Mumbai ( Commodities Control ) :

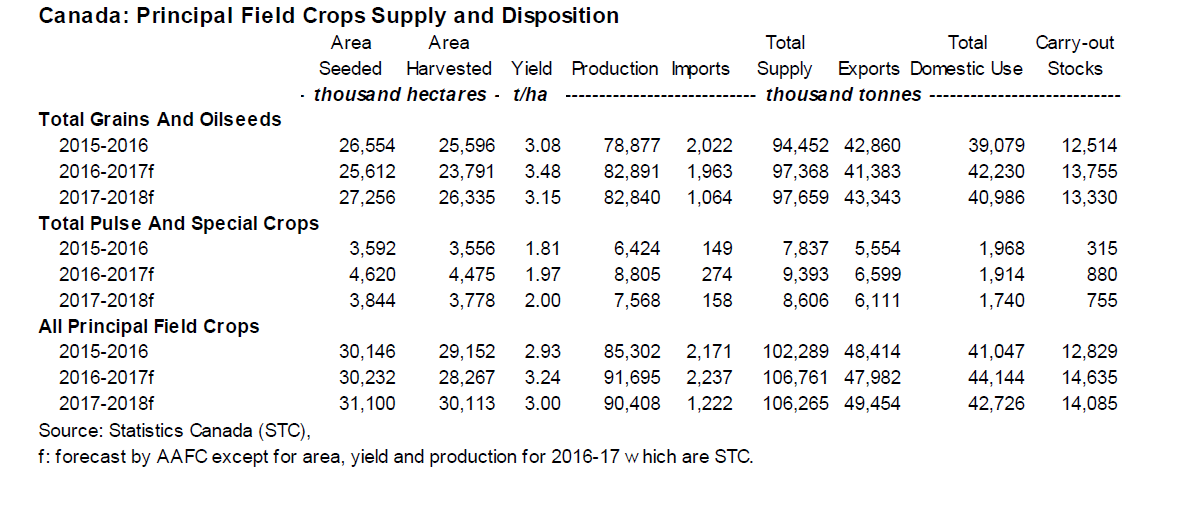

Statistics Canada’s May 5 report on Stocks of Principal Field Crops in Canada at March 31, 2017 has been incorporated for the year ending 2016-17. Partly based on the information, carry-out stocks in Canada are expected to increase by 14 percent to 14.6 million tonnes (Mt) from 12.8 Mt for 2015-16, above the 10-year average of 14.2 Mt.

Largely due to increased supply, for grains and oilseeds (G&O), carry-out stocks are forecast to increase by 10 percent and by 270 percent for pulses and special crops (P&SC). In general, abundant world supplies of grain have pressured world prices, but the weak Canadian dollar has provided strong support to prices in Canada.

For 2017-18, information from Statistics Canada’s April 21 report on the March Seeding Intentions of Principal Field Crops has been reported. Area seeded to field crops in Canada in 2017 is expected to increase by about 3 percent compared to last year.

The higher area seeded to oilseeds, coarse grains and wheat ex-durum is expected to more-than offset the lower area seeded to durum, peas and lentils. For all crops, average or trend yields have been assumed despite the current persistence of excess moisture conditions in parts of Western and Eastern Canada. The unharvested grain in Western Canada from the 2016 crop is a concern at this time in terms of both quantity and quality.

For 2017-18, total crop production, supply and carry-out stocks are currently forecast to be slightly lower than 2016-17, while total exports are expected to increase due to higher exports of G&O. In general, world grain prices are expected to be pressured by an abundant world supply of grain but the impact on grain prices in Canada will be partly mitigated by the low value of the Canadian dollar which is forecast at about C$1.35 per US$1.00.

