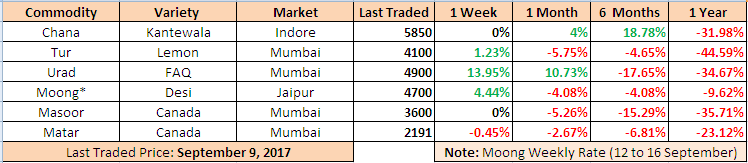

MUMBAI (Commoditiescontrol) – Tur, Urad and Moong moved up for week ending on Saturday (September 11 - 16) as government lifted ban on export of Tur, Urad and Moong dal to help farmers get "remunerative prices". However, exports of these varieties of pulses can be undertaken after taking permission from agri export promotion body Agricultural and Processed Food Products Export Development Authority (APEDA). Exports should be made through customs electronic data interchange (EDI) ports, the notification said.

While, Masoor and White Pea continued to remained weak in the absence of buying. On other hand, Chana traded flat amid slow physical buying and fresh supply from overseas.

Week Highlights

# India Kharif Pulses Sowing Down 3.5 % As On Sep 13 At 140.38 Lakh Ha Vs 145.55 Last Year at same period. Tur : 43 Vs 52.39, Urad : 42.65 Vs 35.13, Moong : 31.63 Vs 34.38, Other Pulses: 22.5 Vs 23.02.

# Burma Government Imposes Temporary Ban On Pulse Import From Sept 15 To Increase Local Use. Imports Allows To Only License Submitted Before Sept 15 With Bill Of Lading.

# US 2017-18 Masoor Production Likely 41% Down At 3.38 Lakh Ton. Matar Crop Estimated 45% Lower At 6.97 Lakh Ton Due To Poor Yield Amid Adverse Weather Conditions.

# Rajasthan Agri Department First Advance Estimates 17-18 Vs Final Estimates 16/17 (IN LAKH TON). Moong:7.60 VS10.49, Urad: 2.43 VS 3.05, Moth:3.51 VS 4.35, Chaula:0.59 VS 0.65.

# Karnataka Agri Department In First Advance Estimates For 2017-18 Said Tur Crop At 6.63 Vs 12 LT LAST YR. Moong Crop At 0.78 LT Vs 1.16 LT.

# Centre Allows Additional 40000-44000MT Tur Imports. Relaxation Will Be Given Only After It Is Duly Verified That Contracts Were Entered Into & Payment Made Prior Aug 5.

# Australia Agri Ministry Cuts 2017-18 Chana Crop Forecast at 11.88 LT From 18.54 Last Year. In June It Projected Crop At 14.16 LT.

# SEBI Is Considering Lifting Ban On Tur/Urad Futures. But Final Decision Could Be Taken After Factoring Production Estimates As Area Under Kharif Pulses Turns Lower.

Burma Lemon Tur:

Tur lemon variety of Burma origin offered firm by Rs 50 to Rs 4,100/100Kgs as government allows export of Tur dal after a decade. However, actual trade activity from millers were sluggish due to dull demand in processed Tur from Wholesale /retail counters, fresh supply in containers from overseas, government liquidating stock below MSP and also confusion over 5% GST On Branded/Non Branded Dal.

Similarly, Processed Tur also priced firm by Rs 100/100Kg, but sellers were active in the market as millers were holding stock, but demand and trading activity in processed pulses is still dull from wholesale/retail counters despite monthly and upcoming festive period. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 6,300/100 Kg, semi-Sortex at Rs 6,050 and regular at Rs 5,800-5,850.

.bmp)

As per market talk, lifted ban of Turdal by government will not sustain the prices of Tur in India as prices which we offer for export were higher compare to other country such as Burma and African exporters. Sellers in Burma for Phatka sortex Tur dal were active to sell around $700-$720 FOB basis for Dubai, but purchasers were interested around $580-$600. Approximately export of Turdal annually around 6,000 ton from Burma. Burma exports Turdal to Dubai, Singapore, Malaysia, Indonesia and Europe.

Approximately 15-20 dal mills were in Africa, which process only Tur Dal. Around 4-5 dall mills were reported in Dubai and 100 small dall mills were in Burma, but 10 mills were crushing Tur and rest crushing Urad and Moong.

Statewise Kharif Tur Sowing Down 17.92 % As On Sep 13 Vs Same Period Last Yr (LAKH HA). Maharashtra:12.72 Vs 15.30, Karnataka:8.79 Vs 11.90, Uttar Pradesh:3.36 Vs 3.52, Andhra Pradesh:2.24 Vs 2.82, Madhya Pradesh:6.51 Vs 6.90, Gujarat:2.70 Vs 3.40, Telangana:2.50 Vs 4.31,Total:43 Vs 52.39.

