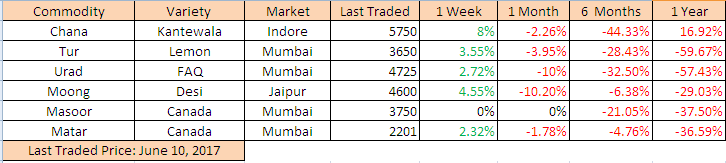

MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Chana, White Pea, Kabuli Chickpea and Moong moved up last week ended on Saturday (June 5 -June 10) on fresh millers buying support at lower rates. While, Masoor remained flat in the absence of buying support and higher supply from overseas.

Trading activities was suspended in the markets of Madhya Pradesh for last ten days due to farmers’ strike because of loan waiver and traders strike due to 50% payment condition in cash and 50 % payment through RTGS.

Week Highlights

# India Kharif Pulses Sowing As On June 7 At 1.64 Lakh Ha Vs 1.20 Last Year. Tur : 0.10 Vs 0.08, Urad : 0.39 Vs 0.36, Mung : 0.35 Vs 0.30.Other Pulses: 0.79 Vs 0.47.

# Rajasthan Govt Removes Stock Limit On Pulses With Immediate Effect.

# IMD: Jun-Sept Rainfall Normal At 98% Of LPA With +/-4%. Rain In North-West Likely 96%, Central India At 100%, South India At 99% & North-East At 96% With +/-8%.

# The central government has approved the hikes in the Minimum Support Price (MSP) of kharif crops for the crop year 2017-18 (July-June) but decision is yet to announce. The Ministry of Agriculture postponed meeting on the kharif crop MSP for 2017-18 due to the on-going strike by farmers.

#Madhya Pradesh Government To Procure Summer Moong At MSP Rs 5225/100Kg, Tur & Urad At 5,050 From June 10 To June 30.

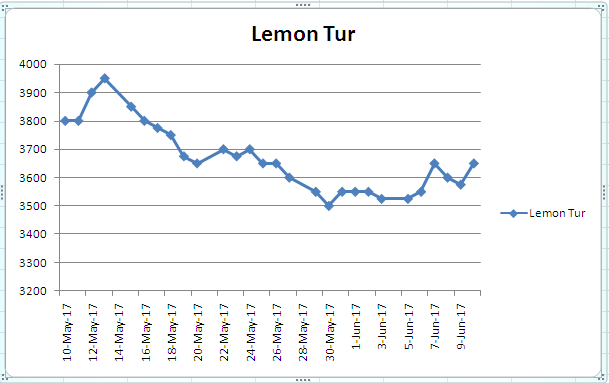

Burma Lemon Tur:

Burma Tur lemon variety gained by Rs 150 to Rs 3,650/100Kgs due to millers and traders buying support as they prefers to process imported Tur due to cheaper prices, slow arrivals of domestic tur and also to avoid stern action if they purchase domestic Tur below MSP from the market. Fresh supply around 446 containers of imported tur arrived at Mumbai. (1 container = 24 MT).

Buying activity was also reported good in processed tur from last couple of day due to monthly demand from Retailers/Wholesale counters. In Maharashtra, processed Tur Phatka Sortex quality priced higher at Rs 5,700/100 Kg, semi-Sortex at Rs 5,500 and regular at Rs 5,400.

NAFED Procures 11467.25 MT Of Tur In Karnataka As On June 8.

As per sources, risk level is very low at current price level and lower prices may attract buyer. Tur dal consumption will also rise due to higher vegetable prices in coming days, followed by end of mango season from June.

Prices of Lemon variety new tur in Burma market was offered at $550 per metric ton on CNF basis for June shipment. But, sellers who had taken position in new tur earlier were ready to sell at lower prices at $535 per metric ton on CNF basis for June shipment & old tur at $515-$520. As per Yangon trader, no sellers in market were active to liquidate their stock below $500 on FOB basis. Shipment for India against June month was more in tur around 30,000-40,000 ton and 50,000 ton for urad.