Pulses

Dry Peas

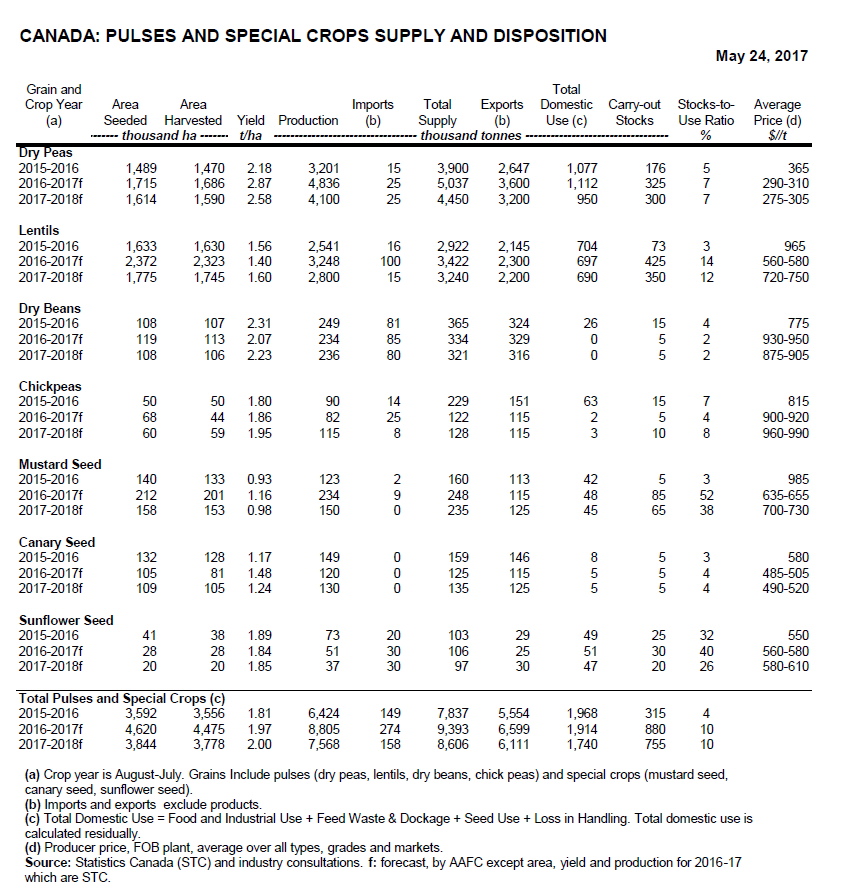

For 2016-17, Canada’s exports are forecast at a record 3.6 million tonnes (Mt), up sharply from the 2015-16 level. This is a result of record exports to India combined with higher exports to China, Bangladesh, the EU and Pakistan.

Canadian exports to the US for the year-to-date (August-March) are higher than for the same period last year despite a record US dry pea crop. Despite higher exports and domestic use, carry-out stocks in Canada are expected to increase sharply to over 0.3 Mt.

The average price is expected to be lower than 2015-16, due to lower yellow and green pea prices when compared to last year. Yellow dry peas prices are expected to maintain a crop year premium of $3/t over green dry peas, compared to the $76/t discount to green dry peas in 2015-16. During the month, of April, Saskatchewan yellow and green pea farmgate prices rose $10/t.

For 2017-18, producer intentions indicate seeded area in Canada will decrease to 1.6 million hectares (Mha), down 6% from 2016-17. Although area is down, this is still the second largest Canadian dry pea area on record. This is largely due to a good return relative to other crops and the continued recognition of the benefits of dry peas as part of crop rotation plan.

By province, Saskatchewan is expected to account for 52% of the dry pea area, Alberta 45%, with the remainder seeded in Manitoba and British Columbia. Production is forecast by AAFC to fall by 15% to 4.1 Mt due to lower average yields and lower area seeded. Supply is forecast to decrease to 4.45 Mt due to higher carry-in stocks partly offsetting the decrease in production.

Exports are expected to be lower than 2016-17 at 3.2 Mt and carry-out stocks are forecast to decrease marginally. The average price is expected to decrease from 2016-17 due to increased world supply. In the US, seeded to dry peas for 2017-18 is forecast by the USDA to fall by 18% to about 1.2 million acres (Mac). This is largely due to a reduction in area in North Dakota and Montana.

