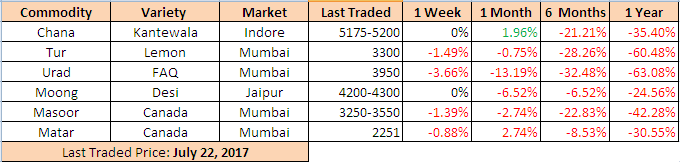

MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Masoor, White Pea, Moong, Chana along with Kabuli Chickpea remained weak for week ending on Saturday (July 17-22) amid lackluster trade activity and good rain in Kharif producing region.

Pulses prices are under stress due to last year’s sharp decline in prices. Majority of the farmers have shifted from Tur to Urad/Cotton cultivation due to better price realizations of the crop last year. Prices of pulses are likely to remain below MSP this season and therefore most of the procurement in the coming season is likely. Cropping Pattern had not changed much compare to last year as farmers have few alternatives. Clear picture will emerge at the end of the season when the sowing window closes. Prices will depend on sowing situation and government policies.

Week Highlights

# India Kharif Pulses Sowing Up 3.35 % As On July 19 At 93.36 Lakh Ha Vs 90.33 In Same Period Last Year. Tur : 29.32 Vs 36.30, Urad : 26.71 Vs 21.40, Moong : 23.09 Vs 24.82, Other Pulses: 14.06 Vs 7.54.

# MP Government Procures Around 1.70 LT Of Summer Moong Crop So Far Since June 10. It Exceeds Govt Target Of 1.5 LT. State Summer Moong Production Estimated At 3LT. Agency Also Buys 17,000 Tonne Urad.

Burma Lemon Tur:

Burma Tur lemon variety traded lower by Rs 50 to Rs 3,350/100Kgs due to sluggish buying from millers and traders, fresh supply around 241 containers from overseas at Mumbai port. (1container = 24 MT). Demand in processed Tur from consumption centers was dull and sellers in processed Tur were active in the market.

The market situation is not good with neither traders nor farmers are happy at the moment and with African Tur being offered at the lower rates, there is very bleak possibility of any sharp rise in Tur prices next season unless government take any bold measures.

The government should support Tur prices by putting quantitative restrictions on imports and it can’t ban imports from many nations amid bilateral agreements.

Statewise Kharif Tur Sowing Down 19.22 % As On July 19 Vs Last Yr At Same Period (LAKH HA). Maharashtra:9.66 Vs 12.46, Karnataka:7.08 Vs 9.07, Uttar Pradesh:1.52 Vs 1.40, Andhra Pradesh: 0.43 Vs 1.19, Madhya Pradesh:4.63 Vs 5.17, Gujarat:2.12 Vs 1.75, Telangana:1.73 Vs 3.09. Total:29.32 Vs 36.30.

On other hand, prices of processed Tur eased on dull trade activity from consumer centre’s at existing rates. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,450/100 Kg, semi-Sortex at Rs 5,275-5,300 and regular at Rs 5,050-5,100.

But, demand in processed Tur expected for short term period from July end- August 1st week as pipeline is empty with retailers and wholesalers counters after imposed of GST.

Spot Technical Trend: Further Weakness Below 3250 On Fall Below 3250 Slide Continue Towards 3000-2725. Resistance At 3500-3950. Pull Back Reversal Above 3950.

.bmp)

Burma Urad:

In Mumbai, Burma origin FAQ and SQ variety Urad was priced lower by Rs 200-250 to Rs 3,950/100Kg and Rs 4,950/100Kg respectively in the absence of buying from millers, fresh supply around 75 containers at Mumbai port owing to the back of poor demand from key consumption centers.

Last couple of week, Urad prices had declined sharply on panic selling in domestic market due to good monsoon in producing area, higher acreage and supply from Burma at Mumbai and Chennai port. But, now buyers were active at lower rates and no supply pressure from Burma in near future as low quantity of cargo may arrive as not much trade done by Indian buyers from Burma. Prices can get support around Rs 300-400 for short term.

However, higher acreage, sufficient availability of crop in domestic market, regular arrivals of summer crop urad will limit the gain.

Bikaner origin branded urad dal priced weak at Rs 5,350-5,500/100Kg. Tiranga brand of Mumbai was offered at Rs 5,700/100Kg. Parivar brand of Jalgaon also ruled weak at Rs 5,600/100Kg.

Statewise Kharif Urad Sowing Up 24.81 % As On July 19 Vs Same Period Last Yr (LAKH HA). Karnataka:1.09 Vs 0.75, Andhra Pradesh: 0.20 Vs 0.28, Maharashtra: 3.48 Vs 3.65, Uttar Pradesh: 1.10 Vs 2.98, Rajasthan: 4.62 Vs 3.19, Madhya Pradesh: 13.67 Vs 7.95, Tamil Nadu: 0.26 Vs 0.30, Total: 26.71 Vs 21.40.

At Chennai, Urad FAQ and SQ variety traded down this week by Rs 100-150 to Rs Rs 4,250/100Kg and Rs 4,950 respectively in ready business as sellers were active in the market.

Similarly, Urad SQ variety priced lower at Rs 4,900/100Kg for August delivery.

