MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Masoor, White Pea, Moong, Chana along with Kabuli Chickpea continued to trade lower for week ending on Saturday (July 24-29) amid lackluster trade activity, fresh supply from overseas and good rain in Kharif producing region.

Week Highlights

# India Kharif Pulses Sowing Up 6.92 % As On July 26 At 114.88 Lakh Ha Vs 107.44 Last Year At Same Period. Tur : 34.88 Vs 41.28, Urad : 34.38 Vs 25.43, Moong : 27.58 Vs 27.07, Other Pulses: 17.84 Vs 13.21.

# Only 15% Of U.S Matar Crop Is In Good/Excellent Condition, While 42% Fields Are Fair Condition & 43% Very Poor Condition Due To Dry Weather.

# Maharashtra Government In New Notification Informed To Remove Stock Limit On All Pulses. Earlier Chana Was Under Stock Limit.

.bmp)

Burma Lemon Tur:

Burma origin lemon Tur offered lower by Rs 150 to Rs 3,125/100Kg on fresh supply around 565 containers from overseas and also dull millers buying activity. (1 container = 24 MT). Demand in processed Tur from consumption centers was dull and sellers in processed Tur were active in the market.

Substantial stocks available with the government agencies, traders and farmers, because of a record output last year, has pulled down prices of tur sharply in the recent months.

Traders said allowing pulses exports would somewhat ease the market. The government must step in to stop further fall in prices of tur by putting quantitative restrictions on imports and it can’t ban imports from many nations amid bilateral agreements.

Overall sowing of tur may not decline sharply from last year due to sufficient stocks in the market. Even if the tur output in 2017-18 crop year declines, there will be still sufficient stocks to curb any rise in prices.

The Food Corporation of India (FCI) has sold 5417.08 MT of Tur in Maharashtra through e-auction which has been procured by the agency earlier at MSP or under price stabilization scheme for buffer stock. The auction has been conducted from July 17-24, 2017.

Statewise Kharif Tur Sowing Down 15.50 % As On July 26 Vs Same Period Last Yr (LAKH HA). Maharashtra:11.41 Vs 13.10, Karnataka:7.36 Vs 10.22, Uttar Pradesh:2.13 Vs 1.80, Andhra Pradesh:0.66 Vs 1.71, Madhya Pradesh:5.70 Vs 6.03, Gujarat:2.45 Vs 2.42, Telangana:2.31 Vs 3.15, Total:34.88 Vs 41.28.

According to trade sources, Malavi and Mozambique red Tur (CNF) was priced lower at $330 per tonne for July-August shipment, whereas Mozambique white Tur unchanged at $370-$380, Matwara offered at $370-$380 per tonne and Arusha at $420-$425 per tonne for August-September shipment. Similarly, Sudan origin Tur (CNF) was said to be at $470-$475 per tonne in ready shipment.

Prices of processed Tur remained weak on dull trade activity from consumer centre’s at existing rates. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,250/100 Kg, semi-Sortex at Rs 5,000-5,100 and regular at Rs 4,850-4,950.

But, demand in processed Tur expected for short term period from July end- August 1st week due to lower rates, monthly counter as pipeline is empty with retailers and wholesalers counters after imposed of GST.

.bmp)

Burma Urad:

In Mumbai, Burma origin FAQ and SQ variety Urad was priced lower by Rs 350-400 to Rs 3,550/100Kg and Rs 4,500/100Kg respectively in the absence of buying from millers, fresh supply around 217 containers at Mumbai port.

However, higher acreage, sufficient availability of crop in domestic market, regular arrivals of summer crop urad and supply from Burma will pressurized the prices more in near future.

Bikaner origin branded urad dal priced weak at Rs 4,850-4,950/100Kg. Tiranga brand of Mumbai was offered at Rs 5,200/100Kg. Parivar brand of Jalgaon also ruled weak at Rs 5,000/100Kg.

Statewise Kharif Urad Sowing Up 35.19 % As On July 26 Vs Same Period Last Yr (LAKH HA). Karnataka:1.14 Vs 0.77, Andhra Pradesh:0.23 Vs 0.33, Maharashtra:4.32 Vs 3.83, Uttar Pradesh:3.53 Vs 3.79, Rajasthan:5.40 Vs 3.50, Madhya Pradesh: 16.23 Vs 9.72, Tamil Nadu:0.31 Vs 0.35. Total:34.38 Vs 25.43.

At Chennai, Urad FAQ and SQ variety traded down this week by Rs 400-450 to Rs Rs 3,750/100Kg and Rs 4,350 respectively in ready business as sellers were active in the market.

.bmp)

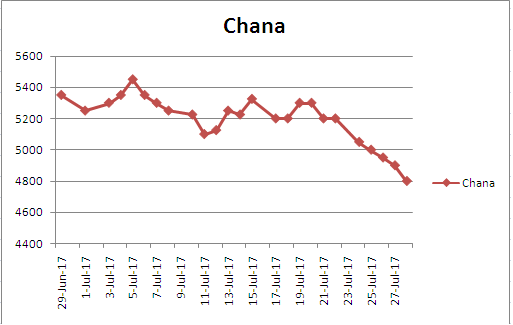

Chana Kantewala (Indore):

In Indore market, Chana priced weak by Rs 300 at Rs 4,800-4,825/100Kg due to dull physical trade activity, weak cues from futures and slack demand in Chana dal as demand had been shifted to other dals, such as Matar dal, Tevda dal and Batri dal due to cheaper prices.

Chana for September delivery ended lower by Rs.18 (-0.37%) at Rs.4,825/100Kgs on the National Commodity & Derivatives Exchange Limited (NCDEX). Earlier in the day, the contract opened at Rs.4,850 dropped to Rs.4,772 and touched a high of Rs.4,850.