Lentils

For 2016-17, exports are forecast to rise from 2015-16 to a record 2.3 Mt. The main markets continue to be the India, Turkey, the United Arab Emirates and Bangladesh. Carry-out stocks are forecast to rise sharply to 0.425 Mt.

The average price of lentils in Canada is forecast to fall sharply from record levels recorded for the previous year due to larger stocks and a below average grade distribution. Large green lentil prices are forecast to have a record $618/t premium over red lentil prices for the entire crop year, compared to a $418/t premium to red lentils in 2015-16. During the month of April, Saskatchewan large green lentil farmgate prices rose $15/t while red lentil farmgate prices rose about $45/t.

For 2017-18, the area seeded to lentils in Canada, based on producer intentions, is expected to fall by 25% to below 1.8 Mha, due to the sharp decline in farmgate prices in the early months of 2017. By province, Saskatchewan is expected to account for 89% of the lentil area, with the remainder seeded in Alberta.

Production is forecast to fall significantly to 2.8 Mt and supply is also expected to decrease to 3.2 Mt, despite larger carry-in stocks. Exports are expected to be 2.2 Mt. Carry-out stocks are forecast to fall to 0.35 Mt. The average price is forecast to rise sharply from 2016-17. This is expected as the result of a more average grade distribution but with lower prices for No.1 red and green lentils grades.

In the US, the area seeded to lentils for 2017-18 is forecast by the USDA at a record 1.1 million acres (Mac), 13% higher than 2016-17, due to record area seeded in Montana.

Dry Beans

For 2016-17, dry bean exports are forecast to increase despite the lower supply situation compared to the previous year. The US and the EU remain the main markets for Canadian dry beans, with smaller volumes exported to Japan and Angola.Smaller North American supply is expected to continue to support US and Canadian dry bean prices for 2016-17. To-date (August-April), Canadian white pea bean prices are over 30% higher, pinto bean prices are 25% higher and black bean prices are 40% above 2015-16 levels.

For 2017-18, the area seeded in Canada is forecast to fall by 9% from 2016-17 to 0.1 Mha because of lower returns from this year. By province, Ontario is expected to account for 47% of the dry bean area, Manitoba 34%, Alberta 17% with the remainder seeded in Quebec. Production is expected to increase marginally to nearly 0.24 Mt and, when combined with lower carry-in stocks, supply is expected to fall marginally. Exports are forecast to fall marginally and stocks are expected to be remain tight. The average Canadian dry bean price is forecast to fall despite expectations for a marginal decrease in North American supply.

In the US, area seeded to dry beans is forecast by the USDA to increase marginally to 1.4 Mac as a rise in area seeded in Nebraska and Minnesota is partly offset by lower area in Michigan.

Chickpeas

For 2016-17, Canadian chickpea exports are expected to decrease sharply to115 thousand tonnes (kt), largely due to lower exports to the US and Pakistan, Canada’s two largest markets. As a result of the decreased export demand but lower supply than the previous year, carry-out stocks are expected to decrease. The average price is forecast to be slightly higher. A below-average grade distribution has offset record prices to-date.

For 2017-18, the area seeded is expected to fall 12% from 2016-17 due to reduced potential for good returns relative to other crops. By province, Saskatchewan is expected to account for 94% of the chickpea area, with the remainder seeded in Alberta.

Production is forecast to rise to 115 kt, assuming lower abandonment than the previous year. Supply is forecast to rise marginally compared to 2016-17. Exports are forecast to be unchanged due to the limited exportable supply. Carry-out stocks are expected to increase. The average price is forecast to be higher than 2016-17, due to expectations for a more average grade distribution, albeit with lower prices for the No.1 grades. US chickpea area for 2017-18 is forecast by the USDA to rise to a record 0.5 Mac, up 53% from 2016-17. This is largely due to an expected rise in area in Idaho and Washington.

(By Commodities control Bureau; +91-22-40015516)