MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Masoor, White Pea, Moong and Chana declined for week ending on Saturday (August 14 - August 19) amid subdued buying activity from millers and traders at higher rates, arrivals of new Urad/Moong and good monsoon in producing kharif pulses region.

Week Highlights

# India Kharif Pulses Sowing Down 3.5 % As On Aug 16 At 130.68 Lakh Ha Vs 135.42 Last Year At Same Period. Tur : 40.81 Vs 49.91, Urad : 39.44 Vs 32.23, Moong : 30.50 Vs 32.60, Other Pulses: 19.70 Vs 20.18.

# India Fourth Advance Estimate For 2016-17 Vs Last Yr (In Lakh Ton), Tur: 47.8 Vs 25.6, Chana: 93.3 Vs 70.6, Urad: 28 Vs 19.5.Total Pulses: 229.5 Vs 163.5.

# India Government In A Notification Allows 122.23MT Pulses Export To Maldives Under Bilateral Agreement During 2017-18, Effective From April.

.bmp)

Burma Lemon Tur:

Tur lemon variety of Burma origin edged lower by Rs. 350 to Rs 4,150/100Kgs on subdued buying support from millers and traders at higher rates as demand was seen absent from last couple of days in processed Tur as wholesalers and retailers procured sufficient stocks to meet near term demand.

Rain was reported in some Tur producing areas of Maharashtra (Vidarbha), Karnataka, Madhya Pradesh and Andhra Pradesh pressurising the sentiment as rain is beneficial for Tur crop. However, yield is already affected in Karnataka and Maharashtra. Also, there is higher probability of Tur production to fall in the Maharashtra state mainly due to shift in acreage to other crops amid poor remunerations to farmers in last one year.

Meanwhile, stock liquidation by government will be a key factor to watch out, as it will play an important role in deciding future course of price trend and thus, hitting prices for the forthcoming crops.

.bmp) According to market experts, the government should fix the prices of Tur above minimum support and should not clear their stock below MSP or at current lower market prices. Selling Tur at lower prices may led to panic in market and likely to weigh on prices. This will not only hurt traders, but lower prices will impact farmers as well, as there will be higher probability for farmers to get poor rates for their produce during the kharif harvesting period 2017.

According to market experts, the government should fix the prices of Tur above minimum support and should not clear their stock below MSP or at current lower market prices. Selling Tur at lower prices may led to panic in market and likely to weigh on prices. This will not only hurt traders, but lower prices will impact farmers as well, as there will be higher probability for farmers to get poor rates for their produce during the kharif harvesting period 2017.

According to market sources, prices of Tur dal may get support due to festive period ahead as pipeline is empty and also higher prices of vegetables.

Statewise Kharif Tur Sowing Down 18.23 % As On Aug 16 Vs Same Period Last Yr (LAKH HA). Maharashtra:12.57 Vs 14.81, Karnataka:8.17 Vs 11.47, Uttar Pradesh:3.18 Vs 3.42, Andhra Pradesh:1.56 Vs 2.34, Madhya Pradesh:6.51 Vs 6.82, Gujarat:2.62 Vs 3.13, Telangana:2.37 Vs 4.06, Total:40.81 Vs 49.91.

Prprocessed Tur also priced lower by Rs 400-500/100Kg in the absence of buying support from wholesalers and retailers counters. Trading volume was negligible as sellers were active in the market. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 6,500/100 Kg, semi-Sortex at Rs 6,300 and regular at Rs 6,100.

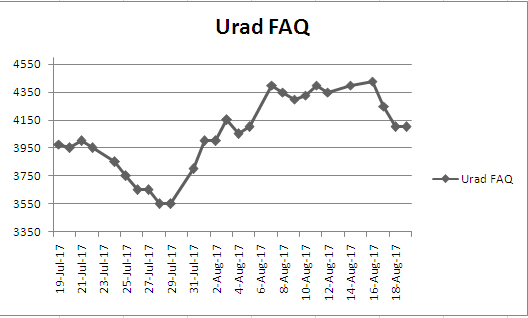

Burma Urad:

In Mumbai, Burma origin FAQ variety Urad traded lower by Rs 400 to Rs 4,050/100Kg dull business activity, higher acreage and also arrivals of new Urad began in few markets of Maharashtra. Demand in processed urad was dull from consumption centers at higher rates.

