MUMBAI (Commoditiescontrol): Indian cotton export shipments astonishingly rose 138 percent, year on year, to 6.21 lakh 170kg bales during the month of May, raised some questions which was justified by late demand amid competitive domestic cotton prices in the International market.

Demonetization brought the entire cotton industry to a halt impacting raw cotton supply, poor sales in both bales and yarn market and delay in export shipments.

However, as the Central Bank withdrew all restrictions held on cash withdrawals during the last week of January,it brought some relief to the industry as both supply picked off reaching the normal levels of 1.70-1.90 lakh bales of daily cotton arrivals and revived demand from MNCs/exporters.

Various MNCs and exporters were actively purchasing to meet delayed shipment deadline and for restocking purposes as domestic prices were in discount by 3-4 cent/lb, during January to mid-March period, compared to Cotlook Index A which measures major global cotton producing country’s prices.

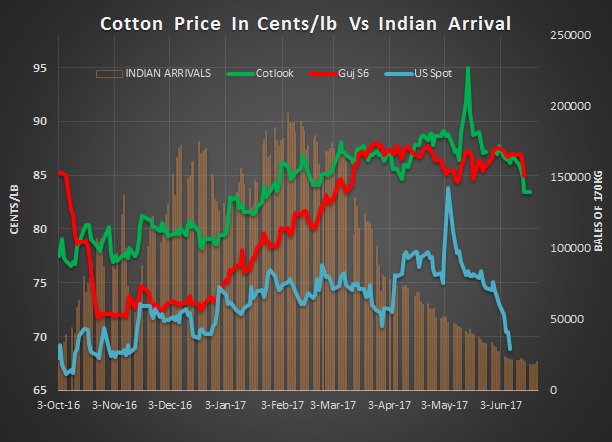

As the price chart shows the comparison between the benchmark Gujarat Shankar 6(30mm), Cotlook Index A and US spot cotton price, the difference between US cotton and Gujarat S6 cotton was marginally ranging between 2 cents in January and 6 cents in February.

There was rise in export demand from neighboring countries such as Bangladesh, China, Vietnam, Thailand, etc for Indian cotton considering competitive basis during the month of January and February amid supportive depreciation in Indian Rupee against US dollar which was around the Rs 68 level and easing supply concerns as daily arrival rose to normal levels.

Taking the Gujarat Shankar 6(30mm) variety cotton as benchmark, prices were in discount by 3-5 percent, during Feb-March, ranging between 80-84 cents/lb compared to Cotlook Index A ranging between 85-88 cents/lb.

However, skepticism over newly elected US president Donald Trump along with host of domestic factors such as BJP’s victory in the Assembly Election, hawkish stance from the Central Bank(RBI) in relation to policy rate and rise in GDP contributed to appreciation of Indian Rupee to Rs 64 against US dollar in mid-March which in turn gradually diminished export demand with domestic cotton prices converging with Cotlook Index A.

Considering the above factors which provided a reasonable justification to delayed shipment leading to 30 percent rise during May. (Full Report)

Further, there could be variation of +/-10 percent in the shipment data compared to the data collated by the Ministry of Commerce.

(By Commoditiescontrol Bureau; +91-22-40015534)