MUMBAI(Commoditiescontrol)- US cotton futures indicated bearish trend to persist with necessary rains on August 17-18 and forecast of widespread rains to persist in Maharashtra is favoring the bears in India.

US MARKET:

The US cotton futures ended bearish for the second consecutive week with December down nearly 1 cent to settle at 67.28 cents/lb.

In the previous weekly report we had mentioned that we spotted a Bearish engulfing pattern for Cotton futures in Weekly chart, highlighting a downtrend to follow for the current week and that prices can touch the previous lows near 66.33 cents/lb. However, prices recorded a 5 week low at 66.64 cents/lb on Thursday.

Prices settled down three out of four trading sessions and the other two upward settlements(Aug 17-18) was a weak pullback to settle at 67.28 cents/lb on Friday.

The good weekly export sales report and the bearish WASDE report, highlighting the large crop at 20.55 million bales(480lb) forecast for US in 2017/18 and a 9 year high ending stock at 5.8 million bales, was the focal point of various traders. (Full Report)

Open interest indicated major selling pressure was the cause behind prices falling to a 5 week low. Open interest, as of August 17, is at 145,976 lots, down 3.5 percent from previous week’s 151,173 lots.

As previously mentioned, Traders will likely trade on USDA WASDE’s figures and prices could likely test strong support levels at 65 cents and with more forecasts of good rains over Delta, Texas and Southwest regions could keep the bearish trend alive.

Technical pullback could be a possibility as prices are trending on oversold levels which could add strength to the long term bearish trend.

.jpg) The USDA export sales report showed a normal to good performance as net sales for the week were recorded at 190,400 Running Bales(492lb)(RB), significantly higher from previous week’s 77,225 RB. Shipments increased to a total of 204,344 RB from previous week’s 119,239 RB.

The USDA export sales report showed a normal to good performance as net sales for the week were recorded at 190,400 Running Bales(492lb)(RB), significantly higher from previous week’s 77,225 RB. Shipments increased to a total of 204,344 RB from previous week’s 119,239 RB.

Total commitments were recorded at 6.32 million RB(6.48 million 480lb bales) while outstanding(un-shipped) were recorded at 6 million RB(6.15 million 480lb bales).

The large outstanding exports amid a tight ending stock, estimated at 2.8 million 480lb bales, provided some support to prices fundamentally.

The latest CFTC report showed the trade at just 10 million bales net short as of August 8, which was two days before the supply/demand report and forecast of large Rest of the World (ROW)(World less China) ending stock at 50.76 million bales, could encourage trade to raise their net short position.

Until the September WASDE report, prices may trade between 65-69 cents/lb with the present momentum inclined to a bearish bias.

The large export commitments at 6.15 million bales and on call commitments at 11.19 million bales (all contracts) with December at 3.4 million bales should not be ignored.

If the September WASDE report holds production above 20 million bales and favorable weather conditions persist during the next few weeks then mills will hold on to their outstanding on-call commitments in hopes to fix at a lower levels below 65 cents.

CHINA MARKET:

.jpg) The ZCE cotton futures traded marginally higher week on week however, open interest suggests that the market sentiment continued to incline on the bearish side during the week.

The ZCE cotton futures traded marginally higher week on week however, open interest suggests that the market sentiment continued to incline on the bearish side during the week.

The benchmark January contract settled at 15,240 yuan/tonne on Friday, modestly gained 15 yuan/tonne over the week. On the other hand, Open Interest rose 8 percent to 236,642 lots implying that the market sentiment is inclined to a bearish side on prospects of higher 2017/18 cotton production and probability of rise in imports.

China raised 2017/18 cotton production forecast by 10 percent, year on year, at 5.28 million tonnes according to the monthly balance sheet estimates (CASDE) released by the Ministry of Agriculture. (Full Report)

Meanwhile, the state reserve auctioned a total of 148,226 tonnes from which it sold a total of 129,269 tonnes for the week ended August 18, recording weekly turnover at 87 percent, hitting a 23 week high.

Since the commencement of auction, around 2,398,377 tonnes (14.11 million 170kg bales) were sold from the total offered quantity of 3,511,374 tonnes (20.66 million 170kg bales). (Full Report)

The cotton yarn futures commenced trading on Friday and settled higher 115 yuan to 23,115 yuan/tonne with volume recorded at 78,284 lots and open interest at 7,634 lots.

INDIAN MARKET:

.jpg) The Indian cotton futures witnessed a bearish trend throughout the week with October down Rs 330 to close at Rs 18,260/bale on Friday.

The Indian cotton futures witnessed a bearish trend throughout the week with October down Rs 330 to close at Rs 18,260/bale on Friday.

Open interest suggested that more short selling was the major cause behind prices falling to more than three week low on Friday on forecast of widespread rains likely to occur in Maharashtra over the weekend.

Trade volume remained subdued at 73,040 bales of 170kg, down 42 percent from previous week(Aug 7-11).

Technically, the Daily Reversal Value(DRV) is flat and indicating that in near term sideways volatility and oscillation around the DRV is a possibility in the next week.

We recommend exit long position on rise from Rs 18,260 to Rs 18,553 and technical rating indicates that the uptrend could persist however at the moment it is weak.

Inter-week resistance is placed at Rs 18,337-Rs 18,553-Rs 19,023 and support is placed at Rs 18,083-17,613. (Technical Report)

DOMESTIC SPOT MARKET:

.jpg) Spot market snapped from two consecutive weeks of winning streak as prices witnessed marginal movement towards the bearish side of the chart during the week(Aug 14-18).

