MUMBAI (Commoditiescontrol) – Castor seed, the non-edible oilseed crop, is once again in spot light after prices rose sharply by around 27 percent on futures exchange (first month continuous) in one month. The rise in castor seed prices were attributed to lower production.

.png) Castor seed production in the country this year (2016-17) is estimated to be lower by 25 at 10.67 lakh tonnes from 14.23 lakh tonnes last year due to lower area planted. Though yield was little better than last year but enough to offset acreage losses.

Castor seed production in the country this year (2016-17) is estimated to be lower by 25 at 10.67 lakh tonnes from 14.23 lakh tonnes last year due to lower area planted. Though yield was little better than last year but enough to offset acreage losses.

Supply of castor seed was on the lower side in the spot market, however improved in the recent times as stockists preferred to liquidate their old stocks from previous year’s crop, which was procured over Rs 4,500 level.

Demand for castor oil has also increased in the recent times, however overall export of castor oil during the current financial year (FY) April-March (2016-17) is likely to decline by 12 percent at 4.80 lakh tonnes against last year because of subdued demand from key importer China, said Atul Chaturvedi, President, The Solvent Extractors’ Association of India (SEA).

.png) "China has slowed buying castor oil from India as some of the castor oil processing factories were violating environmental norms since late November and the Chinese government suspended its operations temporarily until they do not start complying with the norms." he said on the sidelines of Rapeseed-Mustard Conclave 2017.

"China has slowed buying castor oil from India as some of the castor oil processing factories were violating environmental norms since late November and the Chinese government suspended its operations temporarily until they do not start complying with the norms." he said on the sidelines of Rapeseed-Mustard Conclave 2017.

Castor oil exports in FY 2017-18 likely to increase compared to FY 2016-17 due to expectations of improved demand from China.

Further supply of castor seed in the coming one weeks likely to decline as many markets of Gujarat will remain mostly closed for end of financial year. However there after supply is expected to increase in case prices sustain above Rs 5,000 level, but same could fall on lower arrivals.

.png) Market players are very much aware of current tight supply -demand situation and they are unlikely to liquidate their stock easily. The stocks are now with financial strong stockists and farmers and may opt to sell only in the range of Rs 5,000-5,500 level, said Bhupesh Patel, a Deesa-based castor seed trader.

Market players are very much aware of current tight supply -demand situation and they are unlikely to liquidate their stock easily. The stocks are now with financial strong stockists and farmers and may opt to sell only in the range of Rs 5,000-5,500 level, said Bhupesh Patel, a Deesa-based castor seed trader.

Supply-demand situation for castor seed is tight for current season 2017 (Jan-Dec) and carry-over stocks at the end of the season is likely to decline sharply to 0.94 lakh tonnes against 6.1 lakh tonnes in 2016. However, a lot will depend on castor oil exports.

India castor meal exports as on February of the current FY 2016-17 (Mar-Apr) slipped over 11 percent at 3.68 lakh tonnes versus 4.41 lakh tonnes a year ago. In FY 2015-16 castor seed exports totaled at 4.56 lakh tonnes.

Conclusion

Castor seed at least in the near term (1 month) may trade positive as supplies are unlikely to rise due to poor production and farmers, stockists reluctant to liquidate their stock easily. However long term bullish tone will depend on export demand sustainability at the higher level. Generally, demand for castor oil and meal declines in case prices become uncompetitive and thus one should keep close eyes on export number for next few month, which will gauge future trend.

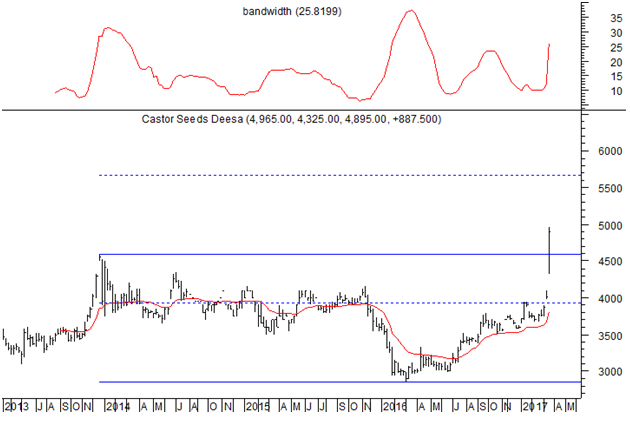

Technical (Weekly Chart): Castor Seed Deesa – Expect a rally to 5668

A breakout above the peak of 4500 has been witnessed.

Expect a rally to continue towards 5668. Correction to 4500-4330 can be for accumulation.

For Previous Technical Report On Castor Seed Please Click Here

(By Commoditiescontrol Bureau; +91-22-40015533)