As per market sources, new Arusha tur was traded at $500 per metric ton on CNF basis for August-September shipment and around $550 for ready shipment.

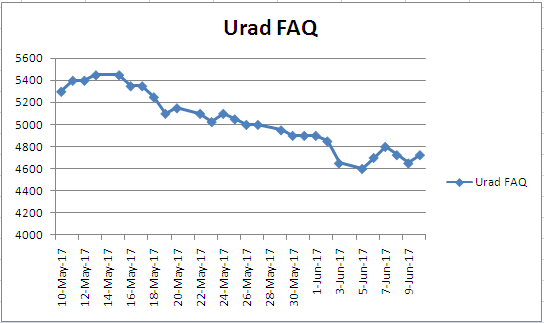

Burma Urad:

In Mumbai, Burma origin FAQ and Sq variety Urad was priced firm by Rs 50-100 to Rs 4,700-4,725 and Rs 5,800/100Kg respectively on fresh buying from mills at low rates despite fresh supply around 332 containers at Mumbai port these week.

Buying support at low level prices from consumption centers in Urad dal accompanied with positive cues from Southern and Delhi market had helped the commodity. Sufficient availability of crop in domestic market, fresh arrivals of summer crop urad in Madhya Pradesh, Uttar Pradesh and Gujarat, supply from Burma will limit the gains.

Similarly, at Chennai, Urad SQ and FAQ variety price traded higher this week by Rs 50 to Rs 5,700/100kg and Rs 4,700 respectively in ready business amid fresh local millers activity.

In forward business, Urad SQ variety traded at Rs 5,800 for July delivery.

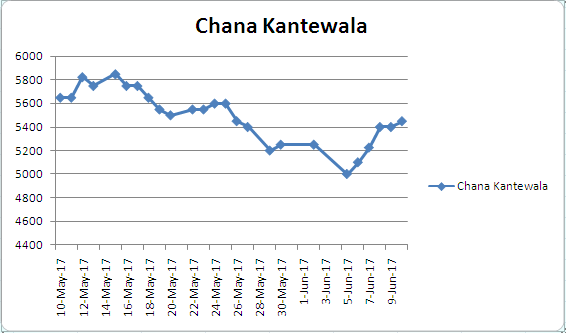

Chana Kantewala (Indore):

In Indore market, Chana gained sharply at Rs 5,450/100Kg, up Rs 450 during the last week in private trade as market was closed due to farmers strike. Further, fresh buying support at lower rates from consumption centers along with slow arrivals had boost the prices to move up.

Demand in Chana dal was reported good from consumption centers. Australian Chana dal traded higher at Rs 6,600/100 Kg, up Rs 200. Domestic Chana dal of Latur origin was priced firm by Rs 200 to Rs 6,700. Chana besan variety gained Rs 100 to Rs 3,900/50 Kg and Vatana besan at Rs 1,600/50 Kg. Vatana dal was traded higher at Rs 2,700, up Rs 75.

NAFED procures 46149.99 MT of Chana As On June 8. Rajasthan: 37,576.35 MT, Madhya Pradesh: 7,615.70 MT, Uttar Pradesh:861.80 MT and Haryana:96.15 MT.

Australia origin Chana in ready business at Mundra and Mumbai port also traded sharply higher at Rs 5,650/100Kg and Rs 5,600.

New Chana crop of Australian origin (2017) offered firm at Rs 5,125/100Kgs for October-November shipment and Rs 5,000 for November-December shipment.

In forward business, Australian Chana offered at $860 for June-July Shipment.

Kabuli Chana in ready business at Indore market gained for second straight week by Rs 200/100Kg to Rs 11900 for 42-44 count and Rs 11700 for 44-46 count amid better buying support from exporters and stockiest at current level.

Traders, stockiest, Millers and even farmers were bearing losses as they had procured chana in anticipation of price may rise in future during festive period. But, scene and sentiments had changed as market players were now active in clearing the old stock before 1st July, GST implementation.

