MUMBAI (Commoditiescontrol) – Masoor, chana along with Kabuli chickpea declined last week ended on Saturday (June 12-June 17) in the absence of millers buying, supply from overseas and domestic arrivals. While, urad FAQ variety remained firm for second straight week on better millers buying.

Traders, millers, buyers were sidelined ahead of GST on July 1. The government has removed necessary food items from GST, but when the same food items are sold under a brand, then it will levy 5% GST on them. The government should also remove APMC cess and service tax.

According to market participants, trade at Indore pulses market had resumed only on mutual agreement between traders and farmers. However, farmers had to provide a form in writing as they agree to sell their agriculture produce below the minimum support price, they added.

Sentiments in pulses remained weak due GST implementation & its impact, negligible demand in processed pulses, higher pulses production, timely/normal monsoon and financial problem.

Farmers are shifting from pulses to more remunerative crops like cotton and maize this kharif season. The area under pulses is likely to decline with prices ruling below minimum support prices in many mandis. Prices of pulses have been under pressure due to record production.

.bmp)

Week Highlights

# India Kharif Pulses Sowing Down 38.85 % As On June 14 At 2.22 Lakh Ha Vs 3.63 Last Year. Tur : 0.19 Vs 1.06, Urad : 0.45 Vs 0.61, Moong : 0.64 Vs 1.35, Other Pulses: 0.95 Vs 0.61.

# India Kharif Pulses 2017-18 MSP:Tur:5250+200=5450 Vs 5050, Mung:5375+200=5575 Vs 5225, Urad:5200+200=5400 Vs 5000

# Australia Pulses Forecast 2017-18 Vs 2016-17. Production (In Lakh Tonne).Chana: 14.16 Vs 18.54, Masur: 5.30 Vs 8.30

# SEBI Issues Guideline For Option Trade In Commodity. It Will Exercise In European Style. Daily Avg Turnover Of Agri Commodity Shall Be 200 Crore & 1000 For Others. SEBI GUIDELINES: Each Exchange Can Launch 1 Commodity On Pilot Basis Meets The Criteria. SEBI Ask Exchanges To Make Necessary Amendments To The Relevant Bye Laws

# Canada White pea 2018-19 (Forecast) Vs 2017-18(LT) Production:42 Vs 41, Masoor : Production:28.5 Vs 28.

# Shipment from Burma to India against June month is more in Tur around 30,000-40,000 ton and 50,000 ton for Urad.

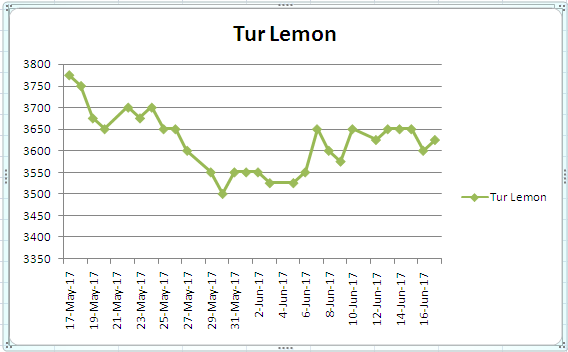

Burma Lemon Tur:

Burma Tur lemon variety traded flat in the range of Rs 3,600-3,625/100Kgs due to dull millers and traders buying support. Demand in processed tur was reported slack from retailers and wholesalers counters. Fresh supply around 210 containers of imported tur arrived at Mumbai. (1 container = 24 MT).

Prices of processed Tur quoted lower between Rs 100-150/100Kg on sluggish trade activity from consumer centre’s at existing rates. In Maharashtra, processed Tur Phatka Sortex quality priced at Rs 5,500/100 Kg, semi-Sortex at Rs 5,350 and regular at Rs 5,200.

NAFED Procures 30,390.75 MT Of Tur In Karnataka under PSS during Kharif-2016 As On June 10.

Government purchased large amounts of tur from farmers to protect them from losses is planning to sell tur after milling it, at Rs 80-90 a kg, or selling it to states where it is not grown. The Maharashtra state is considering selling the stock to other states, which will sell it at fair-price shops.

As per sources, risk level is very low at current price level and lower prices may attract buyer. Tur dal consumption will also rise due to higher vegetable prices in coming days, followed by end of mango season from June.

Burma Urad:

In Mumbai, Burma origin FAQ variety Urad was priced firm for second straight week by Rs 75 to Rs 4,800 on improved buying from mills despite fresh supply around 95 containers at Mumbai port these week. While, SQ variety remained flat at Rs 5,800/100Kg.

