SOYBEAN:

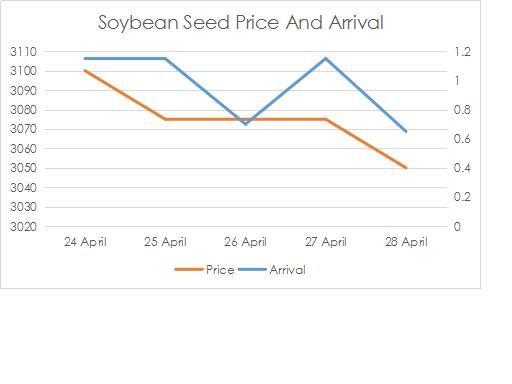

Soybean during the week ended April 29th traded on a bearish note at Rs 2,975-3,050/100Kg at benchmark Indore market of Madhya Pradesh against Rs 3,000-3,100 a week ago.

Farmers reluctance to sell beans at the current levels, coupled with lower offtake of Soymeal from Poultry feed industry & Export markets have led to a bearish trend in consumption of beans.

In futures market, Soybean most active May contract was down by 4.88 percent at Rs 2,929/100kg on the National Commodity & Derivatives Exchange Ltd (NCDEX).

REFINED SOY OIL:

A weak trend was seen in Refined Soy oil market of Madhya Pradesh on higher supplies and slack demand. The present supplies are enough to cater to immediate demand keeping the buyers on the side-lines to add more inventory.

In the International markets, Soy Oil supplies are likely to be in surplus mainly from South America, along with Malaysia and Indonesia Palm oil output is set to rise in the coming weeks as palm trees are recovering from last year dryness.

Soy oil prices in Indore market was down 1.91 percent this week, while prices were higher 1.30 percent in dollar terms (CNF) at Kandla port and was steady in Rupees terms.

With the onset, of marriage season followed by Month long Muslim festival of Ramadan and premium of Rs 10/kg of soy oil over kacchi ghani mustard oil will also support the prices.

CBOT soy oil futures was down 1.56 percent this week largely due to weak demand globally.

In futures market, soy oil most active May contract on the National Commodity & Derivatives Exchange Ltd (NCDEX) was down 2.90 percent this week, while June contract was lower 2.40 percent.

NEXT WEEK: Soy oil will continue to remain under pressure on account of surplus in the Global markets and higher supplies of substitutes.

SOYMEAL:

Soymeal price declined for the week ending April 29th by Rs 800 to Rs 25,200 per tonne on account of lower Export orders and negative demand from poultry feed manufacturers.

Price of broiler chicken were steady at Rs 105/kg at the benchmark Delhi market. Poultry farmers are incurring loss of around 5-10 percent on sale of broiler chicken on account of slow demand for the end product.

Thus, a decline in the Meal prices have led to negative crush margins capping the bulk purchases of Beans by processors.

NEXT WEEK:

Outlook of Soybean for next week will be range bound as seed buyers will be active at lower price levels, however famers will sale at higher levels, capping upside of Soybeans.