MUMBAI(Commoditiescontrol)- The US Market uncertain over crop prospects traded in indecisive trend while the Indian Market focused on large crop prosects.

US MARKET:

The US market was trading in an indecisive trend over uncertainty of crop loss due to Hurricane Harvey/Irma and overstated production forecasts of 21.76 million 480lb bales.

The benchmark December contract traded in a tight range of 164 points within 69.95-69.31 cents/lb during the first half of the week forming a triangle pattern however it broke free on Sept 21 to settle at 1 month low at 68.25 cents and finally witnessed a rebound to end the week at 68.46 cents/lb.

Open interest, as of Sept 21, dropped 4 percent, week on week, to 1.35 lakh lots indicating long liquidation.

Previously, the market had settled limit down on Sept 12 in all three contracts(Oct/Dec/Mar) after WASDE report released. The latest CFTC report showed that as of Tuesday, September 12, speculators were actually 1.36 million bales more long than the week before.

In other words, despite the market falling by over 600 points from its contract high, speculators were getting longer and owned 6.93 million bales in net longs last week. Since most of these longs are under water at this point, we have to assume that there is more spec selling ahead.

Meanwhile, USDA weekly net export sales leaped 303 percent to 278,394 Running Bales(RB) for the week ended September 14 from previous week's 69,052 RB.

Shipments were recorded at 181,336 RB during the week (Sept 8-14) which rose 62 percent from previous week’s 112,200 RB.

Total commitment for the 2017/18 MY reached 7.50 million 480lb bales(50%) of USDA’s revised forecast to 14.9 million 480lb bales of which 1.2 million 480lb bales(8%) have already been shipped.

Meanwhile, the on-call sales commitment hit a record high as of Sept 15, there were a total of 13.27 million bales in unfixed on-call sales, of which nearly seven million were on December and March. The difference between unfixed on-call sales and purchases is also at an extreme at 9.55 million bales.

This large number of open-priced contracts should provide decent support underneath the market and absorb at least some of the expected spec selling that may lie ahead.

CHINA MARKET:

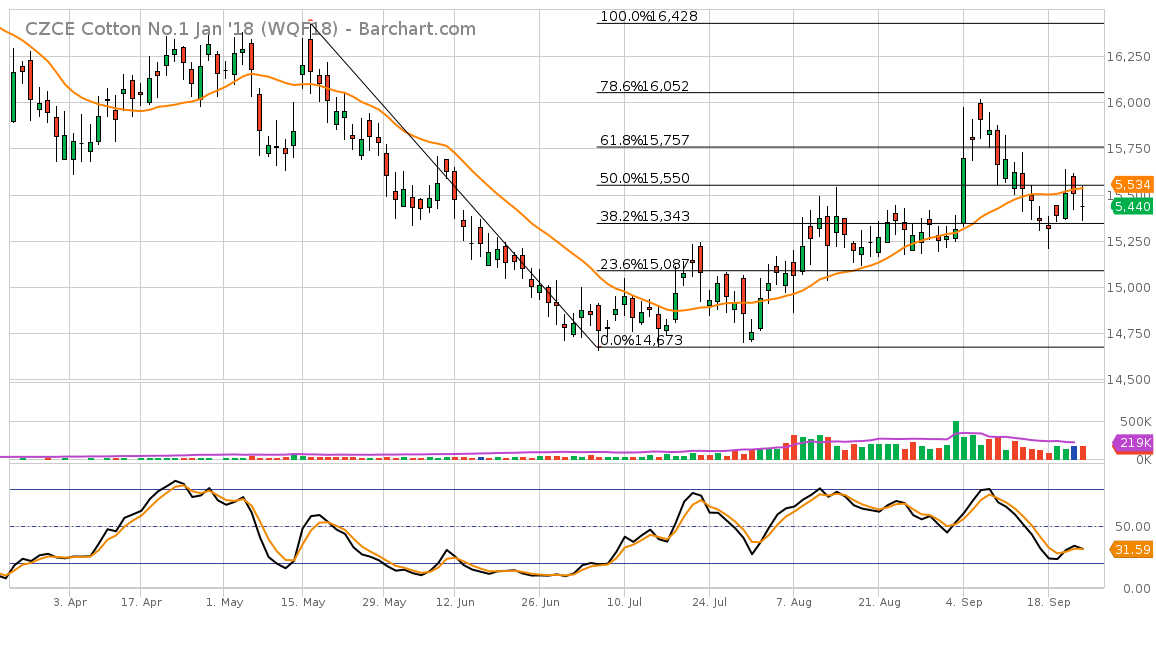

The ZCE cotton futures witnessed minor recovery with the benchmark January showing marginal gain of 0.5 percent over the week.

