MUMBAI(Commoditiescontrol)- US cotton futures witnessed trend reversal after USDA raises production to 20.5 million bales while fresh round of crop concerns arose in India due to unfavorable weather conditions.

US MARKET:

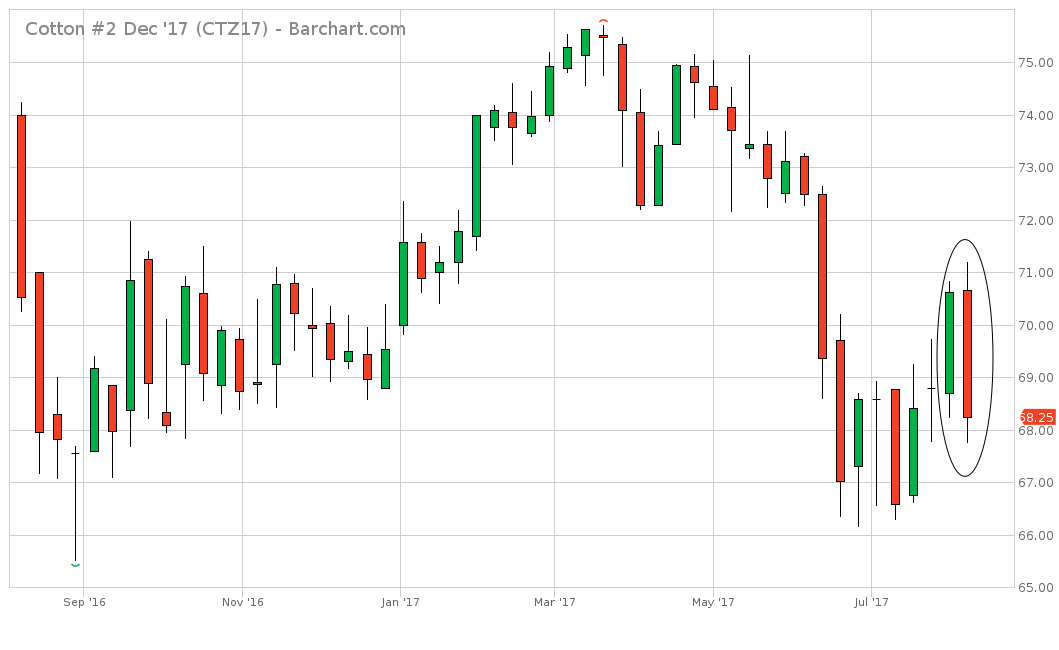

The US cotton futures ended the week on a bearish side with December incurring major losses of 2.37 cents/lb to settle at 68.25 cents/lb making a bearish engulfing pattern of the candlesticks.

Surprise move, by USDA, of raising production estimates by 1.5 million bales to 20.5 million bales with an average yield of average national yield of 892 lb/acre (compared to 867 lb/acre last year) on 11.05 million harvested acres plummeted December cotton futures to close limit down at 68.11 cents/lb on Thursday.

Pre-WASDE estimates ranged between 18.1 to a maximum of 19.5 million bales on doubts over large land abandonment in Texas. However, 8 percent abandonment from the planted area at 12.01 million acres did not effect the estimates and the lower abandonment figure leads to more dryland and marginal acres being harvested where bigger yields are not typical, therefore bringing down averages. (Full Report)

Many experts believe the figures in the WASDE report is overstated and consistency in weather conditions to remain favorable for the next two months is required for the bleak possibility of 20.5 million bales to turn into reality. However, history does not support such bleak possibilities and variations in yield due to inconsistency in favorable weather conditions is much more of a possibility. This would eventually bring down production estimates in the months ahead.

Thus, it should be noted that the historical average deviation between the August estimate and the final harvest is some 1.8 million bales

Traders and experts recommend taking the August WASDE figures ‘with a grain of salt’. The Rest of the World(ROW) beginning stocks at 41.59 million bales which includes a large Indian stocks at 12.59 million 480lb bales(16.1 million 170kg bales)is a proof that the figures are overstated as Indian figures in reality will remain at 10 million 170kg bales(Aug-July) and 0.4 million 170kg bales(Oct-Sept).

On the other hand, 2016/17 ending stocks dropped to 2.8 million 480lb bales after export shipments touched 14.8 million bales(plus 1 milllion bales of exports of own account) which takes total exports at 14.9 million bales.