Burma Urad:

In Mumbai, Burma origin FAQ variety Urad traded higher by Rs 500 to Rs 4,900/100Kg as government allows export of Urad dal after a decade and also good buying support as new urad arrivals contains healthy content of moisture and Dagi due to current rainfall in Madhya Pradesh and Maharashtra; hence millers were interested to source dry quality stock.

At Chennai, Urad FAQ and SQ variety moved up this week by Rs 550-800 to Rs Rs 4,900/100Kg and Rs 6,400 respectively in ready business on millers buying activity.

.bmp)

As per market talk, lifted ban of Uraddal by government will not sustain the prices of Urad in India as prices which we offer for export were higher compare to other country such as Burma exporters. Sellers in Burma for Urad Gota SQ variety were active to sell around $950 CNF basis for Colombo/Dubai and Urad Gota FAQ variety at $750. Approximately export of Uraddal annually around 10,000 ton from Burma.

Similarly, Bikaner origin branded Urad dal price offered sharply higher at Rs 6,600-6,700/100Kg. Tiranga brand of Mumbai at Rs 6,800/100Kg. Parivar brand of Jalgaon also moved up at Rs 6,700/100Kg.

As per market talk, demand may subdued at higher rates and correction is expected in the prices due to bumper crop. However, buyers were cautious and are purchasing as per their immediate requirement because they are aware of increase in upcoming supply of new crop coupled with availability of sufficient stock of domestic Urad.

Statewise Kharif Urad Sowing Up 21.40 % As On Sep 13 Vs Same Period Last Yr (LAKH HA). Karnataka:1.30 Vs 0.83, Andhra Pradesh:0.35 Vs 0.47, Maharashtra:4.83 Vs 4.54, Uttar Pradesh:5.96 Vs 6.01, Rajasthan:5.40 Vs 3.90, Madhya Pradesh: 17.89 Vs 11.68, Tamil Nadu:0.50 Vs 0.60, Total:42.65 Vs 35.13.

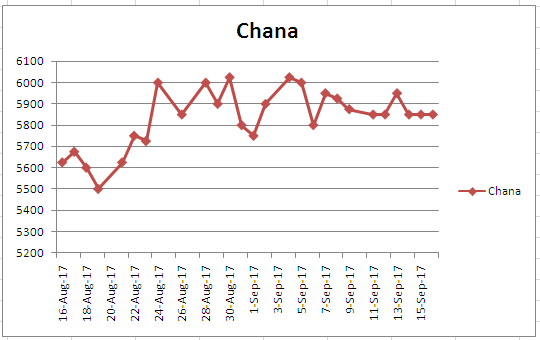

Chana Kantewala (Indore):

In Indore market, Chana priced flat at Rs 5,800-5,850/100Kg on slow physical buying, fresh supply in containers and also from Vessel S Bravery carrying 28,775 tonnes Australia Chana at Mumbai port.

Vessel M V BERGE SHARI carrying 30,300 tonnes of Australia Chana is expected to arrive at Mumbai port on September 24.

Demand and trading activity in processed Chana is reported slack from wholesale/retail counters and time period is less of upcoming festive. Stockiest holding Chana is now getting inferior (Danki) and were sold at lower prices. Stockiest were also having fear of more supply in bulk vessel from Australia expected in near future at Mumbai port.

Australia origin Chana in ready business at Mumbai and Mundra port remained unchanged at Rs 5,925/100Kg and Rs 6,000 respectively.

On other hand, new crop Australia chana (2017) offered firm by Rs 100 to Rs.5,400/100Kgs for October-November shipment and Rs.5,350/100Kgs for November-December shipment due to lower forecast in Australia.

Chana for October delivery on National Commodity and Derivatives Exchange (NCDEX) was settled lower 0.5 Per cent or Rs 30 down at Rs 6,236/100kg. Earlier in the day, the contract had slide to Rs 6,214 and touched a high of Rs 6,299.

In forward business, new crop of Australia Chana priced at $850 per ton for October-November shipment, old crop at $870 per ton for October and $900 per ton for September.

Australian Chana dal priced unchanged at Rs 7,300/100 Kg due to thin trading activity from Wholesalers/Retailers counters. Domestic Chana dal of Maharashtra at Rs 7,400. Regular chana dal at Rs 7,300/100Kg. Chana besan variety also offered flat at Rs 4,220/50. Vatana besan at Rs 1,630/50 Kg. Vatana dal quoted at Rs 2,671.

Kabuli Chana in ready business at Indore market traded firm by Rs 100 to Rs 14000 for 42-44 count and Rs 13800 for 44-46 count amid firm demand from exporters and traders.