Australia origin Chana in ready business at Mundra and Mumbai port remained weak by Rs 400 to Rs 4,800/100Kg and Rs 4,850 amid dull trade and fresh supply around 253 containers at Mumbai port.

Similarly, new Chana crop of Australian origin (2017) eased by Rs 100-150 to Rs 4,750/100Kgs for October-November shipment and Rs 4,700 for November-December shipment.

In forward business, Australia origin chana was priced lower around $750 per ton on CNF basis for August shipment. New crop down at $700 per ton for October-November shipment.

Australian Chana dal traded lower at Rs 6,000/100 Kg, down Rs 300. Domestic Chana dal of Latur origin was priced at Rs 6,200. Regular chana dal was traded at Rs 6,100/100Kg. While, Chana besan variety offered flat at Rs 3,750/50 Kg and Vatana besan at Rs 1,580/50 Kg. Vatana dal was unchanged at Rs 2,750.

NAFED procures 56969.84 MT of Chana As On July 27. Rajasthan: 42,698.68 MT, Madhya Pradesh: 12,966.16 MT, Uttar Pradesh: 997 MT and Haryana: 308 MT. Total target of procurement by government agencies is around 4 lakh metric tonnes of Chana.

Kabuli Chana in ready business at Indore market fell by Rs 500-600/100Kg to Rs 12300 for 42-44 count and Rs 12100 for 44-46 count as demand turned slack from buyers at prevailing rates. According to our market sources, buyers and stockiest had already purchased the commodity in the previous week as per their needs and currently have sufficient inventories in hand.

According to market sources, demand in spot markets were below expectation and prices were declining day by day as buying from wholesaler and retailers counters were slow as demand of Chana dal had shifted to other dals due to cheaper prices. No sale was reported in Chana dal due to weakness in other pulses. Earlier, demand likely to gather pace for short term period ahead of festival. But, sentiments had changed, traders and millers holding Chana were now active to liquidate their stock in the market.

Demand and sale of Chana in Australia slowed down in some areas which produced in large quantities last year amid weak sentiments due to lower prices and acreage of new crop likely to decline.

As per sources in Australia, a new-crop estimate of 1.5 million tonnes was too high. The level of activity this year is probably half compared to what was at this time last year (estimates of previous year was 2.1 million tonnes).

It is difficult to forecast yields due to dry winter till date in Australia’s key Chana-producing areas.

However, Estimation of crop can be as small as 1 million tonnes with average yields or can be big as 1.5 million tonnes only if the weather condition improve.

Demand from India for Australia’s old-crop chickpeas is still being seen and stock left in Australia is almost negligible.

Canada Masoor (Mumbai):

Canada origin crimson variety Masoor remained weak by Rs 200 to Rs 3,000-3,300/100Kgs due to negligible buying from millers and stockiest owing the back of absence in demand from consumption centers. Further, weak trend in prices of Tur accompanied with supply from overseas in vessel Densa Jaguar/ Lowlands Amstel and adequate stock position in Madhya Pradesh and Uttar Pradesh have restricted the prices.

Moreover, importers were in dismay and hesitant as they were suffering with heavy losses amid difference in purchase price and current market rates.

Moreover, rates of Canada Masoor dal of Bhiwandi mills were offered at 4,100/100Kgs, for APMC Vashi market delivery.

.bmp)

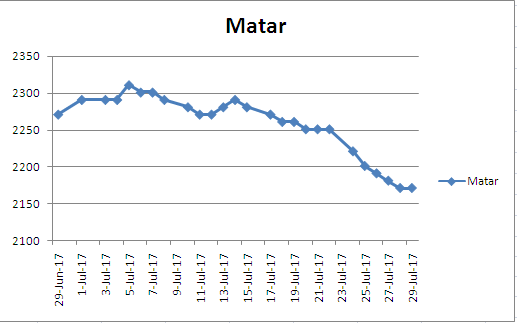

Canada White Pea (Mumbai):

Canada origin white pea at Mumbai traded lower by Rs 50 to Rs 2,171/100Kgs on dull trade activity coupled with adequate supply from overseas. Moreover, business activity in matar dal and besan was slow from consumption centers.

Fresh supply of two break bulk vessel arrived from Russia at Kolkata port along with supply in containers were also pressurizing the sentiments.

Prices may trade steady to firm in the near term at lower rates ahead festive period.

Moong (Jaipur):

Moong priced ruled weak as per quality at Rs 4,000-4,100/100Kg, down Rs 200 during the last week on dull miller buying support and arrivals of summer crop moong from producing region. Similarly, Moong dal prices also remained lower by Rs 100 to Rs 5,100/100Kg.

Immediate rainfall needed within 5-7 days at major producing centers of Tur and moong region in Karnataka and also in Marathwada region of Maharashtra. Earlier rain was reported good in June month, but total dry weather in July month.

Statewise Kharif Mung Sowing Up 1.88 % As On July 26 Vs Same Period Last Yr (LAKH HA). Rajasthan:14.55 Vs 11.97, Karnataka:3.27 Vs 3.74, Maharashtra:4.02 Vs 4.37, Tamil Nadu:0.15 Vs 0.35, Andhra Pradesh:0.12 Vs 0.28, Madhya Pradesh:1.93 Vs 1.71, Odisha:1.16 Vs 1.05, Uttar Pradesh:0.31 Vs 0.31, Telangana:0.76 Vs 2.60. Total:27.58 Vs 27.07.

.bmp)

(By Commoditiescontrol Bureau +91-22-40015513)