MUMBAI (Commodities control) – Cotton Oil cake traded in a bearish trend during the week ending June 2nd with a drop of Rs 50 at Rs 1840/100 Kgs amid slack demand from feed producers.

Major spot markets across the country saw selling from the stockiest who were holding huge stocks in their inventory, along with the lean demand from the consumers of feed industry pulled the prices to five month lows of Rs 1840 /100 kgs.

Taking cues from the spot markets, near month July futures too dropped to lows of Rs 1705/ 100 Kgs on NCDEX with a decline of 8.58%.

.png)

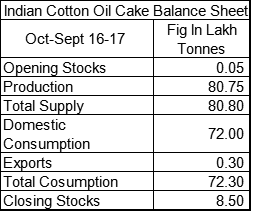

For the above mentioned supply and demand no.s, we have estimated the cotton production in 2016-17 of 330 lakh bales, therefore the availability of cotton seed will be 102.30 Lakh tonnes.

There has been a drop in the consumption pattern for cotton oil cake by 30% since October 2016 as consumers shifted to other substitutes such as Tur churi, Bajara churi, Guar churi and Chana churi which were priced way lower in the range of Rs 1200 -Rs 1500 / 100Kgs leading to a drop in Cotton oil cake prices and usage. A further drop by Rs 200 – 300 / 100 Kgs would attract buyers for this premium product in the feed mix.

Expectations of a sharp rise in cotton production for 2017-18 season is another factor that is weighing on cottonseed oil cake prices. As per our sources, Cotton production in 2017-2018 will be in the range of 370-420 lakh bales higher by 5-20 over last year. Further, prices of feed substitutes will govern the cotton oil cake prices and usage.

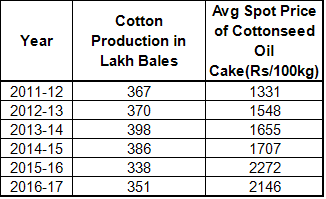

Following is the table showing the average spot price trend of the cotton oil cake as per the production of cotton.

Source: CAB, NCDEX

Tur churi and Cotton oil cake have been close substitutes over the years in the feed mix.Their prices and usage have a high correlation even if one’s production is higher.

Going forward for this season, we expect further drop in cottonoil cake prices largely pressured by higher cotton production and higher ending stocks.

(By Commodities control Bureau; +91-22-40015523)