Rains reported in some Urad producing areas of Madhya Pradesh and Andhra Pradesh, pressurizing the sentiment as rain is beneficial for Urad crop.

Negligible supply pressure from Burma and scanty rain in major producing belt of Urad in Maharashtra may give support to prices at lower rates due to some crop loss and low yield.

Bikaner origin branded Urad dal price declined at Rs 5,700-5,800/100Kg. Tiranga brand of Mumbai was offered weak at Rs 6,200/100Kg. Parivar brand of Jalgaon also down at Rs 6,000/100Kg.

At Chennai, Urad FAQ and SQ variety fell this week by Rs 200-250 to Rs Rs 4,350/100Kg and Rs 5,400 respectively in ready business on subdued millers buying activity.

Buyers were cautious and were purchasing as per their immediate requirement due to fluctuation in urad prices from last one week.

Chennai based importers were active in purchasing urad this week from Burma on conditions to send cargo to Indian ports before September 25, as afterward there will be good availability of new domestic kharif urad crop.

Chennai based importers were active in purchasing urad this week from Burma on conditions to send cargo to Indian ports before September 25, as afterward there will be good availability of new domestic kharif urad crop.

However, higher acreage, sufficient availability of crop in carry forward domestic market and new kharif crop arrivals of Urad may dampened the sentiments.

Statewise Kharif Urad Sowing Up 22.37 % As On Aug 16 Vs Same Period Last Yr (LAKH HA),Karnataka:1.18 Vs 0.83, Andhra Pradesh:0.28 Vs 0.39, Maharashtra:4.66 Vs 4.35, Uttar Pradesh:4.99 Vs 5.93, Rajasthan:5.40 Vs 3.89, Madhya Pradesh: 17.79 Vs 11.18, Tamil Nadu:0.39 Vs 0.46. Total:39.44 Vs 32.23.

Chana Kantewala (Indore):

In Indore market, Chana priced eased by Rs 50 to Rs 5,600/100Kg on dull physical trade activity, weak cues from futures and slow demand in Chana dal.

Chana for September delivery settled weak by Rs.31 (0.6%) at Rs.5,551/100Kgs on the National Commodity & Derivatives Exchange Limited (NCDEX). Earlier in the day, the contract opened at Rs.5,577 dropped to Rs.5,525 and touched a high of Rs.5,634.

Australian origin Chana at Mumbai and Mundra port declined by Rs 150 to Rs 5,600/100 Kgs respectively on slack millers demand at higher rates and supply from Vessel M V YANGTZE KEEPER carrying 29,200 tonnes of Australia chana from overseas at Kandla port.

.bmp)

On other hand, new Chana crop of Australian origin (2017) declined by Rs 50 to Rs 5,050/100Kgs for October-November shipment and Rs 5,000 for November-December shipment. Australia chana for August delivery was traded lower at Rs 5,500/100Kg, down Rs 50.

In forward business, Australia origin chana was priced at $850 per ton on CNF basis Nhava- Sheva for August-September shipment. New crop at $800-$810 per ton for October-November shipment. Tanzania origin chana was priced at $825 per ton on CNF basis Nhava- Sheva for August-September shipment.

Australian Chana dal remained weak by Rs 100 to Rs 6,900/100 Kg on dull buying at higher rates. Domestic Chana dal of Maharashtra at Rs 7,000. Regular chana dal at Rs 6,900/100Kg. Chana besan variety offered at Rs 4,010/50 and Vatana besan at Rs 1,610/50 Kg. Vatana dal quoted at Rs 2,775.

Kabuli Chana in ready business at Indore market remained flat at Rs 13400 for 42-44 count and Rs 13200 for 44-46 count amid limited demand from exporters and stockiest despite improved arrivals.

