015513)