Demand and sale in Chana dal had remained weak due to substitute of vatana dal/Besan (White Pea) which is available at a cheaper rate. Moreover, financial problem (less liquidity), GST implementation & its impact and weakness in all other pulses had also added pressure. Demand in near future will gradually gather pace and support prices till Diwali.

Masoor (Mumbai):

Canada origin crimson variety Masoor remained flat at Rs 3,550-3,750/100Kgs amid slow buying support from Delhi, continued supply from overseas, regular arrivals of new crop from producing belts and carry over stock of domestic/imported masoor of higher cost.

In forward business, Australian Masoor Nugget Variety offered at $550 for June-July Shipment.

Importers were bearing huge losses in Masoor and White Pea due to difference in purchase cost against current market prices and were avoiding to release their cargo and suffering heavy damrage/Detention charges.

In order the support the falling prices NAFED has procured 13313.65 Metric Tonnes (MT) of Masoor as on June 8, 2017 from major states. Madhya Pradesh: 7,604.60 and Uttar Pradesh: 5,709.05.

.bmp)

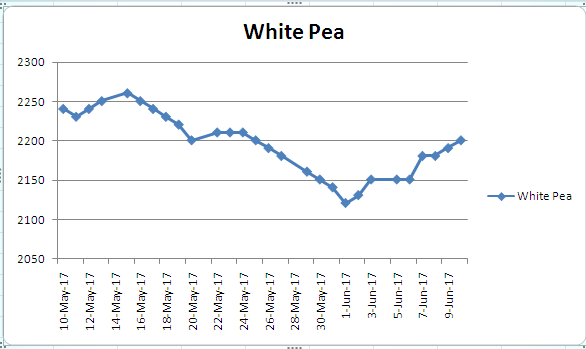

Canada White Pea (Mumbai) :

Canada origin white pea at Mumbai moved up at Rs 2,201/100Kgs, up Rs 50 on fresh trade activity at low rates, slow arrivals of new domestic White Pea from producing belts despite regular supply in breakbulk vessel from vessel Ultra Integrity and Qing Yun Shan from Canada. Farmers hesitated to liquidate their stock in the market due to low prices. Business activity in matar dal and besan was good from consumption centers.

While, new crop Canada white pea (2017) offered unchanged at Rs 2,175/100Kgs on negligible trade activity for September-October shipment.

In forward business, Russia white pea quoted at $325 for May-June shipment. Good flow of overseas and domestic supplies likely to keep matar prices under pressure in the near term.

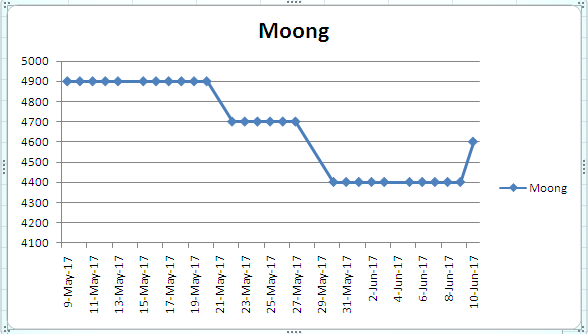

Moong (Jaipur):

Moong priced ruled firm at Rs 4,500-4,600/100Kg, up Rs 200 during the last week on miller buying support at low rates despite fresh arrivals of summer crop moong in Madhya Pradesh, Gujarat and Uttar Pradesh. Similarly, moong dal prices also remained upside at Rs 5,500-5,600/100Kg.

As per market sources, new Tanzania moong was traded at $560 per metric ton on CNF basis for June shipment.

Prices of moong are unlikely to sustain due sufficient kharif crop in Rajasthan and Bihar. Moreover, moong crop in the country is cultivated throughout the year and thus crop is mostly available abundantly for domestic consumption.

NAFED Procures 413.87 MT Moong In Odisha Under PSS On 9 June at MSP prices of Rs 5225 (Rs 4800+425 bonus).

(By Commoditiescontrol Bureau +91-22-40015513)