Total carry over stood at 0.8 million bale which take the total commitments for 2017/18 season at 6.3 million bales. New sales were recorded at 79,317 bales of 480lb while shipments touched 0.12 million bales. However, these figures were only of the first three days of the marketing year hence, new sales were, via extrapolation, better than they appeared on the surface of this latest report. (Full Report)

USDA’s figures will steer prices going ahead unless major market participants find the WASDE report unbelievable which will eventually show in the price action in the next few weeks. Until then, strong support is placed at 65-66 cents level and if weather conditions remain favorable, then the market testing the support level would not be surprising.

However, bears hold your horses, as the large on-call commitments at 11.19 million bales with December at 3.4 million bales and a large outstanding export commitment at 6.1 million bales will provide the necessary support to prices.

If the September WASDE report holds production above 20 million bales and favorable weather conditions persist during the next few weeks then mills will hold on to their outstanding on-call commitments in hopes to fix at a lower levels of below 65 cents. This will put the bears back in the drivers seat.

.jpg) CHINA MARKET:

CHINA MARKET:

The ZCE cotton futures persisted uptrend as the January 2018 contract settled marginally higher 1 percent on new buying during the week.

The benchmark January contract settled at 15,225 yuan/tonne on Friday, rising 150 yuan/tonne over the week. Open Interest rose 43 percent to 217,506 lots implying major long addition during the week.

The market closed 3 out 5 session on the bullish sides with price hitting 2 month high at 15,375 yuan/tonne on Thursday however major long liquidation pressured prices to settle down 1 percent to 15,225 yuan/tonne.

China raised 2017/18 cotton production forecast by 10 percent, year on year, at 5.28 million tonnes according to the monthly balance sheet estimates(CASDE) released by the Ministry of Agriculture which pressured prices on Friday. (Full Report)

Meanwhile, the state reserve auctioned a total of 148,602 tonnes from which it sold a total of 122,757 tonnes for the week ended August 11, recording weekly turnover at 83 percent.

Since the commencement of auction, around 2,269,108 tonnes (13.35 million 170kg bales) were sold from the total offered quantity of 3,363,148 tonnes (19.78 million 170kg bales). (Full Report)

INDIAN MARKET:

.jpg) The Indian cotton futures modestly gained with October ending the week tad higher Rs 20/bale to close at Rs 18,590/bale.

The Indian cotton futures modestly gained with October ending the week tad higher Rs 20/bale to close at Rs 18,590/bale.

Prices strived to breach the symmetrical triangle pattern and were successful until Thursday when it touched a high of Rs 19,140/bale however the efforts of bull speculators went in vain as trend reversal on the ICE futures halted rally.

In the last report we mentioned that another sustained rise/close above Rs 18,640 with bullish candle at the end of the week would likely confirm the trend line breakout however prices settled down at Rs 18,590 wiping all the gains recorded by the four session rally.

Major long liquidation in the last two sessions reversed trend as prices slumped from Rs 19,140 to Rs 18,590. Open interest dropped 7 percent to 2,063 lots(51,575 bales of 170kg) on Thursday from previous session at 2,214 lots(55,350 bales of 170kg) confirming the exit by the bulls.

Uptrend in price could continue if prices close above Rs 19,140/bale. Traders long can maintain a stop loss at Rs 18,300.

Inter-week resistance is placed at Rs 18,743-Rs 18,987-Rs 19,140 and support is placed at Rs 18,347-17,707. (Technical Report)

DOMESTIC SPOT MARKET:

Spot prices witnessed modest gains over the week on tight selling mainly influenced by the trend on the MCX futures.

.jpg) North India market prices, which most of the time moves in line with the futures market trend, rallied for four out of five trading sessions recording a weekly average at Rs 4,484-4,518/maund(Rs 42,800-43,120/candy), up 40-50/maund.

North India market prices, which most of the time moves in line with the futures market trend, rallied for four out of five trading sessions recording a weekly average at Rs 4,484-4,518/maund(Rs 42,800-43,120/candy), up 40-50/maund.

In Central India, Madhya Pradesh cotton prices rose three of the five trading sessions, taking the weekly average higher Rs 370/candy to Rs 43,400/candy. Meanwhile, modest gains ranging between Rs 200-250/candy was observed in Gujarat at Rs 43,400/candy and Maharashtra at Rs 43,850/candy.