As per market talks, yield and crop size of Chana is likely to be lower in Australia this year due to weather concern as it is said to be dry in key producing regions. Hence, buyers were interested to source at prevailing lower rates in forward business, on continued demand for ongoing festive period till Diwali and also sowing period starts from October in domestic markets.

Canada Masoor (Mumbai):

Canada origin crimson variety and Australia Masoor declined by Rs 200-300 to Rs 3,500/100Kg and Rs 3,800 respectively amid subdued mills buying support at higher rates and sufficient stock of imported and domestic Masoor.

On other hand, rates of Canada Masoor dal of Bhiwandi mills were traded weak at 4,500/100Kgs, for APMC Vashi market delivery on subdued buying activity.

Meanwhile, Masoor crop is in trouble in Canada and U.S due to adverse weather condition during growth period. A U.S based trader forecast U.S 2017-18 Masoor crop 437,000 tonnes, down 24 percent from last year despite a nine percent increase in acres. Canada’s crop is also struggling because a lot of green Masoor are grown in the drought-stricken region of south-central Saskatchewan. Trade source is forecasting below-average yields for the province.

.bmp)

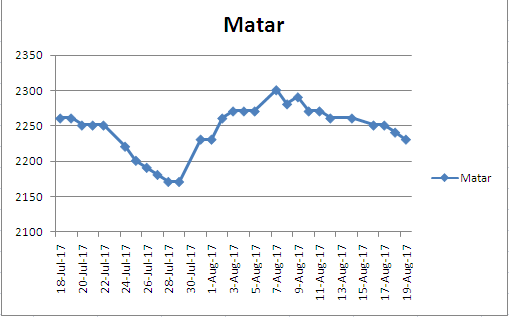

Canada White Pea (Mumbai):

Canadian origin white pea at Mumbai was offered down by Rs.50 to Rs 2,221/100Kgs on dull trade activity at existing rates coupled with adequate supply from overseas. Moreover, business activity in matar dal and besan was slow from consumption centers.

Though Matar prices is under pressure in the country due to higher supply from overseas, but rising Chana prices is likely to provide some push to prices, but gain could be limited due to sufficient supply. Consistent supply of Matar from overseas would weigh on prices with many vessel are in line up to reach Indian ports this month.

Vessel M V AKILI expected to arrive with 24,658 MT Canada Yellow Pea at Mumbai port soon. Vessel M V ALLIANCE 26,260 MT Russia White Pea likely to arrive Mumbai port On August 25. Vessel M V MANDARIN TRADERS carrying 30,000 MT Baltic Yellow Pea would arrive at the Mumbai port on August 29. Vessel M V RELIABLE carrying 40,000 MT France Yellow Pea is expected to arrive at Mumbai port on August 31.

Moong (Jaipur):

Moong priced declined as per quality at Rs 4,800/100Kg, down Rs 250 during the last week on subdued miller buying support and arrivals of new kharif Moong in Maharashtra, Karnataka, Andhra Pradesh and Madhya Pradesh.

As per market talk, harvesting of moong had began, but rain may damage standing crop of new Moong in Maharashtra and Karnataka.

Similarly, Moong dal prices also traded weak by Rs 200 to Rs 6,000/100Kg.

Kharif Mung Sowing Down 6.44 % As On Aug 16 Vs Same Period Last Yr (LAKH HA), Rajasthan:15.56 Vs 15.20, Karnataka:3.39 Vs 3.96, Maharashtra:4.44 Vs 4.86, Tamil Nadu:0.17 Vs 0.35, Andhra Pradesh:0.14 Vs 0.31, Madhya Pradesh:2.22 Vs 2.06, Odisha:1.65 Vs 1.52, Uttar Pradesh:0.40 Vs 0.48, Telangana:0.87 Vs 2.60, Total:30.50 Vs 32.60.

.bmp)

(By Commoditiescontrol Bureau +91-22-40015513)