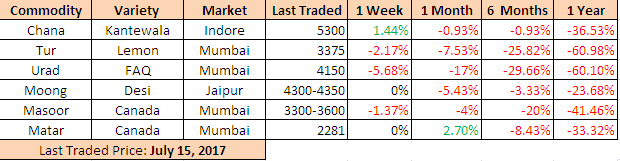

MUMBAI (Commoditiescontrol) – Pulse market witnessed mixed trend for week ending on Saturday (July 10-15). Tur, Urad and Masoor traded lower amid sluggish buying from millers. While, Chana and Kabuli Chickpea moved up on fresh trade activity. On other hand, White Pea and Moong prices remained flat on slow trade activity.

Trading activity in pulses were negligible in the domestic market as major traders have still not received GST number and they are finding difficult to trade for transportation and also for delivery purpose. Millers were also still busy in deregistering their brands.

Good rain in producing region had also dampened sentiment as it beneficial for kharif crop.

Week Highlights

# India Kharif Pulses Sowing Up 23.77 % As On July 12 At 74.61 Lakh Ha Vs 60.28 Last Year. Tur : 21.28 Vs 23.41, Urad : 20.83 Vs 13.54, Moong : 18.96 Vs 17.59, Other Pulses: 13.44 Vs 5.60.

# NCDEX Chana Recieves Encouraging Reponse On First Day Of Relaunch. The contracts registered a turnover of Rs 91 crore with trading volume of 17,380 tonnes. On Friday, its open Interest stood at 6,990 tonnes.

# Maharashtra Government Advised Farmers To Postpone Kharif Crop Sowing Till Jul 20.

# Madhya Pradesh Government Buys 1.44 Lakh Tons Summer Moong From Jun 10-July 10 At MSP 5225.

# Chhattisgarh Government Announces Mandi Tax Waiver On Raw Material Purchased By New Agri & Food Processing Industry From Date Till 5 Yrs, Equal To 75% Of Investment.

Burma Lemon Tur:

Burma Tur lemon variety traded lower by Rs 100 to Rs 3,375/100Kgs due to sluggish buying from millers and traders despite slow arrivals in domestic markets as farmers were busy in Kharif pulses sowing. Demand in processed Tur from consumption centers was dull and sellers in processed Tur were active in the market.

Availability of imported Tur at lower rates coupled with good crop in overseas had pressurized the sentiments.

As per market talk, prices of Tur are trading below the MSP set by the Government. The Government should lift the ban on exports and stop imports to give support to prices from falling in the country. Government had procured large quantity of Tur to support prices from falling. But these efforts failed to arrest the falling in Tur prices.

Statewise Kharif Tur Sowing Down 9 % As On July 12 Vs Last Yr (LAKH HA). Maharashtra:7.43 Vs 6.39, Karnataka:4.76 Vs 7.48, Uttar Pradesh:1.20 Vs 1.08, Andhra Pradesh:0.39 Vs 1.07, Madhya Pradesh:3.21 Vs 2.44, Gujarat:1.49 Vs 0.89, Telangana:1.50 Vs 2.71, Total:21.28 Vs 23.41.

On other hand, prices of processed Tur quoted flat on thin trade activity from consumer centre’s at existing rates. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,500/100 Kg, semi-Sortex at Rs 5,350-5,400 and regular at Rs 5,200.

.bmp)

Burma Urad:

In Mumbai, Burma origin FAQ and SQ variety Urad was priced lower by Rs 250 to Rs 4,150/100Kg and Rs 5,200/100Kg respectively on muted buying from millers owing to the back of poor demand from key consumption centers. Good rain in producing region of urad had also dampened sentiment as it is beneficial for kharif crop.

Urad prices likely to pressurize more in near future due to increase in sowing area of Urad due to better prices compare to other pulses, sufficient availability of crop in domestic market, regular arrivals of summer crop urad and supply from Burma.

Bikaner origin branded urad dal priced weak at Rs 5,800-5,900/100Kg. Tiranga brand of Mumbai was offered at Rs 6,100/100Kg and Parivar brand of Jalgaon quoted at Rs 6,000/100Kg.

Statewise Kharif Urad Sowing Up 53.84 % As On July 12 Vs Last Yr (LAKH HA). Karnataka:0.86 Vs 0.70, Andhra Pradesh:0.19 Vs 0.26, Maharashtra:2.89 Vs 1.81, Uttar Pradesh:0.82 Vs 2.69, Rajasthan:4.16 Vs 2.66, Madhya Pradesh: 10.21 Vs 3.87, Tamil Nadu:0.24 Vs 0.29, Total:20.83 Vs 13.54.

NAFED Procures 14424.92 MT Urad In Madhya Pradesh Under PSS On 13 July.