Buying support at low level prices from consumption centers in Urad dal accompanied with positive cues from Southern and Delhi market had helped the commodity. Sufficient availability of crop in domestic market, fresh arrivals of summer crop urad in Madhya Pradesh, Uttar Pradesh and Gujarat, supply from Burma will limit the gains.

Similarly, at Chennai, Urad SQ FAQ variety price traded higher this week by Rs 50 to Rs Rs 4,800 in ready business, negligible ready stock. While, SQ variety ruled unchanged at Rs 5,700/100Kg as sellers were active in the market at higher rates.

In forward business, Urad SQ variety traded flat at Rs 5,800 for July delivery.

.bmp)

Chana Kantewala (Indore):

In Indore market, Chana priced lower at Rs 5,300-5,350/100Kg during the last week in private trade on subdued buying from millers at higher rates. Demand in processed chana was thin from consumption centers.

Australian Chana dal traded unchanged at Rs 6,600/100 Kg. Domestic Chana dal of Latur origin was priced flat to Rs 6,700. Chana besan variety at Rs 3,920/50 Kg and Vatana besan at Rs 1,580/50 Kg. Vatana dal was remained steady at Rs 2,700.

NAFED procures 47,887.54 MT of Chana As On June 15. Rajasthan: 38,919.62 MT, Madhya Pradesh: 7,961.57 MT, Uttar Pradesh: 877.90 MT and Haryana:128.45 MT.

Australia origin Chana in ready business at Mundra and Mumbai port also fell by Rs 100 to Rs 5,400/100Kg and Rs 5,350 on fresh supply around 435 containers from overseas at Mumbai port.

New Chana crop of Australian origin (2017) offered down at Rs 5,000/100Kgs for October-November shipment and Rs 4,900 for November-December shipment.

In forward business, Australian Chana offered at $910 for July-August Shipment and Pakistan cutting trade at $845 for July-August shipment.

Kabuli Chana in ready business at Indore market declined by Rs 200/100Kg to Rs 11700-11800 for 42-44 count and Rs 11500-11600 for 44-46 count amid subdued buying support from exporters and stockiest at higher level.

Chana prices had been slowed down in recent weeks along with previous month despite lower output compare to government estimates due to weakness in other pulses and also destocking by stockiest who had purchased in cash transaction before GST implement.

After removal of stock limit in Rajasthan state, stockiest were still sidelined to maintain stock or to purchase pulses at existing level despite cheaper prices compare to last year due to upcoming GST.

Demand and sale in Chana dal had remained weak due to substitute of vatana dal/Besan (White Pea) which is available at a cheaper rate. Demand in near future will gradually gather pace after GST clearance and support prices till Diwali.

.bmp)

Masoor (Mumbai):

Canada origin crimson variety Masoor remained lower by Rs 50 to Rs 3,450-3,700/100Kgs amid dull buying support, fresh supply around 300 containers from overseas, regular arrivals of new crop from producing belts and carry over stock of domestic/imported masoor of higher cost.

In forward business, Australian Masoor Nugget Variety offered at $555 for June-July Shipment.

Importers were bearing huge losses in Masoor and White Pea due to difference in purchase cost against current market prices and were avoiding to release their cargo and suffering heavy damrage/Detention charges.

In order the support the falling prices NAFED has procured 14469.07 Metric Tonnes (MT) of Masoor as on June 15, 2017 from major states. Madhya Pradesh: 8,347.27 and Uttar Pradesh: 6,121.80.

.bmp)

Canada White Pea (Mumbai):

Canada origin white pea at Mumbai traded unchanged at Rs 2,221/100Kgs on limited trade activity and regular supply in breakbulk vessel from vessel Ultra Integrity and Qing Yun Shan from Canada. Farmers hesitated to liquidate their stock in the market due to low prices. Business activity in matar dal and besan was slow from consumption centers.

While, new crop Canada white pea (2017) offered unchanged at Rs 2,175/100Kgs on negligible trade activity for September-October shipment.

.bmp)

Moong (Jaipur):

Moong priced ruled unchanged at Rs 4,500-4,600/100Kg during the last week on limited miller buying support and fresh arrivals of summer crop moong in Madhya Pradesh, Gujarat and Uttar Pradesh. Similarly, moong dal prices also remained steady at Rs 5,500-5,600/100Kg.

Prices of moong are unlikely to sustain due sufficient kharif crop in Rajasthan and Bihar. Moreover, moong crop in the country is cultivated throughout the year and thus crop is mostly available abundantly for domestic consumption.

NAFED Procures 573.84 MT Moong In Odisha Under PSS On 14 June at MSP prices of Rs 5225 (Rs 4800+425 bonus).

.bmp)

(By Commoditiescontrol Bureau +91-22-40015513)