Four session rally on the MCX futures over crop concern in Maharashtra and strengthening rupee against dollar influenced seller’s intentions to quote a higher asking rates. Further, some of them were running low on inventories and were not ready to offload at lower bid rates.

However, local mills with intention to run on a hand to mouth basis actively procured small lot deals according to their requirements. The demand lasted merely for few days and a trend reversal on MCX futures prompted them to adopt a wait and watch approach.

Most of the other spinners have stocked up inventories to satisfy their needs at least until end of August while MNCs have stocked up for the next two months. Further, amongst the lots, some of them were satisfied with the May commitments of imported cotton which has reached around 20 lakh bales with probabilities of another 5 lakh bales left to arrive.

Further, almost standstill situation in the yarn market since mid-May due to various factors and confusion in relation to GST has curbed buying enthusiasm of major spinners. Most textile mills were in process of obtaining their GST numbers without which no deals could be agreed upon. Market sources believe that most of them will obtain their GST numbers by next week after which a revival could occur in the yarn market. At the moment, tentative yarn offer were made however no major deal is reported. (Price List)

On the crop scene, the fear of crop loss has more or less subsided in Gujarat with trade sources confirming minimal damage below market speculation of 20-30 percent. Saurashtra, which covers nearly 73 percent of the total cotton area of the state, is likely to incur minor losses while major damage could be observed in Banaskantha and Patan where the cotton area sown is not more than 1 lakh ha.

However, just when all fear was about to fade away, deficient rains in Maharashtra for the third consecutive week has raised crop concern in major producing districts(Nagpur, Aurangabad, Yavatmal and Jalgaon). Agri Experts have recommended to use irrigation facilities to provide necessary moisture to standing crops. Weather forecast of light and scattered rains for the next few days is not supportive either and another week of deficient rains could bring the bulls back into play.

Total cotton planting reached 117.11 lakh ha as of August 10 compared to same period last year at 99.0 lakh ha covering nearly 95.6 percent of the total normal area at 122.46 lakh ha and remained ahead 2.4 percent from the normal area as on date at 109.16 lakh. (Full Report)

Fairly widespread rains could likely occur over Karnataka, Punjab and Telangana from Monday onwards. Meanwhile, good spell of rains could likely occur after August 16 in Central India.

Conclusion:

.jpg) Short term trend is painting a bullish picture on heels of fresh round of crop concern in Maharashtra and possible revival in yarn market. However, long term trend seems bearish considering the good volume of stocks in spinners inventories and if mother nature supports the growers then estimates of large production ranging between 37-40 million bales will turn into reality.

Short term trend is painting a bullish picture on heels of fresh round of crop concern in Maharashtra and possible revival in yarn market. However, long term trend seems bearish considering the good volume of stocks in spinners inventories and if mother nature supports the growers then estimates of large production ranging between 37-40 million bales will turn into reality.

The USDA WASDE reports ending stock at 18 million 170kg bales for the 2017/18(Aug-July) season which is overstated and we keep the ending stock figures ranging between 3.5-3.8 million bales which is ample enough to satisfy the October month’s consumption at 2.5 million bales.

Taking the Gujarat S6 30mm, as the basis of our analysis, spot prices has not yet touched the first resistance level at Rs 44,000/candy this week but may likely hit those levels by end of August after which either the bears will topple over the bulls or a sideway trend would be observed.

In the last season, the new crop price started at major gap of Rs 3000/candy at Rs 43,500/candy from old crop price at Rs 46,500/candy while other varieties saw a wider price difference in comparison. Hence, there is a possibility for the 2017/18 season to begin at Rs 40,000/candy and eventually falling to Rs 38,000/candy by end October as arrival picks off.

Exports may remain sluggish if Rupee against dollar hovers below the 65 point level which at present is trading at 64.13. Further, uncompetitive international cotton basis will likely weigh on export sentiment in October. Forward contract rates of various MNCs ranged between Rs 38,000-40,000/candy for October while ranged between Rs 37,000-39,000/candy for November.

The Gujarat S6(30mm) traded at Rs 43,450/candy(86.58 cents/lb) as of August 11.

(By Commoditiescontrol Bureau; +91-22-40015534)