Spot market snapped from two consecutive weeks of winning streak as prices witnessed marginal movement towards the bearish side of the chart during the week(Aug 14-18).

Central India incurred modest losses with weekly average of benchmark spot price declining Rs 50 to Rs to Rs 43,350/candy in Madhya Pradesh, Rs 130 to Rs 43,710/candy in Maharashtra and Rs 230 to Rs 43,150/candy in Gujarat.

Prices plunged Rs 40-60/maund(37.3kg) in North India with the weekly average recorded at Rs 4,440-4,460/maund(Rs 42,400-42,600/candy) majorly influenced by the downtrend on the MCX futures where the benchmark October was down 2.6 percent or Rs 330 to Rs 18,260/bale. Further, early phase of new crops arrived in Haryana on Friday with the volume recorded at 350 bales which additionally weighed on the spot prices. (Full Report)

Two markets showed a positive trend with prices up Rs 250 to Rs 43,190/candy in Lower Rajasthan and Rs 300 to Rs 44,750/candy in Adilabad, Telangana.

Summarizing the entire week of trading, most traders adopted a wait and watch approach with both ginners/stockists and spinners having stocks to meet their requirements until mid-September. Further, revival in the yarn market, which is experiencing standstill situation since first week of June, could be the only factor to revive the trade activity in the cotton bales market.

The months of August and September is known as the off season for cotton traders as most of them were in preparation to procure new cotton crop, with the first phase to hit North India in early September and progressing towards Central India, beginning from October, and South India, beginning from November. Cotton supply is in full swing from end of October onwards across the country.

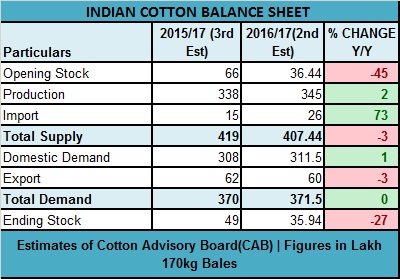

Shifting our focus on the balance sheet, the Cotton Advisory Board released its second estimates for the 2016/17 season with production estimated at 34.5 million bales(170kg each) versus 33.2 million bales in 2015/16 while raised imports to 2.6 million bales from 2.3 million bales in 2015/16 and revises exports downward to 6 million bales from 6.9 million bales.

Shifting our focus on the balance sheet, the Cotton Advisory Board released its second estimates for the 2016/17 season with production estimated at 34.5 million bales(170kg each) versus 33.2 million bales in 2015/16 while raised imports to 2.6 million bales from 2.3 million bales in 2015/16 and revises exports downward to 6 million bales from 6.9 million bales.

Consumption is estimated at 31.1 million bales for 2016/17 season which will take the ending stock for the season at 3.5 million bales. However, as per official data, consumption is slightly overstated and may likely be revised downward to 30 million bales or even less.

.jpg) As of June, total mill consumption is estimated at 21.9 million bales and as per our calculations, with another three months of average consumption at 7.5-7.6 million bales will take total consumption for the season at 29.3 million bales.

As of June, total mill consumption is estimated at 21.9 million bales and as per our calculations, with another three months of average consumption at 7.5-7.6 million bales will take total consumption for the season at 29.3 million bales.

Further, consumption during July and August may likely remain low averaging at 4.8 million bales(2.4 million bales for each month) as switchover to new tax regime(GST) brought the yarn market to a standstill hitting the sales of various spinning mills and limiting full scale yarn production.

On the crop scene, some major cotton producing districts of Maharashtra witnessed good rains since Thursday(Aug 17) which was brought some relief to thirsty crops. Further, forecast of heavy rains is likely to hit Maharashtra over the weekend and followed through into next week until Wednesday as per the Indian Meteorological Department(IMD). A good spell of widespread rains throughout next week will dissolve all poor yield concerns of cotton crops in Maharashtra.

Total cotton planting reached 118.15 lakh ha as of August 19 compared to same period last year at 101.54 lakh ha covering nearly 96.5 percent of the total normal area at 122.46 lakh ha and remained ahead 7 percent from the normal area as on date at 110.71 lakh. (Full Report)

Conclusion:

.jpg) Market participants have adopted a wait and watch approach evident in futures market, in subdued trade volume, and in physical trade. Cotton prices are usually on an uptrend spree during the final months of the season however ample stocks in both MNCs/ginners/stockists and spinning mills have kept cotton price more or less on a sideways trend.

Market participants have adopted a wait and watch approach evident in futures market, in subdued trade volume, and in physical trade. Cotton prices are usually on an uptrend spree during the final months of the season however ample stocks in both MNCs/ginners/stockists and spinning mills have kept cotton price more or less on a sideways trend.

Revival in the yarn market could bring a temporary uptrend, with the Gujarat S6 30mm, our benchmark for analysis, could touch first resistance at Rs 44,000/candy. As of August 18, Gujarat S6(30mm) traded at Rs 43,150/candy(86.12 cents/lb) and we believe, it is a long haul until prices touch first resistance levels and for that to become a reality, sustained demand is required for two consecutive weeks, which at present seems like a bleak possibility.

We have got to wait and see how August turns out in terms of trade and until then we hold on to a sideways to bearish trend with prices ending the 2016/17 season at around Rs 43,000/candy.

.jpg)

(By Commoditiescontrol Bureau; +91-22-40015534)