The benchmark January contract settled at 15,440 yuan/tonne on Friday, up 120 yuan/tonne over the week while open interest plunged 12 percent to 218,980 lots indicating major short covering throughout the week.

The state reserve auctioned a total of 136,499 tonnes from which it sold a total of 132,781 tonnes for the week ended September 22, recording a weekly turnover of 97 percent. (Full Report)

State Reserve has sold around 3,074,837 tonnes (18.09 million 170kg bales) were sold from the total auctioned quantity of 4,227,179 tonnes (24.87 million 170kg bales) taking the season’s turnover at 72.74 percent.

Technically, prices retraced 50% of the Fibonacci retracement levels however settled with a bearish candle for two consecutive session and slightly below the 18 day moving average at 15,529. The trend is down with key support level of 15,205 yuan/tonne while near term resistance stands at 15,550 and above that a key resistance of 15,757.

INDIAN MARKET:

The Indian cotton futures persisted downtrend for the second consecutive week on major short selling.

.jpg)

The benchmark October futures settled at 18,470/bale, declined Rs140 over the week on Friday.

Open interest rose 1.5 percent to 2,904 lots(72,600 bales of 170kg) indicating major short selling took place during the week on focus of large crop prospects ranging between 37-40 million 170kg bales.

Apart from the minor recovery on Friday, October prices closed down four consecutive sessions prior to Friday.

Weekly technicals indicated that the nature of the price movement is sideways and oscillation around the Daily Reversal Value (DRV) at Rs 18,270 is being witnessed. Downtrend may persist if prices fall below Rs 18,000 while key resistance is placed at Rs 19,460.

Inter week support is seen between Rs 18,243-17,793 while resistance is placed between Rs 18,693-19,143.

DOMESTIC SPOT MARKET:

Spot market persisted downtrend in the second last week(Sept 18-22) of the 2016/17 season as large crop prospect dominates market sentiment.

.jpg) The biggest downfall in prices was observed in Gujarat where the weekly average of benchmark Shankar 6(30mm) plummeted Rs 1,860/candy to trade at Rs 40,310/candy and Madhya Pradesh which plunged Rs 1,100/candy to Rs 41,670/candy.

The biggest downfall in prices was observed in Gujarat where the weekly average of benchmark Shankar 6(30mm) plummeted Rs 1,860/candy to trade at Rs 40,310/candy and Madhya Pradesh which plunged Rs 1,100/candy to Rs 41,670/candy.

While other markets witnessed a drop of Rs 700-1,000/candy across their benchmark weekly averages.

Large crop prospects ranging between 37-40 million 170kg bales has now become the center of focus of the market and with nil bullish factors prevailing in the past two weeks, the bears continued to dominate the market sentiment, weighing on cotton prices across the board.

Spinners shifted their focus towards procuring new crop and indulged in forward deals, mostly for the November to December delivery. Hand to mouth trading spinners continued to procure in limited volume however were very cautious to indulge in huge deals due to on-going poor offtake in the yarn market.

Since the market has lost interest over old crop, it may be safe to assume that old crop prices will continue the bearish side while some sellers will offload at buyer’s bid rates in order to clear their inventories for replenishing new crop.

Further, rise in new crop supply and forward rates quoted in the range of Rs 37,000-38,500/candy(October to December delivery) weighed on the market sentiment.

New crop supply for the week(Sept 18-22) recorded a volume of 75,800 bales of 170kg each, significantly higher 126 percent from previous week(Sept 12-16) at 33,500 bales.

North India, which also includes Lower Rajasthan, contributed to nearly 3/4th of the rise in supply during the week at 57,500 bales(25,900 bales last week) and this was the highest level of arrivals observed in many years during the month of September. Arrival volume recorded at 26,200 bales during the same period last year.

As of Date, Total arrivals across the country reached 1.34 lakh bales which was significantly higher compared to 0.63 lakh bales during the same period in 2016. New crop continued to contain higher amount of moisture ranging between 20-30 percent as per trade sources.

On the crop scene, Total cotton planting progressed to 121.72 lakh ha as of September 21 compared to same period last year at 102.56 lakh ha covering nearly 99.4 percent of the total normal area at 122.46 lakh ha and remained ahead 6 percent from the normal area as on date at 114.88 lakh ha. (Full Report)

Conclusion:

Just one week to go for the 2016/17 season to end and the large crop prospects of 37-40 million bales will now continue to dominate the market sentiment to a bearish side unless some ground breaking news hits the stage.

Forward rates were quoted in the range of Rs 37,000-38,500/candy with the potential to persist downtrend as spinners were not very eager to revive their procurement spree as yet.

.jpg)

(By Commoditiescontrol Bureau; +91-22-40015534)