At Chennai, Urad FAQ and SQ variety traded down this week by Rs 200 to Rs Rs 4,400/100Kg and Rs 5,050 respectively in ready business as sellers were active in the market. Demand in processed urad was sluggish from consumption centers.

Similarly, Urad SQ variety priced lower at Rs 5,150/100Kg for August delivery.

.bmp)

Chana Kantewala (Indore):

In Indore market, Chana priced moved up by Rs 100 to Rs 5,300/100Kg during the last week as buyers were sourcing the commodity and slow domestic arrivals in major states. Further, re-launch of Chana futures by SEBI on NCDEX had also supported the price.

On other hand, Australia origin Chana in ready business at Mundra and Mumbai port remained flat at Rs 5,450/100Kg and Rs 5,400 amid limited buying activity against thin supply from overseas.

While, new Chana crop of Australian origin (2017) offered lower by Rs 50 to Rs 5,000/100Kgs for October-November shipment and Rs 4,900 for November-December shipment.

As per market sources, Australia origin chana in forward business was traded around $830 per ton on CNF basis for August shipment.

Australian Chana dal traded flat at Rs 6,500/100 Kg. Domestic Chana dal of Latur origin was priced unchanged at Rs 6,700. Regular chana dal was traded at Rs 6,400/100Kg. Chana besan variety of Samrat brand at Rs 3,775/50 Kg+5% GST and Vatana besan at Rs 1,601/50 Kg+5% GSt. While, Vatana dal was eased at Rs 2,750.

NAFED procures 53,694.90 MT of Chana As On July 13. Rajasthan: 41,633.47 MT, Madhya Pradesh: 10,872.89 MT, Uttar Pradesh: 946.80 MT and Haryana:241.75 MT. Total target of procurement by government agencies is around 4 lakh metric tonnes of Chana.

Kabuli Chana in ready business at Indore market gained sharply by Rs 600-700/100Kg to Rs 12700-12800 for 42-44 count and Rs 12500-12600 for 44-46 count amid rise in demand from exporters and stockiest coupled with shortage of ready stock.

According to market sources, prices are likely to surge for short period ( July-August-September month) due to slow arrivals in domestic market and also from overseas, re-launch of Chana futures on the local bourses. Demand in near future will gradually gather pace and support prices due to upcoming festive period and eight months for arrivals of new crop.

.bmp)

Masoor (Mumbai):

Canada origin crimson variety Masoor remained weak by Rs 50-100 to Rs 3,300-3,600/100Kgs amid slack buying support, weak trend in tur prices coupled with adequate supply of crop from producing belts. Further, absence of demand in Masoor dal from consumption centers had exerted pressure on price.

Moreover, rates of Canada Masoor dal of Bhiwandi mills were offered at 4,400/100Kgs, for APMC Vashi market delivery.

According to shipping sources, Vessel M V LOWLANDS AMSTEL carrying 25,200 tonnes of Masoor and 12,600 tonnes of Yellow pea from Canada is expected to arrive at Mumbai port on 15th July 2017.

Importers were bearing huge losses in Masoor due to difference in purchase cost against current market prices and were hesitating to release their cargo.

In order the support the falling prices NAFED has procured 24,918.52 MT of Masoor as on July 13.Uttar Pradesh:7142.65 MT and Madhya Pradesh:17775.87 MT. Total target of procurement by government agencies is around 1 lakh metric tonnes of Masoor.

.bmp)

Canada White Pea (Mumbai):

Canada origin white pea at Mumbai traded unchanged at Rs 2,281/100Kgs on limited trade activity against cheaper prices compare to other pulses. Business activity in matar dal and besan was as per requirement from consumption centers due to cheaper prices compare to processed chana.

Prices may trade steady to firm in the near term ahead festive period and limited supply from overseas.

While, new crop Canada white pea (2017) offered weak at Rs 2,175/100Kgs, down Rs 25 for September-October shipment.

.bmp)

Moong (Jaipur):

Moong priced ruled unchanged at Rs 4,300-4,350/100Kg during the last week on limited miller buying support and arrivals of summer crop moong from producing region. Similarly, moong dal prices also remained steady at Rs 5,400/100Kg.

Statewise Kharif Mung Sowing Up 7.78 % As On July 12 Vs Last Yr (LAKH HA). Rajasthan:10.57 Vs 7.70, Karnataka:2.19 Vs 3.25, Maharashtra:2.84 Vs 1.98,Tamil Nadu:0.14 Vs 0.35, Andhra Pradesh:0.10 Vs 0.26, Madhya Pradesh:1.17 Vs 0.81, Odisha:0.66 Vs 0.13, Uttar Pradesh:0.13 Vs 0.22, Total:18.96 Vs 17.59.

.bmp)

(By Commoditiescontrol Bureau +91-22-40015513)