As per market talks, buyers may be attracted at lower rates or at any correction in Chana prices due to lower forecast of Chana crop in Australia, on upcoming demand for ongoing festive period till Diwali and also sowing period starts from October in domestic markets.

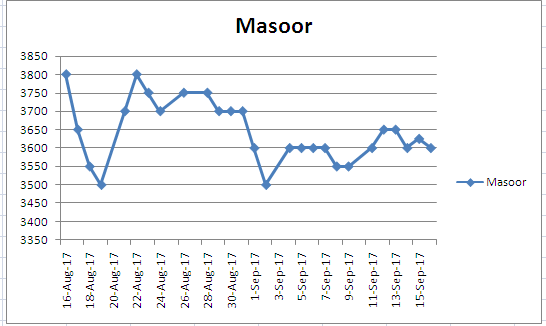

Imported Masoor (Mumbai):

Canada origin crimson variety and Australia origin nugget variety masoor declined by Rs 50 to Rs 3,600/100Kg and Rs 3,800 respectively on dull mills buying support, sufficient stock of imported/domestic Masoor and also expectation of supply from overseas.

On other hand, rates of Canada Masoor dal of Bhiwandi mills were traded flat at 4,550/100Kgs, for APMC Vashi market delivery on sluggish buying activity.

In forward business, Australia origin Nugget variety masoor was priced at $555 per ton on CNF basis Nhava- Sheva for September-October shipment. Canada crimson variety masoor offered at $545-$550 per ton on CNF bais For September-October shipment.

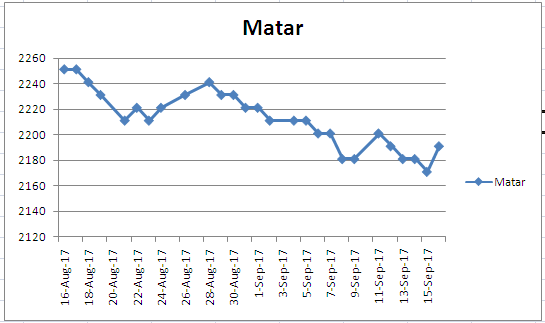

Imported White Pea (Mumbai):

Canadian origin white pea at Mumbai was offered down by Rs.20 to Rs 2,181/100Kgs on thin trade activity at existing rates coupled with fresh supply from Vessel Reliable and Mandarin Traders at Mumbai port. Moreover, business activity in matar dal and besan was slow from consumption centers. Russia origin White Pea also priced lower by Rs 30 to Rs 2,091.

In forward business, Canada White Pea was priced at $315 per ton on CNF basis Nhava- Sheva for September-October shipment. Russia White Pea Baltik variety was priced at $285-$300 per ton on CNF basis Nhava- Sheva for September-October shipment.

Moong (Jaipur):

Moong priced higher in Jaipur market as per quality at Rs 4,800-4,900/100Kg, up Rs 400 during the last week as government allows export of Moong dal after a decade and also miller buying support despite improved arrivals of new kharif Moong in major states. Millers were interested to purchase good quality crop of Chamki polished variety Moong. Moreover, millers and traders were cautious and not interested to source Moong with high content of moisture, dagi and discolour variety.

Similarly, Moong dal prices also traded higher by Rs 500 to Rs 6,200-6,300/100Kg.

As per market talk, lifted ban of Moongdal by government will support prices of Moong in India as prices which we offer for export were cheaper compare to other country such as Burma and Africa exporters. China is main buyer in Moong from Burma. Sellers in Burma for 3MM moong dal variety were active to sell around $1150 CNF basis for Singapore. Approximately export of Moong dal annually around 4,000 ton from Burma. Burma exports Moong dal to Dubai, Singapore, Vietnam, Malaysia, Indonesia and Europe.

.bmp)

Moong prices can also get support if Government starts purchasing moong at MSP price of Rs 5,575 ( Including Bonus Rs 200) or lower level prices attract purchasers for short term basis due to upcoming festive period as retailers/Wholesalers pipeline is empty and also new moong arrivals contains healthy content of moisture, dagi, discolour; hence millers will be interested to source dry and superior quality stock.

Statewise Kharif Mung Sowing Down 8 % As On Sep 13 Vs Same Period Last Yr (LAKH HA). Rajasthan:15.70 Vs 15.34, Karnataka:3.64 Vs 4.15, Maharashtra:4.51 Vs 5.12, Tamil Nadu:0.27 Vs 0.35, Andhra Pradesh:0.15 Vs 0.31, Madhya Pradesh:2.28 Vs 2.25, Odisha:1.95 Vs 1.87, Uttar Pradesh:0.45 Vs 0.49, Telangana:0.89 Vs 2.60, Total:31.63 Vs 34.38.

(By Commoditiescontrol Bureau +91-22-40015513)