Spot Technical Trend: Expect Slide Towards 3725-3200-3024. Expect Atleast 3725 In Near Term To Short Term. Resistance Will Be 4208-4416-4625. Reversal Above 4625 Closing. Exit Long On Rise To Resistance.

.bmp)

Chana Kantewala (Indore):

In Indore market, Chana priced more or less unchanged at Rs 5,175-5,200/100Kg due to slow physical trade activity, weak cues from futures and slack demand in Chana dal as demand had been shifted to other dals, such as Matar dal, Tevda dal and Batri dal due to cheaper prices.

Chana for September delivery was settled weak 1.6 per cent or Rs 81 down at Rs.5,160/100Kgs on the National Commodity & Derivatives Exchange Limited (NCDEX). Earlier in the day, the contract opened at Rs.5,226/100Kgs and slid to Rs 5,124 and had touched a high of Rs.5,233/100Kgs.

On other hand, Australia origin Chana in ready business at Mundra and Mumbai port remained weak by Rs 100 to Rs 5,250/100Kg and Rs 5,300 amid dull trade and fresh supply around 184 containers at Mumbai port.

Similarly, new Chana crop of Australian origin (2017) eased by Rs 50 to Rs 4,950-5,000/100Kgs for October-November shipment and Rs 4,850-4,900 for November-December shipment.

In forward business, Australia origin chana was priced around $815 per ton on CNF basis for August shipment. New crop offered at $750 per ton for October-November and $720 per ton for November-December shipment.

Australian Chana dal traded flat at Rs 6,500/100 Kg. Domestic Chana dal of Latur origin was priced unchanged at Rs 6,700. Regular chana dal was traded at Rs 6,400/100Kg. Chana besan variety of Samrat brand at Rs 3,750/50 Kg+5% GST and Vatana besan at Rs 1,575/50 Kg+5% GST. While, Vatana dal was eased at Rs 2,750.

NAFED procures 54735.41 MT of Chana As On July 20. Rajasthan: 41,997.27 MT, Madhya Pradesh: 11,494.69 MT, Uttar Pradesh: 946.80 MT and Haryana: 296.65 MT. Total target of procurement by government agencies is around 4 lakh metric tonnes of Chana.

Kabuli Chana in ready business at Indore market fell by Rs 200-300/100Kg to Rs 12500 for 42-44 count and Rs 12300 for 44-46 count amid subdued demand from exporters and stockiest despite low arrivals.

According to market sources, demand in near future will gradually gather pace for short term period from July- August-September due to upcoming festive period and also on fall in supplies from producing regions and seven months for arrivals of new crop.

.bmp)

Canada Masoor (Mumbai):

Canada origin crimson variety Masoor remained weak by Rs 50 to Rs 3,250-3,550/100Kgs amid slack buying support, weak trend in tur prices coupled with adequate supply of crop from producing belts. Further, absence of demand in Masoor dal from consumption centers had exerted pressure on price.

Moreover, rates of Canada Masoor dal of Bhiwandi mills were offered at 4,350/100Kgs, for APMC Vashi market delivery.

Vessel Densa Jaguar from Canada had discharged 486 MT Pulses till date and 7014 MT Balance to discharge. Vessel carrying 7500 MT Masoor At Mumbai port.

According to shipping sources, Vessel M V LOWLANDS AMSTEL carrying 25,200 tonnes of Masoor and 12,600 tonnes of Yellow pea from Canada had arrived at Mumbai port on 20th July and will start discharging its cargo within couple of days.

Importers were bearing huge losses in Masoor due to difference in purchase cost against current market prices and were hesitating to release their cargo.

In order the support the falling prices NAFED has procured 27,133.24 MT of Masoor as on July 15.Uttar Pradesh:7352.55 MT and Madhya Pradesh:19780.69 MT. Total target of procurement by government agencies is around 1 lakh metric tonnes of Masoor.

.bmp)

Canada White Pea (Mumbai):

Canada origin white pea at Mumbai traded lower by Rs 30 to Rs 2,251/100Kgs on dull trade activity despite cheaper prices compare to other pulses. Business activity in matar dal and besan was as per requirement from consumption centers due to cheaper prices compare to processed chana.

Prices may trade steady to firm in the near term ahead festive period and limited supply from overseas.

While, new crop Canada white pea (2017) offered unchanged at Rs 2,175/100Kgs for September-October shipment.

.bmp)

Moong (Jaipur):

Moong priced ruled weak as per quality at Rs 4,200-4,300/100Kg, down Rs 100 during the last week on dull miller buying support and arrivals of summer crop moong from producing region. Similarly, Moong dal prices also remained lower by Rs 100 to Rs 5,200-5,300/100Kg.

Statewise Kharif Mung Sowing Down 6.97 % As On July 19 Vs Same Period Last Yr (LAKH HA). Rajasthan:12.01 Vs 10.99, Karnataka: 3.13 Vs 3.58, Maharashtra: 3.39 Vs 4.15, Tamil Nadu: 0.14 Vs 0.35, Andhra Pradesh:0.10 Vs 0.26, Madhya Pradesh:1.54 Vs 1.44, Odisha:0.87 Vs 0.64, Uttar Pradesh:0.20 Vs 0.28, Telangana:0.68 Vs 2.60, Total: 23.09 Vs 24.82.

.bmp)

(By Commoditiescontrol Bureau +91-22-40015513)